Report Overview

Artificial Intelligence (AI) In Highlights

Artificial Intelligence (AI) In Design Market Size:

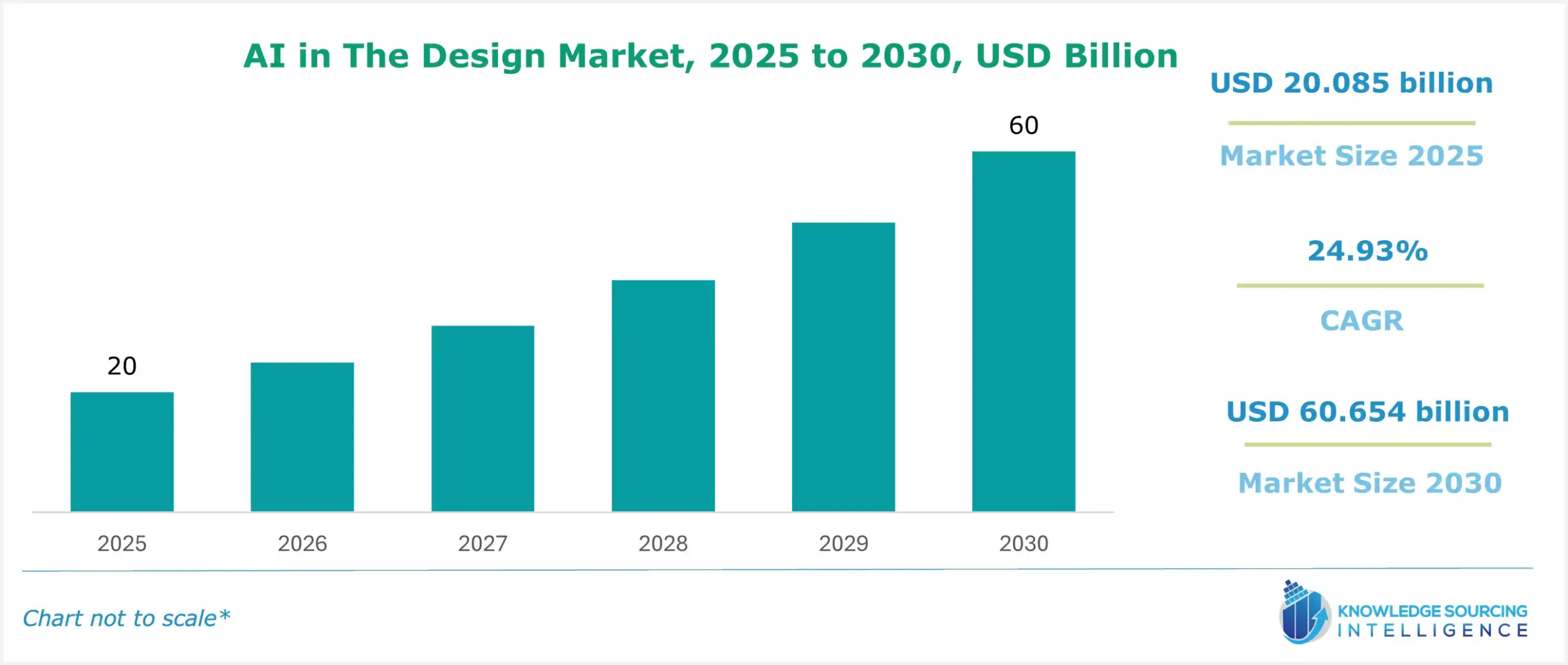

The Artificial Intelligence (AI) in design market is projected to grow at a CAGR of 24.93% over the forecast period, increasing from US$20.085 billion in 2025 to US$60.654 billion by 2030.

Artificial Intelligence (AI) In Design Market Introduction:

An AI, or Artificial Intelligence, is a system developed using computer-generated code. This system can understand human input, be it text, voice, or images and videos, and can generate the desired output accordingly. The AI for designing uses these inputs and helps the operator or user to develop or generate an output in the form of an image or video, which can be further used for designing purposes in multiple industries.

