Report Overview

Biopolymer Packaging Market Report, Highlights

Biopolymer Packaging Market Size:

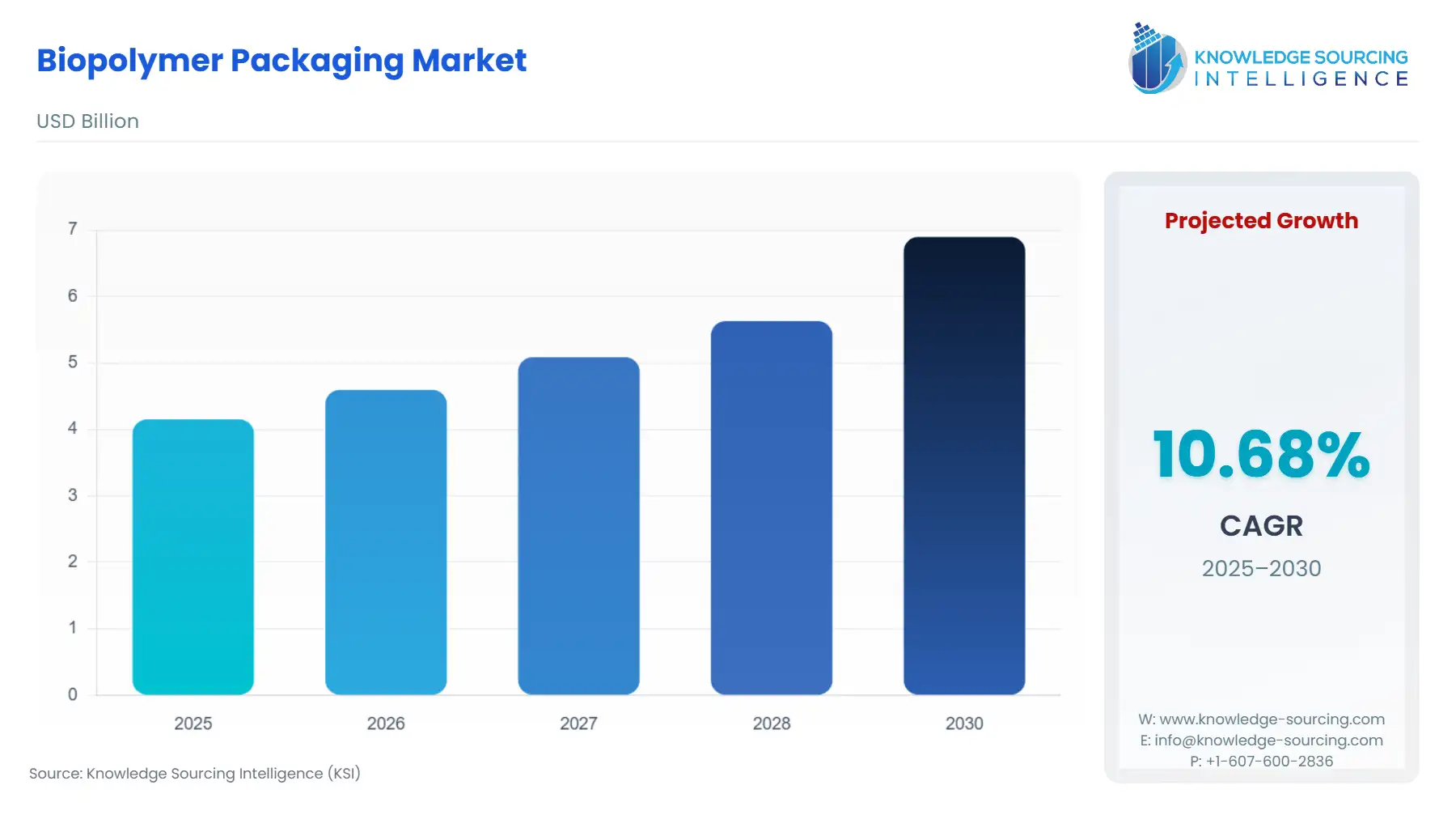

The Biopolymer Packaging Market is expected to grow from USD 4.153 billion in 2025 to USD 6.898 billion in 2030, at a CAGR of 10.68%.

