Non-Woven Adhesive Tapes – Comfort, Quality & Hygiene Solutions

The Non-woven Adhesive Tape Market was valued at US$975.388 million in 2020 and will increase to US$1,620.67 million by 2027. Over the forecast period, this market is estimated to grow at a compound yearly growth rate of 7.52%.

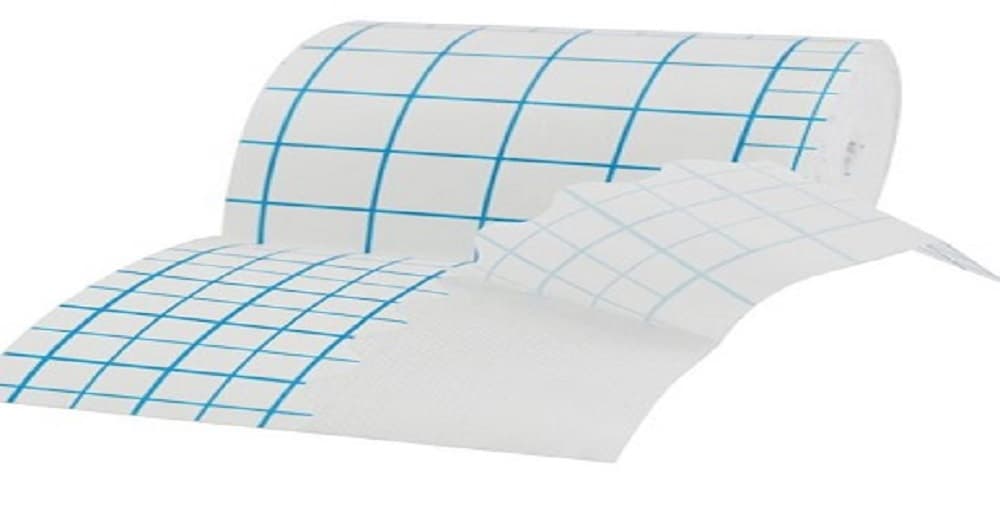

Adhesive tape is one of many types of adhesive-coated backing materials. Based on the material used, they are of two types: Woven tapes and non-woven tapes. Woven tapes are made with fabrics from knitting yarns or weaving. On the other hand, non-woven tapes are made using natural or synthetic fibers that have been thermally, chemically, or mechanically interlocked. Non-woven fabrics have a wide range of properties. For instance, they are flexible, can be stretched, absorb liquids, washable, and are flame retardant. Furthermore, Non-woven tapes can also be recycled after they have been used. These tapes are made from various materials, including polypropylene, polyvinyl chloride, paper, and others. The silicone, rubber, or acrylic adhesives can easily adhere to inanimate objects or even human skin. The Non-woven Adhesive market landscape is segmented upon the adhesive type, material, end-user industries, and geography. Owing to their flexibility, durability, and various other appealing attributes based upon the type of material and adhesives used, the tapes are used in diverse fields.

According to the Analysts, the demand for Non-woven Adhesive Tape Market is expected to increase in Healthcare, Automotive, and Packaging Industries predominantly during the projected period.

Owing to their versatility and recyclability, the non-woven adhesive tapes are widely being used in healthcare, automotive, and packaging segments. Non-wovens are increasingly being used in the interior and exterior of vehicles, and over 40 automotive parts are now made with these fabrics. Non-woven Tapes, in particular, are extensively used in vehicles for permanent emblems bonding, wire harnessing protection, paint masking, sound & vibration damping, and thermal management in fuel lines, firewalls, & floorboards, among many others. Many non-wovens manufacturers are expanding their product lines to meet the growing demand for electric vehicles. Non-woven manufacturers are benefiting from market trends such as "green" mobility and autonomous driving. Furthermore, manufacturers are also gearing up their innovation by deploying new recyclable materials, like flax, for the better mechanical performance of their tapes. At the same time, a few other groups are also deploying strategic developments to enhance their brand presence in the view of expanding market size. For instance, a global pioneer in the development of water-based adhesive tapes, ATP Adhesive's acquisition of BDK Industrial Products Ltd., a specialized adhesive solutions provider, in March 2021 is the best example of this. This partnership is expected to strengthen the duo's presence in the market and expand the product portfolio.

