Report Overview

Clinical Trial Imaging Market Highlights

Clinical Trial Imaging Market Size:

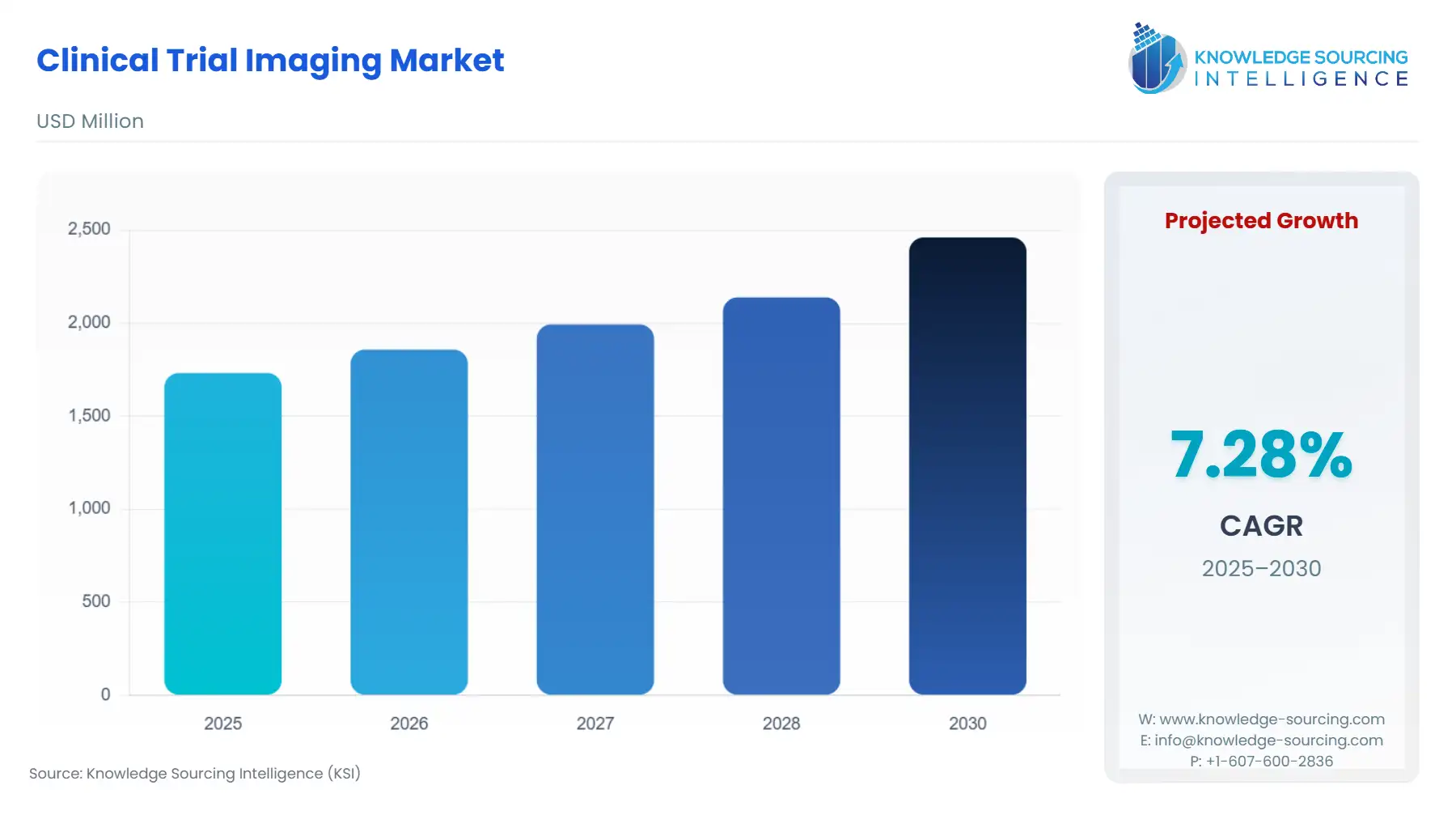

Clinical Trial Imaging Market is projected to expand at a 7.05% CAGR, attaining USD 2.607 billion in 2031 from USD 1.732 billion in 2025.

Clinical Trial Imaging Market Trends:

An imaging exam allows medical professionals to view what is happening inside the human body. These exams expose the body to various sources of energy, such as X-rays, sound waves, radioactive particles, or magnetic fields. The increasing investment in research projects to develop innovative medical solutions for long-lasting diseases such as cancer, chronic kidney disease, and others are major growth factors in the clinical trial imaging market. Moreover, the higher prevalence of this disease and demand for enhanced treatment solutions along with the emerging biotechnology companies due to rising healthcare expenditure are further contemplated to boost the clinical trial imaging market.

