Report Overview

Automated Microbiology Market Report, Highlights

Automated Microbiology Market Size:

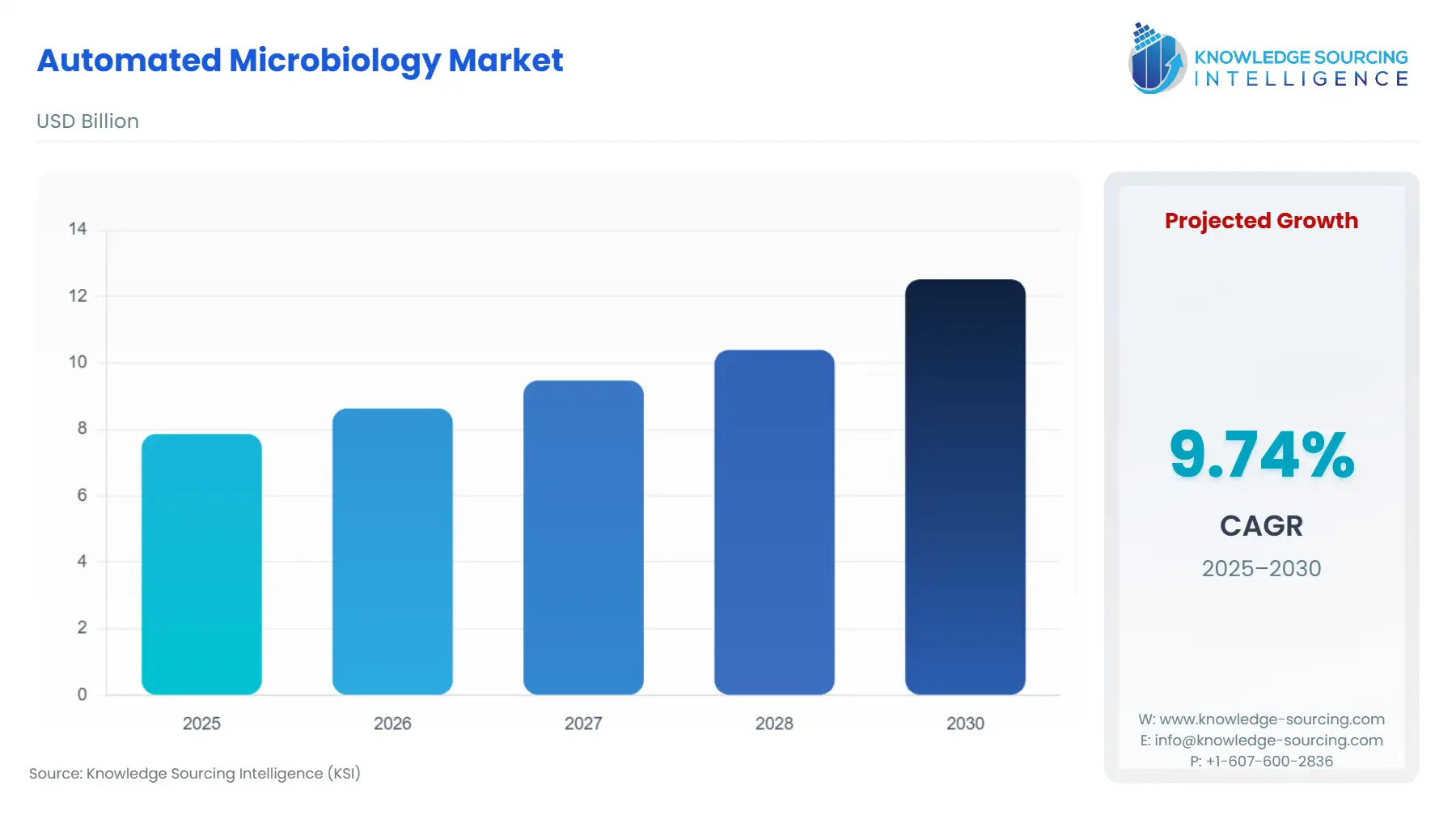

The Automated Microbiology Market is expected to grow from USD 7.865 billion in 2025 to USD 12.519 billion in 2030, at a CAGR of 9.74%.

