Report Overview

Biopolymers for Stimulation Fluids Highlights

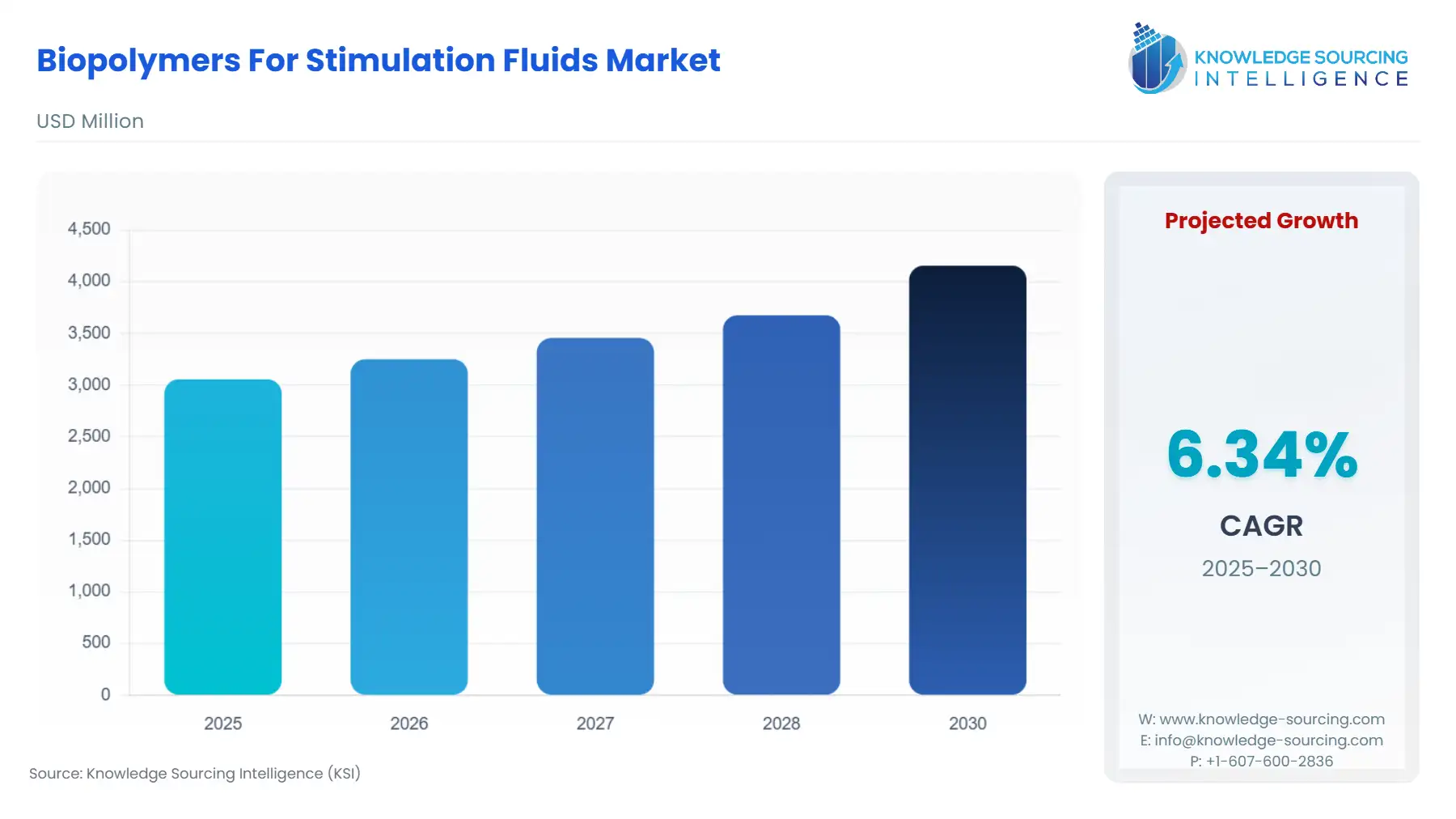

Biopolymers For Stimulation Fluids Market Size:

The biopolymers for stimulation fluids market will grow from US$3,056.650 million in 2025 to US$4,156.720 million in 2030 at a CAGR of 6.34%.