One of the major driving factors for AI in the design market’s growth is the increasing demand for social media and attractive design solutions by brands. Nearly all companies, be they small or big, around the globe have their presence on social media. This platform is mainly for the promotion of their products and announcements. They also use social media posts, in the form of images or videos, to enhance their visibility.

With the increasing number of social media users, the demand for design is expected to increase, increasing the market size of AI for design solutions. In its annual report, Meta (Facebook) stated that Facebook had about 2.11 billion active daily users by the end of December 2023, which increased by about 6% from 2022, when about 2 billion active users were recorded. The company's monthly active users were recorded at about 3.07 billion by the end of December 2023, which increased by about 3% from the previous year, when the monthly active users were recorded at 2.96 billion.

AI in the design market is revolutionizing creative industries through generative design AI and AI-powered design software, enabling rapid ideation and optimization. AI creative tools and AI-assisted design enhance workflows in architecture, product design, and graphic arts, streamlining complex tasks. The growing adoption of AI technologies in business, benefits such as cost reduction, efficiency, optimizing design process, and automating tasks, among others, of the use of AI in design, industrial revolution 4.0, and the growth of small and medium enterprises are driving market expansion comprehensively. Computational design leverages AI design automation to produce innovative, efficient structures, while AI art generators empower artists to create novel visuals. This market drives efficiency, creativity, and scalability across design disciplines. In March 2025, Adobe updated Firefly Design Suite, an AI-powered toolset that enhances graphic design with real-time generative content creation, boosting productivity for professional designers. The market is pivotal for transforming design innovation and accessibility.

In the upcoming years, the use of generative AI will surge, as evident from the growth across the market, such as programs like Midjourney, DALL-E, and Stable Diffusion, generating 2D renderings for architects. This trend is already gaining momentum, with many industries increasingly adopting generative AI tools to accelerate product development, reduce design cycles, and improve innovation outcomes. The market is also witnessing increasing integration of AI with simulation and digital twin technologies, such as Siemens HEEDS AI simulation predictor. The market is also expanding in optimizing designs for material reduction, energy efficiency, and environmental impact, focusing on sustainability and lightweight design, highlighted by the collaboration of General Motors and Autodesk in car manufacturing.

Artificial Intelligence (AI) In Design Market Overview:

The Artificial Intelligence (AI) in design market refers to the use of different artificial intelligence technologies, such as machine learning, generative AI, and other advanced algorithms, to enhance and automate the design process across diverse industries such as graphic design, industrial design, product design, interior design, fashion, architecture, and more. The market comprises these tools and technologies assisting in creating and optimizing the design process, accelerating it, and personalizing the user experience.

As these tools and technologies help in saving time, democratizing design, and reducing cost, the market is experiencing growing adoption. Autodesk, Adobe, Canvas, and Google are leading players in integrating AI into design platforms.

Several factors are continuously positively impacting AI in the design market, driving its expansion. One of the key factors is the rapid technological advancements in machine learning, deep learning, and generative adversarial networks (GANs) that enable AI to produce high-quality, realistic designs, from graphics to industrial prototypes. The growing use of generative AI is allowing for rapid generation of design variations, helping with cost and functionality. For instance, Siemens AG uses generative AI to create and optimize product designs by automatically generating various design options based on key parameters like weight, strength, aerodynamics, and manufacturing constraints.

According to a recent survey, 66% of industry leaders predict AI will become an integral part of their business within the next 2-3 years. This highlights a clear consensus that AI is rapidly transforming the approach to design across product design, architecture, engineering, and more.

The global adoption of Canva among influential companies demonstrates the strong market validation for AI tools in creative and design workflows. Its achievement of over $3 billion in annualized revenue, with a growth rate of more than 30% year-over-year, reflects the rapid market expansion and increasing demand for AI-enhanced design platforms.

Another major factor is the growth of small and medium enterprises. They are increasingly adopting AI tools to compete with larger firms, driving market expansion due to cost-efficiency and personalized user experience. Thus, democratization of design through user-friendly AI tools is enabling non-designers and small businesses to create professional-quality designs, expanding the market.