The automated microbiology market is a dynamic and essential component of the in vitro diagnostics industry, providing advanced systems that streamline the isolation, identification, and susceptibility testing of microorganisms. This market is fundamentally an enabler of efficiency and precision, serving critical roles across clinical diagnostics, pharmaceutical quality control, and life science research. The adoption of automated solutions is a direct response to the global challenges of rising antimicrobial resistance, increasing rates of infectious diseases, and the consistent need for laboratories to improve operational efficiency and reduce turnaround times.

Automated Microbiology Market Analysis

- Growth Drivers

The market's growth is driven by several interconnected factors, each directly influencing the demand for automated microbiology solutions. The rising global prevalence of infectious diseases, including emerging pathogens and drug-resistant strains, is a primary catalyst. The Centers for Disease Control and Prevention (CDC) has identified antimicrobial resistance as an urgent public health threat, with millions of resistant infections occurring annually in the U.S. alone. This is creating an urgent demand for rapid, accurate, and high-throughput diagnostic tools that can quickly identify the causative agent and determine its antimicrobial susceptibility. Automated systems, by their nature, significantly reduce the time required for these critical tasks, which is essential for effective patient care and public health management.

Another powerful driver is the persistent pressure on clinical laboratories and hospitals to enhance operational efficiency. Manual microbiological methods are labor-intensive, prone to human error, and require extensive hands-on time from skilled professionals. Automation addresses these pain points by streamlining workflows, from specimen processing to result interpretation. This not only reduces labor costs and frees up staff for more complex analytical tasks but also improves the standardization and reproducibility of results. This direct impact on cost savings and quality assurance is a significant factor influencing the purchasing decisions of healthcare institutions.

Technological advancements, particularly in molecular diagnostics and robotics, are also fundamentally influencing market demand. The integration of artificial intelligence (AI) and machine learning (ML) into automated systems is enabling more sophisticated data analysis and interpretation. These intelligent systems can analyze digital images of bacterial colonies on agar plates and detect subtle changes that might be missed by the human eye. This capability enhances diagnostic accuracy and shortens the time to result, thereby influencing clinical adoption. The continuous development of more compact, modular, and integrated systems is also making automation more accessible to a wider range of laboratories, including those with limited space or a lower testing volume.

- Challenges and Opportunities

The automated microbiology market, while promising, is not without its challenges. The most significant obstacle is the high initial capital investment required for purchasing automated instruments. This high cost is a major restraint, particularly for smaller clinical laboratories, academic institutions, and those in developing economies, which may lack the necessary budget. The cost extends beyond the instrument itself to include ongoing expenses for specialized reagents, maintenance contracts, and the potential need for facility modifications. This financial barrier directly influences market demand by restricting adoption to well-funded healthcare networks and large-scale reference laboratories.

The need for highly skilled and trained personnel to operate, maintain, and troubleshoot these complex systems is another challenge. The technical expertise required can be a barrier to entry for many laboratories and creates a continuous need for training and education, which adds to the operational cost.

However, these challenges also create opportunities. The high cost of entry has spurred an opportunity for manufacturers to develop more scalable, modular, and cost-effective solutions. Companies are now offering flexible automation systems that allow laboratories to incrementally invest in new capabilities rather than committing to a full-scale, total laboratory automation (TLA) system upfront. This approach widens the addressable market and influences demand from a broader range of customers. Furthermore, the complexity of these systems has created an opportunity for service-based offerings, where manufacturers provide comprehensive support, training, and maintenance packages, transforming the business model from a one-time sale to a long-term partnership. The data generated by these automated systems also presents an opportunity for advanced data analytics and informatics solutions, which can provide laboratories with insights into workflow optimization, antimicrobial resistance trends, and quality control metrics.

- Supply Chain Analysis

The supply chain for the automated microbiology market is multifaceted, primarily composed of instrument manufacturing, reagent production, and software development. Instruments are complex assemblies of mechatronics, optics, and electronics, often with components sourced from a global network of suppliers. The core of the supply chain lies in the production of proprietary reagents and consumables, such as culture media, identification panels, and susceptibility testing strips. These items are often specific to a manufacturer's platform, creating a recurring revenue stream and influencing a laboratory's demand for a particular vendor's consumables after the initial hardware purchase. Software, which serves as the brain of these systems, is often developed in-house or through partnerships, providing the interface and analytical capabilities that define the system's performance. The supply chain for this market is generally stable but can be susceptible to disruptions. For example, a shortage of a specific chemical component for a reagent or a microchip for an instrument can halt production and impact product availability, which in turn influences a laboratory's ability to run tests and may redirect demand toward alternative suppliers.

