Report Overview

5G Network Security Market Highlights

5G Network Security Market Size:

The Global 5G Network Security market is forecast to grow at a CAGR of 15.4%, reaching USD 13.9 billion in 2031 from USD 6.8 billion in 2026.

Network security safeguards the usability of a network by preventing unauthorized access. Due to the enhancement of telecommunication networks on account of growing 5G penetration, the demand for a secure path to protect users’ data and network integrity is also rising. Moreover, the ongoing investment to increase 5G access in urban and rural areas, followed by improvement in high-speed bandwidth, booming global internet penetration, and cyber threat prevalence, has further pushed the demand for network security for 5G. According to the International Telecommunication Union, in 2023, 5.4 billion or 67% of the global population was online, signifying a 4.7% growth over 2022.

5G Network Security Market Growth Drivers:

Growing Investments in network security are propelling the market growth.

Telecom networks show quick adaptation to the ongoing technological shift, inclusive of cloud, AI & IoT, Industry 4.0, virtualization, and disaggregation. The growing innovations in network infrastructure have further increased the overall data traffic, thereby increasing the risk of cyber theft and unauthorized data breaches. And with the growing emergence of 5G technology, investments are being made for safeguarding organizational vulnerabilities and confidential data. According to Trend Micro Incorporated’s research study published in June 2023, global enterprises invest nearly 5-10% or 1.5 million of their IT budget in private 5G network security. By 2027, the investments will reach up to US$12.9 billion.

Cyber threats are also on the rise. According to Apple’s research study, in 2023, cyberattacks and data breaches increased by 20% for USD organizations in the first nine months, representing a massive increase over 2022.

Increased applicability across industry verticals has stimulated market expansion.

5G technology has found its way into various industry verticals such as banking, IT & telecommunications, media & entertainment, manufacturing, and government, expanding the overall usage scope of modern network infrastructure. However, to minimize the possibilities of unwanted interference, major firms operating in these verticals, especially in telecommunications, are emphasizing securing their network infrastructure. For instance, in July 2022, Airtel demonstrated India’s first private 5G network at Bosch’s Bengaluru facility, which was based on the 5G spectrum provided by DoT and enhances data transferring through a highly secured network.

Additionally, various regulations and rules regarding data privacy have further emphasized the need to establish a secure 5G network to protect personal, commercial, or government-associated data.

5G Network Security Market Emerging Opportunities:

SaaS

Based on form factor, the 5G network security market is analyzed into physical, virtual, and SaaS. The latter is poised to show the quickest segments and growth owing to its ability to secure highly crucial user and corporate data in a subscription-based cloud application that grants access to authorized personnel only.

Software-as-a-service tools address new security issues, such as exposure to malware and phishing attacks, which can expose a client’s data on a large scale. Hence, companies are investing in secure cloud-based programs with suitable SaaS security tools to bolster their data integrity.

Furthermore, due to its growing demand, the market players can witness various business measures. For instance,

DATE | TYPE | DESCRIPTION |

February 2022 | Launch | CSG System International launched an open SaaS platform, “CSG Encompass”, which eliminates the digital complexities faced by 5G services by forming dynamic and agile collaboration across many partners. Through such collaboration, CSG offers consumers and enterprises 5G-orientated offerings that deliver a seamless experience. |

February 2022 | Launch | Nokia launched two new SaaS (Software-As-A-Service) for analytics and security, which formed a part of the company’s strategy to provide enterprises and communication service providers with the cost-effective of operating & monetizing their 5G networks. The SaaS tools are based on Network Data Analytics Functions (NWDAF) |

Firewall

The 5G network security market, based on type, is divided into firewall, SSE, SWG, WAF, and others. The firewall is anticipated to hold a significant market share, fueled by favorable investments in developing next-generation network infrastructure to cater to the growing 5G prevalence.

Moreover, the growing advancements in the Internet of Things (IoT) and Artificial Intelligence, followed by a booming cloud ecosystem, have shifted companies' focus toward a data-driven environment, accelerating firewall demand for network security provisions. Some of the latest advancements are:

DATE | TYPE | DESCRIPTION |

November 2023 | Launch | Palo Alto Networks launched five ML-powered Next-Generation Firewalls that exceed 1.5 TBPS App-ID performance. From branch offices to 5G service providers, the firewalls secure every organizational aspect that could be vulnerable to evasive cyber threats. |

5G Network Security Market Geographical Outlook:

With the emergence of 5G globally, the demand for network security has also been increasing. The global 5G network security market consists of major countries undertaking various measures to secure their 5G network across their nations. Some major countries include the USA, Japan, South Korea, China, and Germany. The countries have undertaken various measures, complementing the overall market growth. For instance,

In March 2024, Ericsson established the “Ericsson Federal Technologies Group”, which provides 5G-driven digital offerings to multiple agencies in the US federal government. The technologies provided would form an integral part of economic security and the US Defense Modernization program as they would establish a secure and reliable 5G infrastructure.

