Report Overview

Artificial Intelligence (AI) in Highlights

Artificial Intelligence (AI) in Military Market Size:

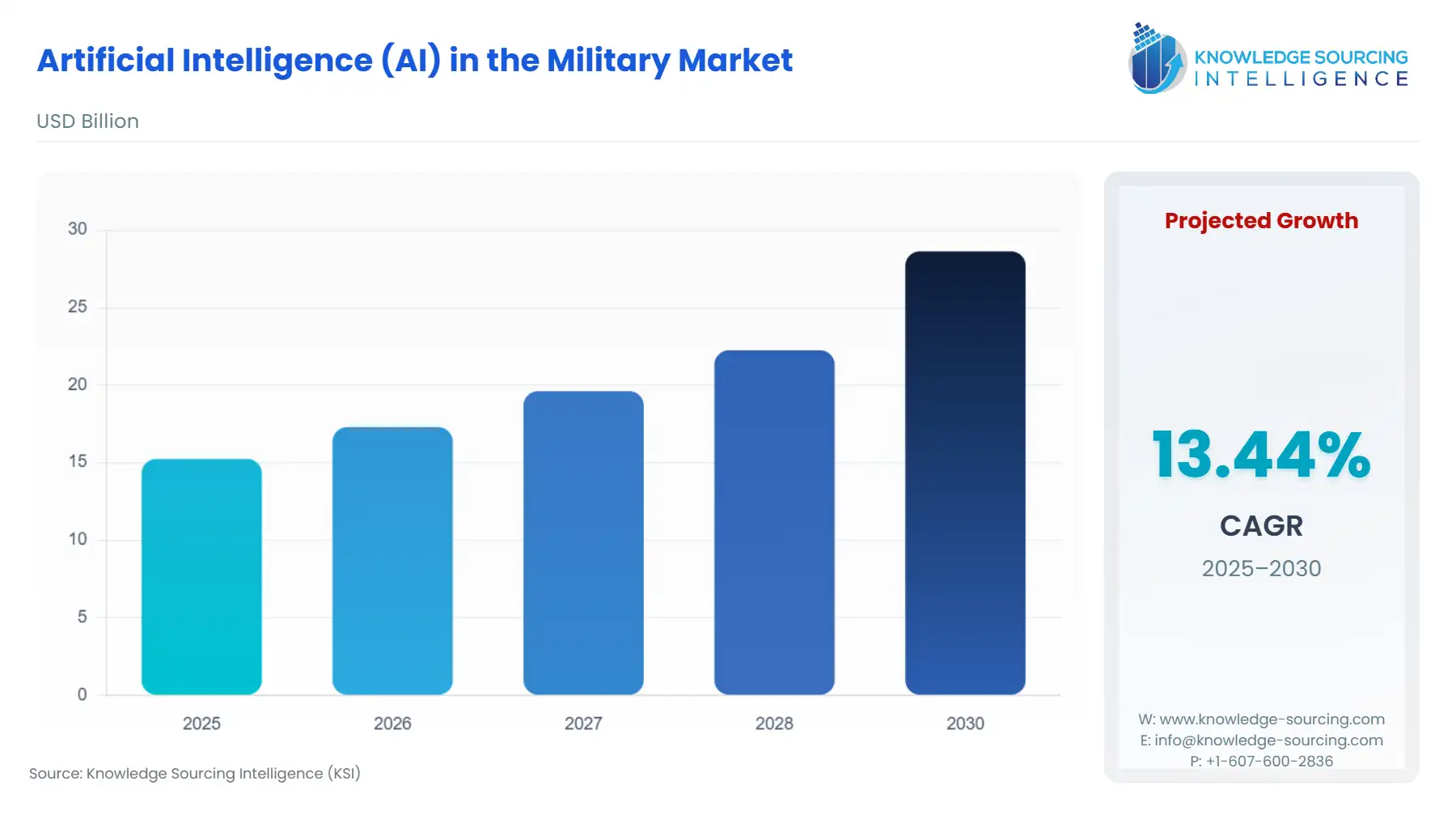

The Artificial Intelligence (AI) in the military market is set to witness robust growth at a CAGR of 13.44% during the forecast period, reaching US$28.633 billion in 2030 from US$15.243 billion in 2025.

Artificial Intelligence (AI) in Military Market Trends:

The AI in military market is experiencing rapid growth, driven by the demand for advanced technology and military modernization. Artificial intelligence (AI) enhances capabilities in autonomous systems, drones, robots, and military laser systems, surpassing traditional weaponry. AI enables independent operations on battlefields, improving combat efficiency, situational awareness, and decision-making, fueling market expansion.

AI-powered drones and robots perform tasks like surveillance, reconnaissance, and target acquisition, reducing risks to human soldiers. Machine learning algorithms optimize battlefield strategies, while AI-driven systems enhance precision targeting in military equipment. The integration of AI in defense technologies supports autonomous navigation and real-time data analysis, critical for modern warfare.

However, cyber warfare poses a challenge, as AI can be exploited to develop malicious cyber tools, threatening global security. Military cybersecurity is thus a priority, with AI being leveraged to detect and counter cyber threats. Government investments in AI research and defense innovation, particularly in North America and Asia-Pacific (e.g., the United States, China), drive market growth. For instance, the U.S. Department of Defense has allocated significant funding for AI military applications to maintain strategic advantages.

Technological advancements in deep learning and neural networks enhance AI system performance, supporting applications in logistics, training simulations, and threat detection. The AI in military market is poised for growth, propelled by defense modernization, autonomous warfare, and strategic investments, despite concerns over ethical AI use and cyber risks.