The biopolymer packaging market is a critical component of the global shift towards a circular economy and sustainable practices. Biopolymers, which are plastics derived from renewable biomass sources such as corn starch, sugarcane, or cassava, offer a compelling alternative to traditional petroleum-based plastics. Unlike their fossil-fuel-based counterparts, many biopolymers are biodegradable or compostable, addressing the pervasive issue of plastic pollution and waste accumulation. This market's expansion is a direct response to the global imperative to reduce environmental impact, driven by both public pressure and regulatory mandates. The demand for biopolymer packaging is not a fleeting trend but a structural change, as industries across the board seek to meet their environmental, social, and governance (ESG) commitments. The market's trajectory is a direct reflection of how governments, corporations, and consumers are prioritizing environmental stewardship in their purchasing and production decisions.

Biopolymer Packaging Market Analysis

- Growth Drivers

The biopolymer packaging market’s growth is propelled by two major and synergistic forces: a complex web of government regulations and a decisive shift in consumer behavior. Governments worldwide are enacting and enforcing bans on single-use plastics, creating an immediate and non-negotiable demand for alternative materials. For example, the European Union's Single-Use Plastics Directive directly restricts products like cutlery, plates, and straws, compelling manufacturers to transition to more sustainable materials. This regulatory pressure forces industries to re-engineer their packaging strategies, with biopolymers emerging as a viable solution to ensure compliance. Similarly, in major Chinese cities, bans on non-biodegradable single-use plastics have driven a direct surge in demand for materials like Polylactic Acid (PLA) and starch-based packaging. This top-down regulatory action is a powerful, market-altering driver that creates a clear need for biopolymer solutions.

Simultaneously, a groundswell of consumer environmental awareness is reshaping market dynamics. Consumers are increasingly conscious of the environmental footprint of their purchases and are actively seeking out products with eco-friendly packaging. This behavioral shift creates a direct market incentive for brands to adopt biopolymers as a means of brand differentiation and to align with consumer values. This is particularly evident in the food and beverages sector, where brands are leveraging biopolymer packaging to enhance their brand image and appeal to a growing demographic of environmentally conscious consumers. The combination of legislative mandates and consumer-driven preferences creates a dual-pronged demand imperative that fuels market growth. Companies that integrate biopolymer packaging into their products are not only meeting compliance requirements but are also gaining a competitive advantage by responding to this evolving consumer demand.

- Challenges and Opportunities

The biopolymer packaging market faces significant challenges, primarily related to cost and performance. The production of biopolymers is generally more expensive than that of conventional, petroleum-based plastics. This higher cost is a substantial headwind, especially for price-sensitive industries like food and beverages, which operate on thin margins. The cost volatility of agricultural feedstocks, such as corn and sugarcane, which are used to produce many biopolymers, also poses a risk to pricing stability. These economic constraints can limit the widespread adoption of biopolymer packaging, particularly in markets where price is the dominant purchasing criterion. Furthermore, some early-generation biopolymers have faced performance limitations, including brittleness, lower heat resistance, and less effective barrier properties compared to their traditional plastic counterparts. These technical constraints can hinder their use in applications requiring specific functionalities, such as prolonged shelf life or high-temperature processing.

These challenges, however, create significant opportunities for innovation and market growth. The high cost of biopolymers incentivizes manufacturers to develop more efficient, scalable production methods. Advances in technologies such as microbial fermentation for PHA production and the use of alternative feedstocks like agricultural waste are paving the way for more cost-effective manufacturing. This technological advancement directly lowers the barrier to entry for many potential end-users and expands the market. The performance limitations of biopolymers also present an opportunity for R&D. Companies are investing in blending biopolymers with other materials and applying advanced coatings to enhance their mechanical strength, heat resistance, and barrier properties. The development of next-generation materials that can match or exceed the performance of conventional plastics will unlock new applications and directly expand the addressable market, moving biopolymers from a niche product to a mainstream alternative.

- Raw Material and Pricing Analysis

The biopolymer packaging market is directly tied to the supply and pricing of its agricultural and biomass-based raw materials. Unlike traditional plastics derived from petroleum, biopolymers are sourced from feedstocks such as corn, sugarcane, starch, and cassava. The pricing of these materials is subject to global agricultural commodity markets, influenced by weather patterns, harvest yields, and broader supply and demand dynamics for food crops. This dependence introduces a degree of price volatility not typically seen in the conventional plastics market. For instance, a poor corn harvest can drive up the price of corn starch, directly increasing the cost of producing PLA and starch-blended biopolymers. This volatility poses a risk to manufacturers, making it difficult for them to offer stable pricing to end-users.

