Report Overview

Adult Diapers Market - Highlights

Adult Diapers Market Size:

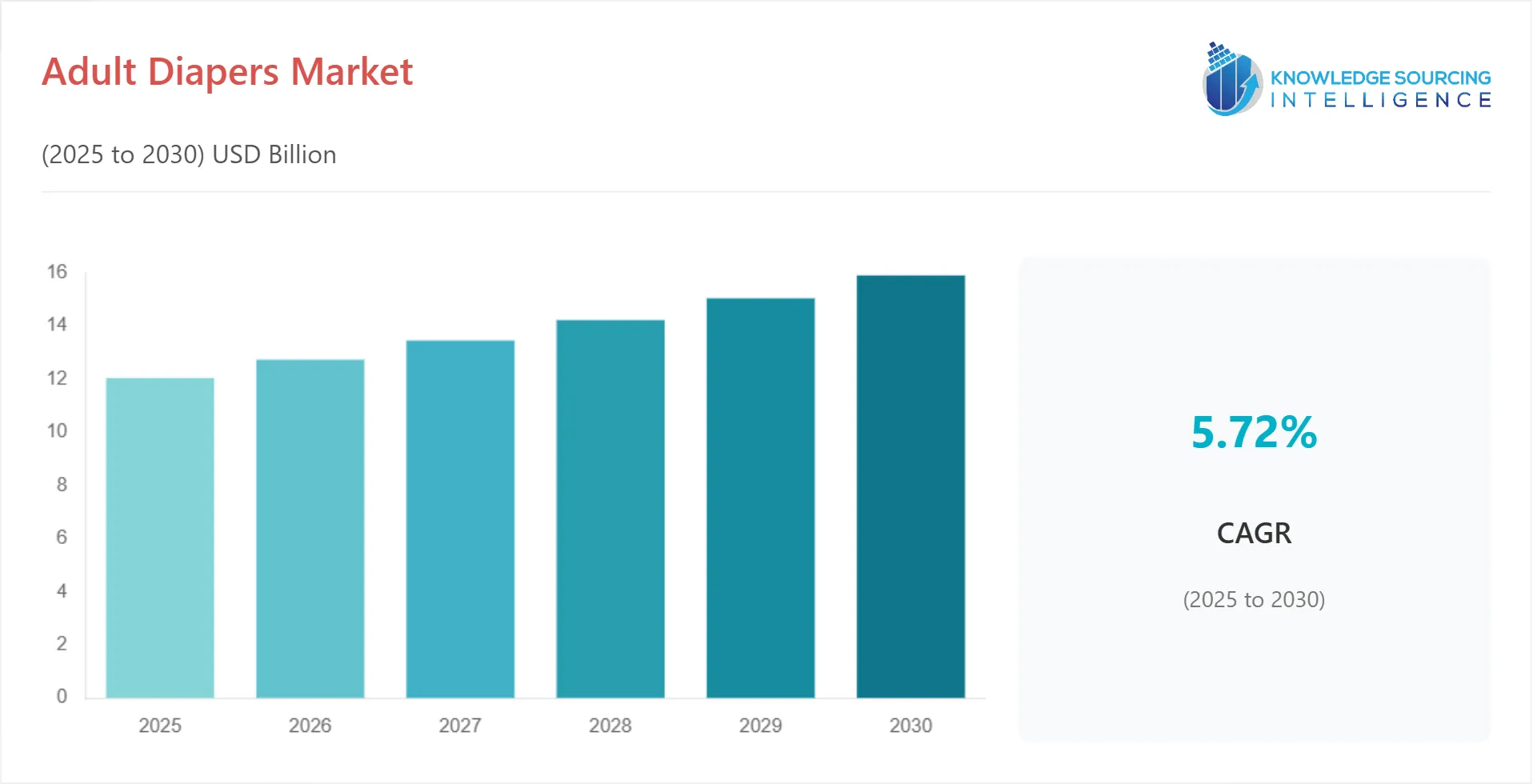

The adult diapers market, valued at $15.895 billion in 2030 from $12.037 billion in 2025, is projected to grow at a CAGR of 5.72% through 2030.

The growth in disposable income has led to the increased affordability of various personal care and hygiene products, which is a key factor supplementing the market expansion during the forecast period. Moreover, rapid urbanization coupled with the growing inclination of people towards personal hygiene is also considered to amplify the demand for adult diapers, thus driving the market expansion.

Furthermore, the growing applications of diapers for non-medical conditions by various working professionals due to long working shifts are further expected to widen the opportunities for the key market players.