The Biopolymers for Stimulation Fluids Market is currently defined by a strategic intersection of volatile raw material markets and rigorous environmental compliance. Biopolymers, primarily guar gum and xanthan gum, serve as critical thickening and stabilizing agents in hydraulic fracturing and matrix stimulation treatments. As of 2025, the market is moving away from generic chemical additives toward specialized, high-performance biopolymer derivatives that offer superior biodegradability and reduced environmental toxicity. This shift is not merely aesthetic but is a response to tightening global regulations and the operational necessity of maintaining fluid integrity in increasingly complex geological formations.

The "green transformation" initiatives of major chemical players like BASF and Solvay heavily influences the demand. The industry is grappling with a prolonged downcycle in global chemical production. This economic environment has forced oilfield service companies to prioritize cost-effective, high-yield biopolymers that minimize "buy-to-well" ratios. The market is also seeing a geographic realignment, with Oman and Saudi Arabia emerging as significant production and application hubs for polymer-enhanced oil recovery (EOR) and stimulation solutions, as evidenced by major project authorizations in late 2024.

Biopolymers for Stimulation Fluids Market Analysis

- Growth Drivers

The primary driver of the Biopolymers for Stimulation Fluids Market is the intensification of hydraulic fracturing activities in North America and the Middle East. As operators target tighter formations, the demand for high-viscosity friction reducers and proppant carriers derived from biopolymers has increased. Guar gum, specifically, remains the vital input due to its versatility and natural origin. Furthermore, the global push for sustainable and "clean-label" industrial chemicals has created a mandate for biodegradable stimulation fluids. This trend is reinforced by the EPA's 2025 regulatory updates, which, although extending some deadlines, maintain a long-term trajectory toward reducing the environmental footprint of oil and gas operations. The shift toward climate-resilient agriculture in India has also stabilized the long-term supply outlook for raw guar, encouraging its continued use over synthetic counterparts.

- Challenges and Opportunities

Supply chain fragility and extreme price volatility represent the most significant headwinds. The concentration of guar bean production in semi-arid regions of India makes the market highly susceptible to climate-driven disruptions, such as the destructive rains of July 2025, which caused price "skyrocketing." However, these constraints create a substantial opportunity for synthetic biopolymer blends and bio-based polyacrylamides. Companies that can offer consistent performance at a lower price point than natural guar are seeing increased adoption. Additionally, the REACH Revision 2025 in the European Union presents an opportunity for biopolymers to replace restricted synthetic substances. The move toward "simpler, faster, bolder" chemical regulation in Europe favors natural, well-documented biopolymers that meet the dual responsibility of protecting health while ensuring industrial competitiveness.

- Raw Material and Pricing Analysis

The pricing of biopolymers for stimulation fluids is intrinsically linked to the agricultural output of guar beans and the capacity of xanthan gum fermentation facilities. In 2025, guar gum prices reached historic highs in July due to a 16% drop in exports and a 7% increase in sowing that was offset by crop destruction. This volatility has forced a "spot market" purchasing behavior among major service providers like Halliburton. For xanthan gum, pricing is influenced by the cost of glucose and the energy required for aerobic fermentation. The market is also seeing a pricing premium for certified organic and biomass-balanced products, with BASF launching ISCC EU-certified portfolios in mid-2025 to meet the regulatory needs of the chemical and biofuel sectors.

- Supply Chain Analysis

The supply chain is characterized by a heavy reliance on Indian and Chinese production hubs for raw materials, with final formulation and distribution handled by global leaders like Schlumberger and Baker Hughes. Logistical complexities in 2025 have been exacerbated by geopolitical tensions in Europe and the Middle East, which have delayed investment decisions and reduced trade volumes. The chemical industry’s "Winning Ways" strategy, implemented by firms like BASF, aims to localize production in key markets like Oman to reduce freight dependency. Dependencies also include the availability of specialized cross-linkers and breakers, which are essential for ensuring that the biopolymer fluid degrades properly after the stimulation treatment is complete to avoid formation damage.

- Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

EPA Subparts OOOOb/c (2025 Update) |

Direct Demand Influence: Extended compliance deadlines for emissions control, allowing operators more capital flexibility to invest in advanced biopolymer-based fluid loss control systems. |

|

European Union |

REACH Revision 2025 |

Strategic Mandate: Moves toward stricter hazard-based restrictions for synthetic polymers, directly increasing the demand for naturally derived, biodegradable biopolymers in offshore stimulation. |

|

Oman |

Ministry of Energy & Minerals Authorization |

Capacity Catalyst: Authorized major polymer production projects (e.g., SNF) to support local chemical-enhanced oil recovery (cEOR) and stimulation needs, reducing import reliance. |

