Report Overview

Clean Energy Technology Market Highlights

Clean Energy Technology Market Size:

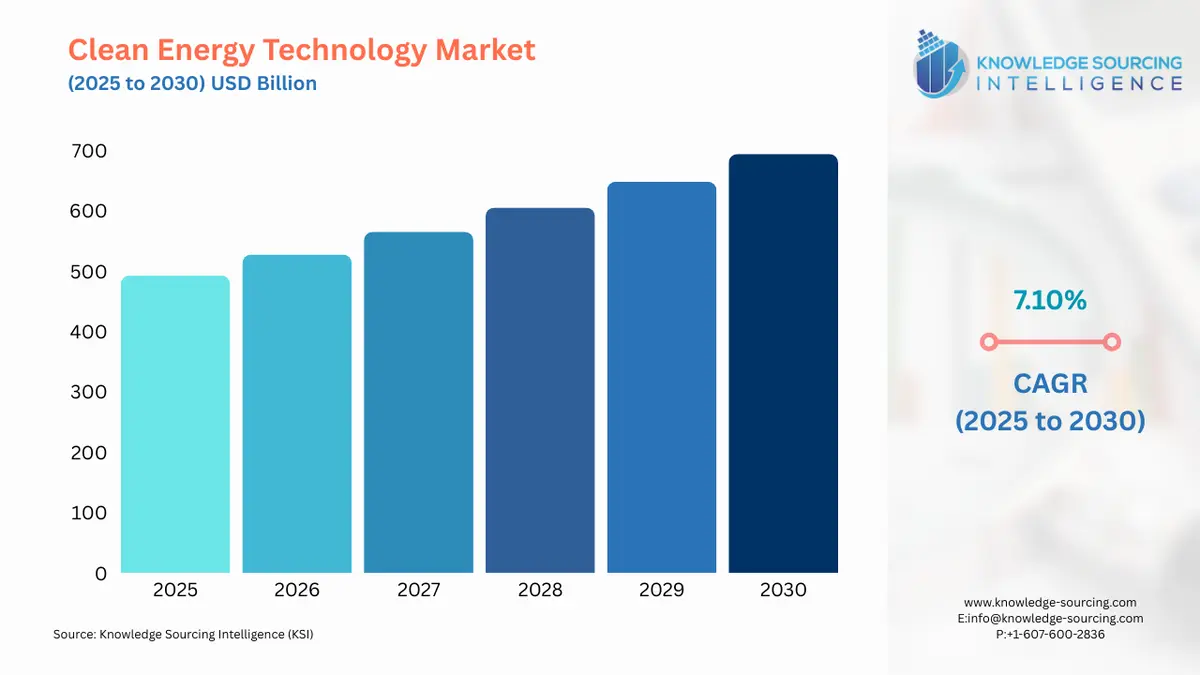

Clean Energy Technology Market is forecasted to rise at a 6.89% CAGR, reaching USD 734.935 billion in 2031 from USD 492.833 billion in 2025.

Clean Energy Technology Market Trends:

Clean energy technology refers to any technology that generates, stores, or utilizes energy in a manner that has minimal or no negative impact on the environment and contributes to reducing greenhouse gas emissions and pollution. Falling costs of clean energy, coupled with the rising environmental effects due to fossil fuels, are major growth drivers of the clean energy technology market. Moreover, the growing population and their increasing power demand along with the technological advancements and government support are further expected to boost the clean energy technology market.

Clean Energy Technology Market Growth Drivers:

Falling Costs of Clean Energy

As technology improves and economies of scale are achieved, the costs of clean energy technologies have been decreasing, which in turn is expected to augment the clean energy technology market. According to the World Economic Forum 2021 report, the cost of large-scale solar projects has experienced a remarkable decline of 85% over the past 10 years. Moreover, the year-on-year cost percentage reduction in 2019-202 for onshore and offshore wind was 13% and 9% respectively as per the International Renewable Energy Agency (IRENA) 2020 report. Additionally, according to the IRENA, emerging economies are projected to realize savings of up to $156 billion throughout the lifespan of renewable projects that were added in 2020 alone.

Rising Environmental Concern

The environmental adversities associated with fossil fuels pose a serious concern, such as greenhouse gas emissions, air pollution, and climate change. These negative impacts create the demand for cleaner fuel, thereby boosting the clean energy technology market. For instance, three gigatonnes of CO2 per year (20% of the emissions) needed to be reduced by 2030 to avoid a global climate disaster that can be stopped by retiring expensive coal plants. According to the IPCC's Sixth Assessment Report (2021), human emissions of gases that trap heat have already caused the temperature to rise by almost 2 degrees Fahrenheit (1.1 degrees Celsius) since the beginning of the Industrial Revolution.

