Report Overview

AI Quality Inspection Market Highlights

AI Quality Inspection Market Size:

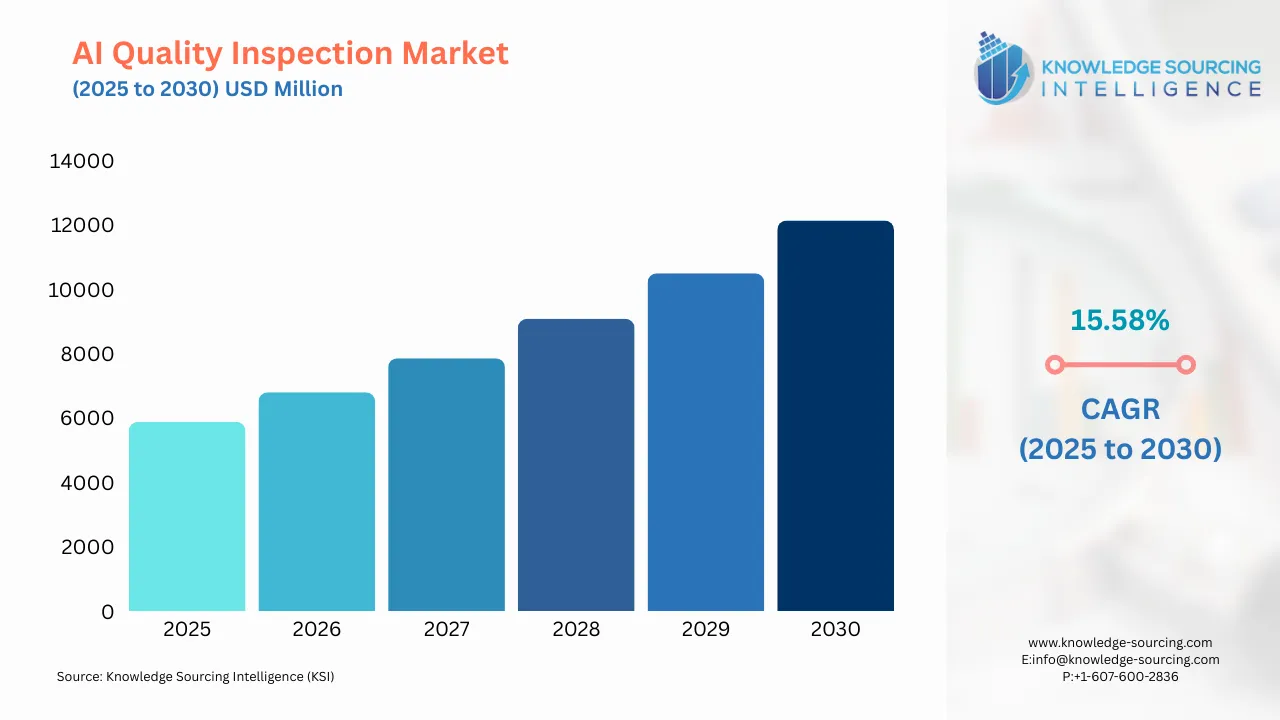

The AI Quality Inspection Market, valued at USD 12,136.294 million in 2030 from USD 5,884.097 million in 2025, is projected to grow at a CAGR of 15.58%.

When using software-driven artificial intelligence and vision technologies, AI quality inspection helps detect and process inconsistencies in products, including semiconductors, pharmaceuticals, textiles, and automotive manufacturing. Hence, due to their precision and time-saving capabilities, AI-powered applications that make quality checks are becoming more common in the semiconductor industry, as well as in medicine, clothing production, car-making industries, and other sectors.

The AI quality inspection software can be manufactured either based on a machine learning model or as a pre-trained software service. The precision offered by AI-powered quality control techniques is a significant advantage over manual quality control, making it the preferred choice for leading manufacturing companies worldwide.

Therefore, considering the increasing demand for AI-based products and other factors influencing the consumption of AI quality inspection software, the AI-based quality control market is expected to reach a larger market size in the forecast period.

AI Quality Inspection Market Overview & Scope:

The AI Quality Inspection Market is segmented by:

Technology: The AI quality inspection market, by technology, is divided into machine learning (ML), computer vision, deep learning, natural language Processing (NLP), and robotics process automation (RPA). The machine learning (ML) category is estimated to grow significantly.

