Report Overview

Butadiene Market Size, Share, Highlights

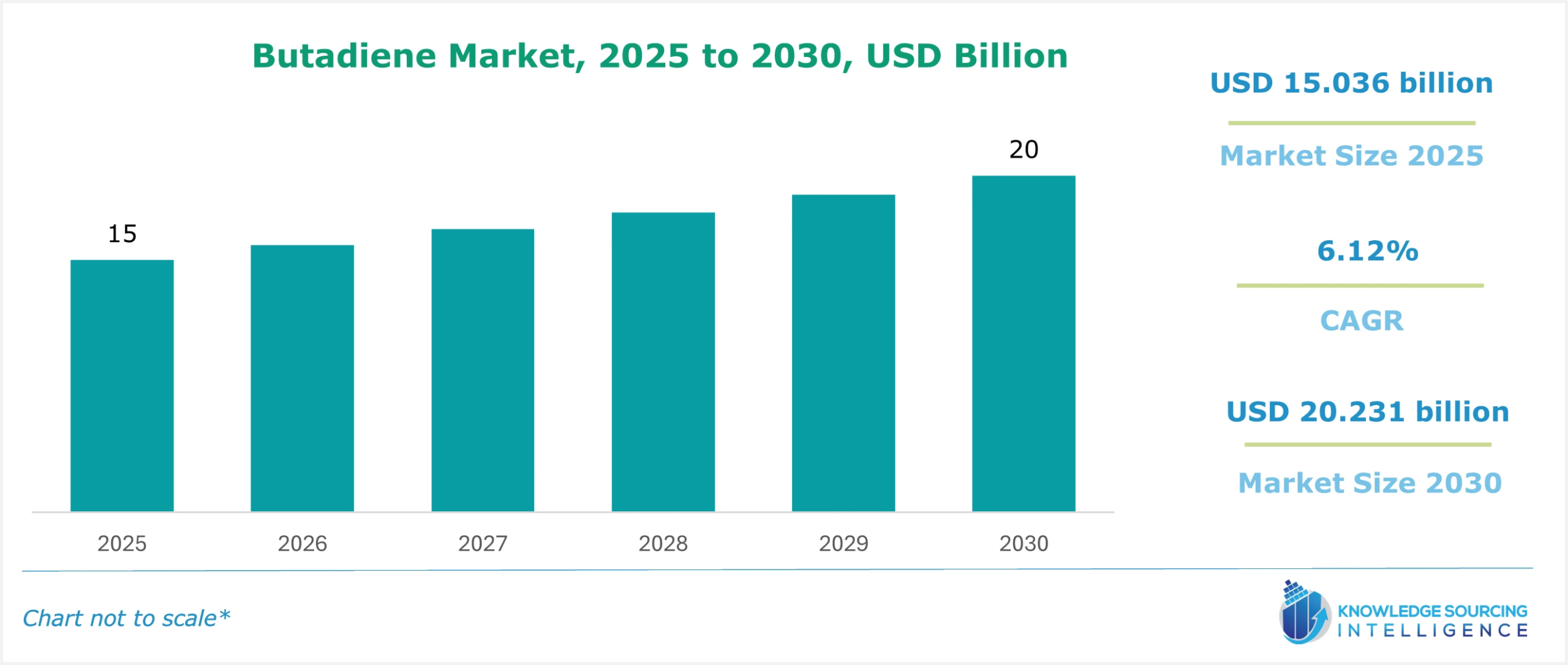

The Butadiene market is predicted to expand at a CAGR of 6.12% to account for US$20.231 billion by 2030 from US$15.036 billion in 2025.

Butadiene is a colorless gas considered to be an industrial chemical precursor to synthetic rubber production, among other activities. This includes styrene-butadiene rubber (SBR), utilized in the tire compound rubber, and nitrile butadiene rubber (NBR), an oil and fuels-resistant rubber. Polybutadiene rubber is also greatly used, especially in the manufacturing of adhesives and sealants as well as in modification of asphalt. Further, butadiene is reactive and has unique physical properties which are used in several industries.

The butadiene market has witnessed growth primarily due to the growing consumption of synthetic rubber in the automobile, construction, and consumer goods industries, where butadiene plays an important role.

