Report Overview

Bleaching Agent Market Report, Highlights

Bleaching Agent Market Size:

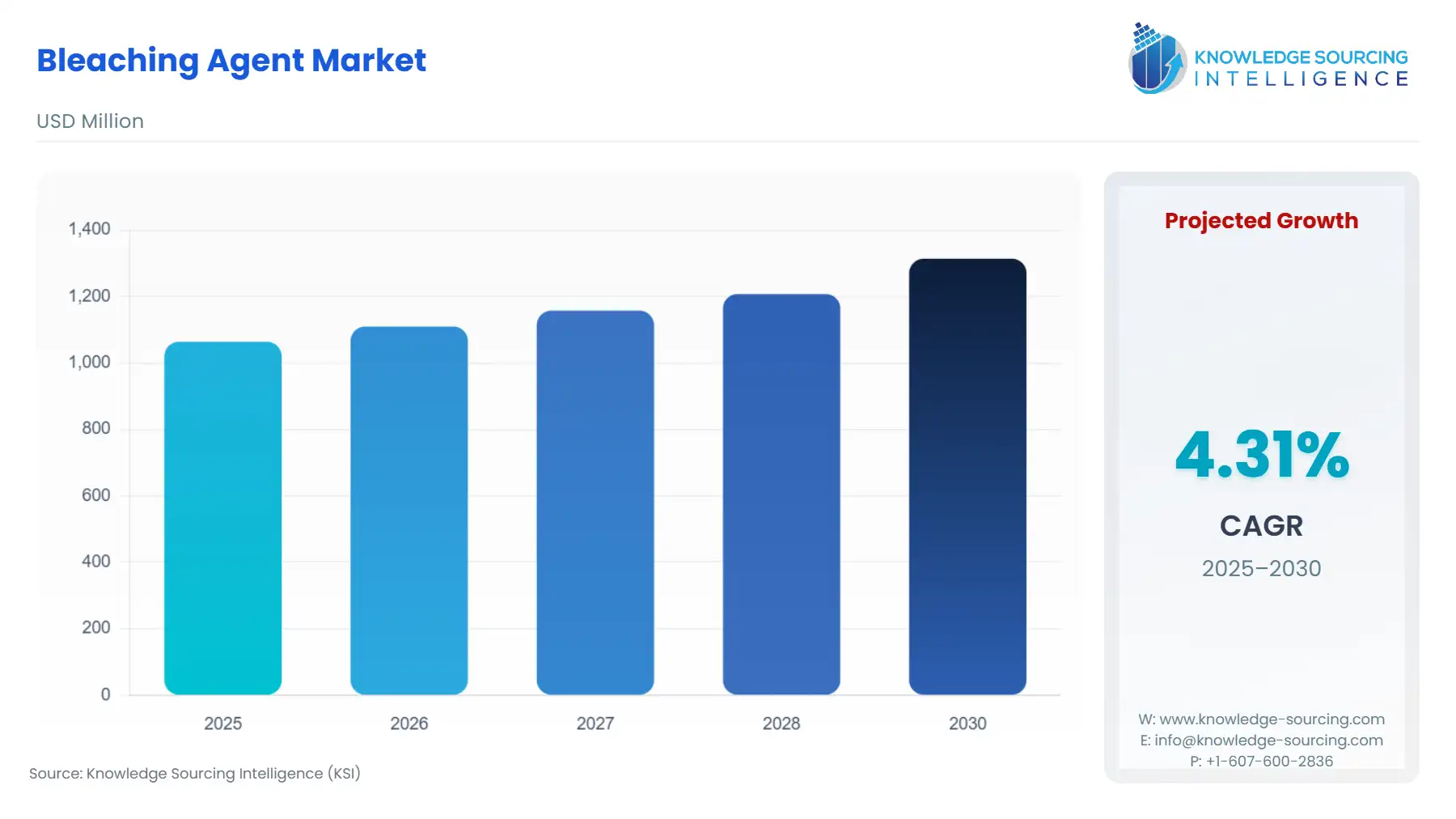

The Bleaching Agent Market is expected to increase from USD 1.064 billion in 2025 to USD 1.314 billion in 2030, driven by a 4.31% CAGR.

The global bleaching agent market, an essential component of the industrial and consumer product value chain, encompasses a diverse portfolio of oxidizing and reducing chemicals critical for whitening, disinfection, and impurity removal. Market dynamics are governed by a complex interplay of environmental regulatory pressure, shifting consumer product preferences, and industrial modernization.