Artificial Intelligence (AI) in Military Market Growth Drivers:

- Increasing Demand for Advanced Military Technologies: AI technology assists defense forces in observing targets and protecting their battlefields by using AI for searching and fighting. These systems keep cyber threats away from the core military systems that power the defense network. AI improves live intelligence data processing, which helps military forces select better targets for weapons. In December 2024, the Indian Army's AI Incubation Centre opened in Bengaluru in partnership with Bharat Electronics Limited to speed up AI tool development and deployment for the military.

- Growing Government Funding and Initiatives: The government is progressively investing significant funds in advancing the military to counteract the growing threats. These funds and programs assist the military in using AI better through money, tools, and regulations for faster adoption. The Pentagon Chief AI Officer began two programs in December 2024, the Rapid Capability Cell (RCC) and Frontier AI pilots, to assist Defense Department personnel in adopting new AI technology. Through these AI RCC projects, the organization works on integrating emerging tech while giving soldiers state-of-the-art AI systems.

Artificial Intelligence (AI) in Military Market Segment Analysis by Component Type:

- Hardware: The military's demand for AI stems from updating hardware to include GPUs, which let systems handle large data sets and run sophisticated AI programs.

- Software: Advancements in machine learning and natural language processing aid designers in developing software systems that recognize targets and analyze threats, while deep learning enhances the processing of intelligence data. Secure military data needs extensive cybersecurity protection, leading to a rise in software demand.

- Services: There is a growing demand for AI services, such as consulting and training, to help military branches use AI technology throughout their operations effectively.

Artificial Intelligence (AI) in Military Market Segment Analysis by Technology:

- Machine Learning: The military works more efficiently through machine learning because it assists in detecting future system breakdowns and monitoring battlefield data in real-time to run supply chains and secure vital information. The technology helps organizations plan equipment updates while streamlining supply networks and guarding their essential systems and information.

- Deep learning: Deep learning technology improves the tracking of images and videos by advanced autonomous systems. This gives military forces smarter information and decisions through drone and ground robotic systems.

Artificial Intelligence (AI) in Military Market Geographical Outlook:

The AI in military market report analyzes growth factors across the following five regions:

- North America: Strong support from North American governments, private sector activities, and industry players improves tech development within defense research projects. The US military recorded $820.3 billion in funding during 2023, making up 13.3% of the federal budget. For 2024, the Department of Defense requested $842 billion for its budget.

- South America: South American nations augment defense funding to build new military equipment that protects their borders from criminal elements and terror groups.

- Europe: European nations are increasing their focus on cybersecurity and advanced vehicle control due to the rise in cyber threats and the practical use of military robots in battlefield operations.

- Middle East and Africa: AI-based intelligence systems are in growing demand across Middle Eastern and African nations because of the growing requirement for advanced systems to fight terrorism and update military tools.

- Asia-Pacific: Increased political conflict across Asia-Pacific pushes defense spending by major countries like Japan, China, and India upward, which, combined with fast AI development to drive military systems development.

List of Top Artificial Intelligence (AI) in Military Companies:

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Thales Group

- BAE Systems plc

These market players are establishing strategic alliances to accelerate the development of AI, targeting R&D investments to focus on emerging areas that align with their goals, such as autonomous systems, cyber warfare applications, and intelligence analysis.

Artificial Intelligence (AI) in Military Market Key Developments:

- October 2025: Global Defense Stocks Surge Due to AI Advancements. Global defense stocks have rocketed higher in 2025, particularly those focusing on artificial intelligence applications and other cutting-edge technologies, signaling strong investor confidence in AI-driven military innovations.

- September 2025: Gallatin AI Secures SBIR Contract for Logistics AI. Gallatin AI was awarded a Small Business Innovation Research (SBIR) contract to investigate generative AI for accelerating military logistics decision support, aiming to enhance supply chain efficiency in defense operations.

- September 2025: Military AI Intensifies Competition for Defense Contracts. The military AI revolution is heightening competition for defense tech contracts, with companies like Palantir securing multi-year deals with the U.S. Army to integrate AI for analysis and new projects.

- September 2025: Altair Showcases AI in Defense at DSEI 2025. Altair will demonstrate AI-powered engineering, smart manufacturing, and connected defense solutions at DSEI 2025, highlighting advancements in military AI applications for enhanced operational capabilities.

- July 23, 2025: Germany Invests in AI Robots and Spy Tech for Warfare. Germany's government is advancing AI and start-up technologies for defense, including spy cockroaches and AI robots, to slash bureaucracy and enhance future warfare capabilities.

- In October 2024, BAE Systems and Aerospike collaborated to create real-time data solutions for the U.S. Army using advanced AI tools under their Mission Advantage technology partnership program to expedite future defense missions.

- In September 2024, the US Army launched Ask Sage, an industry-leading generative AI platform, for use on cARMY, its general-purpose cloud environment. Thus, the US Army became the first military from both the public and private sectors to integrate generative AI technology.

Artificial Intelligence (AI) in Military Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| AI in Military Market Size in 2025 | US$15.243 billion |

| AI in Military Market Size in 2030 | US$28.633 billion |

| Growth Rate | CAGR of 13.44% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the AI in Military Market |

|

| Customization Scope | Free report customization with purchase |

Artificial Intelligence (AI) in Military Market Segmentation:

- By Component Type

- Hardware

- Software

- Services

- By Technology

- Machine Learning

- Deep learning

- Computer Vision

- Natural Language Processing

- Robotics

- Others

- By Application

- Warfare Platforms

- Cybersecurity

- Logistics & Transportation

- Surveillance & Reconnaissance

- Command & Control

- Battlefield Healthcare

- Simulation & Training

- Gathering Intelligence

- Others

- By Platform

- Land-based Force

- Naval Force

- Air Force

- Space Force

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Australia

- Others

- North America