Application: The AI quality inspection market, by application, is divided into defect detection, dimensional measurement, surface inspection, assembly verification, and packaging inspection. The defect detection category is estimated to grow substantially.

Component: Software AI Quality Inspection services have been showing notable growth, as manual quality control offered by the human eye can sometimes fail to detect defects in large batches. To overcome this limitation, leading manufacturing companies worldwide are actively investing in AI-based quality inspection software to identify defective goods earlier and prevent additional expenses.

Industry: The AI quality inspection market, by industry, is divided into manufacturing, healthcare, food & beverage, retail, semiconductor, and textiles. The manufacturing category is growing extensively.

Region: By geography, the AI quality inspection market is segmented into the Americas, Europe, the Middle East and Africa, and the Asia Pacific.

Top Trends Shaping the AI Quality Inspection Market:

AI Vision

The benefit of AI vision in quality inspection is that it provides benefits similar to rules-based machine vision systems, and it can also be iterated over time to improve performance with human supervision. The AI-based quality inspection is an advanced technology integrating technologies like artificial intelligence and machine learning, along with machine vision and other forms of quality inspection solutions. The AI-based quality inspection technology helps in increasing the accuracy of the manufacturing process, and it also reduces human-related errors.

A major factor propelling the growth of global AI in the quality inspection market is the increasing production of electronics products worldwide. In electronics production, AI-based quality inspection solutions offer cost efficiency and higher quality assurance. Similarly, the production of electronics includes higher complexity, necessitating the utilization of AI-based technology in the sector.

The Japan Electronics and Information Technology Industries Association, in its report, stated that in October 2024, the production of consumer electronics in the nation witnessed a growth of 101.5% compared to October 2023. The agency stated that in August 2024, the total production of consumer electronics equipment in the nation was recorded at YEN 26,454 million, which increased to YEN 36,253 million in September and YEN 40,036 million in October 2024.

AI Quality Inspection Market: Growth Drivers vs. Challenges:

Drivers:

Increasing adoption of AI-based quality control software in the manufacturing sector: The growth can be attributed to increased operating costs for manufacturing companies due to the production of poor-quality products. For instance, Toyota Company incurred a loss of $1.3 billion due to manufacturing defects. When a damaged component goes undetected, it is often used in manufacturing the final product. This results in a rise in the operating expenses for the manufacturing company and leads to defective goods not being sold in the market. Such cases are prevalent in companies that engage in mass production of goods in batches.

Growing use of deep learning models: Deep learning models are a subfield within artificial intelligence crafted to behave like the complex neural networks found in the human brain. These models can identify intricate patterns and features within images since they have been trained heavily on large datasets. In visual inspection systems, deep learning models are utilized to accurately detect abnormalities, defects, or specific features in images or videos.

Growing Production of the Automotive Sector: The rising production of the automotive sector is among the key factors propelling the growth of global AI in the quality inspection market during the forecasted timeline. In automotive production, AI-based quality inspection offers higher quality assurance and the capability to scale production, while reducing the cost of manufacturing. Similarly, the introduction of stringent safety and quality regulations worldwide also necessitates the utilization of AI-based quality solutions in the automotive sector.

The International Organization of Motor Vehicle Manufacturers, or OICA, in its global report, stated that between 2021 and 2023, the total production of automotives witnessed a growth of about 17%. The agency stated that in 2021, the total production of automobiles was recorded at 80.004 million units, which surged to 84.830 million units in 2022 and 93.546 million units in 2023.

In the global region, Asia Oceania dominates the production landscape of automotives. In 2023, the total automotive production in the Asia Oceania region was recorded at 55.115 million units, whereas in America and Europe, it was recorded at 19.136 million units and 18.122 million units, respectively.

Challenges:

High initial investment: AI visual inspection systems require a lot of money at once for hardware, software, and training. This makes it hard for small and medium enterprises (SMEs) or organizations with small budgets. Due to their substantial cost, the early introduction of high-powered cameras, magnetic field detectors, and other processing devices used in quality inspection systems is crucial.

