Report Overview

Capsule Endoscopy Market - Highlights

Capsule Endoscopy Market Size:

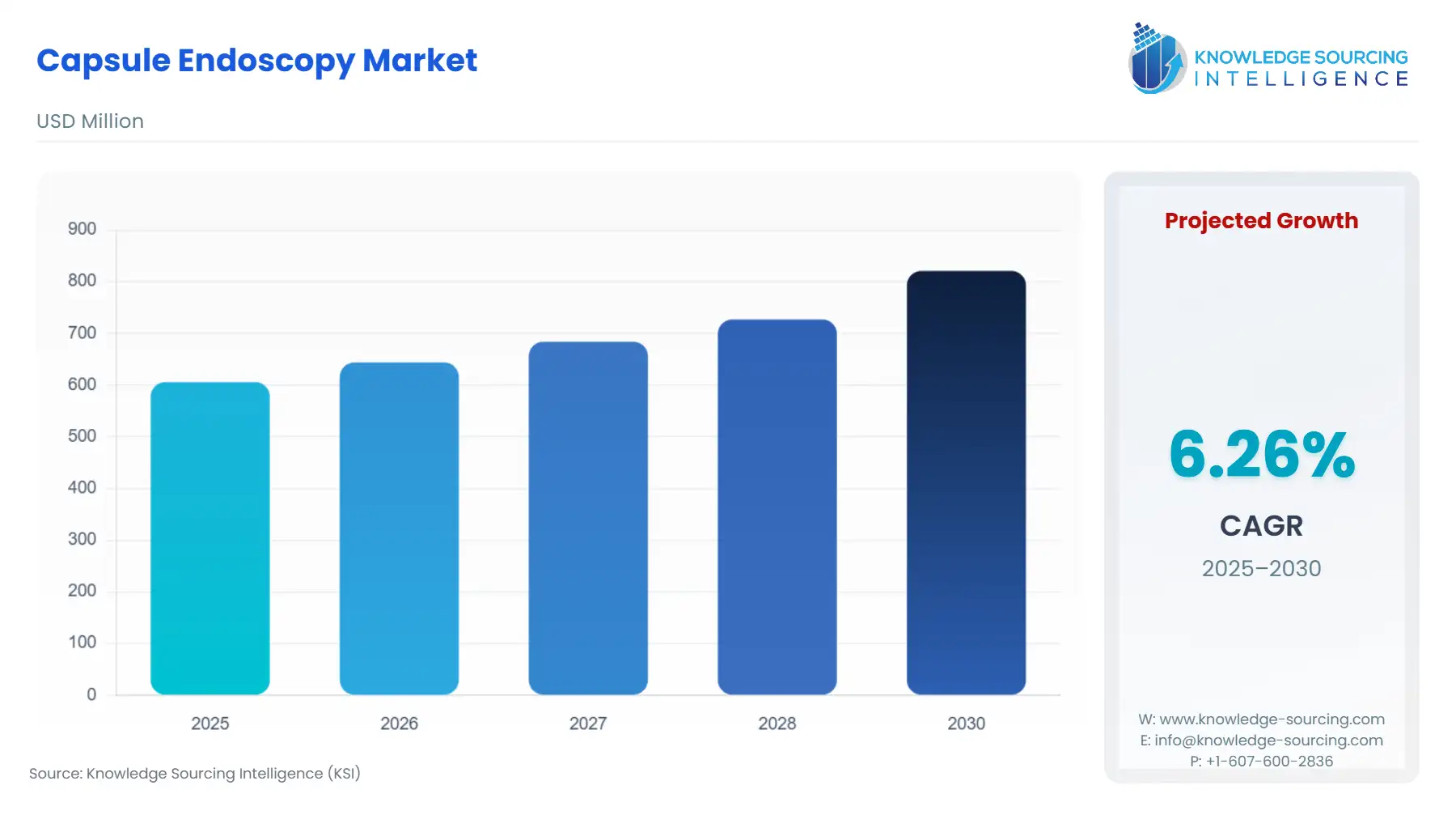

The capsule endoscopy market is expected to grow from USD 605.969 million in 2025 to USD 821.108 million in 2030, at a CAGR of 6.26%.

