Report Overview

Artificial Intelligence (AI) In Highlights

AI in Computer Vision Market Size:

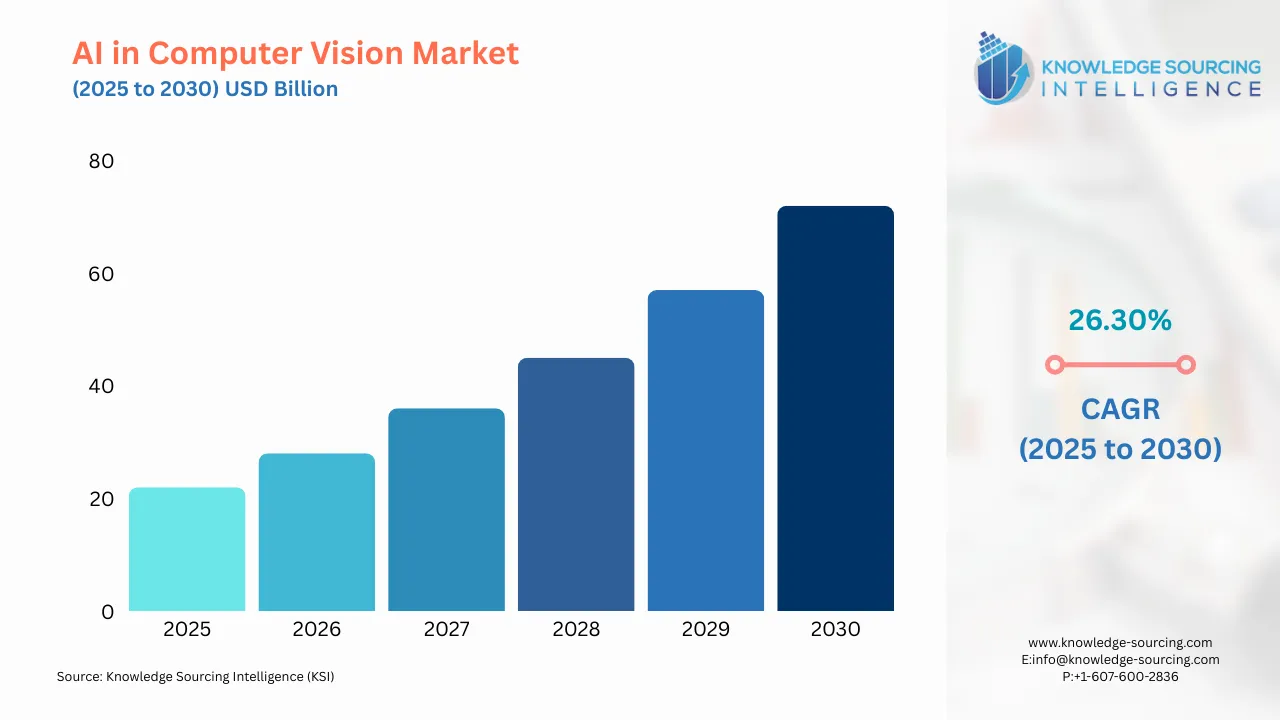

The AI in Computer Vision Market is anticipated to expand at a CAGR of 26.30% to reach a market size of US$71.720 billion in 2030 from an initial value of US$22.320 billion in 2025.

AI in Computer Vision Market Introduction:

Computer vision AI is a subcategory of artificial intelligence (AI) that utilizes AI technology, deep machine learning, and complex interconnected neural networks to process digital visual input to obtain crucial insights or to achieve a targeted result. In an AI-assisted computer vision system, visual input is scanned through a sensing device to produce an output after passing it through an inference device.

AI in computer vision can perform numerous attributes such as face recognition, image detection, moving object detection, grouping of images, object segmentation, future prediction based on past trends, and observation of moving targets. The convenience and versatility of computer vision in AI result in its application in different sectors, such as healthcare, agriculture, transportation, finance, cybersecurity, and retail. Hence, after considering the potential of AI in computer vision to evolve and increase its applications in different sectors, it can be anticipated that this market will experience a rapid expansion in the forecast period.

