Report Overview

Consumer Electronics Packaging Market Highlights

Consumer Electronics Packaging Market Size:

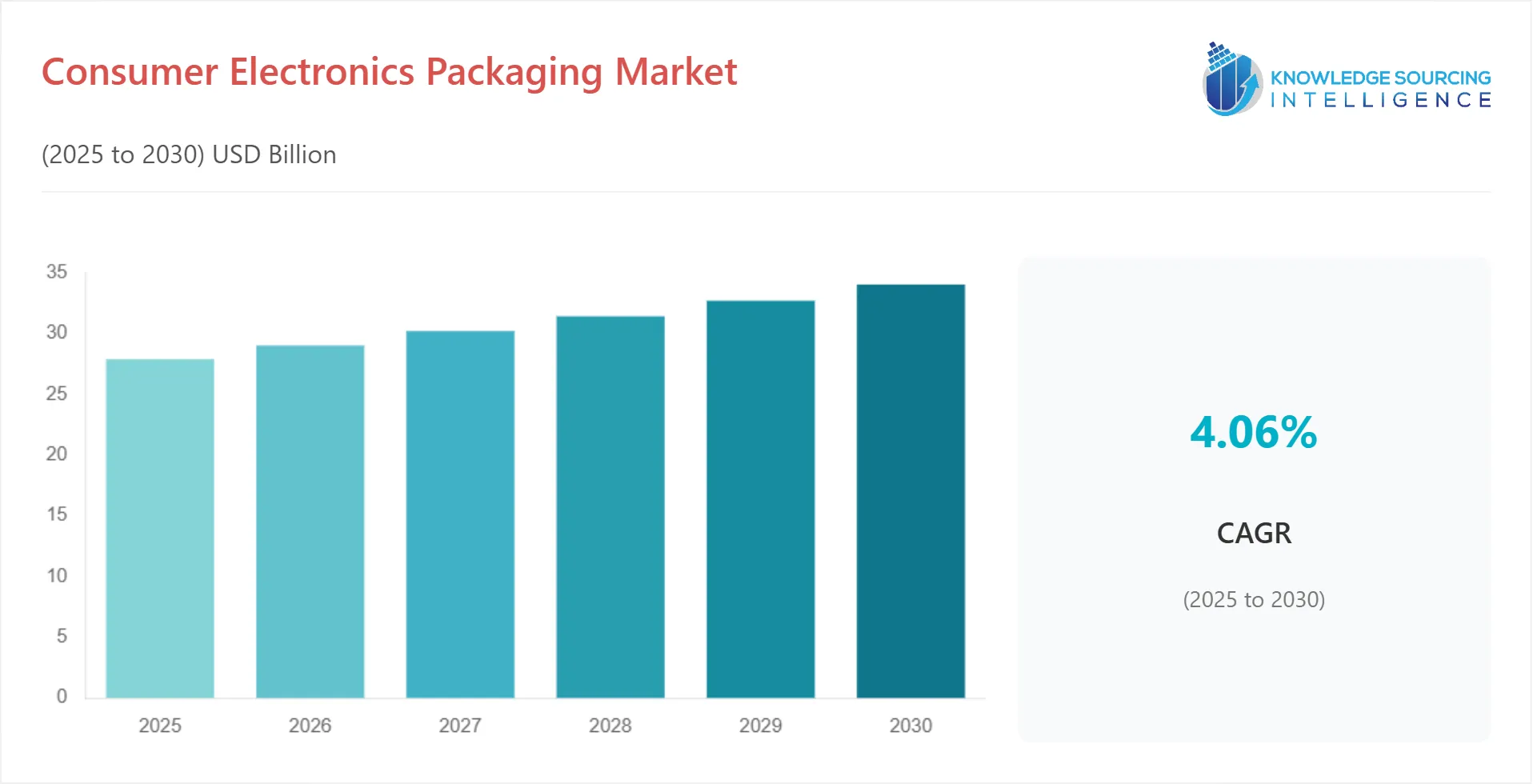

Consumer Electronics Packaging Market, with a 3.94% CAGR, is anticipated to reach USD 35.163 billion in 2031 from USD 27.889 billion in 2025.

Consumer Electronics Packaging Market Trends:

Consumer electronics packaging refers to the specialized packaging solutions designed to protect and present electronic devices and accessories for consumer use. It involves the design and production of packaging materials, such as boxes, trays, inserts, and protective films, that provide secure transportation, prevent damage, and enhance the overall presentation of electronic products. Consumer electronics packaging plays a crucial role in ensuring product integrity, reducing the risk of breakage, and creating an attractive visual appeal for consumers.

The consumer electronics packaging market encompasses the industry that provides packaging solutions specifically tailored for consumer electronics products. This market segment is driven by the rapid growth of the consumer electronics industry, which includes devices such as smartphones, tablets, laptops, gaming consoles, and audiovisual equipment. The consumer electronics packaging market focuses on delivering protective, functional, and visually appealing packaging solutions that enhance product safety during transportation, create a memorable unboxing experience for consumers, and effectively communicate brand identity. The market's growth is fuelled by factors such as technological advancements, product innovations, changing consumer preferences, and the increasing demand for sustainable packaging options.

