Report Overview

Advanced Driver-Assistance System (ADAS) Highlights

Advanced Driver-Assistance System (ADAS) Market Size:

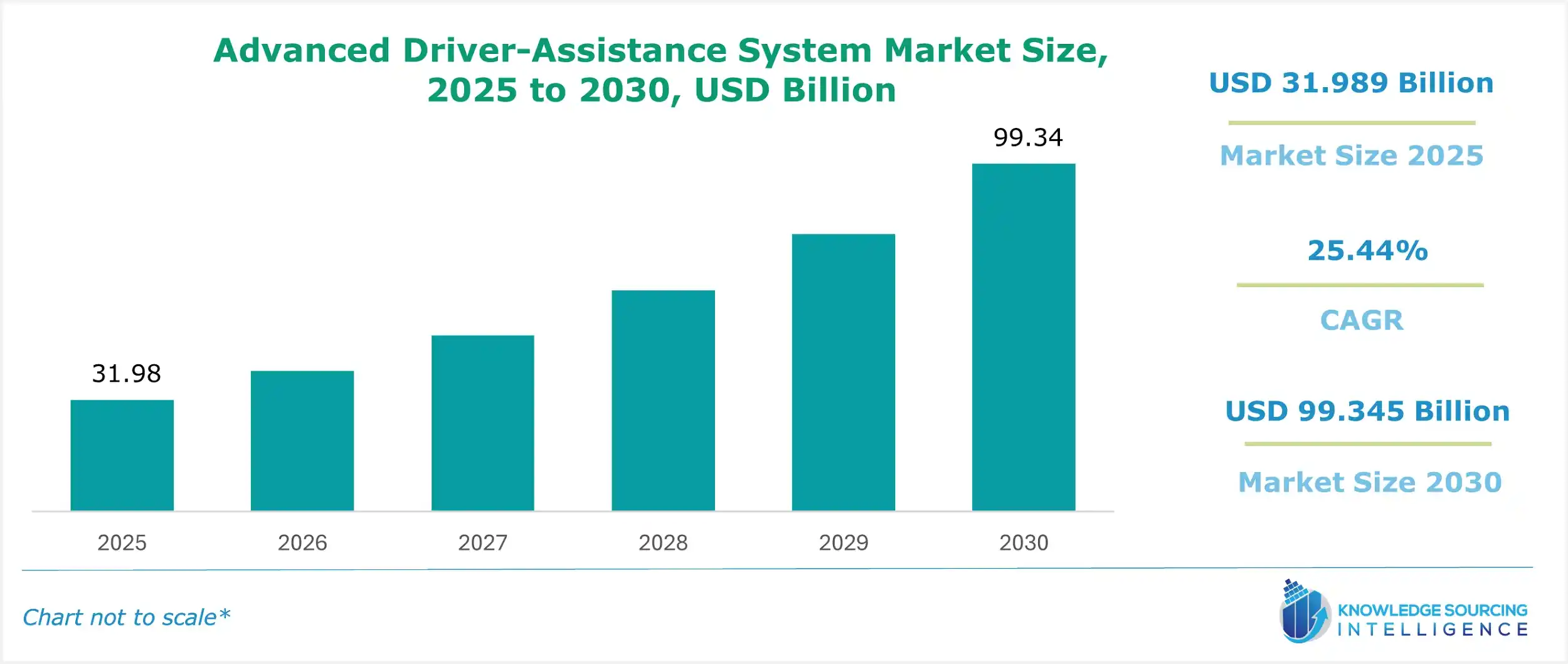

The Advanced Driver-Assistance System (ADAS) market will grow at a CAGR of 25.44% from USD 31.989 billion in 2025 to USD 99.345 billion in 2030.

Advanced Driver-Assistance System (ADAS) Market Trends:

The advanced driver-assistance systems (ADAS) market is driven by electronic technologies that enhance vehicle safety and driving functions. Utilizing sensors, cameras, and radars, ADAS detects obstacles, pedestrians, and blind-spot hazards, significantly reducing accidents and saving lives. Key features include adaptive cruise control, lane departure warnings, and automatic emergency braking, all contributing to improved vehicle safety and road safety.

The market's growth is fueled by rising traffic accidents, stringent government regulations, and increasing demand for electric vehicles (EVs). OEMs (original equipment manufacturers) and advancements in automotive automation through R&D are major contributors. North America and Europe dominate due to strict safety mandates, while the Asia-Pacific (APAC) region is experiencing rapid growth driven by population increases, rising disposable income, and growing adoption of connected vehicles.

The integration of artificial intelligence (AI) and machine learning in ADAS enhances system efficiency, further boosting market demand. However, high costs and technological complexities may pose challenges. Continued innovation, supportive policies, and expanding EV adoption are expected to drive the ADAS market forward, with significant growth projected in the coming years, particularly in emerging markets like APAC.

Advanced Driver-Assistance System (ADAS) Market Growth Drivers:

-

Demand for accident prevention

With the number of global road accidents increasing, some countries have made it a mandatory measure for driver safety. According to the World Health Organization (WHO), approximately 1.3 million people die each year due to road traffic crashes. Furthermore, around 20-50 million more people suffer non-fatal injuries. Around 90% of these accidents happen in low-end, middle-income countries.

The prime factors in road accidents are human errors like speeding, not using helmets, seat belts, child restraints, blind spots, and unsafe vehicles. In addition, unsafe road infrastructure and inadequate laws and regulations are some of the structural reasons for accidents. However, the use of ADAS can prevent most accidents with systems like blind-spot detection, automatic emergency braking, pedestrian detection, and lane departure warning, amongst others.