AI in Computer Vision Market Overview

Artificial intelligence (AI) enables computers and systems to extract useful information from digital photos, movies, and other visual inputs and act upon that information or provide recommendations. When compared with computer vision, human vision is more advanced because it has such a historical background. Such contexts ultimately teach one how to distinguish objects, whether they be in motion or not, concerning an image perception. All that is due to having lifetimes' worth of contexts. These prospects are instructed to machines using computer vision.

The growing domination of markets has been driven by increasing demands for inspection quality, as well as the high use of computer vision in nontraditional and new applications. AI for computer vision is becoming more significant globally. The market is growing as a result of the increased need for process automation across industries. While innovations like the Internet of Things (IoT) are revolutionizing the manufacturing and automotive industries and increasing operational autonomy, AI will assist in further improving computer vision processes. As per OICA data, there was a consistent rise in the sales of vehicles globally, accounting for 82.871 million in 2022 and increasing to 92.725 million in 2023.

In addition, companies are heavily invested in this market as they see huge growth and potential and have been engaged in developing new and innovative products. For instance, in August 2022, Medical Refill, a health consultation company, partnered with TachyHealth, Inc., a Dubai-based provider of artificial intelligence solutions for hospitals and medical institutions. Through the agreement, the clinical team had access to cutting-edge technical tools like computer vision and artificial intelligence.

Some of the major companies include NVIDIA, IBM Corporation, and Intel Corporation.

- NVIDIA is a global corporation focusing on innovative solutions using advanced AI, computer vision, and high-performance computing.

- IBM Corporation is a provider of diverse Computer vision services, including IBM Maximo Visual Inspection. This is an AI tool that empowers quality control and inspection teams by providing an intuitive platform for labeling, training, and deploying AI vision models, enhancing their capabilities in computer vision and deep learning.

- Intel Corporation offers software that simplifies the process of building computer vision models, reducing data usage and time spent on data labeling, model training, and optimization, enabling teams to create custom AI models at scale.

AI in Computer Vision Market Drivers:

- The growing demand for AI in computer vision from the agricultural sector is anticipated to accelerate the market expansion.

The developments in the computer vision AI field help improve the agricultural technology software, innovated to assist and enhance the overall productivity of the agricultural sector. Agricultural enterprises employ computer vision AI technology to predict weather patterns and harvest levels and detect agricultural concerns. Digital inputs from drones and satellites can be accessed to analyze weather patterns and predict the occurrence of natural calamities like hurricanes.

In addition, computer vision AI can assist in improving crop yield and productivity by detecting harmful weeds or issues with crop health. Its applications can further analyze new hybrid crops' color, texture, and quality to check their compatibility with the soil. For instance, companies like Descartes Labs and Blue River Technology are actively providing computer vision AI services to agricultural companies and investing in expanding their product portfolio in this field.

- The requirement for automation in the automotive sector is predicted to boost AI in the computer vision market.

Another market driver increasing the demand for AI in computer vision is the development of automated cars in the automotive sector. These automated cars can be driven either manually or through auto-drive mode. The development and improvement of the auto-drive mode feature in self-driving cars requires the adoption of computer vision AI in their vehicles. Auto-drive mode in automated cars requires the gathering and interpreting of visual data from neighbouring sensors and cameras to respond to the car's surroundings.

The adoption of computer vision AI technology helps the automated car engine to detect and identify traffic light signals and pedestrians, analyze and respond to traffic patterns, sense vacancies in parking lots, and investigate road health. Therefore, the multifunctional utility of computer vision AI in the automotive sector is a key factor driving its market expansion.

- Expanding research and development in the AI sector

Opportunities for AI in the computer vision business are driven by a government push to speed up the development of AI-related technology. Leading governmental organizations worldwide are increasing their investments in AI and developing strategies for using and promoting its use. For instance, in May 2023, seven new National AI Research Institutes were planned to be established with the help of $140 million in funding from the National Science Foundation. With this investment, there would be an expanded network of participating organizations in almost every state of the USA. This funding aims to improve the research and development in the field of AI and the production of new AI tools. Rising investment in artificial intelligence will help boost the AI computer vision market in the projected period.

