Report Overview

Cloud Storage Market Size, Highlights

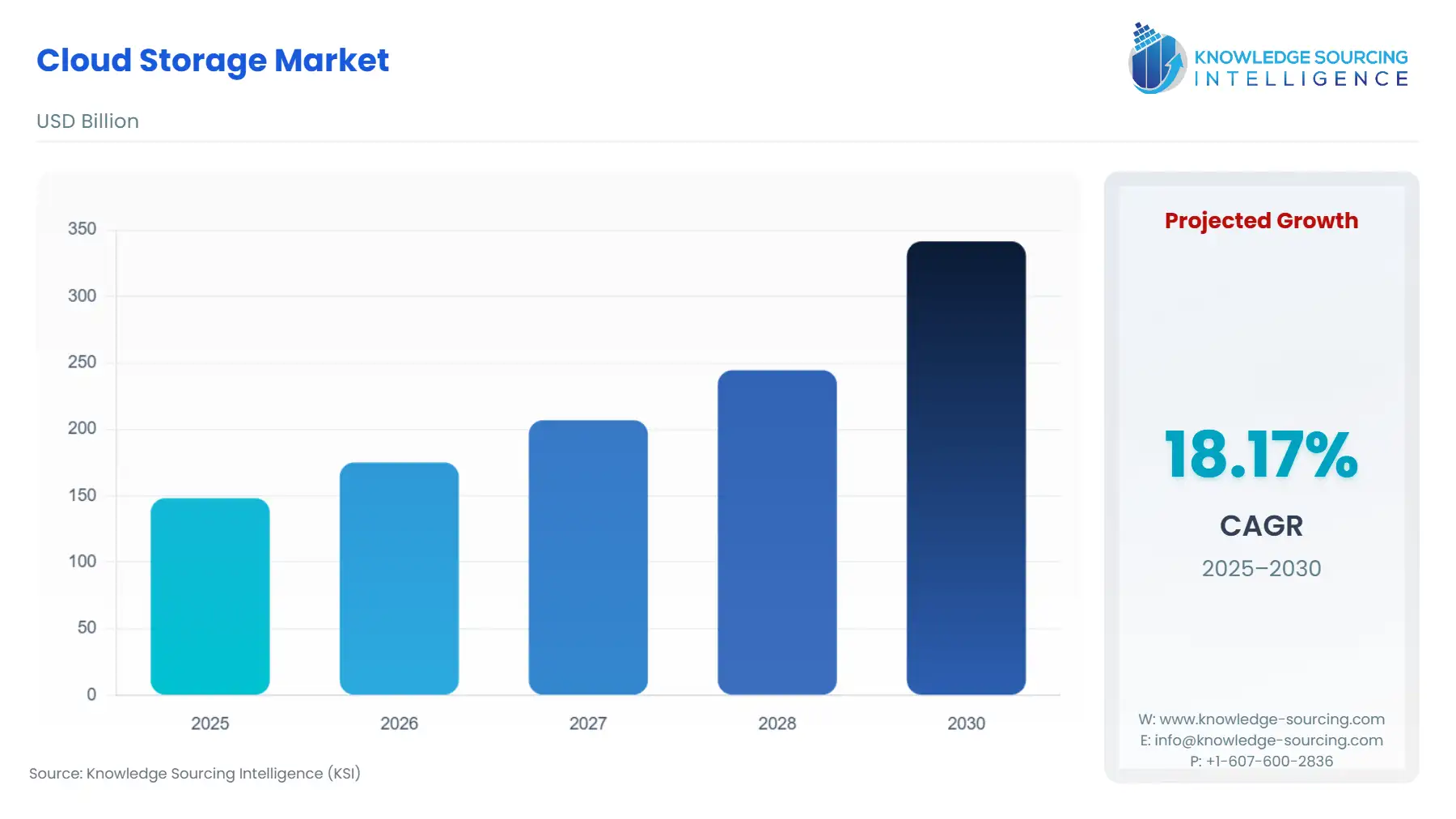

Cloud Storage Market Size:

The Cloud Storage Market is expected to grow from USD 148.236 billion in 2025 to USD 341.534 billion in 2030, at a CAGR of 18.17%.

The cloud storage market is undergoing a fundamental structural transformation, moving beyond simple commoditized capacity toward a highly specialized, compliance-driven, and intelligent service layer. The rapid expansion of enterprise data generated by AI, IoT, and global digital initiatives has rendered legacy on-premises infrastructure economically and operationally non-viable for most modern workloads. This secular shift places scalable, durable, and highly available cloud storage at the core of the global digital economy.

Cloud Storage Market Analysis

- Growth Drivers

The pervasive increase in Big Data and IoT adoption across verticals directly propels the demand for cloud storage, as businesses require highly elastic repositories to ingest and process massive, unstructured datasets. Enterprises are moving to cloud object storage models to manage petabytes of data generated from connected devices and customer interactions.

