Report Overview

AI-Powered Solutions For Elderly Highlights

AI-Powered Solutions For Elderly Care Market Size:

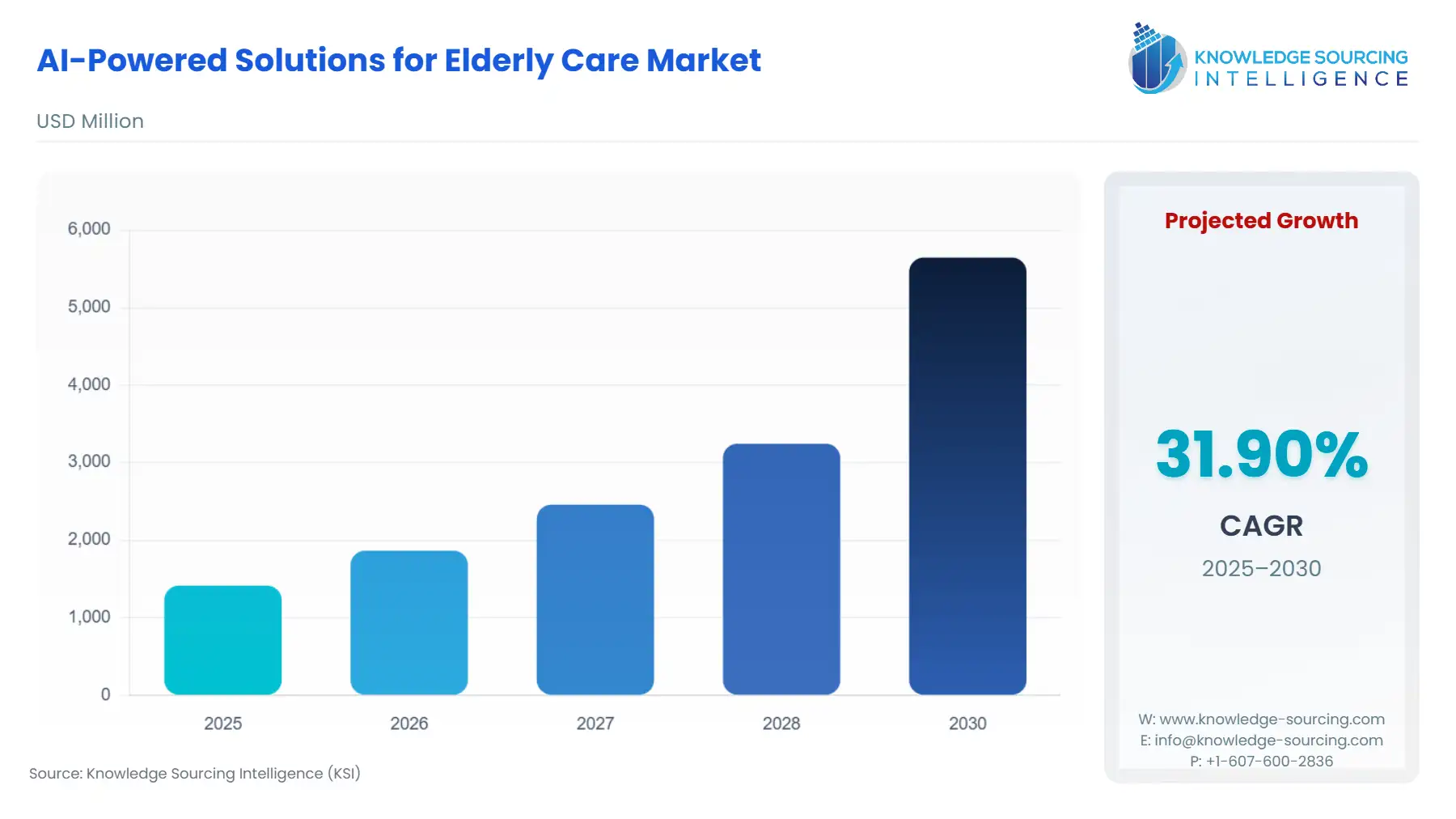

The AI-powered solutions for elderly care market is set to witness robust growth at a CAGR of 31.90% during the forecast period to be worth US$5.646 billion in 2030 from US$1.414 billion in 2025.