Biopolymers For Stimulation Fluids Market Segment Analysis

- By Biopolymer Type: Guar Gum

Guar gum remains the cornerstone of the biopolymer segment, particularly for hydraulic fracturing treatments. Its primary growth driver is its high efficiency as a proppant transport agent. In the shale basins of the United States and Canada, the ability of guar-based fluids to carry high concentrations of sand into fractures is unmatched by most cost-equivalent synthetics. In 2025, the demand for hydroxypropyl guar (HPG) and carboxymethyl hydroxypropyl guar (CMHPG) derivatives has grown significantly. These chemically modified versions offer improved thermal stability and reduced residue, which are critical for minimizing formation damage. The demand is also being shaped by sustainability concerns; as of late 2025, Tier 1 operators are increasingly requiring "Clean Label" certifications for their chemical additives. This shift toward organic and sustainably sourced guar, particularly from the Rajasthan region, ensures that the material remains the preferred choice despite the price volatility seen in July 2025. The market is also seeing a transition toward liquefied guar concentrates, which reduce the footprint of chemical mixing units at the well site, a key operational advantage in remote unconventional plays.

- By Treatment: Hydraulic Fracturing Treatment

The hydraulic fracturing segment is the largest end-user of stimulation biopolymers, dictated by the complexity and depth of unconventional wells. As of 2025, the industry focus has shifted toward "high-intensity" fracturing, where larger volumes of fluid and proppant are used per lateral foot. This directly increases the per-well consumption of biopolymers. This segment’s demand is also being redefined by the need for cross-linked fluid systems that can withstand high shear rates during injection. Biopolymers like xanthan gum are increasingly used in combination with guar to provide superior suspension properties. Furthermore, the rise of water-based fracturing fluids (Slickwater and Linear Gels) in the Permian Basin has solidified the role of biopolymers as friction reducers. In 2025, the demand is particularly high for recycled water-compatible biopolymers, as operators look to reduce their freshwater consumption. This requires biopolymers that can maintain their rheological properties in high-salinity "produced water," leading to the development of salt-tolerant guar and xanthan variants that are now reaching commercial scale in the U.S. market.

Biopolymers For Stimulation Fluids Market Geographical Analysis

- USA Market Analysis

The United States is the primary consumer of biopolymers for stimulation fluids, driven by the resilient activity in the Permian and Bakken basins. Demand is currently focused on cost-optimization and regulatory transparency. Following the EPA’s July 2025 interim final rule, operators have prioritized biopolymers that help them meet "Zero Liquid Discharge" (ZLD) goals and improve the recyclability of fracturing fluids. The U.S. market is also a hub for technological innovation, with companies like Ashland and Dow developing high-purity cellulose derivatives (CMC) that offer better performance in low-permeability reservoirs.

Brazil Market Analysis

In South America, Brazil’s demand is centered on offshore pre-salt stimulation treatments. The Brazilian government’s push for energy self-sufficiency has led to increased matrix acidizing and fracturing activities in deepwater environments. The requirement is specifically for high-temperature stable biopolymers that can function in the extreme conditions of the Santos Basin. However, growth is tempered by strict environmental licensing processes and the high cost of importing specialized biopolymer derivatives from North America and Europe. There is a burgeoning opportunity for local bio-based chemical production as Brazil leverages its massive sugarcane industry for bio-polymer feedstocks.

United Kingdom Market Analysis

The UK market is characterized by a declining North Sea production and a shift toward decommissioning and well-intervention. The need for biopolymers is focused on matrix treatments and scale inhibition to prolong the life of mature assets. The UK’s commitment to "Net Zero" means that any new stimulation activity must utilize the most environmentally benign chemicals available. This creates a mandatory demand for highly biodegradable xanthan gum and CMC. The UK also serves as a regulatory bellwether, with the North Sea Transition Authority (NSTA) increasingly scrutinizing the chemical composition of fluids used in offshore operations.

- Saudi Arabia Market Analysis

Saudi Arabia is a global leader in polymer-enhanced stimulation and EOR. Under the "Winning Ways" paradigm, Saudi Aramco has significantly increased its use of biopolymers to maintain pressure in its massive carbonate reservoirs. Large-scale matrix acidizing projects and the development of unconventional gas resources like the Jafurah field drive the demand. In 2025, the focus is on localizing the supply chain, with partnerships between international chemical firms and local entities to build advanced polymer blending facilities. The Kingdom's focus on "Circular Carbon Economy" also encourages the use of biopolymers that can be easily treated and reused in closed-loop systems.

