Report Overview

AI in Broadcasting And Highlights

AI in Broadcasting and Entertainment Production Market Size:

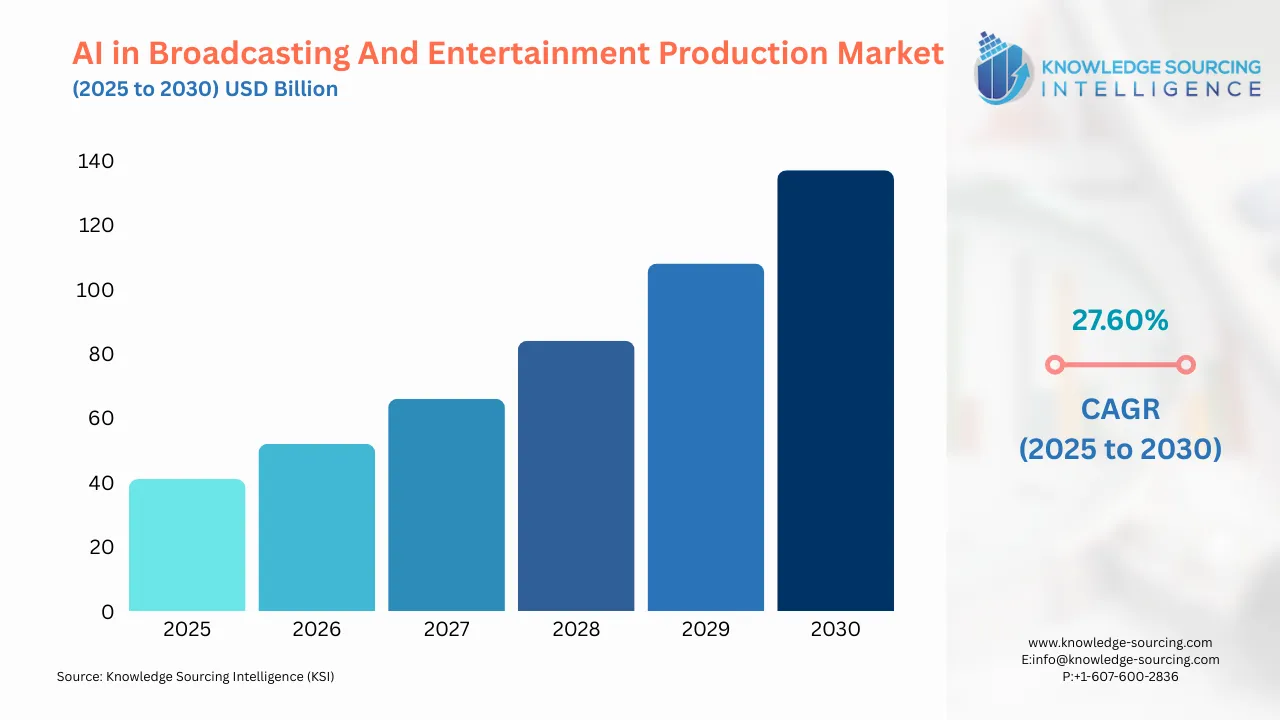

The AI in broadcasting and entertainment production market is projected to grow at a CAGR of 27.60% over the forecast period, from US$40.628 billion in 2025, and is expected to reach US$136.791 billion by 2030.

AI in Broadcasting and Entertainment Production Market Trends:

Artificial Intelligence (AI) is revolutionizing broadcasting and entertainment production by offering brilliant tools and methods. Benefits include expanded proficiency, upgraded content quality, personalized content delivery, data-driven experiences, and potential cost savings. As AI technology advances, more innovative applications will shape the long-term future of broadcasting and entertainment production, fueling market expansion.

Moreover, increased AI utilization for streamlining animation, visual effects, and altering workflows by automating repetitive assignments. Deep learning procedures empower the creation of reasonable special effects, animation, and recreations, upgrading the visual storytelling experience. AI meets strong desires for visual quality and overall production esteem by making immersive and visually stunning experiences for viewers. In addition, as per the Canada Radio-television and Telecommunications Commission, the weekly television viewership increased from 506 million hours in 2021 per week, which grew to 685 million hours per week in 2022.

Traditional TV networks utilize AI to analyze content libraries, identify patterns, and personalize content. AI-driven scheduling and recommendations can make personalized on-demand experiences, whereas AI automates content tagging and categorization assignments. Real-time analytics give broadcasters information on viewership patterns and demographics, empowering optimization of programming schedules and asset assignment and possibly driving cost savings.

AI in Broadcasting and Entertainment Production Market Growth Drivers:

- The rise in AI-powered assistants and audience engagement is anticipated to boost AI in the broadcasting and entertainment production market’s growth.

AI is utilized widely in various applications, such as AI assistants like Alexa and Google Assistant, which are widely used in households for different purposes. These are integrated with entertainment platforms, allowing their customers to use voice commands for content search and playback control and recommending content to their users. Moreover, investment in AI funds research teams to create new algorithms and improve existing technologies, resulting in more effective and versatile AI capabilities as the audience engages more in using AI.

This prediction ensures industries create innovative AI solutions for diverse businesses using more effective, automated, and data-driven procedures. Further, since AI presence has risen, the necessity for AI usage in sectors such as content creation and production is making a larger share of the market for AI products and services.