As per the Stanford Artificial Intelligence report of 2024, with private investments totaling USD 67.2 billion, the US emerged as the top country in the world in AI investment in 2023, followed by China's USD 7.8 billion in AI investments. The US number is over 17.8 times the amount resourced for AI by the UK, which stands at $3.8 billion in 2024. Meanwhile, countries such as India, South Korea, and Israel are investing large sums of their GDP in AI technology. All these factors are influencing AI in the computer vision market’s growth in the anticipated period.

AI in the Computer Vision Market Restraint:

- The heavy investment and resources a company requires to adopt computer vision AI can potentially hinder this market’s growth.

The heavy hardware components and a team of specially trained experts to maintain the computer vision AI system in the consumer’s enterprise result in additional expenses for the enterprise. It might not be economical for small-sized companies to invest such a large amount of money into computer vision AI systems. Some of the most common difficulties experienced by companies while employing these AI systems in their operations are insufficient hardware components, poor management of the AI technology by untrained staff, and inadequate budgets.

AI in Computer Vision Market Segment Analysis:

- The automotives are expected to grow significantly

By application, artificial intelligence in the computer vision market is segmented into automotive, consumer electronics, healthcare, manufacturing, retail, and others. The growing automobile production fuels demand for AI-powered computer vision systems, which are crucial for advanced safety features, autonomous driving, quality control, and enhanced in-vehicle experiences, thereby propelling market growth. For instance, the data published by the Society of Indian Automobile Manufacturers (SIAM) indicates that the production of automobiles, including passenger vehicles, CVs, 3-wheelers, 2-wheelers, and quadricycles produced in India during 2021-22 was 2,30,40,066, which went up to 2,59,40,344 during 2022-23. Nonetheless, in 2023-24, the total number of all these vehicle productions touched 2,84,34,742.

Advanced Driver Assistance Systems, such as lane departure warning and automatic emergency braking, rely on AI-powered cameras and sensors to enhance road safety. Autonomous vehicles can perceive and navigate complex environments by utilizing object detection, traffic sign recognition, and sensor fusion technologies powered by AI.

The manufacturing process has AI vision systems inspecting vehicles for defects to optimize quality control and minimize errors. In addition, AI analyzes production data to optimize assembly lines and predict maintenance needs, thus enhancing efficiency. Moreover, as per ACEA, Brazil’s car production in 2023 was 1,781,612, contributing to a major share of South America’s car production. As the 15th largest manufacturing state of vehicles in the world, the state of São Paulo is the birthplace of the automotive industry in Brazil, concentrating more than 41% of plants in the national automotive complex.

AI also enhances the in-vehicle experience. Driver monitoring systems detect fatigue or distraction, while gesture control and personalized settings improve user comfort and convenience. As the demand for autonomous vehicles grows and safety features become increasingly important, the market for AI in computer vision is poised for significant expansion. For instance, Cogniac's AI delivers superhuman levels of accuracy and performance in the automotive industry, where the production rate can make it physically impossible for human subject matter experts to maintain high levels of quality. This technology is, therefore, driving innovation, improving efficiency, and shaping the future of the automotive industry.

AI in Computer Vision Market Geographical Outlook:

- North America is expected to hold a significant share of AI in the computer vision market.

The rise in the launch of AI startup companies in North America targeting to provide AI computer vision services to their clients demonstrates their market potential. For instance, Ocrolus Company in New York adopts AI computer vision technology and machine learning to offer financial data analysis and consultancy services to its customers. Another AI startup, Orbital Insight, also uses this technology for input into energy and farming by leveraging satellite images and other sources to make recommendations.

In addition, giant technology companies like Google, Microsoft, and IBM are actively investing in developing new AI software, including computer vision AI. There is a rise in the adoption of computer vision AI across various sectors such as agriculture, manufacturing, automotive, and information technology in North American countries like the USA and Canada. This will result in an increase in the market size of North American computer vision AI over the forecast period.

The United States AI in the computer vision market is propelled by several key drivers. Technological advancements, particularly in deep learning and neural networks, have significantly enhanced the capabilities of computer vision systems. This has increased accuracy and efficiency in tasks like object detection, image recognition, and facial recognition.

According to responses to the survey conducted by the U.S. Census Bureau, only 3.9% of businesses claimed to have applied AI for the production of goods or services between Oct. 23 and Nov. 5, 2023. Yet again, the use was far more diverse across economic sectors. Information sector respondents were more likely to have adopted AI than the average: 13.8% said they already used the technology.