The functional imperative of bleaching agents in sectors ranging from textile processing and municipal water purification to food and beverage sterilization positions the market as a non-discretionary expenditure for a broad industrial base. This analysis provides an in-depth assessment of the market's structural drivers, operational constraints, and competitive landscape for an expert industry audience.

Bleaching Agent Market Analysis:

Growth Drivers

The global push for enhanced water quality and expanded sanitation infrastructure acts as a primary catalyst, directly propelling the demand for municipal water treatment chemicals. The World Bank's Water Global Practice, through significant capital commitments in water and sanitation projects, underscores a global investment trend that necessitates increased volumes of chlorine-based bleaching agents, primarily sodium hypochlorite, for essential disinfection and oxidation processes in new and upgraded municipal facilities. Similarly, the continuous expansion of the global textile industry requires consistent and specialized chemical inputs. As global textile exports demonstrate year-on-year growth, the proportional demand for textile bleaching agents, including hydrogen peroxide, sodium hypochlorite, and oxygen-based variants, rises to meet the rigorous quality specifications of international brands concerning fabric whiteness and colorfastness. The industrial expansion in emerging economies, particularly the build-out of new manufacturing capacity in Asia-Pacific, structurally embeds greater consumption of bleaching agents in chemical, textile, and paper production cycles.

Challenges and Opportunities

A significant market challenge is the pervasive health and environmental hazard associated with legacy chlorine-based compounds. This persistent concern restrains demand for conventional agents and has necessitated substantial investment in handling and safety protocols. Conversely, this constraint generates a primary market opportunity: the commercial imperative for green chemistry. Stringent environmental regulations, such as those promoting chlorine-free (TCF) and elemental chlorine-free (ECF) methods, explicitly increase the demand for high-purity, environmentally benign alternatives like hydrogen peroxide. The stability of hydrogen peroxide, which decomposes into water and oxygen, aligns with sustainability objectives and drives its growing adoption across pulp and paper, textile, and electronics manufacturing, creating a structurally growing demand segment.

Raw Material and Pricing Analysis

The Bleaching Agent Market, being fundamentally based on physical chemical products, is inextricably linked to the supply chain and pricing of its core raw materials, notably chlorine, caustic soda, and the precursors for hydrogen peroxide production. Chlorine and caustic soda are co-produced via the chlor-alkali process, creating an interdependent market structure where the demand for one product affects the price and supply of the other. Hydrogen peroxide pricing exhibits regional divergence influenced by energy costs and local consumption patterns. In North America, hydrogen peroxide prices saw an upward trajectory in Q3 2025, driven by strong sustained demand from the pulp & paper and water treatment sectors, compounded by rising regional utility and logistics expenses. This contrasts with price declines observed in Europe and Southeast Asia during the same period, where softened industrial offtake and competitive imports created an oversupply condition, exerting downward pressure on market prices. This feedstock dependency and regional price volatility introduce margin management complexities for producers.

Supply Chain Analysis

The global supply chain for bleaching agents is complex, characterized by concentrated production hubs and a hazardous materials logistical profile. Key production centers for bulk agents like sodium chlorate and hydrogen peroxide are strategically located near major end-user industries (e.g., pulp and paper mills) or accessible sources of low-cost energy. The operational strategy of the Integrated Manufacturing Model (IMM), employed by major suppliers, involves co-locating production facilities adjacent to customer sites. This approach ensures a reliable, continuous chemical supply, minimizes transportation costs, and reduces the logistical complexity and risk associated with transporting hazardous chemicals. The logistical complexities are significant, requiring specialized transport infrastructure and regulatory compliance for the cross-border movement of hazardous or corrosive materials, particularly chlorine gas and high-concentration liquid bleaches. The supply chain maintains dependencies on the upstream energy sector, as the electrolysis process for many base chemicals, like chlorine and sodium chlorate, is highly energy-intensive.

Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union |

EU Ecolabel / REACH |

Drives demand for alternative, safer bleaching agents (e.g., hydrogen peroxide) by explicitly penalizing or restricting traditional, chlorine-releasing compounds in household and industrial cleaning product formulations. |

|

United States |

U.S. Environmental Protection Agency (EPA) / Clean Water Act |

Mandates stricter wastewater discharge limits, forcing industrial and municipal water treatment facilities to adopt more effective oxidizing and disinfecting bleaching agents, thereby increasing steady demand for sodium hypochlorite and chlorine dioxide. |

|

Global / Industry |

Forest Stewardship Council (FSC) Certification |

Directly mandates the adoption of ECF and TCF bleaching methods in the pulp and paper industry to achieve certification, structurally increasing the market share and demand for chlorine dioxide and hydrogen peroxide as alternatives to elemental chlorine. |