Capsule Endoscopy has established itself as an essential, first-line diagnostic modality for visualizing the mucosa of the small bowel, an anatomical region historically difficult to access via traditional tethered endoscopes. This market revolves around a patient-swallowable device—a miniature, pill-sized camera—that traverses the Gastrointestinal (GI) tract, capturing thousands of images and wirelessly transmitting them to an external Data Recorder worn by the patient. The core value proposition of this technology is its ability to offer a non-invasive, patient-friendly method for identifying a range of pathologies, including Crohn's disease, small bowel tumors, and, critically, Obscure Gastrointestinal Bleeding (OGIB). Market growth is intrinsically linked to the increasing global prevalence of chronic GI disorders and the continuous technological refinement of the capsule itself, which enhances image quality and improves diagnostic yield.

Capsule Endoscopy Market Analysis

Growth Drivers

The global escalation in the prevalence of chronic gastrointestinal disorders, notably Crohn’s disease and various small intestine pathologies, creates an amplified and immediate need for effective, high-resolution diagnostic tools, thereby stimulating demand for capsule endoscopes. Furthermore, the demonstrated superiority of capsule endoscopy over other non-invasive imaging techniques for the diagnosis of Obscure Gastrointestinal Bleeding (OGIB) solidifies its position as the standard of care, ensuring consistent demand from gastroenterology centers. The ongoing refinement of the capsule's core technology, including higher frame rates, wider fields of view, and prolonged battery life, continually expands clinical utility and increases physician confidence, compelling broader clinical adoption.

Challenges and Opportunities

A primary market constraint is the inherent inability of the current-generation capsule endoscope to perform therapeutic interventions, such as biopsy or polypectomy, limiting its role strictly to diagnosis and subsequently curbing its competitive advantage over tethered endoscopy. This functional limitation restricts demand to diagnostic-only procedures. However, a significant opportunity lies in the burgeoning field of Artificial Intelligence (AI) for image processing. The implementation of AI-assisted reading software substantially reduces the laborious, time-intensive process of video review for clinicians, enhancing workflow efficiency and improving diagnostic accuracy, which directly creates demand for advanced Data Recorder & Work Stations components.

Raw Material and Pricing Analysis

The capsule endoscope is a sophisticated electronic medical device, making it subject to the pricing dynamics of specialized electronic components. Key raw materials include medical-grade plastics for the outer shell, high-density batteries (often silver-oxide or similar chemistries for a small footprint), and Complementary Metal-Oxide-Semiconductor (CMOS) imaging sensors. Pricing is influenced not by raw commodity costs but by the proprietary nature and miniaturization technology of the sensors and transmitters. The fixed-cost nature of the capsule (single-use, disposable) means price elasticity is low, as the diagnostic outcome justifies the expense. Supply chain volatility, particularly in the sourcing of high-resolution, miniature CMOS sensors and micro-electronic components from Asia-Pacific fabrication hubs, poses a risk to manufacturing costs.

Supply Chain Analysis

The supply chain for the Capsule Endoscopy Market is a specialized, multi-tiered structure beginning with highly concentrated manufacturing of micro-components—chiefly the camera, light source, and transmitter—primarily in East Asia (China, Japan, South Korea). These core components are then assembled into the final, sterile, disposable capsule units by major med-tech companies in their facilities across North America, Europe, and Asia. Logistical complexity centers on managing a high-volume, global distribution of a sophisticated, single-use, electronic medical device that requires stringent quality control. The chain is highly dependent on a few key suppliers for the camera and battery technology, creating points of strategic vulnerability and necessitating robust inventory management at both the manufacturer and the hospital/clinic end-user level.

Capsule Endoscopy Market Government Regulations

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

United States | Food and Drug Administration (FDA) / 510(k) Clearance Pathway | FDA 510(k) clearance validates the safety and effectiveness of new capsule models compared to existing devices. This regulatory approval is essential for market entry and significantly boosts physician confidence, which in turn drives clinical demand and secures insurance reimbursement eligibility. |

European Union | Regulation (EU) 2017/745 (Medical Device Regulation - MDR) | The MDR imposes more rigorous requirements for clinical data and post-market surveillance for Class IIb devices like capsule endoscopes. This raises compliance costs for manufacturers but standardizes product quality and safety across the EU, supporting sustained clinical demand for high-quality devices. |

