Report Overview

Global Banana Powder Market Highlights

Banana Powder Market Size:

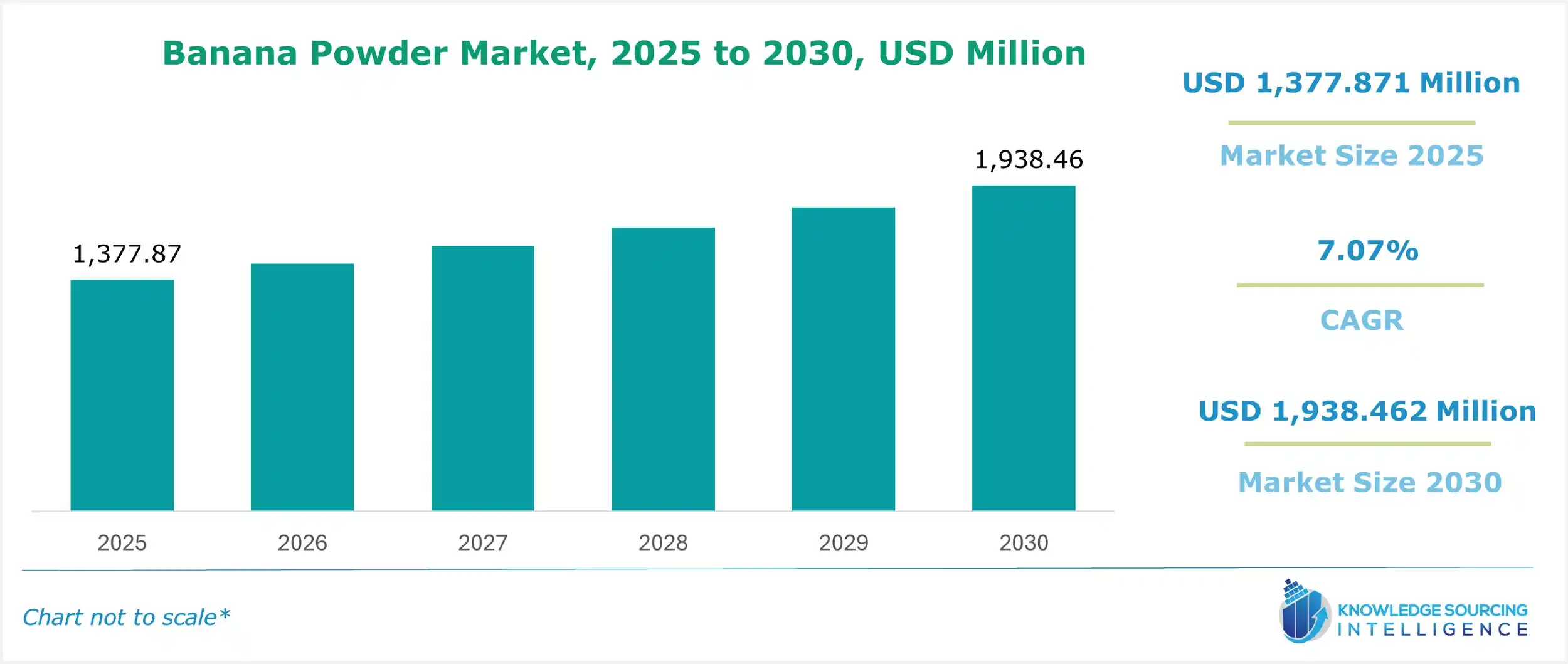

The global banana powder market is expected to grow at a compound annual growth rate of 7.07% over the forecast period to reach a market size of USD 1,938.462 million by 2030 from USD 1,377.871 million in 2025.

Banana Powder Market Highlights:

- Increasing consumer health awareness is driving demand for nutritious banana powder.

- Growing food and beverage sector is boosting banana powder usage globally.

- Asia Pacific is leading the market with major banana production and exports.

- Advancing online retail is enhancing the accessibility of banana powder products.

- Rising cosmetic industry applications are fueling banana powder demand in skincare.

Banana Powder Market Trends:

Banana Powder is formed from the banana pulp, and then, by the mechanical and hydraulic process, it is converted into a paste. Sodium metabisulfite is used for brightening the yellow colour of the banana paste. The paste is dried by spray, freeze, or drum drying processes, and then the powder is produced. The banana powder market is anticipated to grow at a significant rate in the coming years. The surge in demand for natural and organic food products and the enhancement of Banana Powder flavours in food products, cosmetics, and personal care are imperative for the Banana Powder market.

Bananas are commonly used and are the most consumed fruit worldwide. It has rich sources of potassium, vitamins, carbohydrates, and proteins and is cheaper, which makes for a healthier and more affordable diet. Banana powder is most commonly used in the food and beverage, cosmetics, and animal feed industries. Banana powder has a significant global share in the food industry. India is the major exporter of bananas worldwide and accounts for the majority of the market here. China is also one of the major exporters of bananas worldwide.