AI Quality Inspection Market Segment Analysis:

By Technology: Robotic Process Automation (RPA)

The AI quality inspection market is segmented by field into natural language processing, computer vision, machine learning, robotics process automation, and deep learning. The market for robotics in quality inspection is witnessing strong growth, led by the rising need for automation in various manufacturing industries. With increased competition and high-quality standards, manufacturers are increasingly using robotics to automate inspection processes, lower operational costs, and deliver consistent product quality.

Another important growth factor in the robotics sector is the extension of robotic applications. In this regard, the International Federation of Robotics stated that the adoption of robotics is highest in automotive, with 135.461 installations in 2023, followed by electrical, with 125.804 installations in the same year. This signifies that robots are no longer used just on manufacturing floors but are now being brought into everyday life.

Apart from this, the enormous investments in AI and robotics are driving innovation and market expansion. Venture capital funds, corporations, and government entities are investing money in robotics and AI startups and research programs. This injection of capital is underpinning the development of leading robotics technology, collaborative efforts between industry experts and researchers, and the advancement of the commercialization of emerging robotic solutions. For instance,

In China, the "14th Five-Year Plan" for robot industry development continues until 2025. The program, issued by the Beijing-based Ministry of Industry and Information Technology (MIIT) in December 2021, targets boosting innovation. China wants to establish itself as a world leader in robotics technology and industrialization.

In Japan, the "New Robot Strategy" hopes to position the nation as the world's leading robot innovation center. The main sectors are unchanged, such as manufacturing, nursing and medicine, and agriculture. The "Moonshot Research and Development Program", kicked off in 2020, will continue until 2050 with a budget of USD 440 million (JPY 25 billion).

In Korea, the government declared the "4th Basic Plan on Intelligent Robots" in January 2024 and will be in effect until 2028. A budget of USD 128 million (KRW 180 billion) backs the growth of the robotics sector as a core sector for the Fourth Industrial Revolution, as well as manufacturing and service innovation.

Increasing implementation of Industry 4.0 and intelligent manufacturing practices is also a major growth driver for robotics in the quality inspection market. Blending robots with integrated systems makes data transfer seamless and enables real-time monitoring of quality factors. This integration allows manufacturers to apply predictive maintenance, streamline production processes, and guarantee that the products are of the highest quality.

By Industry: Manufacturing

The AI quality inspection market is segmented by industry into manufacturing, healthcare, food and beverage, retail, semiconductor, and textiles. The need for higher accuracy and consistency essentially drives the adoption of AI quality inspection in the manufacturing sector. AI algorithms, particularly those utilizing deep learning, are very effective at detecting minor defects that can go unnoticed by human inspectors. This means defect rates drop considerably, product quality is enhanced, and customer satisfaction increases.

As per the survey conducted by the Reserve Bank of India, capacity utilization in India’s manufacturing sector stood at 76.8% in the third quarter of FY24, indicating a significant recovery in the sector. India's GDP surged 8.4% in the October-December quarter, surpassing expectations.

The merging of next-generation technologies guarantees not only more efficient processes but also the diminishment of unforeseen shutdowns. This offers great returns for the manufacturing sector, facilitating disruptive alterations. This trend is very evident in India's Industrial automation market growth at a rate of CAGR of 14.26% to touch $29.43 Bn by FY2029.

To apply AI, producers attempt to determine what AI system would be most suitable to assist them in addressing their issues, how to responsibly and openly gather the data needed to train and operate the AI model, and where to apply AI to reshape existing processes. In this case, modern producers see data as an essential input that can be used and tapped into to uncover new efficiencies. AI is assisting in reshaping that data and rolling out solutions on a scale impossible to humans by themselves. The graph below shows the adoption of AI in corporate functions:

Apart from this, AI systems gather and analyze huge volumes of inspection data, uncovering insightful patterns and trends that can be leveraged to identify the root causes of defects and optimize manufacturing processes. This data-driven methodology enables manufacturers to make data-driven decisions, execute continuous improvements, and address potential quality issues proactively. For example, Landin AI works with semiconductor and Micro-Electro-Mechanical System (MEMS) manufacturers worldwide. Because of the platform’s automatic defect classification solutions, one leading manufacturer posted an 80% drop in labor costs. Much of the reduction came from streamlining workflows.