The presence of leading technology companies in the U.S., such as Google, Microsoft, and NVIDIA, has further accelerated the market’s growth. These companies are investing heavily in AI research and development, driving advancements in computer vision technology. Moreover, the country's robust startup ecosystem has given rise to numerous innovative companies specializing in AI and computer vision.

Continuous product innovation and launches in the U.S. AI in the computer vision market are driving its growth. New and advanced products include AI chips and the software framework, enhancing abilities and spreading AI to everyone. For instance, in June 2024, Groundlight introduced the Groundlight Hub to easily integrate its artificial intelligence with cameras and alerting for business applications. Groundlight's natural language interface and human escalation technology enable AI computer vision to work reliably for new applications on day one, ensuring false alerts are minimized and notifications are reliable and actionable.

Moreover, in August 2024, Caregility Corporation, the enterprise telehealth leader focused on connecting care for patients and clinicians everywhere, announced the availability of a new fall risk detection capability in its iObserver solution. Care teams in hospitals use iObserver for continuous observation of at-risk patients for self-harm or falls. Developed natively by Caregility, the new AI capability utilizes computer vision to analyze visual information, detect fall risks, and alert caregivers accordingly.

Additionally, Global provider of AI and data services Centific partnered with North American technology integrator Telaid in December 2023 to bring transformative AI and computer vision solutions to retail and quick-service restaurant environments.

The increasing demand for AI-powered solutions across various industries is another major driver. In the automotive sector, AI-powered computer vision is being used for advanced driver assistance systems and autonomous vehicles. In the healthcare industry, it is used for medical image analysis and disease diagnosis. In line with this, as stated by CMS, in 2022, healthcare spending grew by 4.1%. In the retail sector, it is used for facial recognition and inventory management. As the demand for AI-powered solutions continues to grow, so will the U.S. AI in computer vision market.

AI in Computer Vision Market Key Developments:

- April 2024- Cognex introduced the In-Sight® L38 3D Vision System — The First 3D Vision Solution with AI. It bundles the features of AI, 2D, and 3D vision technologies for numerous inspection and measurement applications. This allows for unique projections, aggregating the 3D information into a simple 2D image useful in training and showing features difficult or impossible to see with standard imaging, with variable or undefined features detected by an AI tool.

- February 2023- TechSee, an IT company in Israel, launched a new application named Open Integration. This application integrates AI in computer vision technology and augmented reality features to enhance customer experience.

- February 2023- Niricson, a Canadian start-up company specializing in computer vision AI and robotics, partnered with Arcadis to innovate new solutions for international asset management trials.

- January 2023- Google Cloud introduced four new AI tools for retailers, including a shelf-checking solution based on Vertex AI Vision. The tool leverages Google's People, Places, and Things database to give retailers insights into billions of products through item image recognition. This enables accurate shelf dimensions against the likely range present ahead of NRF 2023, the largest retail event.

Artificial Intelligence (AI) in Computer Vision Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| AI in Computer Vision Market Size in 2025 | US$22.320 billion |

| AI in Computer Vision Market Size in 2030 | US$71.720 billion |

| Growth Rate | CAGR of 26.30% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in AI in Computer Vision Market |

|

| Customization Scope | Free report customization with purchase |

AI in Computer Vision Market Segmentation

- By Type

- Hardware

- Software

- By Product

- Smart Camera-based

- PC-based

- By Function

- Image Classification

- Object Detection

- Visual Inspection

- Others

- By Applications

- Automotive

- Consumer Electronics

- Healthcare

- Manufacturing

- Retail

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- North America

Our Best-Performing Industry Reports:

Navigation

- AI in Computer Vision Market Size:

- AI in Computer Vision Market Highlights:

- AI in Computer Vision Market Introduction:

- AI in Computer Vision Market Overview

- AI in Computer Vision Market Drivers:

- AI in the Computer Vision Market Restraint:

- AI in Computer Vision Market Segment Analysis:

- AI in Computer Vision Market Geographical Outlook:

- AI in Computer Vision Market Key Developments:

- Artificial Intelligence (AI) in Computer Vision Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 19, 2025