Key market players are actively enhancing their offerings by integrating advanced features like automated design generation, real-time simulation, and AI-based predictive analytics.

Artificial Intelligence (AI) In Design Market Major Trends:

AI in the design market is advancing with a focus on design efficiency, enabling rapid prototyping and streamlined design iteration for faster project timelines. Design personalization tailors solutions to individual preferences, while design innovation pushes creative boundaries through AI-driven visualization. Creative augmentation enhances human capabilities, and smart design tools integrate real-time analytics for optimized workflows. Sustainability in design AI promotes eco-friendly materials and processes, aligning with global environmental goals. Design democratization broadens access to advanced tools, empowering various creators. These trends reflect the market’s shift toward intelligent, inclusive, and sustainable design solutions, transforming creative industries with precision and scalability.

Artificial Intelligence (AI) In Design Market Growth Drivers:

- Increase in the global adoption of AI and generative AI

The continuous and growing adoption of AI in the global market by companies and governmental organizations is expected to propel AI in the design market, as it is sure to introduce new technologies and investments in the future. Various countries like India, Japan, and France have also invested heavily in the development of a state-of-the-art landscape for AI in the region.

The Artificial Intelligence Index Report 2024, published by Stanford University, stated that various organizations worldwide have fully operationalized AI in their operations. The report further stated that in Asia and South America, about 25% of the organizations have adopted responsible AI into the workforce, followed by Europe and North America, with organizational rates at 18% and 17%, respectively.

The use of generative Artificial Intelligence (AI) in the Design industry has changed how creatives develop and execute concepts. Tools like DALL·E, Midjourney, Adobe Firefly, and Runway let designers create high-quality visuals, illustrations, textures, and even videos from simple text prompts. This reduces the time and skill required to make prototypes or mockups. Instead of starting from scratch, creatives can build on AI-generated outputs, fine-tuning them to fit brand styles or specific campaign goals. This is especially helpful in fast-moving industries like marketing, entertainment, and e-commerce, where quick turnaround and high content volume are key.

The international scene reflects a strong commitment to integrating AI in public services. About ten countries are already providing AI-enabled services to their citizens, and 75 nations plan to share their AI strategies by 2024. The United States has requested an impressive $3 billion for AI in the FY25 budget. Meanwhile, Singapore aims to spend $1 billion on AI over the next five years. South Korea is prepared to invest $6.94 billion in AI by 2027. These numbers show the global drive toward AI, with significant investments being made so governments can make the most of this technology.

Additionally, generative AI helps improve creativity rather than replace it. Designers use AI not just as a productivity tool but as a collaborator that boosts idea generation and exploration. For instance, product designers can quickly create multiple design variations, play with color palettes, or visualize packaging in 3D. In UI/UX design, AI models can suggest layouts based on usability principles, improving both creativity and functionality. This combined approach allows designers to focus more on strategic thinking, understanding users, and telling brand stories, enhancing the overall quality of their work.

The rise of generative AI is driven by platform integration and wider access. Major software ecosystems like Adobe Creative Cloud and Canva are incorporating AI features into their tools. This makes powerful generative options available to both professionals and beginners. These integrations reduce technical barriers, allowing non-designers like marketers, founders, and educators to create impactful visuals without outsourcing. As AI features keep improving in contextual understanding, resolution, and style consistency, they are becoming increasingly important in the design process across creative industries.

- Enhanced creativity and innovation are boosting the market

A major factor boosting the global AI in the design market is the development of AI technologies and the optimum performance offered by such tools. AI programs use multiple algorithms and machine learning tools, which help them produce fresh and unique design concepts, introduce innovative solutions to projects, and investigate new design procedures or methods that human intelligence may lack. The availability of such capabilities encourages widespread innovation in the sector.

Various companies and research organizations introduced and integrated various tools and algorithms, further boosting the capabilities of the AI design platform. For instance, NVIDIA, a global technological leader, developed its design platform, Canvas. It employs AI-based tools to convert brushstrokes into realistic landscape pictures, enabling speedy background creation and concept development. This platform offers nine design styles, allowing users to paint on distinct layers for each element.