Consumer Electronics Packaging Market Growth Drivers:

The rapid growth of the consumer electronics industry:

The expanding consumer electronics sector, driven by technological advancements and increasing consumer demand for electronic devices, fuels the need for appropriate packaging solutions. The growth in product sales directly influences the consumer electronics packaging market.

Technological innovations in electronics:

Advancements in electronics, such as smaller and more delicate components, touchscreens, and high-resolution displays, require packaging solutions that provide adequate protection against damage during transportation and handling. The need for specialized packaging to accommodate these technological advancements drives the market.

Product differentiation and branding opportunities:

Consumer electronics packaging serves as a platform for brand differentiation and visual appeal. Packaging designs that convey a strong brand identity, showcase product features, and create a premium unboxing experience help attract consumers and contribute to market growth.

Growing e-commerce sales of consumer electronics:

The rise of e-commerce platforms and online purchasing of consumer electronics drives the need for protective packaging solutions that can withstand the rigors of shipping and handling. Packaging that provides secure and damage-resistant protection is essential in this context.

Sustainability and eco-friendly packaging:

Consumer preferences are increasingly shifting towards sustainable packaging options. The demand for eco-friendly materials, recyclable packaging, and reduced waste in the consumer electronics sector drives the market for sustainable packaging solutions.

Compliance with safety and regulatory standards:

Consumer electronics packaging must comply with safety regulations to ensure the protection of users and meet international standards. Packaging that adheres to regulations regarding labelling, safety warnings, and product information drives the market growth.

Customization and personalization:

Consumer electronics packaging that offers customization and personalization options, such as color choices, logo placement, or personalized messages, enhances brand loyalty and customer satisfaction. The ability to provide tailored packaging solutions drives market demand.

Rising disposable income and consumer spending:

Increasing disposable incomes and higher consumer spending on consumer electronics drive the demand for aesthetically pleasing and value-added packaging. Consumers are willing to pay for packaging that enhances the overall experience of owning and using electronic devices.

Focus on product protection and logistics efficiency:

Consumer electronics packaging must provide adequate protection during transportation, storage, and handling to prevent damage and ensure product integrity. Packaging solutions that are lightweight, efficient in space utilization, and compatible with automated logistics systems meet the market's demand for optimized supply chain operations.

Product life cycle and replacement purchases:

The regular upgrade and replacement cycles of consumer electronics contribute to the ongoing demand for packaging solutions. As consumers replace their devices, the need for packaging that can accommodate various product sizes and variations sustains the market.

List of Top Consumer Electronics Packaging Companies:

Apple launched a new line of packaging for their iPhone 13 models that is made from 100% recycled materials. The packaging is also designed to be 100% recyclable so that it can be easily disposed of at the end of its life.

Microsoft launched a new line of packaging for their Surface Laptop Studio that is made from 30% recycled content. The packaging is also designed to be recyclable, and Microsoft has committed to making all of its packaging recyclable by 2025.

Dell launched a new line of packaging for their XPS laptops that is made from recycled materials and is printed with soy-based inks.

Google launched a new line of packaging for their Pixel 6 models that is made from recycled cardboard and is printed with soy-based inks. The packaging is also designed to be flat-packed, which reduces transportation costs and storage space.

Consumer Electronics Packaging Market Segmentation Analysis:

The segment of the consumer electronics packaging market that is experiencing sustainable growth is sustainable packaging. As environmental concerns gain prominence, consumers and manufacturers alike are increasingly prioritizing eco-friendly packaging solutions. Sustainable packaging in the consumer electronics industry involves using recycled materials, reducing waste, and adopting biodegradable alternatives. This segment's growth is driven by the growing demand for environmentally conscious products, regulatory pressures to reduce carbon footprint, and the positive brand image associated with sustainable practices. Manufacturers that offer sustainable packaging options cater to the rising consumer preference for environmentally friendly choices, leading to rapid growth in this segment of the consumer electronics packaging market.

Consumer Electronics Packaging Market Geographical Outlook:

Asia-Pacific region is expected to hold a significant share:

Asia-Pacific is expected to dominate the consumer electronics packaging market share. This dominance can be attributed to several factors. Firstly, the region is home to major consumer electronics manufacturing hubs, such as China, South Korea, and Japan, where a significant portion of global electronic devices are produced. Secondly, the region has a large and growing population with increasing disposable income, driving consumer demand for electronic products. Thirdly, the presence of a well-established supply chain infrastructure, including packaging manufacturers and logistics networks, supports the growth of the consumer electronics packaging market in Asia-Pacific. Additionally, favorable government policies, industrial investments, and technological advancements in the region further contribute to its dominant position in the market.

Consumer Electronics Packaging Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Consumer Electronics Packaging Market Size in 2025 | USD 27.889 billion |

Consumer Electronics Packaging Market Size in 2030 | USD 34.025 billion |

Growth Rate | CAGR of 4.06% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Consumer Electronics Packaging Market |

|

Customization Scope | Free report customization with purchase |

Consumer Electronics Packaging Market Segmentation

By Packaging Type

Rigid Packaging

Flexible Packaging

By Material

Paper & Paperboard

Plastic

By Application

Smartphone

Computing Devices

Television/ DTH Box

Electronics Wearable

Others

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Italy

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Taiwan

Others