Automated Microbiology Market Government Regulations:

Government regulations are a critical factor influencing the automated microbiology market. They directly impact a company's ability to bring a product to market and shape the demand for products that meet specific safety, quality, and performance standards.

|

Regulation/Policy |

Description |

Market Implication |

|

US FDA 510(k) and PMA Approval Process |

The US Food and Drug Administration's premarket notification (510(k)) and premarket approval (PMA) pathways for in vitro diagnostic (IVD) devices. The 510(k) process demonstrates substantial equivalence to a legally marketed device, while the PMA is for high-risk devices. |

This process influences the market by creating a high barrier to entry for new technologies. Companies must invest significant resources in clinical trials and regulatory filings. The duration and complexity of the process directly influence a company's go-to-market strategy, and successful approval signals to clinical laboratories that a product is safe and effective, thereby influencing demand and adoption. |

|

EU In Vitro Diagnostic Regulation (IVDR) |

A new regulation that replaced the older IVD Directive, placing a greater emphasis on clinical evidence, quality management systems, and post-market surveillance for all IVDs sold in the European Union. |

The IVDR is influencing the market by raising the quality bar for all devices. Many legacy products require re-certification under the new, stricter rules, which may lead to some older products being removed from the market. This creates an opportunity for new, compliant devices, and a shift in demand towards products that have successfully navigated the more rigorous certification process. |

|

China National Medical Products Administration (NMPA) Policies |

China’s NMPA has recently implemented measures to accelerate the development and approval of high-end medical devices, including AI-powered diagnostics. |

These policies are influencing the market by creating a fast-track pathway for innovative, domestically produced, or internationally competitive technologies. This directly impacts market access and can accelerate the adoption of new, advanced automated systems, especially those that align with the country's strategic goals of promoting domestic innovation and self-sufficiency. |

|

CLIA Regulations (Clinical Laboratory Improvement Amendments) |

US federal regulations governing all clinical laboratory testing performed on humans in the United States. |

These regulations influence market demand by mandating a minimum level of quality and performance for all diagnostic tests. Automated systems that offer enhanced traceability, quality control, and standardized workflows are viewed favorably by laboratories seeking to ensure compliance and avoid regulatory scrutiny, thereby influencing their purchasing decisions. |

Automated Microbiology Market Segment Analysis:

- Clinical Laboratories Segment Analysis

The clinical laboratories segment is a cornerstone of the automated microbiology market, with demand driven by the continuous need for rapid and accurate diagnosis of infectious diseases. The primary demand drivers in this segment are the pressure to reduce turnaround times (TAT), manage labor shortages, and improve the consistency and reliability of test results. Clinical laboratories, particularly those in large hospital networks and reference labs, handle a high volume of samples. Automation allows them to process a significantly greater number of specimens with fewer errors and in a shorter time frame, directly translating into improved patient care and reduced hospital stays. This is particularly critical in the context of sepsis and other life-threatening infections where every hour to diagnosis matters.

A significant challenge influencing this segment is the high initial cost of total laboratory automation (TLA) systems. While these systems offer long-term efficiency benefits, the upfront capital expenditure can be prohibitive, especially for independent or smaller-scale clinical labs. This financial barrier can lead to a reliance on manual or semi-automated processes, which, while cheaper in the short term, are less efficient and more susceptible to variability. Another challenge is the integration of these complex systems into existing laboratory information systems (LIS). Seamless data transfer and communication between instruments and the LIS are essential for a streamlined workflow, and any integration issues can negate the benefits of automation. The opportunity for market players lies in providing flexible, scalable, and interoperable solutions that can be adopted in a phased manner, as well as offering robust software and service support to ensure seamless integration and operation.