- Enhanced and improved design quality

The capability of offering enhanced and higher-quality output of AI tools in the design sector is among the major factors contributing to AI in the design market. AI-powered technologies can analyze large volumes of data inputs, identify trend variations, and make data-driven design decisions to offer an optimum and higher-quality output. This capability of AI-powered tools helps generate higher-quality designs that are personalized to the needs of the individual.

Various companies have introduced multiple tools and solutions designed to offer users more personalized and accurate design outputs. For instance, the AI Studio offered by Vertex provides APIs for foundation models, quick prototyping, and application deployment, among others, and uses Google's Gemini multimodal models platform. The AI Studio offers a quick model adaptation as well as fully controlled tools for creating extensions that connect models to proprietary data sources or third-party services.

Artificial Intelligence (AI) In Design Market Challenges:

A major challenge to the global AI in the design market’s growth is the increasing risk of data breaches and cyberattacks. AI in design platforms mostly relies on user behavior, personalization data, and design assets, which the tools collect and store in their dedicated cloud storage. With the increasing risk of data breaches, there are concerns related to data privacy, security breaches, and the abuse of sensitive information. This is discouraging multiple companies and organizations dealing with sensitive information or public data from adopting AI-driven design solutions.

Artificial Intelligence (AI) In Design Market Segment Analysis

- The automotive design segment is expected to grow significantly

By application, the Artificial Intelligence (AI) in the Design market is segmented into automotive design, interior design, architecture, product design, graphic design, and others. The use of AI in automotive design arises from the need for quicker and more efficient vehicle development. Traditional automotive design is slow and expensive, requiring many rounds of sketching, modeling, simulation, and testing. AI, especially generative design algorithms and neural networks, can significantly reduce this time by automating concept creation and assessing thousands of design options based on performance goals and material limits. This speeds up prototyping, boosts innovation, and helps automakers launch new models faster.

In line with this, the data published by the Society of Indian Automobile Manufacturers (SIAM) indicate that the production of automobiles, including passenger vehicles, CVs, 3-wheelers, 2-wheelers, and quadricycles in India during 2021-22 was 2,30,40,066, which went up to 2,59,40,344 during 2022-23. Nonetheless, in 2023-24, the total number of all these vehicle productions touched 2,84,34,742.

Another key factor is the growing demand for personalization and data-driven customization. Consumers want vehicles that match their tastes in both style and function. AI helps automotive companies collect and examine user data to guide choices about interior design, infotainment systems, and even exterior appearance. By using machine learning models based on user behavior and market trends, designers can create features like customizable dashboards, adaptive lighting, and climate systems that meet individual needs. This approach not only improves customer satisfaction but also makes designs more relevant across various markets and groups.

Moreover, integrating AI into advanced 3D modeling, simulation, and industrial design tools is changing the way automotive design teams work together and test their ideas. AI-driven tools like Autodesk's generative design, Siemens NX, and ANSYS simulations now provide automated stress testing, aerodynamic simulations, and ergonomic checks early in the design process. This reduces the need for physical prototypes, minimizes material waste, and ensures that designs meet performance and safety standards.

The ability to simulate real-world conditions with AI also helps design next-generation vehicles, including electric vehicles (EVs) and self-driving cars, which require entirely new structures. This makes AI an essential part of future automotive advancements. In line with this, according to the IEA, in 2023, approximately 14 million electric cars were sold, of which 95% were purchased by consumers in Europe, China, and the United States. Compared to 2022, this figure showed a 35% increase, with 3.5 million more registered EVs. The IEA data further represented that the sale of electric cars rose from 13.7 million in 2023 to account for 16.6 million units by 2024.

Artificial Intelligence (AI) In Design Market Geographical Outlook:

By geography, the AI in the design market is segmented into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific.

The North American AI in the design market has been segmented into the United States, Canada, and Mexico. The United States is expected to hold a substantial market share owing to the presence of key players in the nation.

