Report Overview

Artificial Intelligence (AI) in Highlights

Artificial Intelligence (AI) in Edtech Market Size:

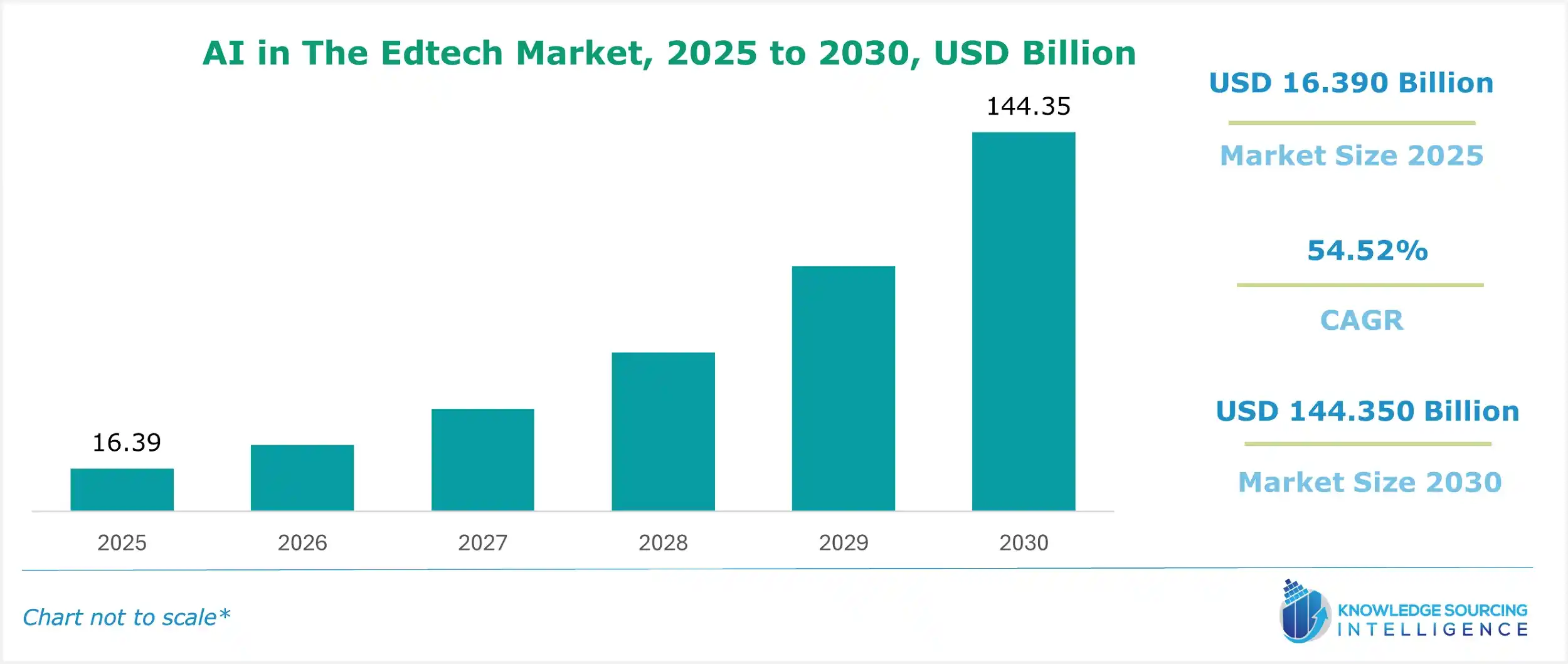

The Artificial Intelligence (AI) in Edtech Market is estimated to grow at a CAGR of 54.52% to attain US$144.350 billion in 2030, increasing from US$16.390 billion in 2025.

In the edtech or educational technology sector, artificial intelligence (AI) plays a critical role in technology development. In this sector, AI offers multiple applications, including various benefits, like personalized learning programs and intelligent tutoring systems that can offer users better curriculum programs. The AI-based tools and platforms can also automate grading and assessment features, and they also have the capability of adaptive learning platforms, virtual classroom aides, and educational data analytics.

The AI in the edtech platform offers various key components that use multiple tools like Adaptive Learning Systems, Intelligent Tutoring Systems (ITS), Natural Language Processing, and Machine Learning (ML). Adaptive Learning Systems use AI algorithms to personalize learning experiences to individual students' requirements, preferences, and styles, altering pace, material, and instruction delivery to maximize learning results.

Intelligent Tutoring Systems use artificial intelligence to deliver personalized coaching and feedback to students, much like a human teacher would. They analyze performance data to identify strengths and shortcomings and then provide tailored learning interventions. ML technologies enable computers to learn from data and make predictions or decisions without explicit programming. In EdTech, ML is used for personalized recommendation systems, predictive analytics, and content customization.

Artificial Intelligence (AI) in Edtech Market Growth Drivers:

- Increasing investment opportunities in the global Edtech sector

The rising investments by governmental and private organizations for developing the global edtech sector are estimated to propel global AI in the edtech market.

The global market witnessed a significant increase in investment strategies in the educational technology sector, including the introduction of key policies and strategies by the governments of various countries worldwide.

