Report Overview

Cloud Managed Services Market Size:

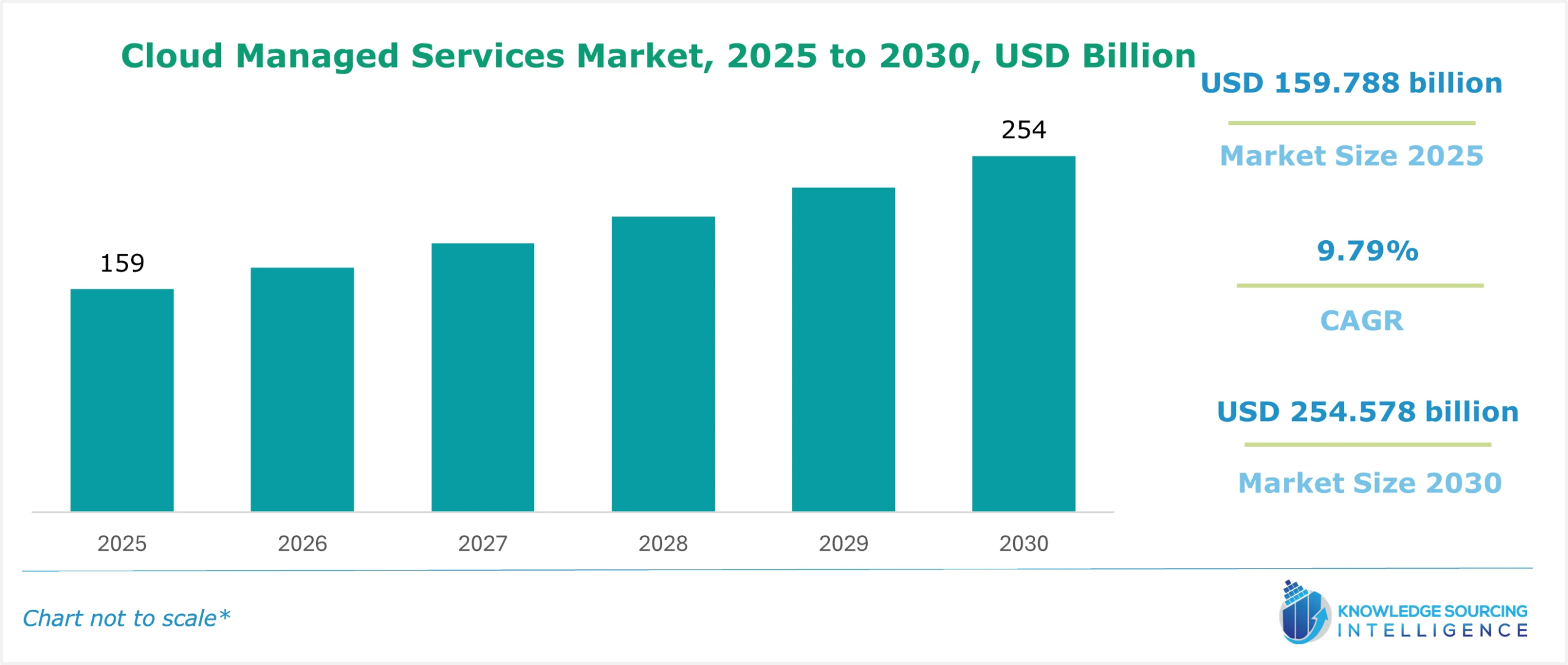

The cloud managed services market is expected to grow at a CAGR of 9.79%, reaching a market size of US$254.578 billion in 2030 from US$159.788 billion in 2025.

Cloud-managed services comprise an ecosystem of services such as 24/7 help desk support, operation management, engineering on demand, and hosting managed by third-party organizations. These services also include managed network operations, security operations, applications, and mobility.

Cloud-managed services establish a structural framework that plays an important role in preventing unauthorized data access, thereby reducing the risk of data theft against any organization. With the growing global cases of data breaches and cyber-attacks, the demand for cloud managed services is estimated to move forward.