The surge in the global elderly population underscores a pressing imperative for scalable care models that preserve independence while mitigating health risks. In 2024, over 1.2 billion individuals worldwide exceeded age 60, a figure poised to double by 2050 according to United Nations projections. This demographic shift strains traditional caregiving infrastructures, where caregiver shortages evident in the U.S. exacerbate vulnerabilities to falls, isolation, and chronic ailments. AI-powered solutions emerge as a catalyst here, transforming passive oversight into dynamic support systems that detect anomalies in real time and facilitate timely interventions.

The integration of AI with everyday environments, from wearable sensors capturing vital signs to ambient audio analytics gauging emotional well-being. These technologies not only alleviate the burden on families and providers but also empower seniors to navigate daily challenges autonomously. For instance, predictive algorithms analyze movement patterns to forecast potential falls, a leading cause of injury among those over 65, thereby slashing emergency responses and associated costs. Yet, this promise hinges on addressing entrenched barriers: data privacy concerns under frameworks like HIPAA persist, while uneven access in low-resource regions curtails equitable deployment.

Market forces further propel this trajectory. Government initiatives, such as China's December 2024 guidelines promoting AI and robotics in elder services, signal a policy pivot toward tech-enabled longevity. In parallel, academic inquiries reveal AI's efficacy in reducing urinary tract infections through behavioral insights, underscoring its role in preventive care. As stakeholders from startups like CarePredict to incumbents like Philips ramp up investments, the sector teeters on a threshold where innovation must balance efficacy with ethical imperatives.

Ultimately, AI redefines elderly care not as a reactive service but as an anticipatory ecosystem. By harnessing vast datasets from global trials, these solutions tailor interventions to individual profiles, fostering resilience amid demographic pressures. The ensuing analysis dissects these dynamics, illuminating pathways to sustain vitality for an aging world.

AI-Powered Solutions for Elderly Care Market Analysis

Growth Drivers

Demographic pressures forge the foremost catalyst for AI adoption in elderly care, as nations grapple with escalating numbers of seniors requiring sustained support. The United Nations “World Population Prospects 2024” reports that the global population aged 80 years and above will be near 265 million by mid 2030s. Such growth in population will accelerate the demand for AI-driven platforms like remote vital sign trackers to avoidable hospitalizations by flagging early deteriorations in conditions such as hypertension or diabetes is anticipated to grow. Such interventions cut per-incident costs thereby compelling healthcare providers to integrate these tools amid rising Medicare expenditures annually.

Technological maturation in machine learning and natural language processing amplifies this momentum, enabling nuanced behavioral analysis that anticipates needs before crises erupt. Studies suggest that wearable sensors, leveraging algorithms trained on datasets from over a million activity logs, discern subtle shifts like irregular gait patterns signaling fall risks with high accuracy. This precision drives uptake in homecare, where seniors demand for products that promote medication adherence and social check-ins. By reducing isolation-linked depressions, which affect most of elders globally, the AI-based elderly care systems extend independent living tenures by up to two years, slashing institutional care demands that burden budgets in aging societies in major regions.

Caregiver scarcity compounds urgency with global healthcare professional strength falling near 18 million by 2030, according to the World Bank. Hence, AI mitigates this void through virtual assistants that handle most of the routine queries, from appointment reminders to emotional support dialogues. This efficiency appeals to providers facing high vacancy rates, prompting investments in scalable AI that optimizes staff allocation yielding high productivity gains in pilot programs across European facilities. Consequently, demand surges for platforms that not only fill gaps but enhance human interactions, preserving care quality amid workforce contractions. Likewise, the chronic disease proliferation further galvanizes market expansion, as AI excels in predictive analytics for conditions afflicting most of seniors. Heart disease and dementia treatment benefit from computer vision tools that monitor sleep disruptions or mobility lapses, alerting clinicians hours pre-escalation.