Furthermore, the global mandate for digital transformation acts as a powerful catalyst; as organizations modernize monolithic applications and shift core business processes to the cloud, they create a non-negotiable demand for high-performance, durable storage back-ends. The increasing complexity of disaster recovery and business continuity planning also drives demand, with firms replacing expensive, complex tape backups and secondary data centers with cost-effective, easily managed cloud backup and archiving solutions.

- Challenges and Opportunities

A primary challenge constraining cloud storage demand is the prevailing lack of in-house expertise in managing complex hybrid and multi-cloud environments, which deters smaller and medium-sized enterprises (SMEs) from rapid adoption. The cost management complexity inherent in "pay-as-you-go" models, where under-optimization leads to hidden charges, also acts as a headwind. Conversely, these challenges unlock significant opportunities in the Services segment—namely Integration & Implementation and Training & Consulting—as companies actively seek third-party expertise to navigate technical complexities and optimize cost structures. The growing requirement for data localization in jurisdictions like the EU and India creates a massive opportunity for providers offering sovereign cloud architecture and clear legal jurisdiction, directly increasing demand for in-region data centers and specialized compliance-focused storage products.

- Supply Chain Analysis

The cloud storage market, being a service, relies on a highly sophisticated global supply chain for its physical infrastructure layer: data centers. Key production hubs are concentrated in regions with access to cheap, reliable power and robust fiber-optic networks, notably the US (Virginia, Oregon), Ireland, and Singapore. The supply chain is subject to dependencies on the global semiconductor market for server components (CPUs, specialized storage processors) and the NAND flash memory market for high-performance solid-state storage arrays. Logistical complexities stem from the massive capital expenditure required for data center construction, the long lead times for specialized high-density hardware, and the energy sourcing contracts needed to power these facilities. Price volatility in the underlying hardware, combined with global shipping constraints, directly impacts the long-term operational expenditure and therefore the pricing models of cloud service providers.

Cloud Storage Market Government Regulations

Government regulations are no longer peripheral compliance matters; they are fundamental drivers reshaping cloud storage architecture and purchasing decisions.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union |

General Data Protection Regulation (GDPR), EUCS (proposed) |

GDPR mandates high security and accountability for personal data, creating a direct demand for certified, auditable, and secure storage solutions. The EUCS is driving demand for providers (often European) that can guarantee data sovereignty, potentially restricting competition by raising barriers to entry for non-EU providers. |

|

India |

Digital Personal Data Protection (DPDP) Act, 2023 |

The DPDP Act strongly encourages data residency by imposing strict governance and cross-border transfer limits. This is creating an unprecedented surge in demand for local data center capacity and India-based cloud storage infrastructure, fueling domestic investment. |

|

United States |

Federal Risk and Authorization Management Program (FedRAMP) |

FedRAMP compliance is mandatory for cloud services used by federal agencies. This regulation segments the market by creating a high-assurance tier, driving demand for providers who invest heavily in dedicated government clouds and rigorous security protocols to access the lucrative public sector market. |

Cloud Storage Market In-Depth Segment Analysis

Public Cloud Storage (By Deployment Model)

The Public Cloud segment commands the largest share, driven by the immediate, non-linear scalability it offers, which directly meets the high-volume, variable demands of Big Data, AI, and e-commerce workloads. The core demand driver is the Capital Expenditure avoidance imperative. SMEs and even large enterprises actively move away from the prohibitive upfront costs and complex operational management of building and maintaining on-premises storage infrastructure. The "pay-as-you-go" model transforms storage from a static asset to an elastic operational expense, significantly lowering the barrier to entry for digital innovation. Furthermore, Public Cloud providers, such as Amazon Web Services (AWS) and Microsoft Azure, leverage immense economies of scale to offer unparalleled levels of data durability and a global distribution of data centers.

BFSI (Banking, Financial Services, and Insurance) (By End-User Industry)

The BFSI sector’s demand for cloud storage is primarily driven by twin pressures: the need for regulatory compliance and security, and the imperative for customer-centric digital transformation. Regulatory bodies, while strict, are increasingly permitting cloud adoption provided strict compliance is maintained, which drives demand for private and hybrid cloud models tailored for sensitive client data and transactional records. The cost of a data breach, averaging in the millions of dollars globally, makes highly secure, cloud-native storage with advanced encryption, granular access control, and comprehensive audit logs a non-negotiable feature. Simultaneously, the industry is using cloud storage to power AI-driven personalization and real-time risk management. Massive amounts of customer transaction data and market feeds are stored and analyzed via cloud-based platforms to detect fraud, model risk, and deliver hyper-personalized financial products.