China | National Medical Products Administration (NMPA) / Innovation Device Review | The NMPA's classification and fast-track pathways for innovative devices encourage domestic R&D and manufacturing. This fosters a competitive local supply and increases the availability of lower-cost devices, driving broader adoption and higher demand in the vast domestic Chinese market. |

Capsule Endoscopy Market Segment Analysis

By Product: Small Bowel Capsule

The Small Bowel Capsule segment dominates the market because its utility addresses a critical, unmet diagnostic need: the visualization of the small intestine. This anatomical area is inaccessible to standard gastroscopy and colonoscopy. The primary growth driver is the high prevalence and necessity of diagnosing Obscure Gastrointestinal Bleeding (OGIB), where the small bowel capsule serves as the gold standard, non-invasive tool for lesion localization. Clinical guidelines from international gastroenterology societies consistently recommend its use for this indication. Furthermore, the use of small bowel capsules for assessing the severity and extent of Crohn’s disease in the small intestine, without requiring invasive procedures, further strengthens the product's demand. The segment’s growth is sustained by continuous technological improvements, such as adaptive frame rate control and larger angle optics, which consistently improve the diagnostic yield and solidify its foundational clinical role.

By End-User: Hospital

The Hospital end-user segment maintains the largest market share due to critical infrastructure requirements and high procedural volume. Hospitals, particularly large academic and regional medical centers, are the primary purchasers because they possess the requisite advanced medical infrastructure, including specialized gastroenterology departments and dedicated IT networks necessary to manage the large data sets generated by capsule procedures. The principal growth drivers are high patient throughput, which makes capital investment in the technology justifiable, and the ability to manage complex cases that require immediate follow-up or intervention. Furthermore, established hospital reimbursement policies for capsule endoscopy procedures, coupled with the presence of experienced gastroenterologists capable of accurate video interpretation and follow-up care, centralize patient referrals and sustain high demand within this end-user category.

Capsule Endoscopy Market Geographical Analysis

US Market Analysis

The US market is characterized by high adoption rates and premium pricing, largely driven by widespread private insurance and Medicare reimbursement for capsule endoscopy procedures, making the technology economically viable for hospitals and clinics. Demand is stimulated by the high prevalence of complex GI disorders and a well-established medical infrastructure that rapidly integrates technological advancements, such as AI-assisted reading software. Local factors include aggressive marketing by key manufacturers and a strong clinical culture that favors non-invasive diagnostic alternatives when supported by rigorous FDA clearance.

Brazil Market Analysis

The Brazilian market is growing, but demand remains segmented, primarily driven by the private healthcare sector in major urban centers. The key growth catalyst is increasing awareness among private-pay patients and clinicians regarding non-invasive diagnostic alternatives for OGIB and inflammatory bowel diseases. Adoption in the public sector (SUS) is constrained by budget limitations and prioritization of basic care. Local factors accelerating demand include the expansion of private diagnostic laboratories and the local regulatory agency (ANVISA) actively streamlining the clearance process for internationally-approved, innovative medical devices.

German Market Analysis

Germany exhibits a mature European market, where demand is robust, driven by a national healthcare system that provides comprehensive reimbursement for diagnostic procedures when clinical necessity is established. Local demand factors include a high concentration of sophisticated gastroenterology centers and a clinical emphasis on diagnostic thoroughness, compelling the use of high-yield tools like capsule endoscopy. The market is highly sensitive to the stringent quality and clinical data requirements imposed by the European Medical Device Regulation (MDR), favoring established, compliant device manufacturers.

United Arab Emirates (UAE) Market Analysis

The UAE market for capsule endoscopy is experiencing rapid, government-funded growth, driven by strategic efforts to establish the nation as a regional medical tourism hub. Institutional demand is the primary factor, with major government and private hospital groups investing heavily in state-of-the-art diagnostic equipment, including advanced capsule systems. Local factors include high disposable income among the resident population and expatriates, leading to a strong preference for non-invasive, high-comfort procedures, bolstering the overall market expansion.

China Market Analysis

China represents a massive, rapidly expanding market, driven by government healthcare reforms aimed at enhancing diagnostic capabilities across a vast population. Local manufacturers, such as JInshan Science & Technology, benefit significantly from preferential policies and accelerated regulatory pathways via the NMPA. This has led to a greater supply of domestically produced, cost-effective capsule systems, which dramatically increases accessibility and penetration across tier-two and tier-three hospitals, acting as a profound catalyst for overall market growth.