There has also been positive growth in the butadiene demand globally owing to the rising infrastructure investments. The overall investment by the UK government into the infrastructure sector as of 2023 was around £13.8 billion, a rise of around 3.9% from the previous year. Likewise, demand for infrastructure sector assets also rose, with net assets of the infrastructure sector being valued at £350.2 billion, an increase of 0.3% from 2022.

Demand for infrastructure sector assets also rose, with net assets of the infrastructure sector being valued. Further, the investment by companies in procurements in butadiene facilities will, in turn, accelerate the market growth more so that advanced technology is employed to increase productivity and reduce expenditures and waste emissions. For instance, a new styrene-butadiene copolymer (SBC) project was launched by a subsidiary of China Petroleum & Chemical Corporation Sinopec in Hainan, China, with an annual capacity of 170000 tons, which started in April 2023.

What are the drivers of the Butadiene Market?

- Expanding Automotive Sector

Butadiene is one of the important materials for the automotive industry, which is mainly due to the production of synthetic rubber used in vehicles. The optimistic projections related to this market include the production of tires, the leading consumer of butadiene, and the manufacturing of automotive components with butadiene-based products for hoses, belts, and seals. With the increasing market for automotive products, the consumption of tires will witness a drastic increase, propelling the butadiene market. In the annual data report by OICA, the Motor Vehicle Manufacturers Global Association elaborated that vehicle production in 2023 exceeded the volumes noted where 84.830 million units were produced in 2022, rising to 93.546 million units in 2023. Further, in 2023, the production of vehicles in China was 30.130 million vehicles and 10.611 million in the USA. Such a growing vehicle population across the globe will potentially contribute to the market growth in the subsequent years

- The synthetic-styrene butadiene rubber segment is expected to grow significantly

Synthetic-styrene butadiene rubber is a synthetic rubber compound commercially used in tires and other rubber goods. It is a copolymer of the two major monomers: styrene and butadiene. These copolymers are produced when the string of styrene and butadiene are varied in gender and cross-link density along a polymer backbone.

The minimal rolling resistance also contributes to improved fuel efficiency in vehicles since it takes less effort to roll the tires. This affects fuel economy and decreases GHG emissions. It also has excellent aging, weathering, and abrasion resistance, making it suitable for various applications outside tires, such as the automotive and outdoor industries (industrial products, conveyor belts, and shoes).

Moreover, the increasing tire production will drive its market growth by boosting the use of its components. Rising tire production capacities, enhancing existing tire production efficiencies, or new tire production techniques that are more styrene butadiene rubber intensive. Eco-friendly and ecologically sustainable tires will also promote market growth.

Moreover, tire qualities have been enhanced through the use of styrene butadiene rubber. It improves fuel economy and lessens rolling resistance. Additionally, it enhances braking and tire wet grip. To increase the tire's lifespan, it also shields it from damage. Title sales have also increased. For example, the U.S. Tire Manufacturers Association (USTMA) projects that the total number of tires shipped in the United States increased from 331.9 million in 2023 to 337.4 million in 2024.