- DNA & RNA Probe Sequencing Segment Analysis

The DNA & RNA Probe Sequencing segment is at the forefront of technological innovation in automated microbiology, influencing demand by providing an unparalleled level of specificity and sensitivity in pathogen identification and characterization. This technology, which includes real-time PCR (qPCR) and next-generation sequencing (NGS), is a significant demand driver in applications where rapid and precise identification is critical, such as in infectious disease diagnostics, epidemiology, and public health surveillance. The ability of probe sequencing to detect specific genetic markers, including those associated with antimicrobial resistance genes, is a key factor influencing its adoption. For instance, a clinical laboratory may use an automated qPCR system to quickly detect a specific viral pathogen directly from a patient sample, bypassing the need for traditional culture methods that can take days. This speed and accuracy directly influence clinical decision-making and patient outcomes.

A major challenge for this segment is the complexity and cost of the technology. While costs have decreased over time, they remain high, which can limit widespread adoption, especially in resource-constrained settings. The data generated by these systems is also a challenge; analyzing and interpreting the vast amount of genetic information requires specialized bioinformatics expertise, which may not be available in every laboratory. This creates an indirect barrier to demand. However, the opportunity for market players lies in developing more user-friendly, automated systems with integrated software that simplifies data analysis and interpretation. By making the technology more accessible, manufacturers can expand its use beyond specialized research labs and into routine clinical diagnostics. The increasing demand for companion diagnostics in the pharmaceutical industry also presents a significant opportunity, as probe sequencing is essential for identifying patients who will respond to specific targeted therapies.

Automated Microbiology Market Geographical Analysis:

- US Market Analysis

The US market for automated microbiology is a mature yet expanding landscape driven by a robust healthcare infrastructure and high expenditure on diagnostic technologies. A key factor influencing demand is the country's focus on cost-efficiency and quality assurance in healthcare. As hospitals and laboratory networks consolidate, there is a growing trend towards total laboratory automation to improve workflow, reduce labor costs, and manage increasing sample volumes. Furthermore, the rising threat of antimicrobial resistance and the demand for rapid diagnostics are key drivers for the adoption of automated molecular platforms. The US Food and Drug Administration (FDA) approval process acts as a stringent filter, and successful clearance of a product signals high quality and reliability, directly influencing clinical adoption and demand.

- German Market Analysis

The German market is a key player in Europe, with demand for automated microbiology systems influencing by a strong emphasis on public health, a well-funded healthcare system, and a robust pharmaceutical and biotechnology sector. The country's commitment to high standards of quality and patient safety drives the adoption of advanced, highly reliable diagnostic technologies. The transition to the new EU IVDR is a major factor currently influencing demand, as companies and laboratories are actively seeking new, compliant systems to replace older products that may not meet the new regulatory requirements. This creates an opportunity for manufacturers with IVDR-certified products. The country's strong life sciences research sector also fuels a consistent demand for advanced systems for drug discovery and development.

- Chinese Market Analysis

The Chinese market is one of the fastest-growing in the world, with demand for automated microbiology systems influencing by massive government investment in healthcare infrastructure and a large population base. The government's "Healthy China 2030" plan is accelerating the modernization of hospitals and clinical laboratories. The rising prevalence of infectious diseases, coupled with a growing middle class that expects better healthcare services, is creating a significant and sustained demand for rapid and accurate diagnostics. Recent NMPA policies that favor domestic innovation are also influencing the market by creating a more streamlined approval process for locally developed automated systems. This dynamic has a direct impact on the competitive landscape, as both multinational corporations and domestic players vie for market share.

- Japanese Market Analysis

The Japanese market is characterized by a strong focus on quality, precision, and technological excellence. Demand for automated microbiology is influencing by a rapidly aging population, which increases the burden of infectious diseases and the need for efficient diagnostics. The country's advanced clinical laboratory network and a high-tech manufacturing sector provide a favorable environment for the adoption of sophisticated automated systems. However, the market is also shaped by a preference for long-standing relationships with established vendors and a meticulous regulatory process, which can slow the adoption of new, disruptive technologies. The opportunity for market players lies in providing highly reliable, precise, and integrated solutions that can meet the stringent quality standards of the Japanese healthcare system.