Banana Powder Market Growth Drivers:

- Increasing Consumer Preferences

Banana powder has a substantial demand in the market. Banana powder's popularity will continue to soar among consumers because of its rich and healthy properties, and also because it is affordable. Consumers are shifting away from processed and refined food products. There has been a substantial increase in the knowledge and awareness of consumers regarding the harmful effects of artificial preservatives, flavours, and colours.

Consumers are diversifying their purchasing options when it comes to food and beverage products. Technology has been playing an imperative role in enhancing awareness and knowledge among consumers. A consumer can now locate the source of the food to ensure the safety of the product. Consumer demands and preferences have been constantly changing with time. There are a lot of people who are suffering from various harmful diseases and are not comfortable with artificial products. This has led to a surge in demand for Banana Powder. It has a plethora of properties that are beneficial for human growth. It has a substantial content of carbohydrates and calories. It is also consumed for its anti-oxidant properties, preventing ageing effects and dehydration. It also helps in reducing blood fluctuations and is beneficial in the growth of bones. It is widely used in baby foods, which helps in the growth of the bones and weight gain in infants. It also helps in preventing and curing dehydration. It is becoming significant in the pharmaceutical industry as it has a substantial number of medical-related properties. It helps in digestion and prevents or treats ulcers in the stomach. Moreover, there is a lot of demand for banana powder in the cosmetics and animal feed industries.

- Enhancement in Distribution Channel

Currently, store-based retail businesses have the majority of the market share in the global banana powder market. Supermarkets and convenience stores are boosting the retail growth of Banana Powder-based products. A lot of traction is also being gained by online retail. Online retail will significantly grow in the coming years due to a substantial number of internet users and a surge in smartphone demand.

Nonetheless, banana powder is easily available in retail stores, so the offline retail business is expected to hold a substantial share in the future. Further, as stated by the USDA, food retailing in the UK is dominated by four supermarket companies, which collectively control 66% of the total business. The market leader is Tesco with a 26.9 per cent market share, while Sainsbury’s took 15 per cent, and Asda 14. 1 per cent and Morrison’s 10 per cent. Some other grocery chains in the United Kingdom are Aldi, The Co-operative Group, Waitrose, Lidl, and Iceland.

Currently, the United Kingdom is recognized as the world’s leading nation in private label development and has one of the most advanced Private Label markets. The big supermarket chains in the UK can be viewed as market leaders, primarily accounting for 47% of private label products on average in their stores.

Banana Powder Market Geographical Outlook:

- The global banana powder market is segmented into five regions worldwide:

Geography-wise, the market of global banana powders is divided into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific. Market share is dominated by the Asia Pacific, followed by North America and Europe. The major exporters of banana powder are India and China. Banana Powder has a substantial share in the market because India is a major banana producer.

Moreover, the market is fueled by the growth in the food and beverage industry regionally. In line with this, according to the USDA Report called “Retail Foods” in July 2023, the food and beverage retail sales in the Philippines were expected to witness a 6% growth in 2023. Furthermore, as per the report, hypermarkets hold 6% of the market share for food sales, whereas supermarkets lead the industry by having 23% market share. Amongst this, informal traditional retailers held the maximum market share of 45%.

Owing to the presence of major cosmetics, food and beverage, pharmaceutical, and animal feed companies in Europe, Europe, and North America are expected to grow significantly. For instance, as per Statistics Sweden, in 2022, total sales of food and beverages amounted to SEK 356 billion. This is a rise of approximately SEK 22 billion, or 6.6 per cent, compared with 2021. In fixed prices, the sales of sweets increased to SEK 107 per capita compared with 2021. The animal industry further aids in increasing revenue because animal feed and banana products are less expensive, and most countries rely on livestock products.

Banana Powder Market Key Developments:

- In March 2024, OLEHENRIKSEN launched a one-step makeup prep for skin that's instantly illuminated by offering golden lit glow like the Scandinavian sun with Banana Bright+ Instant Glow Moisturiser. Formulated to improve the appearance of makeup, visibly brighten skin both instantly and over time, and reduce the look of fine lines and wrinkles.

List of Top Banana Powder Companies:

Banana Powder Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Banana Powder Market Size in 2025 | USD 1,377.871 million |

| Banana Powder Market Size in 2030 | USD 1,938.462 million |

| Growth Rate | CAGR of 7.07% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Banana Powder Market |

|

| Customization Scope | Free report customization with purchase |

The global banana powder market is segmented and analyzed as follows:

- By Nature

- Organic

- Conventional

- By Process

- Freeze Dried

- Spray Dried

- Drum Dried

- By Applications

- Food and Beverage

- Cosmetics

- Pharmaceuticals

- Animal Feed

- Others

- By Distribution Channel

- Online

- Offline

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America