Bleaching Agent Market Segment Analysis:

By Application: Pulp and Paper Industry

The pulp and paper industry is structurally dependent on bleaching agents to achieve the whiteness, brightness, and cleanliness standards required for printing, packaging, and tissue grades. This sector's demand is fundamentally driven by the global imperative for sustainable sourcing and production, evidenced by the industry's widespread adoption of ECF and TCF processes. This shift, driven by environmental responsibility and regulatory pressure, directly generates non-negotiable demand for chemicals like hydrogen peroxide and sodium chlorate. Hydrogen peroxide is crucial not only for the high-brightness bleaching of virgin pulp but also for the de-inking and re-brightening of recycled fiber, a segment that has experienced accelerated growth due to increased e-commerce packaging demand. The consumption volume in this segment is vast and continuous, making it the bedrock of the industrial bleaching agent market, with demand being directly proportional to global paper production output and its shift toward certified sustainable methods.

By End-User: Household Cleaning Products

Demand in the Household Cleaning Products segment is overwhelmingly driven by consumer-level sanitation awareness and public health concerns. The essential function of sodium hypochlorite as a cost-effective, broad-spectrum disinfectant catalyzed a substantial and lasting demand increase following the global focus on infectious disease control and surface sanitation. The product’s strong oxidizing power makes it indispensable for stain removal and disinfection in laundry, kitchen, and bathroom formulations. Unlike industrial demand which is project-based or capacity-driven, household demand is consumption-based, characterized by high-frequency, low-volume purchases. This segment's stability is reinforced by public health regulations that recommend specific concentrations of hypochlorite for domestic and institutional disinfection protocols, ensuring a persistent, baseline consumption level that is less sensitive to industrial economic cycles.

Bleaching Agent Market Geographical Analysis:

US Market Analysis (North America)

Demand in the US market is highly concentrated in municipal water treatment and the household products sector, underpinned by federal regulations on water quality and sanitation. The U.S. Environmental Protection Agency's strict enforcement of the Clean Water Act ensures consistent, high-volume demand for sodium hypochlorite and chlorine-based agents in urban water systems. The pulp and paper industry, while mature, focuses on premium grades and utilizes advanced ECF methods, sustaining demand for high-purity hydrogen peroxide. The market is also driven by robust consumer spending in the household cleaning segment, translating to high, stable demand for finished bleach products.

Brazil Market Analysis (South America)

The Brazilian market is characterized by a high correlation with the massive domestic pulp industry, which dominates regional demand. Brazil is a global leader in pulp production, and major chemical producers have invested in significant, often on-site (IMM), sodium chlorate and hydrogen peroxide facilities to serve this industry's expansion. Demand is directly linked to the operational capacity and expansion of new pulp mills. Furthermore, efforts to expand access to clean water in rapidly urbanizing areas ensure a consistent, growing demand for hypochlorite in municipal water purification projects and sanitation services.

Germany Market Analysis (Europe)

The German market operates under the most stringent regulatory framework, with demand significantly weighted toward eco-friendly solutions. EU Ecolabel and REACH regulations act as powerful demand-shifters, creating a premium market for non-chlorine-releasing bleaching agents like hydrogen peroxide, particularly in the domestic and institutional cleaning and cosmetics industries. This regulatory environment mandates innovation, driving high demand for specialized, low-toxicity formulations that support the regional focus on high-performance, sustainable chemistry.

Saudi Arabia Market Analysis (Middle East & Africa)

Demand in Saudi Arabia is fundamentally driven by industrial activity in the energy and chemical processing sectors and the urgent need for large-scale water management solutions. Bleaching agents, including chlorine derivatives, are critical for industrial water treatment, cooling towers, and maintaining sanitation in massive petrochemical and construction projects. The market is characterized by bulk imports and large tender-based procurement, with demand stability tied to state-backed industrial diversification and infrastructure development programs.

China Market Analysis (Asia-Pacific)

The Chinese market is the epicenter of global demand, serving the world’s largest paper and textile manufacturing industries. Domestic consumption of bleaching agents—from basic chlorine bleach and sodium hypochlorite to advanced hydrogen peroxide—is vast and capacity-driven. Government policy supporting rapid industrialization, combined with increased investment in mandatory wastewater treatment, ensures a sustained and substantial growth trajectory for all major bleaching agent product types. The demand profile is highly diversified, spanning from commodity-grade industrial bulk to highly specialized electronics-grade hydrogen peroxide.