Challenges and Opportunities

Privacy erosion poses a formidable headwind, as AI's voracious data appetite drawing from audio feeds and motion trackers leads to large volume of data generation for patients including their critical information such as medical records. Hence, processing of such high data is faced with the constant risk of breach & theft, for instance, according to the Health-ISAC’s “2025 Q2 Cybersecurity Trends and Threats to the Health Sector” report states that the healthcare data breach stood at 1,651 which marked 6.6% of the total breaches tracked. Hence, such data breach prevalence creates confidentiality concern and clashes with consent norms, thereby dampening adoption in healthcare facilities where senior care is provided.

Algorithmic biases exacerbate inequities, with models trained on skewed datasets overrepresenting affluent demographics misclassifying risks for minorities, inflating false positives. Hence, such flaws deter diverse uptake, contracting demand in multicultural markets like India, where most of senior hail from underserved groups. Counterintuitively, this spurs innovation in federated learning frameworks, aggregating insights sans central data hoards, promise bias audits that elevate the overall accuracy thereby fostering inclusive demand surges in pilot cohorts.

Moreover, high deployment costs hinder scalability, with initial setups for IoT arrays per household costing in thousands, which is prohibitive for most of global elders below median income lines. This barrier throttles homecare expansion, where ROI lags two years amid upfront hurdles. However, modular SaaS models which are subscription-based democratize access thereby converting cost constraints into recurring revenue streams that broaden market reach. Ethical quandaries around autonomy erode confidence, as overreliance on AI companion risks diminishing human bonds, with most of caregivers reporting relational strains. This aversion caps demand for companionship bots, limiting growth in isolation-prone segments.

Caregiver resistance to tech integration followed by interoperability gaps hobble ecosystems, as siloed platforms lacking API standards fragment data flows, hiking error rates in multi-vendor setups. Universal protocols, akin to FHIR in health IT, forge seamless integrations, unlocking demand uplift in networked care models.

The ongoing development to promote remote patient monitoring followed by efforts to bolster smart healthcare management has provided new growth opportunities for the adoption of AI-powered products for elderly care. Likewise, the regulations & guidelines issued by the governing authorities in major economies such as China to specifically integrate Artificial Intelligence in elderly has provided a blueprint to accelerate the adoption.

Raw Material and Pricing Analysis

The AI-powered elderly care devices rely on a mix of advanced electronics, sensors, and biocompatible materials to ensure durability, comfort, and functionality. Raw materials are primarily sourced from semiconductors, conductive polymers, and biopolymers, with supply chains dominated by Asia. Hence, the logistical chokepoints emerge in trans-Pacific shipping, where delays averaged weeks amid Red Sea disruptions, thereby inflating delivery costs.

Supply Chain Analysis

AI elderly care solutions rely on a fragmented global supply chain, centered on U.S. and Asian hubs for software development and hardware assembly. Key production nodes include Silicon Valley for algorithm prototyping and Shenzhen, China, for sensor fabrication. Likewise, the U.S. reciprocal tariffs on countries has created frictions in global supply chain, however efforts to reduce such tariffs and promote trade with major nations such as China is expected to remove the bottleneck in supplies.

Government Regulations & Programs

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

United States | HHS AI Task Force Guidelines (2024) / U.S. Department of Health and Human Services | Mandates transparency in predictive algorithms, boosting demand for auditable AI in Medicare-funded programs; nondiscrimination clauses curb biases, expanding access for underserved seniors and accelerating compliant deployments amid high annual eldercare spend |

European Union |

EU AI Act (effective August 2024) / European Commission |

Classifies eldercare AI as high-risk, requiring conformity assessments that delay launches but heighten trust, driving uptake in homecare; fosters ethical innovation, mitigating privacy fears and unlocking cross-border investments for bias-free systems. |

AI-Powered Solutions for Elderly Care Market Segment Analysis

By Application: Fall Detection and Prevention

By application, the fall detection and prevention is expected to account for a considerable market share. The fall detection stands as a cornerstone application, propelled by its capacity to avert 37 million annual global incidents that claim 684,000 lives, predominantly among elders over 60, according to the World Health Organization. AI's edge lies in multimodal sensing accelerometers fused with computer vision achieving high precision in real-time anomaly spotting, far surpassing manual checks.