The supply chain is further complicated by the fact that these feedstocks are also used for food and animal feed, creating a "food versus fuel" debate and a potential for supply constraints. The high demand for these agricultural products can also lead to price competition that affects the final cost of the biopolymer. Manufacturers are mitigating this by exploring the use of non-food biomass and agricultural waste as alternative feedstocks. This strategy could stabilize material costs and improve the market's sustainability profile. This shift would reduce the industry's reliance on food crops, addressing a key criticism and creating a more resilient supply chain.

- Supply Chain Analysis

The global supply chain for biopolymer packaging is characterized by its dependence on agricultural production centers and specialized conversion facilities. The chain begins with the cultivation and harvesting of renewable feedstocks, which are often concentrated in specific agricultural regions. For example, corn is a major feedstock for PLA, with large-scale production facilities located in areas with an abundant corn supply. The next stage involves the conversion of these feedstocks into biopolymer resins, a process that requires specialized chemical and manufacturing plants. These facilities are critical production hubs, often located near feedstock sources or in major industrial regions to optimize logistics.

Logistical complexities arise from the global nature of the supply chain, as raw materials, such as sugarcane or corn starch, are often transported across continents to reach biopolymer production facilities. Tariffs on imported raw materials or export restrictions imposed by countries during domestic shortages can disrupt the supply and raise production costs. The final step involves converting the biopolymer resin into packaging products, such as films or containers, which are then distributed to end-users. Dependencies within the supply chain are pronounced; a bottleneck at a single, large-scale production facility or a disruption in the supply of a specific feedstock can impact the entire market. For instance, the demand for PLA films in Europe is dependent on the consistent supply of PLA resin from production facilities in North America and Asia.

Biopolymer Packaging Market Government Regulations

Government regulations are a foundational force driving the biopolymer packaging market’s expansion. These regulations, which are becoming more pervasive and stringent globally, are directly compelling industries to adopt sustainable packaging solutions.

Biopolymer Packaging Market Analysis

- European Union: Single-Use Plastics (SUP) Directive and Packaging and Packaging Waste Regulation. The SUP Directive directly bans single-use plastic items for which alternatives exist, creating a legal imperative for businesses to find substitutes. This has a direct and significant impact on demand for biopolymer packaging. The Packaging and Packaging Waste Regulation sets ambitious targets for recycling and mandates the use of recycled content, which further encourages a shift away from non-recyclable conventional plastics and toward materials like biopolymers that can fit into a more circular system.

- China: National Development and Reform Commission (NDRC) and Ministry of Ecology and Environment (MEE) Directives. China has implemented phased bans on single-use non-degradable plastics in major cities and specific sectors, such as express delivery and food services. These directives, announced by top government bodies, are non-negotiable and have a direct market impact. They create a massive, immediate demand for biopolymer packaging as a compliant alternative, particularly for items like shopping bags and straws. This regulatory push is a primary driver of the rapid growth in biopolymer production and adoption in the Asia-Pacific region.

- India: Plastic Waste Management Rules (2016, amended 2021) and State-level Bans. The Indian government has imposed a nationwide ban on specific single-use plastic items. Furthermore, many states have enacted their own, often more stringent, bans. This patchwork of regulations creates a complex but powerful demand signal. Industries are forced to find alternatives, and biopolymer packaging, particularly compostable materials, is emerging as a preferred solution to comply with these rules. This regulatory environment is a key factor in the increasing demand for biopolymer packaging in the Indian market.

Biopolymer Packaging Market Segment Analysis

- By Material Type: Polylactic Acid (PLA)

Polylactic Acid (PLA) is a cornerstone of the biopolymer packaging market, primarily driven by its unique combination of properties and its environmental profile. PLA is a thermoplastic derived from renewable resources like corn starch or sugarcane. Its demand in packaging is specifically propelled by its use in trays, containers, and films for the food and beverages sector. PLA is a suitable substitute for conventional plastics like PET for cold-food applications due to its transparency, stiffness, and excellent barrier properties against oxygen. This allows it to preserve the freshness of products like salads and fresh produce, directly meeting the industry's need for functional, sustainable packaging. The growth in demand for packaged and ready-to-eat foods, driven by changing consumer lifestyles, creates a direct and proportional increase in the demand for PLA trays and containers. Furthermore, as consumers become more health-conscious, they seek out packaging that is free from harmful chemicals, a quality that PLA offers.