For instance, in India, the government introduced two key AI-based policies, Make AI for India and Make AI Work for India, aimed at creating sustainable and state-of-the-art AI technological development across the nation in multiple sectors, including education. The government allocated about INR 255 crore for the interim budget 2024-25 towards this mission. The government also introduced 100% foreign investment in education technology and institutions to boost the innovation of the edtech sector in the nation.

- Increasing demand for personalized learning propels the market

The increasing demand for personalized solutions across multiple industries is a major factor propelling global AI in the edtech market. AI provides adaptive learning systems that personalize educational content and learning experiences to students' unique requirements, preferences, and learning styles, resulting in greater engagement and understanding. Among various products available in the market, the Cognii Learning Platform is a handy, stand-alone platform that combines the Cognii Virtual Learning Assistant for students and Cognii Analytics for teachers, providing AI-powered learning, feedback, tutoring, fast course creation, and simple content production templates. Overall, the growing desire for personalized learning emphasizes the value of AI in EdTech as a potent tool for providing more equal, inclusive, and successful learning experiences for all students.

- The need for enhanced teaching experiences is boosting the market

AI-powered educational technologies and platforms, such as virtual reality simulations, intelligent tutoring systems, and gaming learning activities, can enhance learning engagement and effectiveness by providing dynamic and immersive experiences. One of the products, Knewton Alta, is a cheap adaptive courseware that extends personalized learning beyond homework by delivering extensive answer explanations, just-in-time education, and remediation of required skill gaps. It continually evaluates students' knowledge and changes in real-time to maximize learning outcomes, organizing information by learning objectives and providing it to students based on their requirements.

Artificial Intelligence (AI) in Edtech Market Restraints:

- Data privacy concerns

The collection and analysis of student data raises privacy issues among parents, educators, and policy officials. Issues with data protection, permission, and abuse can erode faith in AI-powered EdTech solutions, leading to regulatory scrutiny and compliance issues.

The global cases of data breaches and cyberattacks have witnessed a massive increase in recent years. The IT Governance UK stated that in February of 2024, a total of 719.366 million records were breached globally, whereas about 299.368 million data breaches occurred in March 2024. In April 2024, about 5,336.840 million data breaches were recorded globally.

Artificial Intelligence (AI) in Edtech Market Geographical Outlook:

- North America is forecasted to hold a major share of the AI in the Edtech market.

The North American EdTech ecosystem, which includes Google, Microsoft, Magicedtech, and Amazon, is promoting the development of innovative technologies such as AI. This culture of creativity and entrepreneurship in Silicon Valley is likely to substantially impact the application of AI in education, improving learning experiences in schools, universities, and virtual learning environments.

North America's considerable share of AI in the EdTech market is due to its leadership in technological innovation, strong ecosystem collaboration, financing availability, a favorable regulatory framework, and rising demand for digital learning solutions.

Major Products in Artificial Intelligence (AI) in Edtech Market:

- StepWise AI is a Virtual Tutor Software that simulates the supervision of an experienced teacher, assisting students in problem-solving by submitting each step for review and receiving prompt responses. It is adaptable, personalized, and responsive to pupil development, allowing them to proceed as soon as they are prepared. StepWise offers instructors valuable data to help them understand their students' problem-solving abilities and skill levels.

- ClearMath Solutions is a dynamic strategy that aims to assist kids in developing math abilities, confidence, and enthusiasm. They believe every kid can be a mathematician and want to build a community of educators to help children become creative problem solvers, critical thinkers, and lifelong learners.

Artificial Intelligence (AI) in Edtech Market Key Developments:

- October 2025: HMH Highlights Top K-12 EdTech Trends for 2025. Houghton Mifflin Harcourt (HMH) released a report on emerging AI-driven trends in K-12 education, including self-directed learning, AI literacy building, and automation of teacher tasks like grading, emphasizing ethical AI integration to enhance student outcomes.

- October 2025: Inside Higher Ed Report Warns of AI Prioritization Over Educator Expertise. A new report critiques ed-tech companies for prioritizing AI development over educator input, recommending collaborative approaches to address technical issues like AI hallucinations and privacy in personalized learning tools.

- October 2025: EdTech Magazine Releases AI Playbook for Higher Education. EdTech Magazine unveiled a comprehensive AI playbook for colleges, detailing strategies for AI deployment in student support, faculty tools, and campus operations, with case studies showing improved engagement through AI-powered adaptive platforms.

- February 2024, Wiley announced a new three-year open-access partnership with the University of Macau, the first between a Macau university and a worldwide publisher. The deal would provide academics with access to Wiley's journal portfolio and enable researchers to publish open access in almost 2,000 hybrid and fully gold open-access publications.

List of Top Artificial Intelligence (AI) in Edtech Companies:

- Microsoft

- Magicedtech

- Amazon

- Intel Corporation

Artificial Intelligence (AI) in Edtech Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

AI In The Edtech Market Size in 2025 |

US$16.390 billion |

|

AI In The Edtech Market Size in 2030 |

US$144.350 billion |

| Growth Rate | CAGR of 54.52% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in AI In The Edtech Market |

|

| Customization Scope | Free report customization with purchase |

Artificial Intelligence (AI) in the Edtech Market Segmentation:

- By End-Users

- Students

- Teachers

- Parents

- Institutions

- By Deployment

- Cloud

- On-Premise

- By Application

- Content creation

- Personalized Learning

- Operations

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Taiwan

- Others

- North America