Report Overview

Global Cyber Insurance Market Highlights

Cyber Insurance Market Size:

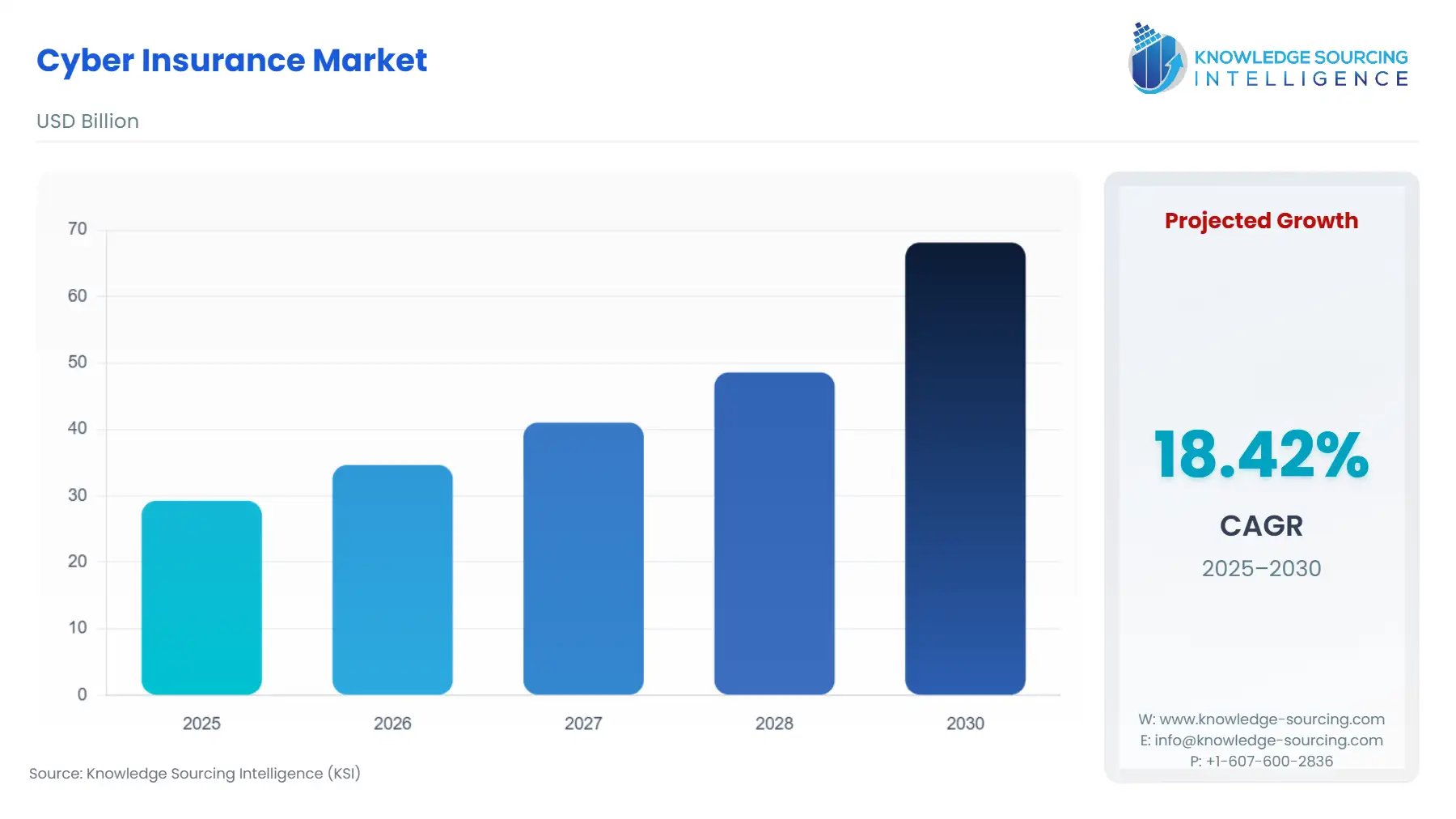

The cyber insurance market is projected to grow at a CAGR of 18.42% during the forecast period to reach US$68.14 billion by 2030, from US$29.261 billion in 2025.

Cyber insurance is termed as a type of coverage that comes with the settings to secure the company from cyber-security threats, which may include, for instance, security breaches and ransomware attacks. A company takes care of its own cyber security but in obtaining the right insurance, it would not be alone, for instance, in occurrence of a cyber assault. As a result, cyber liability insurance would provide invaluable help to keep a company afloat.

Growing technologization of industries, digital dependency, and e-commerce expansion have made cybercrime more facile. New statutory frameworks like the GDPR and CCPA have put companies in the spot to fine-tune cybersecurity measures. Insurers are progressing towards offering comprehensive insurance covers which include ransomware, business interruption, and regulatory penalty damages which is expected to boost the market growth in the coming years.

Furthermore, the rise in cases of cyber-attacks and data breaches has led to an increase in the demand for cyber insurance companies since organizations have started to understand the importance of data security. To adopt a proper cyber insurance policy, it is essential to strategize the goals and functions of the policy the organization will be adopting. The US currently occupies a major segment of the cyber insurance market.