The market for PLA is also driven by its commercial compostability. In regions with established composting infrastructure, PLA packaging can be broken down into natural components, thereby reducing landfill waste and microplastic pollution. This characteristic makes it a favored choice for companies seeking to meet their sustainability commitments and for cities and municipalities with organic waste collection programs. The demand for PLA is thus a function of both its functional performance and its role in enabling a more circular economy.

- By End-User: Food and Beverages

The food and beverages industry is the single most significant end-user for biopolymer packaging, driven by a confluence of regulatory, consumer, and corporate pressures. This sector's extensive use of packaging, from films and containers to bottles and cutlery, makes it a prime target for sustainability mandates. Regulatory bodies in Europe, Asia, and North America are implementing bans on single-use plastic items commonly used in the food service industry, compelling food and beverage companies to seek alternatives. This has led to a direct and sharp increase in demand for biopolymer-based food containers, cups, and cutlery that comply with new legal requirements.

Beyond regulation, consumer preference is a significant market growth driver. A growing number of consumers actively choose brands that demonstrate a commitment to environmental stewardship. Food and beverage companies are responding by adopting biopolymer packaging to enhance their brand image and attract these consumers. Furthermore, major corporations within the sector have set ambitious internal sustainability targets, such as achieving 100% recyclable or compostable packaging. These corporate commitments create a large and consistent demand for biopolymers as companies transition their product lines away from traditional plastics to meet their self-imposed goals. This collective action by the industry's largest players solidifies the food and beverages sector's position as the primary engine of demand for biopolymer packaging.

Biopolymer Packaging Market Geographical Analysis

- US Market Analysis

The US market for biopolymer packaging is a complex and growing landscape driven by a combination of state-level regulations and corporate sustainability initiatives. While there is no overarching federal ban on single-use plastics, many states, such as California and New York, have enacted or proposed their own bans, creating a fragmented but powerful demand signal. This regulatory patchwork compels companies to adopt biopolymer packaging to comply with a variety of local laws. Furthermore, the market is significantly influenced by major corporations, such as Walmart and Whole Foods, which have established ambitious sustainability goals that prioritize biodegradable and compostable packaging. These corporate commitments create a large and consistent demand for biopolymer solutions. The US market is also characterized by a high degree of consumer awareness regarding plastic waste, which reinforces corporate decisions to invest in sustainable packaging.

- Brazil Market Analysis

Brazil’s biopolymer packaging market is shaped by its position as a major producer of renewable feedstocks, particularly sugarcane. This abundant, low-cost raw material supply provides a significant competitive advantage for local biopolymer manufacturers. The necessity for biopolymer packaging is driven by a growing national focus on sustainability and waste management, though enforcement of regulations can be uneven. The country’s food and beverages sector, a key consumer of packaging, is increasingly adopting biopolymers to meet international export standards and to cater to a rising domestic consumer base that is becoming more environmentally aware. Braskem, a major Brazilian chemical company, is a key player in this market, leveraging its access to sugarcane to produce bio-based polyethylene, thereby directly fueling the demand for biopolymer products within the country and beyond.

- Germany Market Analysis

Germany's market for biopolymer packaging is one of the most advanced and highly regulated in the world. The market is propelled by a robust legal framework, including the national VerpackG (Packaging Act) and the broader EU directives, which set high recycling and waste reduction targets. The country has a strong public and corporate commitment to a circular economy, which makes biopolymers a natural fit for its waste management infrastructure. Germany’s advanced recycling and composting systems also facilitate the end-of-life disposal of biopolymers, a key factor in their adoption. The market is characterized by a preference for high-performance biopolymers and a strong focus on technical properties, as German manufacturers of industrial goods and food products seek to maintain quality while adhering to sustainability mandates. The market is driven not only by a search for alternatives but also by a pursuit of superior, integrated, and sustainable packaging solutions.

