Report Overview

Bioadhesive Market Report, Size, Highlights

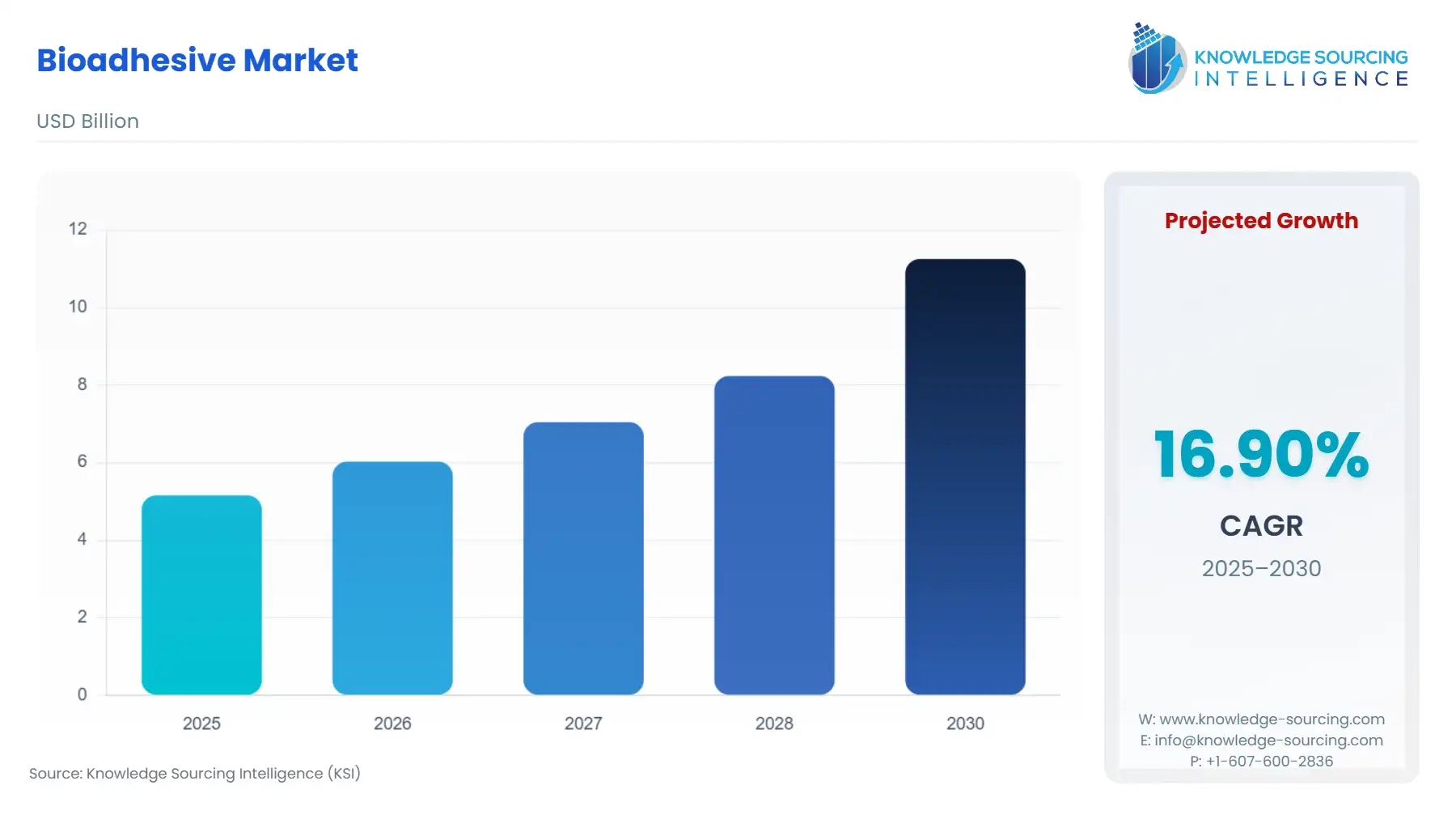

Bioadhesive Market Size:

The bioadhesive market is expected to grow at a CAGR of 16.9%, reaching a market size of US$11.256 billion in 2030 from US$5.156 billion in 2025.

The global bioadhesive market is primarily driven by the fluctuating crude oil prices worldwide, as the raw material required for the manufacturing of synthetic adhesives is declining, thereby increasing the need for alternatives, i.e., bioadhesives, over the forecast period. The increasing applications from healthcare, construction, packaging, and consumer goods are estimated to increase continuously over the forecast period. Growing bioadhesive usage in the healthcare and packaging industry will also contribute to the bioadhesives market growth over the forecast period. Further, the growing construction industry, both the commercial and residential sectors, is driving the demand for bioadhesives.