Bleaching Agent Market Competitive Environment and Analysis:

The bleaching agent market features a high degree of consolidation, with key players leveraging extensive, integrated global production networks and proprietary technological advantages, particularly in chlorine-free processes. Competition is centered not just on price, but on supply reliability, logistics, and technical application support for complex industrial end-users like pulp and paper mills.

Company Profile: Nouryon

Nouryon strategically positions itself as a global leader in essential and sustainable specialty chemicals, particularly in the pulp and paper value chain. Their core product offering includes the Eka® portfolio of sodium chlorate, hydrogen peroxide, and chlorine dioxide solutions. Nouryon emphasizes its Integrated Manufacturing Model (IMM), which co-locates production facilities adjacent to customer pulp mills, ensuring reliable, cost-effective, and continuous chemical supply—a critical differentiator in the high-volume, continuous-process pulp industry. Their commitment to sustainability is highlighted by the development of low-carbon footprint hydrogen peroxide (Eka® HP Puroxide™), which utilizes fossil-free hydrogen, directly addressing the Scope 3 emissions targets of their European customers and bolstering demand for their premium-priced, environmentally conscious products. In 2024, Nouryon commenced production at new sodium chlorate and hydrogen peroxide facilities in Ribas do Rio Pardo, Mato Grosso do Sul, Brazil, affirming their commitment to the growing South American pulp market.

Company Profile: Arkema S.A.

Arkema focuses its strategy on Specialty Materials, where its bleaching agent portfolio, primarily based on the Peroxal® brand of specialty hydrogen peroxide, supports high-growth, high-tech sectors. Their positioning targets demanding applications in the health, hygiene, beauty, and cleaning solutions markets. Arkema promotes Peroxal® hydrogen peroxide as an efficient, more sustainable alternative to chlorine-based solutions, capitalizing on the demand for eco-labeled and high-purity ingredients in homecare and institutional cleaning products. Furthermore, their offerings extend to specialty additives for personal care, including products with disinfecting and tooth-whitening properties, strategically diversifying their market exposure beyond bulk industrial applications and into value-added, formulator-driven segments.

Company Profile: BASF SE

BASF SE, as a diversified global chemical major, integrates its bleaching chemical offering into its broad portfolio, particularly for the paper and textile industries. A key product line is Hydrosulfite/Blankit®, utilized primarily as a bleaching or reducing agent in the mineral and paper sectors. BASF leverages its long history and manufacturing excellence in this area, positioning the product line as a cost-effective, fiber-sparing, and environmentally-friendlier alternative for pulp bleaching, especially for recycled paper applications. The company’s strategic direction, outlined in its "Winning Ways" strategy (September 2024), centers on enabling its customers' "green transformation." This explicitly directs their business model toward developing and marketing chemical products with superior sustainability attributes, creating a competitive advantage by aligning their bleaching solutions with global decarbonization and circular economy trends.

Bleaching Agent Market Recent Developments:

- July 2025: Nouryon announced an expansion of its industry-leading sodium chlorate capacity in South America by 20%. This capacity addition is specifically designed to support a long-term agreement with a major customer, Arauco, and cater to the growing demand from the Brazilian pulp industry. This move demonstrates a strategic capital investment directly tied to the exponential growth of sustainable pulp production in the region.

- June 2025: Nouryon introduced a low-carbon footprint hydrogen peroxide product line in the Nordic region. This launch is positioned to assist European industries in meeting their Scope 3 reduction targets by providing a product manufactured using fossil-free hydrogen and leveraging low-emission transportation options, creating a premium market for sustainable bleaching chemistry.

Bleaching Agent Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1.064 billion |

| Total Market Size in 2031 | USD 1.314 billion |

| Growth Rate | 4.31% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product Type, Form, End-User Industry, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Bleaching Agent Market Segmentation:

- BLEACHING AGENT MARKET BY PRODUCT TYPE

- Chlorine Bleach

- Sodium Hypochlorite

- Bleaching Powder

- Chlorine Dioxide

- Chlorine Gas

- Oxygen Bleach

- Hydrogen Peroxide

- Sodium Perborate

- Azodicarbonamide

- Others

- BLEACHING AGENT MARKET BY FORM

- Powder

- Liquid

- BLEACHING AGENT MARKET BY END-USER INDUSTRY

- Industrial Water Treatment

- Textile Industry

- Chemical Processing

- Pulp and Paper Industry

- Electronics Industry

- Food and Beverage Industry

- Personal Care and Cosmetics

- Household Cleaning Products

- BLEACHING AGENT MARKET BY GEOGRAPHY

- North America

- South America

- Europe

- Middle East & Africa

- Asia Pacific