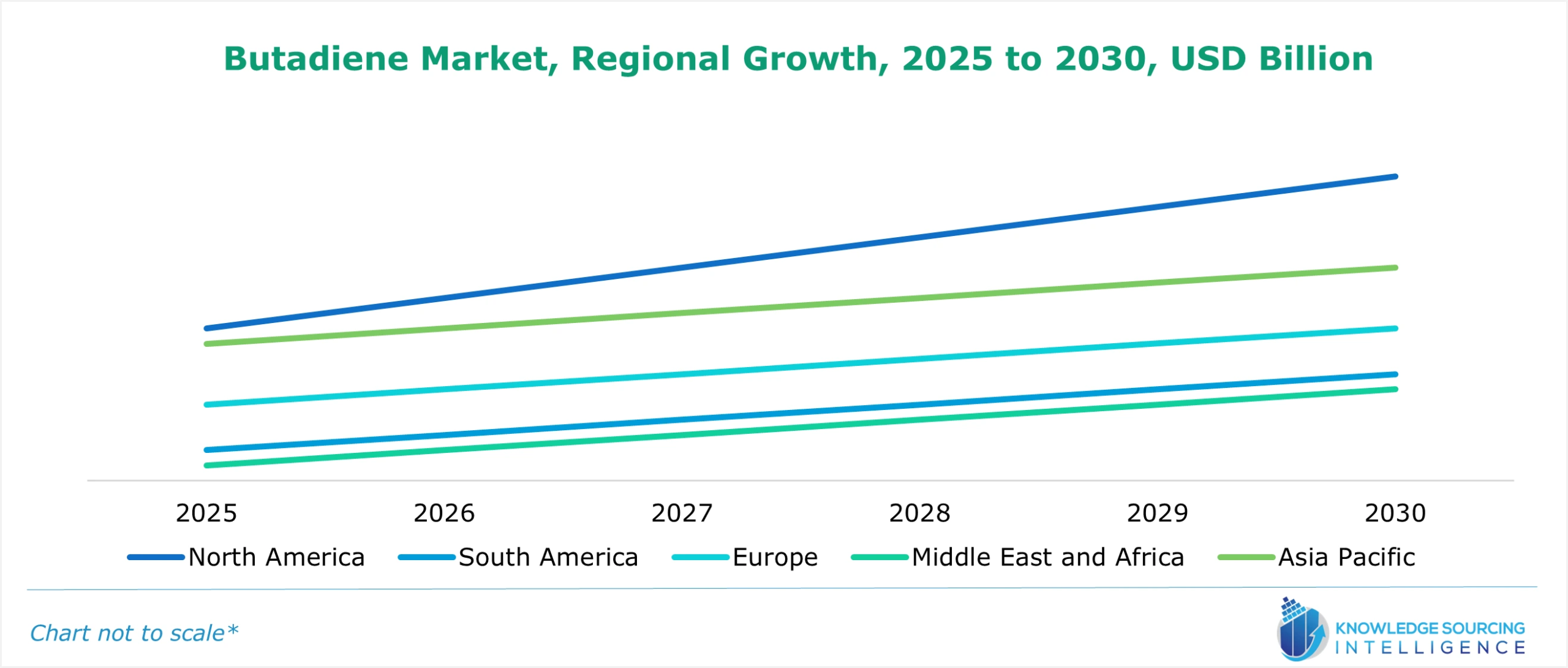

Geographical Outlook of the Butadiene Market:

- The United States in the North American region is expected to hold significant shares of the Butadiene market.

The market in the United States is mainly influenced by the demand for butadiene as a base product for producing and processing elastomers and their chemical derivatives. Such elastomers include Acrylonitrile Butadiene Styrene, Poly Butadiene Rubber, and Styrene Butadiene Rubber (SBR), amongst others. Nevertheless, due to its inherently high resistance to slip and wear and its ability to withstand various organic solvents, oils, and fuels, SBR is in great demand across all sectors. Polystyrene-Polybutadiene rubber, a very popular synthetic rubber, is found in most of the applications in tires and other industrial products.

Moreover, the rising demand for this specific rubber from the tire segment is among the key factors contributing to the growth. Moreover, demand for butadiene will increase, particularly in the forecast period, because of the production of advanced materials like butadiene acrylonitrile for automotive applications and increased export of butadiene rubber. For instance, butadiene rubber was exported by the United States to Mexico at $91,995.92K for 53,441,000 Kg and Canada at $68,221.64k for 34,471,500 Kg as per data from WTIS.

Company Profiles in the Butadiene Market:

- LOTTE Chemical Corporation is a well-known international enterprise in the chemical industry that manufactures various petrochemical products, including butadiene. The firm employs a vertical integration strategy that is lean and very effective in the production of value-added products associated with construction, domestic electric appliances, and textiles.

- JSR Corporation, or Japan Synthetic Rubber Co., Ltd., was formed in 1957 and started with the production of synthetic rubber for the domestic market. Over the years, however, the company has widened its scope to cover the manufacturing of emulsions, plastics, and materials, including Butadiene, used within the semiconductor, flat panel display, and optical device markets.

- Sinopec is an energy and chemical group that dominates in the production and application of butadiene, an all-purpose hydrocarbon, which has diverse applications, in particular in manufacturing synthetic rubber for tires, belts, hoses, and other rubber good

- ENEOS Holdings Inc., is a Japanese petrochemical company which operates in various business segments, inclusive of energy, oil & gas, lubricants, and high-performance materials. Its acrylonitrile butadiene rubber contains excellent oil & mold contamination resistance and good processibility, due to which they are mainly used in automotive & industrial parts. ENEOS provides its butadiene rubber under its high-performance materials business, and through the establishment of various subsidiaries & regional offices in major regions, namely North & South America, Europe, and Asia, the company can market its product on a global scale.