- China Market Analysis

China is both a major producer and a massive consumer of biopolymers, particularly xanthan gum. The intensive development of domestic shale gas resources in the Sichuan Basin drives this demand. Chinese manufacturers have achieved significant economies of scale, making them the primary suppliers of industrial-grade biopolymers to the global market. In 2025, the Chinese market is seeing a shift toward high-end specialty chemicals as the government pushes for "Self-Sufficiency" in oilfield technologies. This has led to the rapid development of domestic HPHT-resistant biopolymers that are increasingly competing with Western-branded products in the Asia-Pacific region.

Biopolymers For Stimulation Fluids Market Competitive Environment and Analysis

The competitive landscape is defined by a move toward vertically integrated service models and the development of proprietary biopolymer blends that offer higher temperature and salinity resistance.

- Schlumberger (SLB)

SLB maintains a leadership position through its global integrated drilling and completion services. Their strategy in 2025 is focused on "Digital and Sustainable" oilfield solutions. SLB’s biopolymer strategy involves the use of advanced fluid modeling software to optimize the concentration of guar and xanthan gum in real-time based on downhole sensors. This "precision stimulation" approach reduces chemical waste and improves well productivity. In recent years, SLB has focused on expanding its presence in the Middle East, particularly Oman, where it is implementing new polymer-enhanced solutions for complex reservoirs.

- Halliburton

Halliburton is a dominant player in the North American hydraulic fracturing market. Their strategic positioning centers on operational efficiency and "Smart" chemistry. In November 2025, Halliburton launched the LOGIX™ unit vitality platform, which uses AI to optimize cementing and stimulation operations. While the platform is hardware-focused, it directly impacts the Biopolymers market by ensuring that biopolymer-based fluids are mixed and injected with maximum precision. Halliburton’s "Multi-Chem" division is a leader in developing salt-tolerant biopolymer friction reducers, which are critical for the U.S. market’s transition to recycled produced water.

- BASF SE

BASF is a primary supplier of the chemical building blocks and specialized biopolymers used by service companies. Their "Winning Ways" strategy, implemented in early 2024, focuses on green transformation and portfolio rebalancing. In 2025, BASF expanded its ISCC EU-certified biomass-balanced methanol and biopolymer portfolio, allowing customers to track the carbon footprint of their stimulation chemicals from cradle to well. BASF’s strategy is to move away from commodity chemicals and toward high-margin specialty biopolymers that offer unique functionalities, such as enhanced proppant suspension or rapid biodegradation in sensitive environments.

Biopolymers for Stimulation Fluids Market Product Offerings:

- FLOWZAN® Biopolymer- Flowzan Biopolymer by Chevron Phillips Chemical Company LLC is a pure and xanthan gum biopolymer that significantly enhances product dispersion and solubility and reduces the formation of fisheyes. Advantages of thinning fluid for optimum penetration rates include minimizing formation damage and thermal stability in freshwater and saturated saltwater applications, and reducing circulating pressure losses.

Biopolymers For Stimulation Fluids Market Developments

- November 2025: Halliburton introduced the LOGIX™ unit vitality platform to advance cementing and stimulation operations. The AI-driven system improves equipment readiness and optimizes the operational efficiency of biopolymer fluid injection.

- July 2025: The international guar gum market saw record price hikes due to supply chain tightening and crop damage in India. This spike triggered a strategic shift toward more efficient biopolymer derivatives and synthetic blends among global oilfield service providers.

- December 2024: European chemical supplier SNF received authorization to implement a major polymer production project worth $250 million in Oman. This development aims to localize the supply of stimulation and EOR polymers for the Middle Eastern market.

Biopolymers For Stimulation Fluids Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Biopolymers For Stimulation Fluids Market Size in 2025 | US$3,056.650 million |

| Biopolymers For Stimulation Fluids Market Size in 2030 | US$4,156.720 million |

| Growth Rate | CAGR of 6.34% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Biopolymers For Stimulation Fluids Market |

|

| Customization Scope | Free report customization with purchase |

Biopolymers For Stimulation Fluids Market Segmentation:

- By Biopolymer Type

- Guar Gum

- Xanthan Gum

- Polyacrylamide

- CMC (Carboxymethylcellulose)

- Others

- By Treatment

- Hydraulic Fracturing Treatment

- Matrix Treatment

- By Type

- Water based

- Oil-based

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America