The United States AI market for design is anticipated to grow significantly. This is owing to factors such as the high penetration of technologically advanced companies in the region, coupled with the increasing use of technology such as AI and generative AI in various end-use industries. Additionally, the country has a high penetration of artificial intelligence in industries such as engineering, graphic design, and architecture, among others.

New and innovative product launches by companies in the AI for design market are also expected to positively influence market growth. For instance, in July 2024, Microsoft, headquartered in Washington, United States, announced the launch of the Microsoft Designer App, which will be available to anyone with a personal Microsoft account. This app will help in creating and editing new ideas using AI.

Artificial Intelligence (AI) In Design Market Key Developments:

The market leaders for AI In The Design Market are Autodesk, Adobe, Google, Nvidia, OpenAI, Galileo.ai, Coohom, Canva, Siemens, Monolith, Uizard, Designs.AI, Looka Inc., Let’s Enhance, Inc., and MidJourney.. The key players in the market implement growth strategies such as product launches, mergers, acquisitions, etc., to gain a competitive advantage over their competitors. For Instance,

- In May 2025, Snowflake, the AI Data Cloud company, announced the continued growth and strong momentum of its AI Data Cloud for Manufacturing, highlighting a strategic push toward expanding automotive-focused solutions within the sector.

- In April 2025, Canva launched the Visual Suite 2.0. It is designed to bridge the gap between creativity and productivity and to seamlessly create content with personalization features.

- In March 2025, Adobe announced that it is allowing third-party generative AI models (e.g., Google Veo 2, Imagen 3, Runway, Flux 1.1 Pro) inside its ecosystem. Like Adobe Express and Project Concept, alongside its proprietary Firefly models. This move gives users more flexibility during the ideation phase while maintaining IP-safe output options via Firefly.

- In February 2025, Mistral AI and Stellantis N.V. are strengthening their strategic partnership to apply artificial intelligence (AI) in various fields, including in-car experiences and vehicle engineering. Through this collaboration, Mistral AI's proficiency with large language models (LLMs) and AI-driven automation will be applied to numerous systems and applications throughout Stellantis Enterprise, thereby facilitating data analysis, expediting development, and augmenting customer engagement.

- In December 2024, to help automotive companies hasten the development of workload-specific silicon and software required to power AI-enabled features in next-generation cars, Synopsys and SiMa.ai announced a strategic partnership. For maximum customisation of IP, subsystems, chiplets, and SoCs, the solution will integrate the best-in-class EDA, automotive-grade IP, and hardware-assisted verification solutions from Synopsys with the top-tier machine learning accelerator (MLA) IP and full ML software stack application development environment from SiMa.ai.

- In September 2024, SimScale GmbH announced a suite of enhancements designed to deepen its support of real-time, simulation-driven design for the automotive sector.

- In July 2024, Canva announced plans to acquire Leonardo AI. Leonardo.AI is Australia’s fastest-growing startup and a leading generative AI content and research company. Leonardo.AI is used by millions of people for the production of quality images and videos.

- In February 2024, IKEA, a global furniture and interior design leader, launched IKEA Kreative, an AI-powered design tool that features lifelike spatial features that can transform the home's physical environment into a 3D showroom of the company.

- In February 2023, NASA announced the use of artificial intelligence to build mission gear that resembles extraterrestrial bones but is lighter and more stress-resistant. It also took less time to construct than human-designed parts, despite the possibility of increased structural stresses.

List of Top Artificial Intelligence (AI) In Design Companies:

- Autodesk

- Adobe

- Nvidia

- OpenAI

Artificial Intelligence (AI) in the Design Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| AI in The Design Market Size in 2025 | US$20.085 billion |

| AI in The Design Market Size in 2030 | US$60.654 billion |

| Growth Rate | CAGR of 24.93% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in AI in The Design Market | |

| Customization Scope | Free report customization with purchase |

Artificial Intelligence (AI) In The Design Market Segmentation:

- By End-User

- Small-sized organization

- Medium-sized organization

- Large-sized organization

- By Deployment

- Cloud

- On-Premise

- By Application

- Automotive design

- Interior design

- Architecture

- Product design

- Graphic design

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Indonesia

- Rest of Asia-Pacific

- North America