Key developments in the Butadiene Market:

- In 2022- ENEOS Holdings Inc. formed a joint research project with Bridgestone Corporation for the development of recyling technologies that would convert used tires in chemical raw materials inclusive of butadiene which can be used in making synthetic rubber.

Butadiene Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Butadiene Market Size in 2025 | US$15.036 billion |

| Butadiene Market Size in 2030 | US$20.231 billion |

| Growth Rate | CAGR of 6.12% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Butadiene Market | |

| Customization Scope | Free report customization with purchase |

The Butadiene market is segmented and analyzed as below:

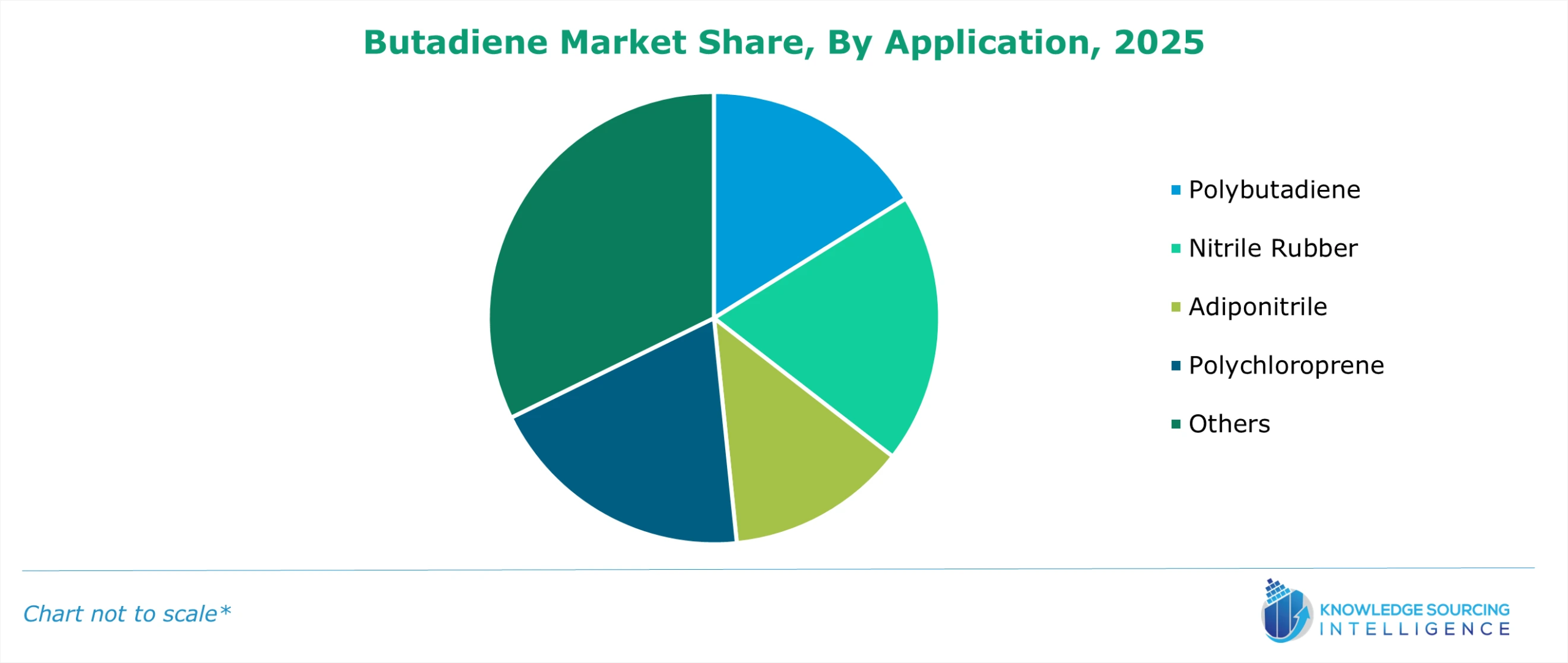

- By Application

- Styrene-Butadiene Rubber (SBR)

- Polybutadiene

- Nitrile Rubber

- Styrene Butadiene Latex

- Acrylonitrile Butadiene Styrene (ABS)

- Adiponitrile

- Polychloroprene

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- North America