Capsule Endoscopy Market Competitive Environment and Analysis

The Capsule Endoscopy Market is dominated by a few key players who possess strong intellectual property rights and established global distribution networks, primarily in the Small Bowel Capsule segment. Competition revolves around technological differentiation, particularly in image resolution, field of view, battery life, and the integration of Artificial Intelligence for diagnostic interpretation. Strategic positioning often involves expanding clinical utility to the esophagus and colon, and securing favorable reimbursement in major regions. The landscape also includes smaller, innovative firms specializing in next-generation features like steering or therapeutic capabilities.

Medtronic Plc.

Medtronic Plc. is a commanding force in the market, primarily through its PillCam portfolio, which includes the PillCam SB 3 (Small Bowel), PillCam COLON 2, and PillCam™ patency capsule. Medtronic’s strategy is based on continuous innovation, focusing on patient comfort and physician workflow. The company emphasizes high-resolution imaging and adaptive frame rate technology to maximize diagnostic yield. Their strategic positioning is enhanced by the PillCam™ Genius Link Device for comfortable data capture and the GI Genius™ intelligent endoscopy module (developed through a partnership with Cosmo Pharmaceuticals), which integrates AI to expedite small bowel capsule image review, directly augmenting the value and demand for their systems.

Olympus Corporation

Olympus Corporation is a major global player in the broader endoscopy equipment market, leveraging its extensive existing sales channels and reputation for optical excellence to position its capsule endoscopy products. The company focuses on integrating capsule imaging within its comprehensive suite of gastrointestinal diagnostic solutions. Olympus’s strategy includes targeting efficiency and connectivity, aiming to provide a seamless diagnostic ecosystem for gastroenterologists. Their competitive advantage stems from their deeply entrenched relationships with hospitals and clinics worldwide, which facilitates the rapid adoption of their new or improved capsule endoscopy platforms and associated workflow software.

Jinshan Science & Technology (Group) Co., Ltd.

Jinshan Science & Technology (Group) Co., Ltd. is a significant, rapidly growing competitor, particularly dominant in the Asia-Pacific region and strategically expanding globally. The company’s core product is the OMOM capsule endoscopy system, including the OMOM HD and the OMOM CC (Colon Capsule). Jinshan’s strategy focuses on delivering cost-effective, high-quality systems and innovative features, such as its development of a magnetically guided robotic capsule system. Their strong market share is driven by deep penetration into the massive Chinese domestic market, providing them with economies of scale and a strong base for international expansion into emerging markets.

Capsule Endoscopy Market Developments

December 2024: Medtronic deployed its updated PillCam™ Genius Link Device receiver sticker technology. This innovation condenses the bulky external equipment into a less cumbersome adhesive sticker, significantly enhancing patient comfort and improving the adherence and quality of image data capture.

October 2024: Olympus announced CE mark approval for its cloud-based AI medical devices (CADDIE, CADU, SMARTIBD) under the MDR. While focused on tethered endoscopy, this approval signals a strategic shift to AI integration, which will inevitably be leveraged for future Olympus capsule endoscopy workstations, driving software demand.

April 2024: Medtronic hosted its Genius Summit 2024, highlighting innovations and collaborations advancing endoscopic care. The event showcased the commitment to AI-driven solutions, including the GI Genius system, demonstrating a strategic imperative to enhance the efficiency and effectiveness of capsule image review.

Capsule Endoscopy Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 605.969 million |

| Total Market Size in 2030 | USD 821.108 million |

| Forecast Unit | Billion |

| Growth Rate | 6.26% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Component, Product, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Capsule Endoscopy Market Segmentation:

By Component

Sensors

Data Recorder & Work Stations

By Product

Small Bowel Capsule

Esophageal Capsule

Colon Capsule

By Application

Obscure Gastrointestinal Bleeding

Crohn’s Disease

Intestine Disease

Others

By End-User

Hospital

Clinics

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Italy

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Isreal

Others

Asia Pacific

China

Japan

South Korea

India

Indonesia

Thailand

Taiwan

Others