- The building construction permits in Germany have been significantly high, with 217,586 in 2022 and 163,906 in 2023. The estimated cost spent for the structure was 134,990 thousand Euros in 2022 and 112,992 thousand Euros in 2023.

- The number of tourists visiting Spain was 85,169,050 in 2023 and 71,659,281 in 2022, a significant jump in the number. Resulting in demand for more hotels and restaurants.

- The federal government in Canada launched a $1.5 billion program to build a new generation of co?op housing in June 2024. The program will build thousands of new co-op homes by 2028.

Bioadhesive Market Growth Drivers:

- Increasing demand from the residential sector

The growth in the residential sector is due to the growing global urbanization and growing economic development in different parts of the world. A significant part of the development of construction goes for the building of houses, hospitals, hotels, restaurants, schools, etc., for the population. According to the World Economic Forum, the share of the urban population of the total population is 55% in 2022 and likely to be 80% by 2080. These increased urban population setups needed different varieties of buildings, including the major residential buildings. To accommodate this rising population, governments worldwide are investing funds to construct the residential sector.

In the United Kingdom, the following number of dwellings were completed: 174,600 in England, 5,790 in Wales, 23,510 in Scotland, and 6,420 in Northern Ireland. There were a total of 210,320 dwellings completed in the UK. The Housing Development Program would increase the number of affordable homes in the UK. These developments in the construction sector would lead to the usage of wood for many purposes like flooring, structural support, designs, ceiling designs, etc. The use of bioadhesives would increase due to the increase in sustainable materials usage in the construction industry.

- Growing environmental concerns due to petrochemical-based adhesives

The use of bioadhesive reduces the generation of CO2 emissions. Further, it is free of volatile organic compounds and solvents. They can offer stability and quality to the application. Petrochemical-based adhesives are concerned with fluctuating prices and supply chain disturbances. The major raw material price volatility causes a disturbance in the production process. Beyond product manufacturing and properties, bioadhesive products also support easy application. Several certifications are also available related to bioadhesive, such as the ISCC (International Sustainability and Carbon Certification) PLUS certification. This certification supports the claims related to sustainable, traceable, and climate-friendly supply chains.

Bioadhesive Market Segmentation Analysis:

- The bioadhesive market is segmented into source type and industry vertical

Plant-based and Animal-based are two key source types. Plant-based adhesives are expected to have a significant market share during the forecast year. Mounting environmental concerns are a major driving factor behind the market's growth over the period.

Packaging, Construction, Healthcare, Consumer Goods, and some other industries are the primary users of bioadhesives. The packaging industry has a significant market share due to a growing supply chain and increasing e-commerce market. The development of sustainable packaging applications for food, pharmaceutical, and other verticals, coupled with sustainability initiatives to reduce Volatile Organic Compound (VOC) emissions, is boosting the need for bio-based materials.

Bioadhesive Market Geographical Outlook:

- The Asia Pacific region will dominate the bioadhesive market during the forecast period.

By geography, the market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies, such as ASEAN countries, are from this region.

Bioadhesive Market Restraints:

- Bioadhesives are easily substituted by other materials available in the market. Those are synthetically derived and, thus, easy to manufacture and available at a much lower price in comparison to the bioadhesives.

Bioadhesive Market Key Developments:

- In February 2024, German chemical companies Henkel and Covestro joined hands to make adhesives in load-bearing timber construction. These would be sustainable as materials manufacturer Covestro provides Henkel with polyurethane based raw materials linked to bio-based feedstocks. Collaboration would enable a circular and climate-neutrality for both companies.

- In November 2023, Henkel launched the first bio-based PUR adhesives for load-bearing timber construction. Loctite HB S ECO and Loctite CR 821 ECO would be certified polyurethane (PUR) adhesives as bio-based variants. This ecologically friendly material variant additionally improves the environmental footprint: CO2 emissions are 62 percent lower than those of a fossil-based version. The product was developed with 71 percent bio-based materials.

- In May 2023, Fraunhofer WKI presented a formaldehyde-free bio-adhesive for wood-based materials production at LIGNA 2023. It is a newly developed lignin-HMF resin with advantages as a sustainable wood-based material. It is made from a bio-based alternative to petrochemical condensation resins. Furthermore, by using this substance, wood-based materials would contain extremely low levels of formaldehyde, which occurs naturally.

Bioadhesive Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Bioadhesive Market Size in 2025 | US$5.156 billion |

| Bioadhesive Market Size in 2030 | US$11.256 billion |

| Growth Rate | CAGR of 16.9% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Bioadhesive Market |

|

| Customization Scope | Free report customization with purchase |

Bioadhesive Market Segmentation:

- By Source

- Plant-Based

- Animal Based

- By Industry Vertical

- Packaging

- Construction

- Healthcare

- Consumer Goods

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America