Report Overview

Consumer Electronics Electric Capacitor Highlights

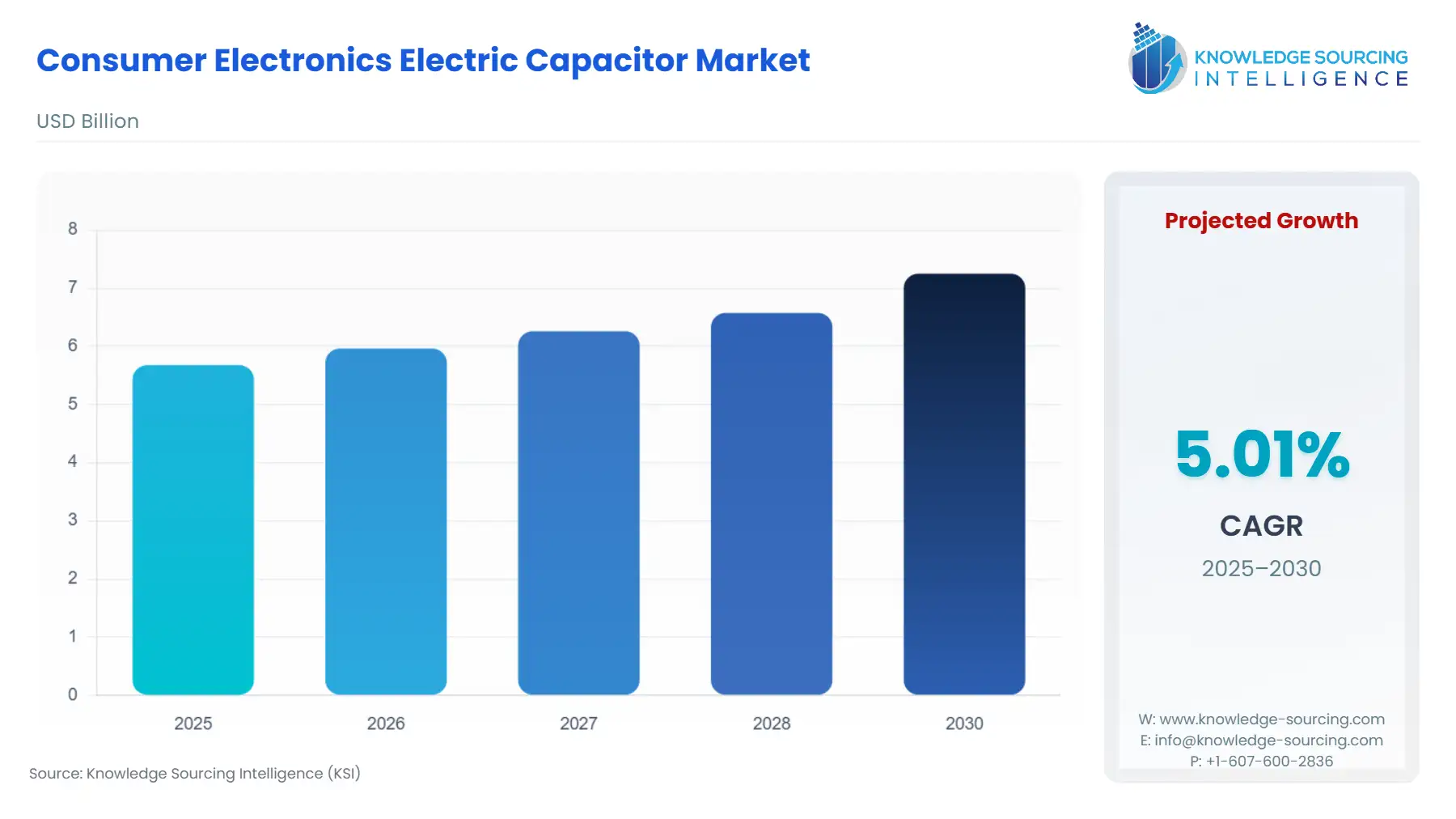

Consumer Electronics Electric Capacitor Market Size:

The Consumer Electronics Electric Capacitor Market is expected to grow from US$5.679 billion in 2025 to US$7.251 billion in 2030, at a CAGR of 5.01%.

