The surge of the Ingestible Sensor Market

The ingestible sensor market is projected to grow at a CAGR of 8.98% during the forecasted period to reach a market size of US$937.779 million by 2027, from US$513.789 million in 2020.

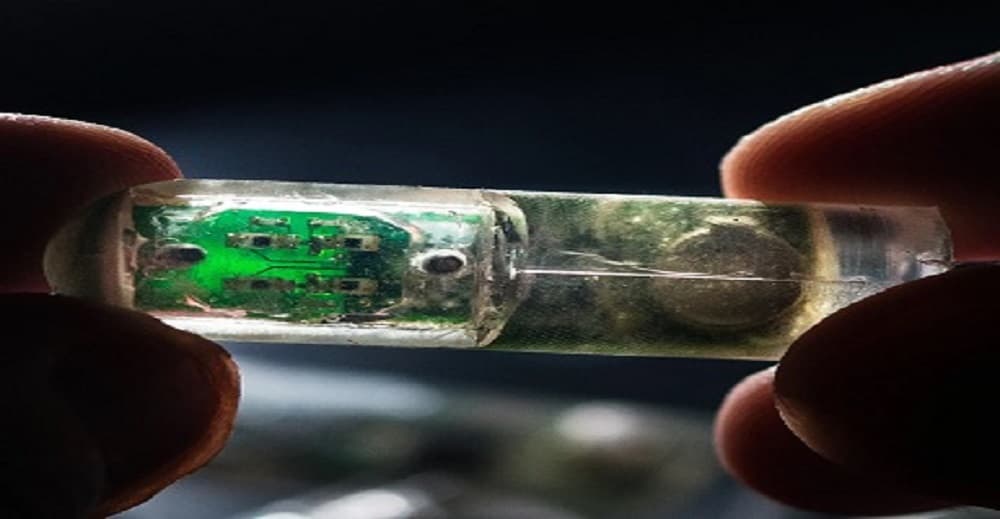

Ingestible electronic systems consist of a biocompatible microprocessor, sensors, power supply, and various other components, that enable the device to communicate with a mobile application for diagnosis and monitoring. These capsule-sized devices have the ability to screen for diseases that are otherwise difficult to detect at early stages using other techniques. Further, they also have the potential to reduce the expenses of facility and labor that are typically associated with the multiple procedures and offer a base for epithelial-targeted therapeutic interferences. All these technological advancements possess the potential to make disease monitoring, as well as treatment far more effective for a broad range of conditions, that enable patients to live longer and healthier life. A rise in chronic diseases and the advancement of technologies are likely to promote market growth in the forecast period. The ingestible sensor market is segmented based on applications, sensor types, and geographical regions.

Technological advancements and the growing prevalence of chronic diseases due to rising sedentary lifestyles drive growth in the market

Sedentary lifestyles that are caused by lack of physical activity, alteration of dietary habits, and increasing desk work have been contributing to the rising associated health risks. In accordance with the WHO’s Global Action Plan of Physical Activity 2018-2030, about one-fourth of adults and three-fourths of youngsters fail to meet the physical activity standards set by the organization. Further, factors like improving economic development, rising urbanization, and evolution in transportation have been causing inactivity levels in a few countries to reach as high as a whopping 70%. About 3.2 million people have been reported to die as a consequence of chronic conditions like cardiovascular diseases, high blood pressure levels, cancer, diabetes, lipid disorders, and obesity. According to the ESC (European Society of Cardiology), CVDs are expected to be the primary cause of death among people in most countries across the European region and are responsible for over 45% of all total deaths. Additionally, as reported by the Global Health Data Exchange in 2019, among the 18.6 million patients suffering from cardiovascular diseases across the globe, 58% of those patients were from Asia. Because of such a situation, these ingestible sensors are gaining traction as a crucial technology, due to their appealability features. Technological advancements in electronic components have aided in making the designs smarter, more compact, efficient, as well as multifunctional. The non-invasive sensor that is embedded in the capsule is not only able to monitor the blood pressure and glucose levels and keep track of the dosage of medicines taken but also can capture images and help in the monitoring of the microbial communities in the intestines of the patients. The captured data is then sent to the application on smartphones and digital portals, which enables physicians and patients to record and monitor this data. The widely growing penetration of smartphones worldwide has further aided in augmenting the utility of this application.

Key developments by the major players to further expand the size of the market

The increasing technological innovations and strategic developments by the key players in the market are expected to propel growth in the market. Powered by advanced cutting-edge technologies, companies have been gearing up to explore the abyss of human anatomy and physiology that never seemed possible before. The collaboration by Sead Health and Pear Therapeutics with Atmo Bioscience and etectRx, respectively, are some of the best examples of these developments. In February 2021, Pear Therapeutics, a DTx enterprise, teamed up with etectRx, an adhesion tool developer, in order to develop a product that would combine the goodness of the digital therapeutics of Pear Therapeutics with the digital pill offering. Further, this partnership was the first of its kind that contributed to developing ingestible sensors that were based on Prescription Digital Therapeutics, where the two companies were planning the design and production of two drug solutions that would deal with the central nervous systems. In November 2019, Seed Heath, a microbial science-based enterprise, partnered with Atmo Biosciences, a digital health firm, in order to profile main gases that are produced within the intestine in real-time with the use of world's first cutting-edge ingestible gas-sensing capsule solution. Further, in the same year, in January 2019, a Silicon Valley enterprise, Proteus, entered the growing oncology market in the US with its digital ingestible pill. According to the company, these digital pills are potent for detecting, as well as alerting physicians about the ingestion of the chemotherapy drug, capecitabine by the patient. Furthermore, it is also capable of recording and sending physiological responses of that drug to a smartphone-based Proteus application, thus, enabling efficient tracking.

COVID-19 Insights

COVID-19 slowed down the ingestible sensor market due to lockdowns and social distancing measures mandated by various governments across the world, which forced several enterprises to pause their operations. The rise of active cases further declined the number of employees working in the companies, thus, reducing overall productivity. The gap developed in the supply chain due to all this caused a constraint in the market growth during the peak of the pandemic. However, the technological innovations and the growing demand for health solutions witnessed in the pandemic brought some stability back to the market.

Ingestible Sensors Market Scope:

| Report Metric | Details |

| Market size value in 2020 | US$513.789 million |

| Market size value in 2027 | US$937.779 million |

| Growth Rate | CAGR of 8.98% from 2020 to 2027 |

| Base year | 2020 |

| Forecast period | 2022–2027 |

| Forecast Unit (Value) | USD Million |

| Segments covered | Sensor Type, end-user industry, And Geography |

| Regions covered | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies covered | Proteus Digital Health, HQ Inc., CapsoVision, Given Imaging Ltd., Medimetrics |

| Customization scope | Free report customization with purchase |

Get in Touch

Interested in this topic? Contact our analysts for more details.

Latest Blogs

Solar Control Window Films Market expected to reach USD 1,224.951 million by 2030

RecentlyTop Companies Leading the Silicon-Based Capacitor Revolution

Recently

The Role of Chemical Blowing Agents in Sustainable Foaming Solutions

Recently

Top 10 Emerging Beverages Set to Dominate the Market in the Coming Years

Recently