Consistent Government Initiatives and Policies

Many governments around the world have implemented supportive policies, regulations, and financial incentives to encourage the development and deployment of clean energy technologies. These can include tax credits, feed-in tariffs, grants, and renewable portfolio standards. For example, the US government launched the Global Methane Pledge in 2021 to advance climate action both domestically and internationally, and it also aims to cut the net greenhouse gas emissions by 50-52% in 2030. According to the Press Information Bureau of India, the government aims to fulfill almost 50% of energy requirements from clean energy and increase non-fossil energy capacity to 500 Gigawatts by 2030. These efforts are likely to accelerate the clean energy technology market.

Advancements in Technology

Ongoing advancements in clean energy technologies have led to improved efficiency, lower costs, and increased accessibility. As these technologies become more competitive with traditional energy sources, their clean energy technology market is anticipated to grow in the coming year. A recent development in sustainable energy technology is building-integrated photovoltaics. BIPV has a desirable quality in that it is economical and reduces the cost of power. It also reduces the additional cost of solar panel mounting methods. Moreover, the Indian government launched a Mission on Advanced and High-Impact Research Initiative (MAHIR) in June 2023 to facilitate the development and demonstration of emerging technologies in the power sector.

Increasing Public Awareness

There is a growing public interest in supporting clean energy initiatives due to concerns about climate change, the health impacts of pollution, and a desire to transition to a sustainable energy future. For instance, the UNDP’s People’s Climate Vote Survey in 2021 revealed that 64% of the population believes that climate change is a global emergency and urgent action is required. Of the respondents in eight out of ten survey countries with the highest emissions from the power sector, the majority of people backed renewable sources of energy.

Growing Population and Power Demand

The growing global population and increasing power demand present significant opportunities for clean energy solutions. In 2019, there were still over 750 million people without access to electricity, and many more had to deal with intermittent power, according to the IRENA. The rising power demand owing to the growing population can be fulfilled with clean energies as they are renewable and can cater to the unlimited demand when combined with proper technology, thereby boosting the clean energy technology market. For instance, the present world population exceeds 8 billion, and it is projected to reach 9.8 billion by 2050 as per the United Nations projections.

Clean Energy Technology Market Geographical Outlook:

Asia-Pacific is Expected to Grow Significantly

The Asia-Pacific region is expected to hold a significant share of the clean energy technology market during the forecast period. The factors attributed to such a share are the growing population in the region, with India and China being the top two countries by population. Moreover, the energy access in the region, along with the advancements in technology and emerging companies such as CDL and Xinyi Solar Holdings, is further propelling the clean energy technology market. For instance, China stated its intention to achieve carbon neutrality by 2060 in September 2020, a significant advancement from its earlier pledge to reach the peak of carbon emissions by 2030.

Clean Energy Technology Market Major Players:

Envision Group is a leading Chinese technology company specializing in clean energy and smart city solutions. Envision Group's core focus is on providing innovative and sustainable solutions for energy generation, storage, and management.

Acciona SA is a Spanish multinational company focused on sustainable infrastructure solutions and renewable energy. It offers solar photovoltaic energy plants with a capacity greater than 1 MW.

Clean Energy Technology Market Key Developments:

In April 2023, Brown University launched a New Initiative for Sustainable Energy to galvanize research to develop solutions in three areas of sustainable energy that are crucial for reducing climate change and its consequences.

In January 2023, Caltech Space Solar Power Project (SSPP) launched a Space Solar Power Demonstrator (SSPD) into orbit which will test several key components to harvest solar power in space and beam the energy back to Earth.

In September 2022, Serentica Renewables launched a renewable energy platform in India to supply round-the-clock carbon-free power to large consumers of energy in India.

Clean Energy Technology Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Clean Energy Technology Market Size in 2025 | USD 492.833 billion |

Clean Energy Technology Market Size in 2030 | USD 694.460 billion |

Growth Rate | CAGR of 7.10% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Clean Energy Technology Market |

|

Customization Scope | Free report customization with purchase |

Clean Energy Technology Market Segmentation

By Technology

Hydropower

Clean Coal

Wind

Solar

Others

By Application

Industrial

Residential

Commercial

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others