- Brazilian Market Analysis

Brazil’s automated microbiology market is emerging, with demand influencing by the expansion of the country's public and private healthcare systems. The rising prevalence of infectious diseases, including tropical and hospital-acquired infections, is a key factor driving demand for rapid diagnostic tools. Government initiatives and public-private partnerships aimed at improving healthcare access and quality are creating a new demand base. However, the market is also challenged by economic volatility and complex regulatory hurdles. The demand structure is segmented, with private laboratories and large hospital networks as the primary adopters of high-end automated systems, while the public sector often relies on more basic or semi-automated methods due to budgetary constraints.

Automated Microbiology Market Competitive Analysis:

The competitive landscape of the automated microbiology market is dominated by a few large multinational corporations that possess extensive product portfolios, global distribution networks, and strong R&D capabilities. Their strategies are primarily focused on developing fully integrated, "sample-to-result" solutions and expanding their market share through strategic acquisitions and collaborations.

- bioMérieux is a global leader and their strategic positioning is centered on providing comprehensive, end-to-end diagnostic solutions for infectious diseases. Their key products, such as the VITEK® and BacT/ALERT® systems, are designed to streamline the entire microbiology workflow, from specimen management to final report. By offering a full suite of instruments, reagents, and software, bioMérieux influences demand by presenting a compelling value proposition of improved laboratory efficiency, reduced turnaround times, and enhanced quality control. The company's focus on antimicrobial resistance, including the development of advanced susceptibility testing, directly caters to a critical market need and reinforces its position as a key partner for clinical laboratories worldwide.

- Becton Dickinson (BD) is another major player, strategically positioned as a broad-based medical technology company with a strong presence in clinical diagnostics. BD influences demand through its extensive installed base of instruments and its strategic focus on providing integrated diagnostic solutions. The company's products, such as the BD BACTEC™ and BD Kiestra™ systems, are designed to automate and standardize pre-analytical, analytical, and post-analytical phases of the microbiology workflow. BD's strategy is to capture market demand by offering interoperable platforms that can be seamlessly integrated into existing laboratory workflows, thereby improving efficiency and reducing the manual labor associated with traditional methods.

- QIAGEN has established a strong presence in the market by focusing on molecular technologies and sample preparation solutions. The company's strategy is to influence demand by providing high-performance, automated platforms for nucleic acid extraction and analysis, which are critical for advanced microbiological techniques like DNA sequencing. QIAGEN's key products, such as the QIAcube and other automation solutions, are designed to provide laboratories with reproducible and standardized results for downstream applications. This focus on the "Sample to Insight" workflow positions the company as a key enabler for laboratories seeking to transition from traditional culture-based methods to modern, molecular-based diagnostics.

Automated Microbiology Market Developments:

- March 2025: Beckman Coulter announced FDA clearance of the DxC 500i Clinical Analyzer, an integrated clinical chemistry and immunoassay system. The new analyzer is designed for flexibility and scalability for laboratories of all sizes, influencing demand by providing a high-throughput solution for timely clinical decision-making.

- January 2025: BioMérieux finalized the acquisition of Neoprospecta, a Brazil-based company specializing in data and genomics solutions for quality assurance in the food and pharma industries. This acquisition strengthens bioMérieux's data and genomics portfolio, influencing demand by providing customers with innovative tools for microbiological risk prevention and control.

- January 2025: Beckman Coulter received FDA Breakthrough Device Designation for an Alzheimer's disease blood test. This development influences the market by highlighting the company's focus on developing novel diagnostic tools for high-need disease areas, signaling future opportunities for automated platforms in neurodegenerative disease research.

Automated Microbiology Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 7.865 billion |

| Total Market Size in 2031 | USD 12.519 billion |

| Growth Rate | 9.74% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Solutions, Technology, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Automated Microbiology Market Segmentation:

- By Solutions:

- Hardware

- Software

- Services

- By Technology:

- Detection Technique

- DNA & RNA Probe Sequencing

- DNA Sequencing

- Others

- By End-User:

- Pharmaceutical & Biotech Companies

- Clinical Laboratories

- Others

- By Geography:

- North America (USA, Canada, Mexico)

- South America (Brazil, Argentina, Others)

- Europe (Germany, France, the United Kingdom, Spain, Others)

- Middle East and Africa (Saudi Arabia, UAE, Others)

- Asia Pacific (China, India, Japan, South Korea, Indonesia, Others)