For instance, IT Governance UK, in its report, stated that in April 2024, the globe witnessed about 5.336 billion records breached. The total number of records breached grew significantly from March 2024, when 299.368 million records were breached. The report further stated that the IT services and software industry witnessed the majority of cases, with about 5,244.119 million records breached, followed by 18.301 million in the manufacturing industry and about 15.280 million in the insurance industry.

What are the Cloud Managed Services Market drivers?

- Growing demand for improving operational efficiency drives market expansion.

Increased demand for performance and reliability will boost service demand, allowing businesses to move data between their operations by providing custom-made solutions to the services available. Companies are more focused on lowering IT expenses, fueling future demand. For instance, pay-as-you-go enables companies to use services until they want, and no payment is made in advance. Such a method saves a lot of capital for companies, as payment is only made for the resources used.

- Enhanced IT services stimulate the cloud-managed service market growth.

Cloud-managed services include improved IT functionality and customized IT services that can cater to the growing emphasis on improving network congestion caused by multiple users accessing the cloud at the same time, which can cause downtime. Companies such as Google and IBM have already started investing in this direction.

- Growing usage of Anything-as-a-Service can stimulate the overall cloud-managed service market expansion.

Anything-as-a-Service is referred to as XaaS. Platform-as-a-Service, Infrastructure-as-a-Service, and Software-as-a-Service constitute three pillars of cloud computing, offering a comprehensive range of services related to databases and networks. As end-users realize the benefits of XaaS, it is increasing faster than cloud computing.

Moreover, growing cloud computing has provided MSPs with the necessary infrastructure to manage and deliver their application and services. As a result, they can make the most of their IT budgets. Improvement in IT infrastructure has created a shift from capital to operational expenditures, lowering total ownership costs.

Cloud Managed Services Market is analyzed into the following segments:

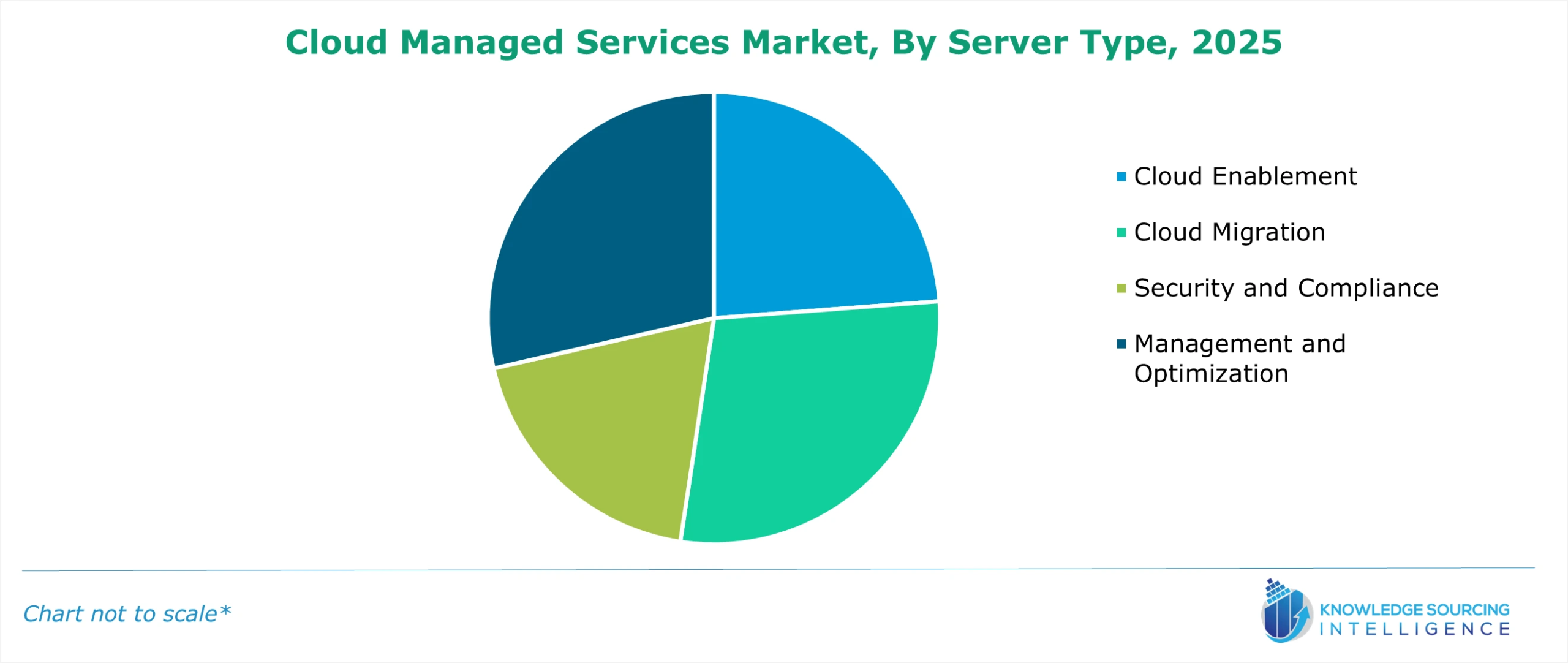

- Management and optimization hold a considerable market share.

Based on the service type, the market is divided into cloud enablement, cloud migration, management, optimization, and security and compliance. Management and optimization account for a considerable share, attributable to benefits provided by services such as economic benefits, future-proofed technology, tailored and integrated service, solid infrastructure, predictable and recurrent monthly charges, centralized services and applications, and availability across all service levels.

As cloud use grows, businesses increasingly rely on SaaS apps like business software suites, sales networks, and even Google suites as a centralized platform. As businesses become more aware of the cloud's intrinsic benefits, such as cost savings and mobility, they turn to it for data security.

- Large enterprise holds a considerable share of the market.

The cloud-managed service market is segmented by enterprise size into small, medium, and large. The latter is projected to hold a significant market share, fuelled by the growing investments in improving MNCs' IT infrastructure. Managed services have primarily been provided for broadband connections, security services, IP communications, VPNs, data centres, security, and mobility, which have been popular among smaller businesses.

- BFSI is expected to grow at a rapid rate.

Based on the end-user industry, the cloud-managed market is divided into BFSI, healthcare, education, government, communication and Technology, and others. The BFSI sector is projected to show the quickest growth, fuelled by ongoing collaborations to digitize the banking sector in major economies such as the USA and investments in cloud computing.

By evaluating transactional data to assess risks based on market activity and scoring consumers and future clients, big data solutions enable organizations to make educated decisions, allowing them to make better decisions. Major financial institutions, namely BNY Mellon, Bank of America Inc., and Morgan Stanley have started implementing a data-centric approach in their operations, which is further expected to bolster the overall segment growth.

Geographical outlook of the Cloud Managed Services Market:

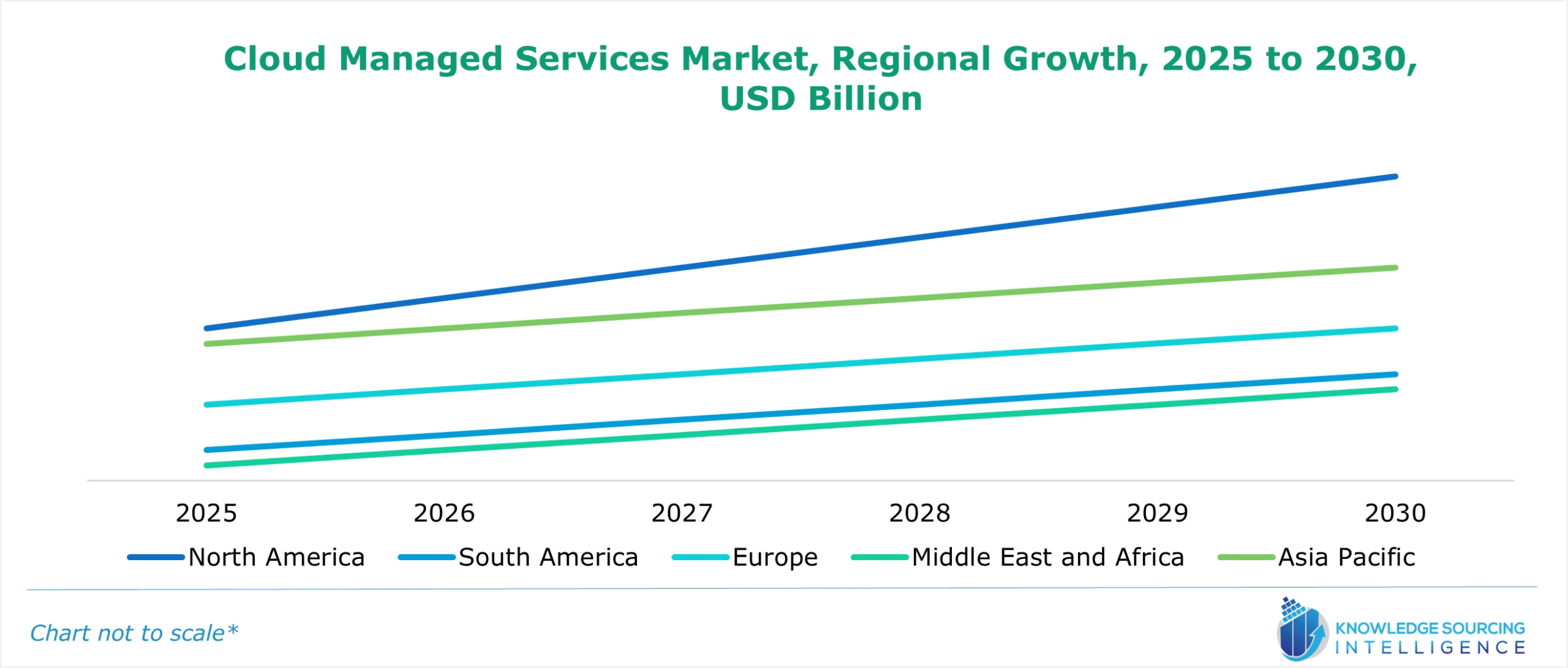

- Asia Pacific is witnessing exponential growth during the forecast period.

During the projection period, the APAC region is expected to see substantial expansion fuelled by the increased investment in cloud computing and favourable initiatives to digitize the economy, such as “Industry 4.0”. Moreover, due to the increased acceptance of cloud-managed services by small and medium-sized organizations, it is likely to drive market expansion. Asia Pacific is anticipated to witness the fastest region over the forecast period.

Additionally, the growing strength of SMEs, which account for a major portion of the employed workforce in major APAC economies, namely India and China, has bolstered the requirement for appropriate IT infrastructure to provide 24/7 desktop support. This has provided a wider scope for cloud-managed services in the region.

Key launches in the Cloud Managed Services Market:

- In August 2024, IBM partnered with Intel to deploy Intel Gaudi 3 AI accelerators as a service on IBM Cloud, expected to start in early 2025.

- In July 2024, IBM and Microsoft collaborated to bolster cybersecurity to assist clients in modernizing security operations and managing hybrid cloud identities.

Cloud Managed Services Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Cloud Managed Services Market Size in 2025 | US$159.788 billion |

| Cloud Managed Services Market Size in 2030 | US$254.578 billion |

| Growth Rate | CAGR of 9.79% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Cloud Managed Services Market |

|

| Customization Scope | Free report customization with purchase |

The cloud managed services market is segmented and analyzed as follows:

- By Server Type

- Cloud Enablement

- Cloud Migration

- Management and Optimization

- Security and Compliance

- By Enterprise Size

- Small

- Medium

- Large

- By End-User Industry

- BFSI

- Healthcare

- Education

- Government

- Communication and Technology

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America