Cloud Storage Market Geographical Analysis

- US Market Analysis (North America)

The US market for cloud storage is characterized by early and deep adoption, primarily driven by a highly mature ecosystem of hyperscalers and a massive corporate demand base. The central demand factor is the Federal Government's Cloud-First strategy and the subsequent requirement for highly secure, certified cloud services under programs like FedRAMP. This creates a powerful, high-margin niche, compelling providers to invest in specific, isolated Government Clouds. Furthermore, the US is the global epicenter for Big Tech and advanced AI/ML development, which generates exponential demand for petabyte-scale object storage and high-performance block storage to train and run complex AI models.

- Brazil Market Analysis (South America)

Demand in Brazil is strongly influenced by its large, rapidly digitizing economy and a legal framework that is relatively favorable to data centers, viewing them as an economic activity under a free enterprise regime. A key local driver is the growing digital inclusion and adoption of new technologies like IoT and AI, which creates a constant, organic demand for connectivity and storage capacity. Regulatory discussions around local data storage requirements push companies with a national focus toward in-country data centers to preemptively meet potential data residency mandates, bolstering local investment in cloud infrastructure.

- German Market Analysis (Europe)

Germany's cloud storage demand is heavily defined by the imperative for digital sovereignty and data protection, primarily stemming from the GDPR and a strong national sentiment against foreign data access (such as the US CLOUD Act). This environment drives intense demand for sovereign cloud solutions and providers that can guarantee data storage and processing exclusively under EU jurisdiction. Businesses, especially in the highly regulated manufacturing and financial sectors, prioritize jurisdictional clarity over sheer cost savings, creating a segmented market where European-headquartered providers gain a competitive edge by explicitly eliminating the risk of foreign government data access.

- Saudi Arabia Market Analysis (Middle East & Africa)

The Saudi Arabian market is being propelled by the government’s ambitious Vision 2030 digital transformation agenda, which includes massive investments in smart city projects and nationwide digitalization. This top-down push generates substantial demand for cloud infrastructure, positioning cloud storage as a foundational enabler. Critical local demand drivers include the need for highly secure, compliant solutions in the BFSI and Healthcare sectors, which often adhere to a hybrid or multi-cloud strategy to balance the need for local data control with global scalability.

- India Market Analysis (Asia-Pacific)

India is witnessing explosive demand, primarily driven by the confluence of rapid digitalization, massive data consumption, and the Digital Personal Data Protection (DPDP) Act, 2023. This regulation, by creating strict guidelines for cross-border data transfers, is the single most critical factor generating an urgent demand for local, in-country cloud storage infrastructure. The mandate effectively necessitates a migration to India-based servers for certain types of personal data, driving the expansion of data center capacity—projected to increase fivefold by 2030—and fueling massive capital expenditure across the local and international provider landscape.

Cloud Storage Market Competitive Environment and Analysis

The competitive environment in the cloud storage market is dominated by a few global hyperscale infrastructure providers who leverage vast capital resources and economies of scale. Competition centers on service differentiation, performance (latency and throughput), global region footprint, and, increasingly, compliance features such as data residency and sovereignty. Niche players focus on specific value propositions like low-cost archival storage or open-source compatibility to gain market traction against the dominant oligopoly.

- Amazon Web Services- AWS maintains a leading position through its comprehensive suite of services, anchored by Amazon S3 (Simple Storage Service), which offers unmatched durability and scalability for object storage. Its strategic positioning is defined by its deep integration with a vast ecosystem of other AWS services, making it the default choice for enterprises building cloud-native applications on the AWS platform.

- Microsoft Corporation-Microsoft Azure's strategic positioning leverages its deep incumbency within the global enterprise market through its dominance in operating systems and productivity software. The company drives demand for its Azure Storage offerings by focusing on the hybrid cloud imperative, offering products like Azure Stack that allow enterprises to run Azure services, including storage, within their on-premises data centers..

Cloud Storage Market Recent Developments

- In September 2025, Cubbit partnered with HERABIT to deploy geo-distributed S3-compatible cloud storage in Italy. The system uses Cubbit DS3 Composer across three data centers with 2 PB capacity, ensuring data sovereignty, encryption, lower costs, and reduced environmental impact.

- In July 2025, QNAP launched myQNAPcloud One (Beta), a unified cloud platform combining NAS backup and scalable S3-compatible storage. It includes features like object locking, bucket versioning, and data access logs. The service offers global access via 13 data centers with plans starting at USD 8.39/month for 1TB.

Cloud Storage Market Segmentation

By Solution

- Primary Storage

- Backup Storage

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Service

- Integration & Implementation

- Training & Consulting

- Others

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End-User Industry

- BFSI

- Healthcare

- IT & Telecommunication

- Retail & E-Commerce

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Indonesia

- Others