- Saudi Arabia Market Analysis

The biopolymer packaging market in Saudi Arabia is in an early but accelerating stage of development, driven by the country’s economic diversification efforts and large-scale, government-led industrial projects. The Vision 2030 plan, which aims to reduce the kingdom’s reliance on oil, includes a focus on sustainability and advanced manufacturing. The biopolymer packaging market is concentrated in the burgeoning food and beverages and retail sectors, where companies are increasingly seeking to align with global environmental standards. While the market is currently small, the demand is growing due to a rising consumer base with a higher disposable income and a preference for packaged goods, coupled with a growing awareness of environmental issues. The market presents a clear opportunity for international biopolymer companies that can provide certified products that meet global standards, particularly for the petrochemical and packaging industries seeking to innovate.

- Japan Market Analysis

Japan's market for biopolymer packaging is characterized by a strong culture of innovation, precision, and environmental consciousness. The market is driven by a combination of corporate sustainability goals and an aging, health-conscious population that values high-quality, safe, and eco-friendly products. Japanese companies in the food, cosmetics, and healthcare industries are early adopters of advanced biopolymer materials to reduce their environmental footprint. The market has a high need for biopolymer films and other flexible packaging products that offer excellent barrier properties and are suitable for a wide range of applications, from food pouches to medical device packaging. The government’s initiatives to promote a circular economy also encourage the development and use of biopolymers, ensuring a steady growth trajectory.

Biopolymer Packaging Market Competitive Analysis:

The competitive landscape of the biopolymer packaging market is a mix of specialized biopolymer producers and large chemical companies that have expanded their portfolios to include sustainable materials. Competition is based on product performance, scalability of production, and the ability to meet specific regulatory and end-user needs.

- Danimer Scientific, Inc.: Danimer Scientific is a specialized biopolymer company that has strategically positioned itself as a leader in Polyhydroxyalkanoates (PHA). The company’s core product is Nodax PHA, which is a versatile, biodegradable, and compostable biopolymer. Danimer’s strategy is to focus on a high-performance material that can be used for a variety of packaging applications, from straws and flexible films to rigid containers. The company emphasizes its ability to provide a complete solution that is marine and soil biodegradable, a key selling point for brand owners seeking to address plastic pollution.

- NatureWorks LLC: NatureWorks is a major player and a market leader in the production of Polylactic Acid (PLA), marketed under the Ingeo brand. The company's strategic positioning is built on large-scale production, a strong focus on research and development, and a broad portfolio of PLA grades tailored for different packaging applications. NatureWorks has consistently expanded its product offerings, such as Ingeo 1102 for paper coating and Ingeo Extend for BOPLA films, to meet the evolving needs of the food service and flexible packaging industries. The company’s focus on educating the market about the benefits of PLA and building a network of partners for composting and recycling reinforces its leadership position.

- Braskem S.A.: Braskem, a global chemical company, has made a strategic move into the biopolymer market with its "I’m green" bio-based polyethylene (PE). This bio-based PE is chemically identical to conventional PE but is produced from sugarcane ethanol, making it a renewable resource. Braskem’s strategy is to leverage its existing infrastructure and market presence to offer a drop-in sustainable solution that does not require end-users to change their production processes. The company’s focus on large-scale production and partnerships with major brands demonstrates its commitment to making bio-based polymers a mainstream alternative.

Biopolymer Packaging Market Developments:

- October 2024: Braskem Siam, a joint venture between Braskem and SCG Chemicals, chose a Japanese company as the FEED contractor for a new bio-based ethylene plant in Thailand. This development is a clear capacity addition signal, as it outlines plans for a major new production facility that will significantly expand Braskem's biopolymer manufacturing capabilities in Asia.

- September 2024: Danimer Scientific and Ningbo Homelink Eco-iTech announced the commercial launch of a new home compostable extrusion coating biopolymer based on PHA. This product launch expands Danimer's portfolio and provides a verifiable, innovative solution for paper-based packaging, such as coffee cups, addressing a key market need for sustainable coatings.

- March 2024: Braskem announced a partnership with Shell Chemicals to bring certified bio-attributed and bio-circular propylene and polypropylene to the US market. This development, a partnership between two major industry players, demonstrates a strategic shift toward circular economy models and the expansion of bio-based materials into new markets.

Biopolymer Packaging Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 4.153 billion |

| Total Market Size in 2031 | USD 6.898 billion |

| Growth Rate | 10.68% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product, Material, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Biopolymer Packaging Market Segmentation:

- By Products

- Bio-based Films

- Bio-Based Containers

- Others

- By Material Type

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Starch Blends

- Polybutylene Succinate (PBS)

- By End-User

- Food and Beverages

- Retail

- Healthcare

- Cosmetic

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America