Similarly, the demand for non-woven adhesives is increasing in the healthcare sector as well. They are used to affix dressing for a skin injury and also to hold the primary dressing in position and shape. Additionally, they are used to hold electrodes, intravenous needles, or medical devices in place. Special medical-grade hypoallergenic adhesives are used in the tapes for the healthcare industry for clean and painless removal. Furthermore, their water-repellent, anti-microbial, stretchable, sterile, and soft attributes, as mentioned above, makes them perfect for use in wound dressing and other clinical applications. At the same time, several manufacturers are gearing up to produce innovative to meet the increasing demand. 3 M's launch of new medical-grade non-woven adhesive tape in May 2022 is a prime example of this. The new Spunlace Extended Wear Adhesive Tape on Liner, 4576, was developed by 3M for extended wear devices that required adherence to the skin for about a 21-day wear time. The Longer wear times of this innovative approach offer the best user compliance and hygiene. Similar developments are expected to drive the market growth of the non-woven adhesives in Healthcare and automotive segment.

During the forecast period, the Non-woven Adhesive market in the Asia Pacific region is expected to have a dominant share.

Based on geography, the Global Non-woven Adhesive Tape market landscape is segmented into five regions: North America, South America, Europe, the Middle East and Africa, and the Asia Pacific. The Asia Pacific is expected to hold a dominant share of non-woven adhesive tapes. The rapid growth could be attributed to an increase in the development of automotive and Healthcare segments in the region, particularly in countries like China and India. For instance, according to OICA, of the 80 million units of motor vehicles produced in 2021, over 46 million units were produced in the Asia Pacific region. About 50% percent of these units, over 26 million units, were produced by China, the largest automobile producing nation globally. Furthermore, a recent initiative taken by the Chinese government to sell 7 million electric cars by 2025 and the lifting of JV regulation for foreign manufacturers is further expected to expand the EV segment market in China. Similarly, India, the fifth-largest global car manufacturer, has aimed to expand the electric vehicle sales to thirty percent by 2030 in support of the EV30@30 Campaign.

At the same time, growing Healthcare and medical device in the region is also expected to increase the demand for non-adhesive tapes in the region. For instance, according to the IBEF (Indian Brand Equity Foundation), the Indian hospital industry accounts for 80% of the nation's overall healthcare market. In comparison, the healthcare market in the country is expected to increase to US$ 372 billion by 2022. This growth could be attributed to the rising income, better awareness of health and diseases along with growing access to health insurance. Similarly, according to the Chinese National Health Commission, as of 2020, the country had over 35,000 hospitals, over 7 million beds, and about 3.32 billion patient visits. Such factors are expected to drive the growth of the Non-woven adhesive tape market in the region during the forecasted period.

Covid-19 Insights

COVID-19's impact on the non-woven adhesives market varied depending upon the end-user industries. The outbreak of the pandemic and the subsequent lockdown resulted in the closure of many automobile facilities. The increased infection rates had further affected the staffing in the industries, thereby reducing productivity. Subsequently, several projects were also put on hold and were postponed. The disruptions in demand and supply chains and volatile prices had negatively affected the market. In the automobile industry, for instance, the number of units manufactured in 2020 fell to 77,621,582 units from 92,175,805 in 2019 worldwide, according to the statistics derived by OICA. Overall, the manufacturing of motor vehicles in 202o decreased by 15.8% globally. Consequently, the automobile industry's demand for non-woven adhesive tapes decreased during the pandemic. Conversely, the demand for the tapes in Healthcare saw a drastic increase due to an increase in the number of hospitalized patients. With the recovering economy and initiatives carried by the governments of several nations towards sustainability, the industry is expected to grow even more in upcoming years.

Non-Woven Adhesive Tape Market Scope:

| Report Metric | Details |

| Market Size Value in 2020 | US$975.388 million |

| Market Size Value in 2027 | US$1,620.67 million |

| Growth Rate | CAGR of 7.52% from 2020 to 2027 |

| Base Year | 2020 |

| Forecast Period | 2022–2027 |

| Forecast Unit (Value) | USD Million |

| Segments Covered | Adhesive Type, Material, End-User And Geography |

| Regions Covered | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies Covered | 3M, Nitto Denko Corporation, Tesa SE, Avery Dennison Corporation, Intertape Polymer Group, LINTEC Corporation, Berry Global Inc, Scapa, Lohmann GmbH & Co.KG, Rogers Corporation |

| Customization Scope | Free report customization with purchase |

Get in Touch

Interested in this topic? Contact our analysts for more details.

Latest Thought Articles

Top OSAT Companies Driving Semiconductor Assembly and Test Services Worldwide

Recently

EV Charging Stations Market Outlook: Smart Charging, Fast Charging, and Regional Expansion

Recently

Future of Corporate Wellness: Global Trends and Regional Outlook

Recently

Regional Breakdown of the Mechanical Keyboard Market: Who Leads and Why?

Recently