AI Quality Inspection Market Regional Analysis:

North America: North America, being a strong technological evolution force in the international artificial intelligence market, has been actively investing in expanding the scope and applications of AI software, including AI quality control and inspection. The top companies in the software sector are working on developing and competing with other companies to enhance their AI products and services portfolio.

For instance, Microsoft has introduced its virtual AI quality inspection product, Spyglass Visual Inspection, which integrates technological services to identify any product defects. In addition to this, IBM has introduced its latest AI quality inspection product, which implements a federated learning model. Apart from these established companies, several startups in the USA are dedicating their product line to innovating novel models and methods to improve AI-assisted quality inspection.

For instance, the AI-based quality control application of Neurala Inc., a Boston startup, has been incorporated by one of the leading manufacturers in the world, IHI Corporation. Therefore, considering the present trends in the AI market and the recent developments in AI quality inspection products in the USA, the North American AI quality inspection market will likely expand over the forecast period.

In developed economies such as the United States, the introduction of AI in the field of quality inspection is expected to bring transformation in various industries. The benefits of AI-powered quality inspection over manual inspection include faster processing speeds, enhanced safety, and increased uptime with accuracy improvements. The intervention in the software sector by the top companies will lead to expansion in AI software applications, such as advancement in AI quality control and inspection. For instance, the virtual air quality inspection product, Spyglass Visual Inspection, offered by Microsoft, is a unique IoT solution offering that enables manufacturers to eliminate false rejects, reduce product defects, and thereby increase overall customer satisfaction.

Moreover, the key developments in the market will boost the market growth during the forecast period. For instance, in July 2023, Intel launched AI reference kits in collaboration with Accenture. This is expected to bring automation under visual quality control inspections for the life sciences. It will demonstrate training up to 20% faster and will bring 55% faster results in visual defect detection with oneAPI optimizations. The AI reference kit also offers a 25% increase in prediction accuracy.

Furthermore, startups nationwide are actively focusing on product development that contributes to AI-assisted quality inspection. For instance, Neurala Inc., a Boston-based startup, partnered with IHI Corporation and IHI Logistics & Machinery Corporation. This is anticipated to bring a boost to AI-based quality control applications.

According to a few sources from IBM, Forbes, Small Business AI Adoption Survey, and McKinsey & Company, it was stated that 47% of business leaders are considering using AI instead of hiring new employees. Over half (56%) are leveraging AI to streamline and optimize their business operations, 51% of businesses are adopting AI to enhance their cybersecurity and fraud prevention efforts, 46% are using AI for customer relationship management, 2 in 5 are adopting AI for better inventory management, 30% are adopting AI tools for accounting support and supply chain operations, 25% of businesses have turned to AI to mitigate labor shortages and 75% of small businesses are using AI for a wide variety of business functions.

AI Quality Inspection Market: Competitive Landscape:

The market is fragmented, with many notable players, including Intel Corp, Kitov Systems, Mitutoyo America Corporation, Landing AI, NEC Corporation, Robert Bosch GmbH, Wenglor Deevio GmbH, Craftworks GmbH, Pleora Technologies Inc, IBM Corporation, Qualitas Technologies, Lincode, and Crayon AS, among others:

A few strategic developments related to the market:

August 2025: ViTrox showcases Smart 3D AOI inspection solutions at SEMICON and Productronica India 2025, featuring AI?enhanced dual?sided and 3D X?ray capabilities for precision PCB and advanced packaging defect detection.

June 2025: Cognex announces OneVision™ cloud platform, a new AI?powered machine vision solution that helps manufacturers build, train, and scale AI inspection models from the cloud for enhanced defect detection and automation.

AI Quality Inspection Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 5,884.097 million |

| Total Market Size in 2030 | USD 12,136.294 million |

| Forecast Unit | Million |

| Growth Rate | 15.58% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Technology, Component, Application, Region |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

AI Quality Inspection Market Segmentation:

By Technology

Machine Learning (ML)

Computer Vision

Deep Learning

Natural Language Processing (NLP)

Robotics Process Automation (RPA)

By Component

Hardware

Software

Services

By Application

Defect Detection

Dimensional Measurement

Surface Inspection

Assembly Verification

Packaging Inspection

By Industry

Manufacturing

Healthcare

Food and Beverage

Retail

Semiconductor

Textiles

By Region

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

Japan

China

India

South Korea

Indonesia

Thailand

Taiwan

Others