In February 2023, ATOS launched a “5Guard” security offering for organizations and telecom operators looking to improve, integrate, and automate security in their 5G networks to safeguard their digital assets. The new addition serves the company’s objective of providing end-to-end security solutions to protect confidential business data by reducing risk across a 5g core network, multi-cloud platform, multiple access edge computing, and radio access network (RAN).

List of Top 5G Network Security Companies:

Major market players, including Palo Alto Networks, Fortinet, and Nokia, among others, are implementing various strategies such as strategic collaboration with corporate or government agencies, new product launches & developments, investments, and partnerships, which have bolstered their market presence. For instance,

In April 2024, Perfectum selected Nokia to deploy cutting-edge 5G technology in Uzbekistan, which would revolutionize connectivity and pave the way for future innovations. The end-to-end 5G standalone would improve operational efficiency by bolstering network integrity, and the rollout formed part of Uzbekistan’s strategic investment in bolstering the country’s digital transformation.

In February 2024, Palo Alto Networks launched its end-to-end private 5G security solutions, enabling organizations to easily deploy and manage a secured network for their private 5G. The launch integrates Palo’s “Enterprise-Grade 5G Security” with firms providing private 5G services.

5G Network Security Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

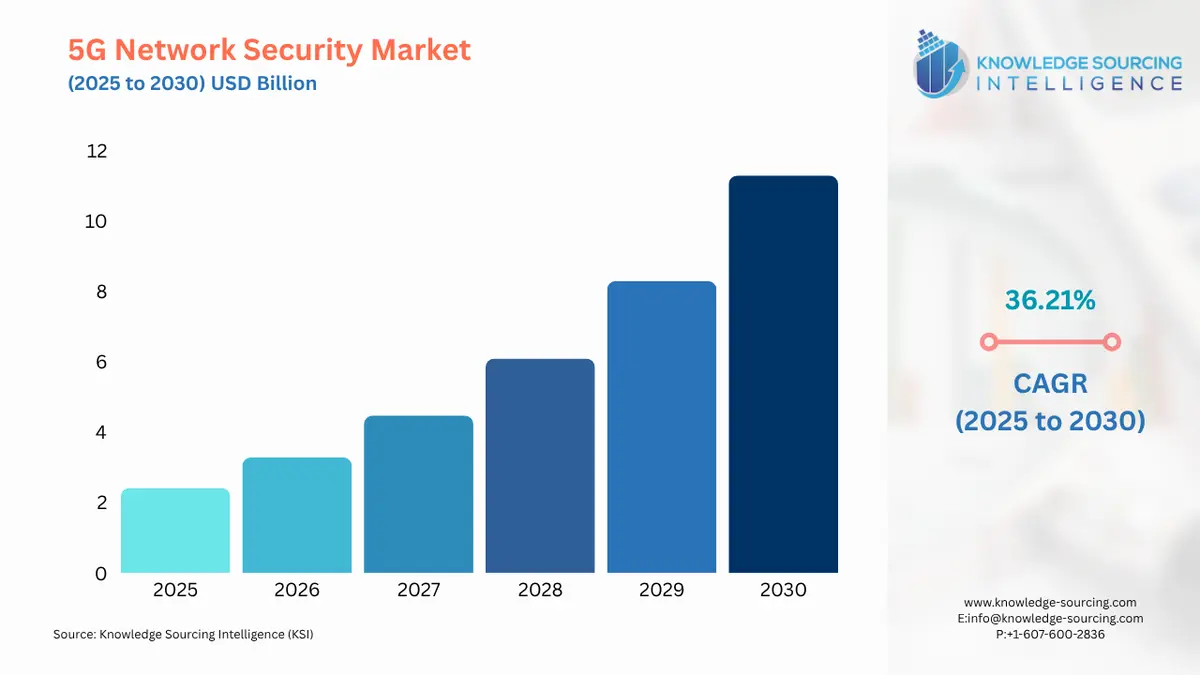

Market Size Value in 2025 | US$2.408 billion |

Market Size Value in 2030 | US$11.29 billion |

Growth Rate | CAGR of 36.21% from 2025 to 2030 |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segments Covered |

|

Companies Covered |

|

Regions Covered | North America, South America, Europe, Middle East and Africa, Asia Pacific |

Customization Scope | Free report customization with purchase |

5G Network Security Market Segmentation:

By Form Factor

Physical

Virtual

SaaS

By Type

Firewall

SSE

SWG

WAF

Others

By Industry

Banking

Telecommunication

Government

Manufacturing

Others

By Geography

Americas

United States

Others

Europe, Middle East, and Africa

Germany

UK

Others

Asia Pacific

China

Japan

South Korea

Others