The contemporary consumer electronics market is characterized by a relentless drive toward enhanced performance, increased functionality, and extreme miniaturization. This imperative fundamentally elevates the role of electric capacitors, which function as indispensable components for power stabilization, signal filtering, and energy storage across the entire spectrum of consumer devices. The structural complexity of modern printed circuit boards (PCBs) in products like smart televisions, high-end gaming consoles, and Internet of Things (IoT) devices necessitates a significantly higher density of passive components, making capacitors a critical bottleneck and a primary focus for technological advancement in material science and packaging.

Consumer Electronics Electric Capacitor Market Analysis

-

Growth Drivers

The increasing functionality and complexity of electronic devices stand as the foremost growth catalyst. Modern smartphones and high-resolution displays integrate multiple processors, advanced sensors, and high-speed memory, requiring meticulous voltage regulation and noise suppression on the power rails. This complexity directly increases the required quantity and performance specification of decoupling and filtering capacitors, particularly driving demand for high-reliability, low Equivalent Series Resistance (ESR) MLCCs. Furthermore, the rise of smart homes and IoT ecosystems, where billions of devices must maintain continuous, energy-efficient connectivity, significantly propels the adoption of low-voltage, small-form-factor capacitors for power management and wireless communication modules.

-

Challenges and Opportunities

The primary market challenge is the persistent price and supply volatility of critical raw materials, notably tantalum, which significantly influences the production cost of electrolytic and tantalum capacitors. Geopolitical uncertainties and concentrated refining operations exacerbate these supply chain risks, constraining manufacturer profit margins and creating procurement hurdles. Conversely, a substantial opportunity exists in the transition to more sophisticated capacitor technologies, such as advanced polymer aluminum electrolytic capacitors and silicon capacitors. These technologies offer superior thermal stability and higher energy density, enabling engineers to design more robust and smaller power systems, thereby creating new, high-value demand pockets in premium, high-power consumer electronics and fast-charging peripherals.

-

Raw Material and Pricing Analysis

Capacitors are physical products; thus, raw material dynamics are paramount. Tantalum, used in tantalum capacitors prized for high capacitance density, and aluminum, essential for electrolytic capacitors, exhibit supply chains prone to disruption. Tantalum sourcing often involves complex, global logistics due to its concentration in specific mining regions. Aluminum prices, tied to global energy costs, introduce significant manufacturing cost instability for volume production. Ceramic capacitors, while less exposed to geopolitical risks, face fluctuating costs in high-purity ceramic powders like barium titanate, essential for high-performance dielectrics. This raw material volatility compels manufacturers to maintain dual-source strategies and to invest in component redesigns that minimize reliance on single-source or volatile materials.

-

Supply Chain Analysis

The global capacitor supply chain is characterized by a highly centralized manufacturing base, primarily concentrated in the Asia-Pacific region (China, Japan, South Korea, and Taiwan). This structure features an advanced but fragile ecosystem where a small number of key manufacturers produce the majority of MLCCs, aluminum, and tantalum capacitors. Logistics complexity stems from the sheer volume and small size of components, requiring highly specialized, just-in-time inventory management. The critical dependency on single-region production hubs creates a structural vulnerability, as demonstrated by past supply shortages following natural disasters or geopolitical trade friction, compelling Original Equipment Manufacturers (OEMs) globally to maintain larger strategic component buffers.

-

Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union |

Restriction of Hazardous Substances (RoHS) Directive |

Mandates the restriction of specific hazardous materials (e.g., lead, cadmium) in electrical and electronic equipment. This directly drives demand for compliant, lead-free soldering and component materials, necessitating re-engineering and qualification of capacitor models, particularly in high-reliability segments. |

|

United States |

Conflict Minerals Rule (SEC) |

Requires publicly traded companies to disclose whether their products contain tin, tantalum, tungsten, or gold sourced from the Democratic Republic of Congo or adjoining countries. This regulation increases the operational cost and complexity for manufacturers using tantalum capacitors, pushing demand toward suppliers with verified, ethical, and transparent sourcing protocols. |

|

India |

Electronics Component Manufacturing Scheme (ECMS) |

Provides financial incentives and subsidies to promote domestic manufacturing of electronic components. This policy stimulates new domestic production capacity for capacitors within India, intending to localize the supply chain and reduce reliance on imports, thus creating long-term shifts in regional demand fulfillment. |