Cyber Insurance Market Growth Drivers:

- An increase in cyber-attacks is predicted to promote the cyber insurance market expansion.

With the growing adoption of cloud-based technology among companies, cybercrime cases have increased significantly. According to data from official sources in the last years, data violation incidents increased. Cases of cyber attacks are getting very frequent and sophisticated with every passing day. It results in the increased emphasis on the possible financial and reputation losses these cyberattack results to cause. It includes cyber insurance which, due to the increase in loss, basically covers ransomware payments and data breach costs, legal fees, regulatory fines, and business interruption; lost revenues and productivity are likely to occur after losses.

Global average data breach cost exceeds 4.88M USD in 2024 growing by up to 10% per year, making it the highest it's ever been as per IBM report. Data have been proliferated in ways that have become harder for tracking and safeguarding, with one in three breaches involving shadow data. In contrast, organizations that use security AI and automation in prevention have saved an average of $2.22M.

The IC3 reported in March 2022 that it received over 20,000 Business Email Compromise (BEC) complaints last year, with estimated adjusted losses amounting to US$ 2.4 billion. The cyber insurance industry is anticipated to expand significantly due to the increasing number of cybercrimes.

- The rise in healthcare is anticipated to boost the cyber insurance market growth.

There are numerous cyber-attacks in the healthcare industry. Cyberattack is one of the main difficulties that health workers are faced with concerning cyber-security. Also, the increase of technological relevance in EHR and telemedicine has led to an increase in the cyber-attack surfaces faced by the industry. Such institutions are well known to be storing valuable data of great interest to cybercriminals. There is HIPAA, a mandatory data protection norm with strict penalties if orgnisations do not comply, these regulations lead to growth of the market in the coming years to protect cyperattacks in this sector.

Further, some specific cybersecurity threats include having valuable patient data to protect health companies from-the ransomware attack, data breaches, phish scams, malware infections. Such risks may disrupt patient health care, damage the organization's reputation, or cause financial losses. Therefore, the healthcare companies must dedicate these cyber security risks most foresighted by protecting their invaluable patient data.

Cyber Insurance Market Restraints:

- Lack of focus on SMEs could hamper the market growth.

With the increasing cost of cyber insurance services, small and medium enterprises find it challenging to cope with the market. This has left SMEs vulnerable to cyberattacks and breaches, which has resulted in them being easy prey for cyber attackers. Moreover, most major corporations have the financial resources to address the problem if it arises. Tiny enterprises, on the other hand, lack the financial capacity to pay such a large expenditure, which means that a cybersecurity assault may shut down a small company forever. Further, the survey revealed that over a third of respondents are unconcerned about their online security, believing their company is "too little" to be a target. Factors like these are expected to decrease the market growth of the cyber insurance market.

Cyber Insurance Market Geographical Outlook:

In geographical terms, the cyber insurance market can be segmented as follows: North America, South America, Europe, the Middle East and Africa, and Asia Pacific. Geographically, North America is expected to boost market share with robust infrastructure and technology. Regionally, the United States stands at the front with the limit of cyber-attacks, and insurance serves as an extremely significant and essential risk mitigation measure. The region is fairly advanced in the relative maturity of markets, increasing consciousness of cyber insurance, and a growing emphasis on regulations for cybersecurity provide opportunities for the rapidly growing demand. Moreover, a vast range of coverage options that includes established companies heightens the appeal.

However, Asia Pacific is predicted to have the fastest expanding cyber insurance market during the forecasted period due to rapid digitalization, increased cyber threats, and an increased awareness in the segment of buyers about the significance of holding a cyber insurance policy due to government initiatives. The dependence of a large part within financial transactions, health care, e-commerce, and other such fields upon its technology serving in business activities makes businesses more prone to cyber threats. This has led to the increased demand for cyber insurance as risk mitigation against frequently mentioned concepts such as ransomware, data breaches, and phishing attacks. Establishing an awareness of such aspects would drive the demand for cyber insurance and similarly increase the industry's products.

Cyber Insurance Market Key Developments:

- October 2024- Stellar Cyber introduced a new RiskShield Cyber Insurance Program specifically developed for Managed Security Service Providers and their clients. This new insurance product is programmed to screen the risks selling within commercial population cyber insurance policy. Employing the Stellar Cyber Open XDR platform, the customers have a single location where they can see and assess those risks insured by insurance companies and provide such customers with customizable security.

List of Top Cyber Insurance Companies:

- Allianz

- Lloyd’s

- American International Group, Inc

- AXA SA

- Zurich Insurance Group, Inc.

Cyber Insurance Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Cyber Insurance Market Size in 2025 | US$29.261 billion |

| Cyber Insurance Market Size in 2030 | US$68.14 billion |

| Growth Rate | CAGR of 18.42% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Cyber Insurance Market |

|

| Customization Scope | Free report customization with purchase |

Cyber Insurance Market Segmentation:

- By Enterprise Type

- By End-User Industry

- BFSI

- Healthcare

- Telecommunications

- Retail

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Thailand

- Others

- North America