Clinical Trial Imaging Market Segmentation Analysis:

Increasing Biotechnological Companies

The increasing number of biotechnology companies with a focus on clinical trial imaging studies is expected to boost the clinical trial imaging market in the coming years. For instance, the Indian biotechnology industry crossed $80.12 billion in 2022 which is a 14% increase from 2021 as per the National Investment Promotion & Facilitation Agency, India. Moreover, around $1 billion was invested in the biotechnology R&D sector of India in 2022. The Australian biotechnology sector showed a 43% increase in 2022 from 2019 as per the AusBiotech Snapshot 2022. Moreover, the presence of leading biotechnology companies and emerging companies such as BioTelemetry, WCG Clinical, CRISPR Therapeutics, and 10x Genomics among others are further driving the clinical trial imaging market.

Increasing Cancer Cases

Imaging tests can be used to analyze cancers since they frequently exhibit a variety of structural, physiologic, and molecular changes as well as acquired biological abilities. Therefore, the rising cancer cases are contemplated to augment the clinical trial imaging market. For instance, one in six deaths, or around 10 million deaths, was due to cancer in 2020, making it the top cause of death globally as per the WHO. In low and lower-middle-income nations, cancer-causing infections including the human papillomavirus (HPV) and hepatitis are estimated to be the cause of 30% of cancer cases. The promise of novel targeted medicines with more focused action and reduced toxicity compared to standard chemotherapeutics is altering the management paradigm towards more tailored treatment and individualized care as the search for a cancer cure continues.

Growing Burden of Chronic Diseases

Chronic disease is a long-lasting condition that deteriorates a huge number of people on earth therefore, clinical trial imaging is crucial in earlier detection and treatment of disease as it ensures timely intervention. The rising cases of chronic diseases such as diabetes, kidney disease, cardiovascular diseases, and several others are expected to drive the clinical trial imaging market. For instance, More than one in seven adults in the United States, or around 37 million people, suffer from chronic kidney disease (CKD) as per the NIDDK. The primary cause of death in the world is cardiovascular disease (CVD). 32% of all fatalities worldwide in 2019 were predicted to have been caused by CVDs, killing 17.9 million individuals. Heart attack and stroke caused 85% of these fatalities according to the WHO.

Increasing Research Projects in the Field

The rising research projects including imaging clinical trials are another major growth driver in the clinical trial imaging market. For instance, the US National Library of Medicine reported that as of April 2022, there were 410,319 registered research spread throughout all 50 US states and 220 international locations, including 61,961 recruitment studies and 169,924 pharmacological or biological trials. Moreover, the Co-Clinical Imaging Research Resources Program (U24s) is run by the US Department of Health to focus on the optimization of quantitative imaging methods for precision medicine in preclinical and clinical settings. It supports ten co-clinical trial projects spanning a diverse range of therapeutic interventions, and imaging modalities.

Clinical Trial Imaging Market Geographical Outlook:

North America is Expected to Grow Significantly

The North American region is projected to hold a significant share of the clinical trial imaging market during the forecasted period. Various factors attributed to such a share are increasing healthcare expenditure, the prevalence of chronic diseases, and the growing older population. For instance, the healthcare system in the US contributed 17% of GDP in 2021 which is way higher than other regions as per the Common Wealth Organization. Additionally, technological advancements and government-backed research in healthcare by experts are further expected to propel the market size. The presence of market leaders such as Medpace is further anticipated to boost the clinical trial imaging market.

List of Top Clinical Trial Imaging Companies:

IXICO is a UK-based medical imaging services provider to enhance the outcomes of CNS trials. Through its remote access Trial Tacker Technology, the company created and implemented a ground-breaking machine learning AI data analytics in September 2022 to increase the pharmaceutical clients' return on investment in drug research and lower risk during clinical trials.

Navitas Life Sciences is an Indian drug development and clinical research company based out of Bengaluru. Master Protocol offered by the company increases the success rate and recognizes failure faster and at a lower cost in oncology clinical trials. It is also consistent with the US FDA’s goal of helping and making safe drugs.

Resonance Health is an Austalia-based medical technology company with a focus on the development and commercialization of non-invasive medical imaging analysis. It provides laboratory CRO services and imaging services for iron overload disorders, metabolic disorders, liver-related disorders, and brain diseases.

Clinical Trial Imaging Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Clinical Trial Imaging Market Size in 2025 | USD 1.732 billion |

Clinical Trial Imaging Market Size in 2030 | USD 2.461 billion |

Growth Rate | CAGR of 7.27% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Clinical Trial Imaging Market |

|

Customization Scope | Free report customization with purchase |

Clinical Trial Imaging Market Segmentation

By Offerings

Solutions

Services

By Technique

MRI (Magnetic Resonance Imaging)

CT (Computed Tomography)

PET (Positron Emission Tomography)

Ultrasound

Others

By Application

Oncology

Cardiology

Gastroenterology

Neurology

Pediatrics

Others

By End-User

Hospitals & Clinics

Diagnostics Centers

Others

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others