Consumer Electronics Electric Capacitor Market Segment Analysis

-

By Technology: Ceramic Capacitor Segment Analysis

The ceramic capacitor segment, dominated by Multilayer Ceramic Capacitors (MLCCs), drives the market's technological frontier, mainly due to the universal demand for device miniaturization and high-frequency performance. MLCCs function as the primary decoupling and filtering components in virtually all portable consumer electronics. The major growth driver is the architectural complexity of new devices, particularly the increased pin-count and clock speed of System-on-Chips (SoCs). Each incremental performance enhancement necessitates placing a higher number of low-inductance, high-capacitance MLCCs closer to the integrated circuit. The shift to 5G and Wi-Fi 6 standards also compels an upswing in demand for MLCCs with extremely low Equivalent Series Inductance (ESL) and low ESR to manage the higher operating frequencies and signal integrity challenges inherent in modern RF front-end modules, ensuring stable power delivery for high-speed data transmission. The continuous innovation in dielectric layers allows manufacturers to pack higher capacitance into 0201 or 01005 case sizes, making the MLCC indispensable for flagship smartphones and compact wearables.

-

By Polarization: Polarized Capacitor Segment Analysis

The polarized capacitor segment, comprising aluminum electrolytic and tantalum capacitors, fundamentally driven by power supply units (PSUs) and energy storage applications in consumer electronics. Electrolytic capacitors, especially the polymer variants, find their primary growth driver in high-power applications, such as power adapters for laptops, high-wattage sound bars, and the increasing number of charging peripherals that support fast-charging protocols. The need for these components is directly proportional to the output power and stability requirements of the device's main power circuit. For example, a high-fidelity audio system or a 4K/8K television's power supply requires high-capacitance, stable, polarized capacitors to smooth out large ripple currents and maintain clean direct current (DC) rails. Tantalum capacitors, due to their superior volumetric efficiency and high stability, see specific demand in space-constrained, critical voltage applications where a burst of power is needed, such as in solid-state drive (SSD) power systems used in high-end computing.

Consumer Electronics Electric Capacitor Market Geographical Analysis

-

United States Market Analysis (North America)

The US market for consumer electronics electric capacitors is characterized by robust demand in high-value, early-adoption sectors such as premium smart home automation, high-end computing, and the advanced gaming console market. The requirement is less driven by sheer volume manufacturing and more by the need for cutting-edge component specifications. The rapid deployment of 5G and the increasing domestic focus on advanced semiconductor packaging necessitate demand for specialized, high-performance components, including silicon capacitors and specialized low-ESL MLCCs. Local factors, such as the large ecosystem of Silicon Valley tech firms driving next-generation device design, prioritize suppliers who can deliver technical support and component traceability.

-

Brazil Market Analysis (South America)

The Brazilian market’s growth is largely a function of domestic manufacturing and local consumption of mass-market consumer electronics like mid-range smartphones and assembled televisions. The local factor driving capacitor demand is the domestic-centric assembly industry, often influenced by trade policies and import tariffs aimed at promoting local production. This context creates a preference for cost-effective, readily available components, predominantly standard-grade aluminum electrolytic and ceramic capacitors, where the demand volume tracks closely with the country's economic stability and consumer disposable income for appliance replacement cycles.

-

Germany Market Analysis (Europe)

The German market's capacitor requirement is primarily driven by its strong industrial and high-quality appliance manufacturing sectors, particularly for complex home appliances (e.g., induction cooktops, high-efficiency washing machines) and professional audio equipment. The key local factor is stringent European energy efficiency regulations and a consumer base that demands product longevity, which translates directly into higher demand for long-life, high-reliability polymer aluminum and film capacitors capable of enduring elevated temperatures and high ripple currents over extended periods. The need for standard consumer electronics components often reflects EU-wide compliance with environmental directives like RoHS.

-

Saudi Arabia Market Analysis (Middle East & Africa)

The Saudi Arabian market sees its capacitor demand heavily influenced by significant infrastructure spending and the adoption of modern communication and digital technologies, particularly smart city initiatives. A major local factor is the climate—high ambient temperatures necessitate electronic components with enhanced thermal tolerance. This drives specific demand for high-temperature-rated aluminum electrolytic and ceramic capacitors used in air conditioning units, outdoor digital signage, and telecommunication infrastructure, where reliable operation under heat stress is a non-negotiable requirement for system longevity and performance.