In addition, Goldman Sachs, a well-known investment banking, investment management, and securities firm, forecasts that the world’s AI investment will be about US$132.12 billion in 2024, with the United States and China being the largest contributors to this increment. The United States is predicted to spend US$68.14 billion on artificial intelligence, while China is expected to invest US$24.66 billion in 2024.

AI in Broadcasting and Entertainment Production Market Geographical Outlook:

- Canada region is anticipated to have a significant market share.

The Canadian market for AI in broadcasting and entertainment production is anticipated to grow significantly in the projected period, owing to the rising speed of connected devices and the increasing use of over-the-top (OTT) platforms. These OTT companies use AI for predictive analysis, recommendations for shows, journey mapping, and audience segmentation, which helps enhance the customer experience. The increasing internet penetration is one of the major reasons fueling the market for these OTT platforms in the country. For instance, according to the Government of Canada statistics, in 2022, 95% of the Canadian population aged more than 15 years had internet access, whereas in 2020, this statistic was 92% of the population.

The increasing investment in the Canadian AI market by the country's government is expected to positively impact AI in Canada's broadcasting and entertainment production market in the projected period. For instance, in April 2024, an investment of US$2.4 billion was implemented in the upcoming Budget 2024 for Canada’s AI advantage. This investment aims to boost Canada’s AI sector and increase productivity by helping researchers and businesses adopt AI and ensure smooth usage. Of this investment, US$200 million will be invested in deploying AI in various sectors such as healthcare, agriculture, clean technology, and manufacturing. Hence, increased investment in AI in Canada is anticipated to propel market growth in the coming years.

According to the Government of Canada Consultation on Artificial Intelligence (AI) Compute, Canada is one of the renowned countries in the AI ecosystem. Over 1,500 companies are developing AI solutions, and 10% of the world’s top-tier researchers are second globally. According to a new report from Microsoft, conducted by Accenture, launched in 2024, Generative AI can add a whopping US$187 billion annually to the Canadian economy in labor productivity gains by 2030 and help workers save more than 125 hours per year. Hence, with such increasing development in AI, the market for Canadian AI in broadcasting and entertainment is expected to grow in the coming years.

The broadcasting and television industry is increasing in the country. In the projected period, the use of artificial intelligence in this industry is anticipated to propel it. For instance, according to the Canada Radio-television and Telecommunications Commission, the conventional television sector revenue in 2022 was US$1,497 million, which was a 5% increase over the previous year, when the revenue was US$1,424 million. The discretionary television service revenue in 2022 was US$4,092 million, an increase of 3% compared to the previous year. In 2021, the revenue was US$3,959 million. Hence, the increasing broadcasting industry is anticipated to act as a huge end-user industry for Canada's AI in the broadcasting and entertainment production market in the projected period.

AI in Broadcasting and Entertainment Production Market Players and Products:

- Veritone Inc.- Veritone provides face recognition, natural language processing, and recognition technology for identifying logos, on-screen text, and other identifiable assets. Veritone Discovery, powered by aiWARETM, enables you to quickly and easily search through massive media libraries, pre-recorded shows, and live broadcasts in almost real-time.

- Valossa- Valossa developed an Artificial Intelligence platform that understands video as a human would, analyzing everything said, seen, and heard in a video with a powerful analysis engine. Beyond the capabilities of conventional visual recognition systems, Valossa AI creates the most comprehensive understanding of video to date by combining all of the content data, including people, speech, sounds, emotions, and visual entities.

List of Top AI in Broadcasting and Entertainment Production Companies:

- Amazon Web Services, Inc.

- Veritone, Inc.

- GrayMeta, Inc.

- Valossa Labs Ltd.

- IBM Corporation

AI in Broadcasting and Entertainment Production Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

AI in Broadcasting And Entertainment Production Market Size in 2025 |

US$40.628 billion |

|

AI in Broadcasting And Entertainment Production Market Size in 2030 |

US$136.791 billion |

| Growth Rate | CAGR of 27.60% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in AI in Broadcasting And Entertainment Production Market |

|

| Customization Scope | Free report customization with purchase |

AI in the Broadcasting and Entertainment Production Market is segmented and analyzed as below:

- By Technology

- Machine Learning

- Deep Learning

- By Solution

- Hardware

- Software/Services

- By Application

- Content Production

- Content Distribution

- Post-production

- Others

- By End-User

- Broadcast TV networks

- Cable TV networks

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America

Our Best-Performing Industry Reports:

- Global Broadcasting Equipment Market

- Portable Spectrum Analyzer Market

- Global Video Encoder Market

- Entertainment Robot Market

Navigation

- AI in Broadcasting and Entertainment Production Market Size:

- AI in Broadcasting and Entertainment Production Market Highlights:

- AI in Broadcasting and Entertainment Production Market Trends:

- AI in Broadcasting and Entertainment Production Market Growth Drivers:

- AI in Broadcasting and Entertainment Production Market Geographical Outlook:

- AI in Broadcasting and Entertainment Production Market Players and Products:

- List of Top AI in Broadcasting and Entertainment Production Companies:

- AI in Broadcasting and Entertainment Production Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 22, 2025