-

Increasing use of electric vehicles

With the rising concern for the environment and climate change, the demand for electric vehicles and eco-friendly vehicles has increased significantly. This increase in demand is expected to positively impact the advanced driver-assistance systems market. Many nations, especially in the regions of Europe and North America, are systematically imposing a ban on the use of fossil-fueled cars. For instance, Britain has set a target to become net-zero emissions by the year 2050.

Furthermore, the European Union has imposed a ban on new petrol and diesel cars from the year 2035. In Norway, electric cars account for 60% of the monthly car sales. The country has set a target of 2025 to stop sales of fossil fuel-powered cars. In the United States of America, the state of California proposes to ban new gasoline-powered passenger cars and trucks from 2035. Moreover, the world’s most populous country, China, has a rising demand for electric vehicles.

Advanced Driver-Assistance System (ADAS) Market Restraint:

-

Cost and technological complexity as restraints

The integration of ADAS systems substantially increases the cost of vehicles, rendering them less accessible to price-sensitive consumers. This expense is particularly pronounced for advanced systems, such as those reliant on LiDAR technology.

The amalgamation of diverse sensors, software, and algorithms necessitates sophisticated engineering skills to achieve seamless integration. This intricacy often results in prolonged development periods and elevated development expenditures.

Advanced Driver-Assistance System (ADAS) Market Segment Analysis:

-

The Advanced Driver-Assistance System (ADAS) market by technology is segmented into Radar, LiDAR, Camera, and Ultrasonic technologies:

The segmentation of the Advanced Driver-Assistance System (ADAS) market by technology includes Radar, LiDAR, Camera, and Ultrasonic technologies. Radar technology encompasses features such as adaptive cruise control, blind spot detection, and collision avoidance systems.

LiDAR technology offers functionalities for Autonomous Driving Systems, lane departure warning, and parking assistance systems. Camera technology provides capabilities for lane departure warning, traffic sign recognition, pedestrian detection, and automatic emergency braking.

Ultrasonic technology involves park assist systems, blind spot detection, and object proximity sensors.

Advanced Driver-Assistance System (ADAS) Market Geographical Outlook:

-

North America is anticipated to hold a significant share Advanced Driver-Assistance System (ADAS) market

The Advanced Driver-Assistance System (ADAS) market is experiencing robust growth, with North America anticipated to hold a significant share due to its early adoption of innovative technologies. ADAS, encompassing features like adaptive cruise control, lane departure warnings, collision avoidance, and automated parking, enhances vehicle safety and driver convenience, driving demand in the region.

North America benefits from advanced infrastructure and superior connectivity, enabling seamless integration of ADAS functionalities. The United States and Canada lead due to strong consumer demand for safety technologies and automotive innovation. The region’s robust regulatory framework, including safety standards set by the National Highway Traffic Safety Administration (NHTSA), supports ADAS adoption. Additionally, government incentives and R&D investments in autonomous driving and smart mobility fuel market growth.

The automotive industry in North America is supported by major players like Tesla, General Motors, and Ford, who integrate AI-powered ADAS systems leveraging sensors, cameras, and radar technology. These systems enhance road safety and align with consumer preferences for connected vehicles. Urbanization and traffic congestion further drive demand for intelligent transportation solutions.

Globally, the Asia-Pacific, led by China and Japan, is a fast-growing market due to electric vehicle (EV) adoption and smart city initiatives. However, North America remains dominant, propelled by technological advancements, infrastructure readiness, and consumer trust in ADAS technologies, ensuring sustained market leadership in vehicle safety and autonomous driving.

Advanced Driver-Assistance System (ADAS) Market Developments:

- October 2025: Nissan Expands AI Partnership with Monolith. Nissan and Monolith AI extended their joint efforts to leverage AI for reducing car development time, following the successful use of AI to cut physical testing time for chassis components.

- August 2025: Helm.ai Partners with Honda for ADAS Development. Helm.ai announced a multi-year joint development agreement with Honda Motor Co. to integrate AI-driven ADAS software for mass-production consumer vehicles.

- August 2025: STRADVISION Expands SVNet Deployment. STRADVISION reported strong H1 2025 growth, adding nearly 1 million SVNet-equipped vehicles, enhancing ADAS capabilities amid industry competition.

- July 2025: Lucid Introduces Hands-Free ADAS Features. Lucid updated its DreamDrive Pro suite with Hands-Free Drive Assist and Hands-Free Lane Change Assist, advancing ADAS roadmap for safer driving.

- January 2025: STRADVISION Showcases ADAS at CES 2025. STRADVISION highlighted groundbreaking ADAS innovations featuring Texas Instruments processors at CES 2025, focusing on advanced vision systems.

List of Top Advanced Driver-Assistance System (ADAS) Companies:

- Robert Bosch GmbH

- Continental AG

- Aptiv

- Valeo

- Autoliv Inc.

Advanced Driver-Assistance System (ADAS) Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Market Size Value in 2025 | USD 31.989 billion |

| Market Size Value in 2030 | USD 99.345 billion |

| Growth Rate | CAGR of 25.44% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segments Covered |

|

| Companies Covered |

|

| Regions Covered | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Customization Scope | Free report customization with purchase |

Advanced Driver-Assistance System (ADAS) Market Segmentation:

- By Type

- Automatic emergency braking

- Parking Assistance

- Blind Spot Detection

- Traffic sign recognition

- Collision Warning

- Lane departure warning

- By Technology

- Radar

- LiDAR

- camera

- Ultrasonic

- By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Others

- North America