IoT mats and smart flooring, embedded with pressure algorithms, trigger haptic feedback or automated barriers, slashing hospital transfers. Regulatory nudges for FDA's clearances for AI wearable medical devices has provided new growth prospects. Chronic comorbidities like osteoporosis, affecting million globally, intensify needs as AI correlates bone density scans with mobility data, customizing prevention plans that extend mobility.

By End-User: Homecare Settings

Based on end-user, the homecare settings is poised for a positive growth thereby accounting for a considerable share. This tilt stems from cost efficiencies coupled with AI's seamless embedding in domestic routines. Platforms like Sensi.AI's audio agents parse ambient sounds for distress cues, yielding high accuracy in isolation detection and curbing depressions. Technological enablers, including 5G-enabled wearables, facilitate granular tracking heart rhythms to sleep cycles averting most of cardiac events through anomaly alerts. Sustainability drives further: AI optimizes energy in smart homes, trimming utility bills while monitoring adherence. This nexus of preference, thrift, tech prowess, and incentives cements homecare as the vanguard, reimagining elder support as empowered domiciles rather than sterile wards.

AI-Powered Solutions for Elderly Care Market Geographical Analysis

The AI-powered solutions for elderly care market analyzes growth factor across following regions

North America: The growing technological innovations in healthcare sector in major regional economies has provided new growth prospects. Hence, the establishment of polices that comply with next-generation technology adoption such as “AI Action Plan” has provided a framework for usage of innovation in healthcare applications including elderly care. Additionally, the constant progression in old-age people population is impacting the market demand, according to the US Census Bureau, in 2024, the share of population aged 65 years and above has grown up to 18% which marked a continuous growth from the past twenty years.

Europe: The implantation of polices to bolster automation and accelerate the digital processing and infrastructure is driving the regional market expansion. Economies such as Germany has established plans such as “Digital Strategy 2025” which aims to which drive country’s digital labor force which is expected to drive AI-investments and explore their usage in healthcare application including elderly care.

Asia Pacific: Ongoing efforts to bolster automation and improve smart patient management is driving the adoption of AI-based tools in healthcare applications in major economies namely China, India, South Korea and Japan thereby providing new growth prospects for elderly care.

South America & MEA: The growing frequency of old age population has increased their chronic disease prevalence in South America which has impacted the demand for modern concepts to bolster elderly care. Likewise, the ongoing investments to bolster industrial AI-adoption is driving their usage in healthcare sector in major MEA economies.

AI-Powered Solutions for Elderly Care Market Competitive Environment and Analysis

The landscape features fragmented innovation, with startups investing in product development to improve their market image.

Intuition Robotics leads companionship, with its cutting-edge ElliQ's AI-companion robot which features medication reminders and health & pain tracking thereby enabling smart & healthier aging.

Sensi.AI excels in audio intelligence, its Care Copilot detecting high emotional cues through advanced audio technology thereby offering real-time virtual assessment with high accuracy. The company’s constant investment in advancing its AI-tool has enabled Sensor.AI to garner a wider customer base.

AI-Powered Solutions for Elderly Care Market Developments

March 2025: CarePredict announced the launch of “CarePoint” AI-platform which offers real-time care assessment for the senior living by increasing the overall transparency and accuracu scale that bridges gap between care delivered and care reimbursed.

February 2024: Intuition Robotics announced the launch of “ELLIQ 3” which is an upgrade over its predecessor that further improves the level of companion robot services for elderly and address issues such as loneliness and isolation.

AI-Powered Solutions for Elderly Care Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 1.414 billion |

| Total Market Size in 2030 | USD 5.646 billion |

| Forecast Unit | Billion |

| Growth Rate | 31.90% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Technology, Application, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

AI-Powered Solutions for Elderly Care Market Segmentation:

By Technology

Machine Learning

Natural Language Processing (NLP)

Robotics

Computer Vision

Others

By Application

Fall Detection and Prevention

Remote Monitoring and Healthcare

Personalized Virtual Assistants

Medication Management

Social Interaction and Companionship

Others

By End-User

Home Care Settings

Assisted Living Facilities

Nursing Homes

Hospitals And Clinics

Others

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

Japan

China

India

South Korea

Indonesia

Thailand

Others