-

China Market Analysis (Asia-Pacific)

China is both the world's dominant production hub and its largest consumption market, acting as a gravitational center for capacitor demand. The local factors driving growth are vast: massive domestic consumption of smartphones, laptops, and IoT devices; government initiatives promoting local semiconductor and component self-sufficiency; and a vast, vertically integrated supply chain ecosystem. The aggressive manufacturing targets for electronic devices drive overwhelming demand for high volumes of nearly all capacitor types, particularly MLCCs, which are essential for their gigantic output of mobile and computing hardware destined for both local and global distribution.

Consumer Electronics Electric Capacitor Market Competitive Environment and Analysis

The competitive landscape in the consumer electronics electric capacitor market is defined by a high degree of technological specialization and volume-scale manufacturing capabilities, with a few large Asian and American firms dominating the market share. Competition is centered on product quality, miniaturization breakthroughs, and the ability to maintain supply reliability amidst raw material turbulence. Major players leverage decades of material science expertise to offer differentiated products with superior parameters like ultra-low ESR/ESL and high-temperature tolerance.

-

Murata Manufacturing Co., Ltd.

Murata Manufacturing Co., Ltd. is strategically positioned as a global leader, particularly in the production of high-performance Multilayer Ceramic Capacitors (MLCCs). The company’s focus is on components that support the critical requirements of 5G, advanced automotive electronics, and ultra-miniaturized consumer devices, including smartphones and wearables. Murata's product portfolio is extensive, covering ceramic capacitors, polymer aluminum electrolytic capacitors, and silicon capacitors. Its competitive edge is rooted in its proprietary ceramic material technology, which enables it to achieve higher capacitance values in the smallest case sizes, directly aligning its product offerings with the industry's miniaturization imperative.

-

TDK Corporation

TDK Corporation, through its focus on passive components, magnetic products, and sensor systems, maintains a strong competitive stance, notably via its subsidiary Epcos. TDK's strategic positioning targets both the high-volume consumer electronics market and the more demanding automotive and industrial segments. The company offers a wide array of products, including aluminum electrolytic capacitors, film capacitors, and a comprehensive range of ceramic capacitors. TDK's strategy involves heavy investment in materials and process technology to enhance the performance and reliability of its components, particularly to meet the stringent quality demands for power applications in smart home appliances and power tools.

-

Nichicon Corporation

Nichicon Corporation is a dominant player primarily focused on aluminum electrolytic capacitors and film capacitors, essential for power supply applications. Nichicon's strategic emphasis is on developing long-life, high-reliability electrolytic capacitors, including its polymer aluminum electrolytic capacitor series, which offer low ESR and high ripple current capability. This positioning makes the company a preferred supplier for power-centric consumer electronics that require robust and enduring performance, such as smart TVs, desktop computer power supplies, and audio systems. Nichicon's product lines directly serve the consumer demand for appliance durability and power efficiency.

Consumer Electronics Electric Capacitor Market Developments

-

March 2025: KYOCERA AVX announced the world's first 47µF multilayer ceramic chip capacitor (MLCC) in a compact 0402 case size. This product delivers over double the capacitance of previous models. It is specifically targeted for high-performance, space-constrained applications, including smartphones and advanced AI servers.

-

July 2024: Murata Manufacturing introduced the world's first multilayer ceramic capacitor with 100µF capacitance in a miniature 0603-inch size. This breakthrough component is designed for high-density applications such as data centers and servers, enabling significant space-saving circuit designs while maintaining stable performance for arduous consumer-adjacent electronics.

Consumer Electronics Electric Capacitor Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 5.679 billion |

| Total Market Size in 2030 | USD 7.251 billion |

| Forecast Unit | Billion |

| Growth Rate | 5.01% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Companies |

|

Consumer Electronics Electric Capacitor Market Segmentation:

By Type

-

Aluminum

-

Ceramic

-

Tantalum

-

Paper and Film

-

Supercapacitor

-

Others

By Polarization

-

Polarized

-

Non-Polarized

By Voltage

-

Low

-

High

By Geography

-

North America

-

United States

-

Canada

-

Mexico

-

-

South America

-

Brazil

-

Argentina

-

Others

-

-

Europe

-

United Kingdom

-

Germany

-

France

-

Spain

-

Others

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

Others

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Taiwan

-

Others

-