Adult Diapers Market Overview & Scope:

The adult diapers market is segmented by:

- Type: Pads are in high demand because of their versatility, comfort, and discreet design, which caters to people with varying levels of incontinence. Both active users and those receiving care can benefit from these products' user-friendliness and adjustable fit. User confidence is increased by their lightweight design and absorbent materials, which effectively manage moisture without being bulky. Incontinence products also include pad-type diapers, which are widely accessible and reasonably priced, making them the most popular for consumers and caregivers seeking to manage incontinence effectively.

- Distribution Channel: The distribution channel is segmented into online and offline. Retail sales growth for incontinence underwear and the fast adoption of male guards and liners are the primary drivers of the offline market. Additionally, the online segment is believed to be the most rewarding of all the distribution channels. The rapid expansion and adoption of e-commerce are driving an increase in online purchases owing to its convenience availability and appealing pricing.

- Region: The adult diaper market is flourishing due to the rapidly aging population of the Asia Pacific region, especially in China, South Korea, and Japan. Moreover, the demand for adult diapers in the North American region is also anticipated to grow due to the rising healthcare facilities for the elderly population.

Top Trends Shaping the Adult Diapers Market:

1. Rising Geriatric Population

- The prime factor driving the adult diapers market growth during the forecast years is the rising aging population, especially in the developed economies. This is propelling the demand for diapers as the demographic shift towards an older population is burdening various age-associated diseases. The factors for this demographic shift include declining fertility, increased life expectancy, and a healthy lifestyle. According to data from the United Nations, in 2024, 10.3% of the world's population was 65 and older. As older adults are considered susceptible to suffering diseases such as incontinence and mobility disorders, among others, the demand for adult diapers is growing significantly, thus positively impacting the market growth.

2. Product Design Advancement

- Ongoing technological and product design advancements are greatly impacting the market expansion for adult diapers. Modern adult diapers have increased absorbency, odor control, and protective materials with a modern design to provide comfort and effectiveness for the wearer. Their ultra-thin, discreet designs allow users to lead an active lifestyle despite incontinence. Moreover, technological innovations such as smart diapers with moisture level sensors have become increasingly popular, especially in institutional care. This has made adult diapers a logical choice for personal and professional caregiving applications, catering to consumer demand for comfortable, effective, and user-friendly solutions.

Adult Diapers Market Growth Drivers vs. Challenges:

Opportunities:

- Lifestyle changes and urbanization: Adult diaper demand is fueled by urbanization, and changes in modern lifestyle, including sedentary habits and unhealthy eating habits, have spurred demand for adult diapers because of increases in incontinence cases due to poor lifestyle habits. For instance, long working days in urbanized areas result in reduced physical exercise, resulting in bladder regulation issues. More patients use adult diapers to manage incontinence effectively amidst a lifestyle change.

- Rising e-commerce: The advent of online retail platforms has greatly increased the availability of adult diapers to consumers, particularly in rural areas without conventional brick-and-mortar stores. For example, e-commerce giants like Amazon provide a large selection of adult diaper options with doorstep delivery, enabling people in rural areas to easily and discreetly buy these necessities, increasing market penetration.

Challenges:

- Fit and Comfort Issues: Adult diapers have difficulty fitting and comfort because users have different body shapes and sizes. Poor-fitting products cause discomfort and leaks that could make a buyer hesitant to buy. Comfort levels that differ by demographics create challenges for manufacturers, user satisfaction, and retention.

Adult Diapers Market Regional Analysis:

- Asia-Pacific: The Asia-Pacific region's expanding population, which necessitates medical assistance, creates a spike in demand. Additionally, the market is expected to grow due to rising per capita disposable incomes and a more organized retail sector. Furthermore, the market is growing as more people become aware of biodegradable diapers.

Adult Diapers Market Competitive Landscape:

The market is fragmented, with many notable players, including Abena A/S, Nobel Hygiene, Attends Healthcare Products, Inc., and Adult Diapers and Chux, among others:

- New Product: In April 2023, UltraThinz, India's first disposable, ultra-thin absorbent underwear, was introduced by Friends Adult Diapers. UltraThinz is intended for younger individuals with mild incontinence.

Why Purchase This Report?

- 70+ pages of actionable data: Pricing trends, units, regional demands, analysis (2023-2030), and competitive benchmarking.

- Proprietary insights: Surveys from industry leaders.

- Excel deliverables: Pre-formatted tables for seamless integration into business strategies.

Adult Diapers Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Adult Diapers Market Size in 2025 | US$12.037 billion |

| Adult Diapers Market Size in 2030 | US$15.895 billion |

| Growth Rate | CAGR of 5.72% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Adult Diapers Market |

|

| Customization Scope | Free report customization with purchase |

Adult Diapers Market Segmentation:

By Type

- Pad Type

- Tape On

- Pant Style

- Others

By Distribution Channel

- Online

- Offline

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa