Emerging Technologies in the Waterproofing Systems Market

The process of waterproofing involves making a building or object watertight or water-resistant so that, in most cases, water won't affect it or, in certain cases, prevent water infiltration. These products are suitable for use in damp conditions or at specific underwater depths. Examples of waterproofing systems are integral systems, waterproofing membranes, and waterproofing chemicals. Water conservation, transportation, and purification become more critical when precipitation varies seasonally and regionally. Membranes for waterproofing are widely used in the waste and water management sectors.

The irregular seasonal and geographical rainfall causes more water treatment, transport, and conservation demand. There are several uses of waterproof membranes, such as wet rooms, roofs, sewerage and water treatment plants, retaining walls, foundations of buildings, and tunnels. The demand for this is also projected to rise due to the increased consumer consciousness regarding its advantages over the expected period and the use of new materials like geomembranes.

Global Production Trends

Membranes that are waterproof stop water from penetrating a building. The bulk of the market for waterproofing systems is accounted for by this category. These membranes come in two types—sheet and liquid applied membranes with the former more preferred by the users because they are less costly compared to the latter and also less intricate to use. They are easy to replace while guaranteeing waterproofing, come with less hustle over time as well as easy when to use.

Moreover, the future requires having more demand concerning fluid-applied membranes based on the world water treatment infrastructure development and conservation. It can be applied in different ways due to its uniform thickness. These membranes are frequently used for stadium stands, damp rooms, water and sewage treatment plants, roof waterproofing, and other applications.

Regulatory bodies are also trying to create rules that will lower pollution levels while simultaneously creating a framework that will incentivize green and energy-efficient buildings. Such activities are expected to drive up demand for chemicals used in waterproofing. The governments of developing nations will have to work harder to provide basic infrastructure like concrete homes, decent roads, and better irrigation—which will increase demand for waterproofing chemicals.

Waterproofing Systems Use Case

The growing demand for residential construction is what drives the growth of the roofing industry. Due to their extensive exposure to atmospheric moisture and precipitation, roofs are eating away at these membranes at an increasing rate. Stresses that building structures may experience include those related to water, temperature changes, chemical exposure to groundwater, biological contaminants, and more. Building structures that are waterproofed will be protected from stresses over time and require less maintenance over time. The global infrastructure and industrialization projects will contribute to the growth of the tunnels and landfills market. Tunnel liners make use of these membranes.

Market Dynamics and Drivers

Increased infrastructure development and growing industrialization in China and India are expected to fuel market expansion. In addition, the waste management and roofing sectors are expanding, which is driving market growth in this region. Variations in the price of raw materials will probably drive up the manufacturing cost of waterproofing membranes overall, which will lower demand. In addition, a shortage of raw materials is anticipated to impede the growth of the worldwide market for waterproofing membranes because of a gap in supply and an increase in demand. The exterior pathways and balconies of inhabited buildings are the usual applications for the rapid-curing resin technique.

There are two uses for this technique: waterproofing and roofing. This technology is based on a cold-liquid applied reinforced membrane system. To address particular circumstances, the membrane system can be installed in isolated regions or as an entire edge-to-edge membrane system. These technologies are in demand in the market due to the growing need for waterproofing membranes worldwide.

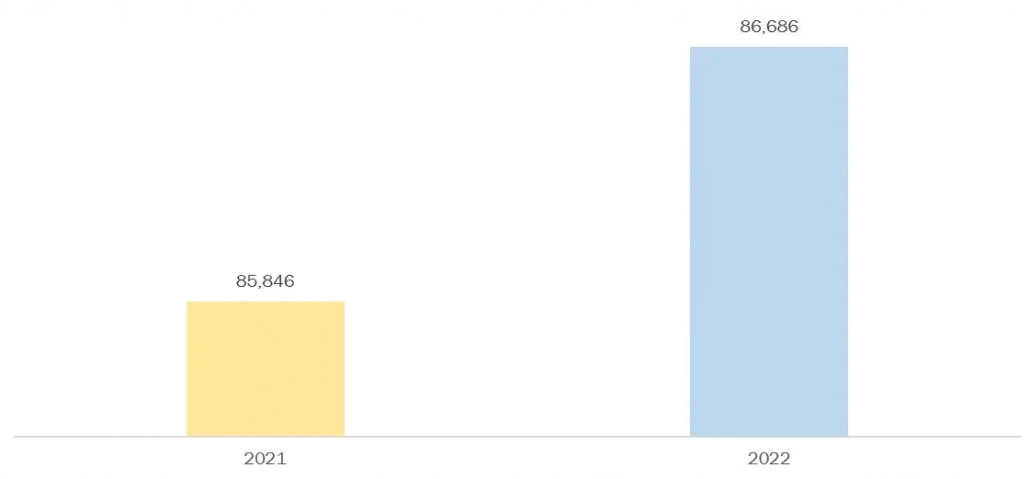

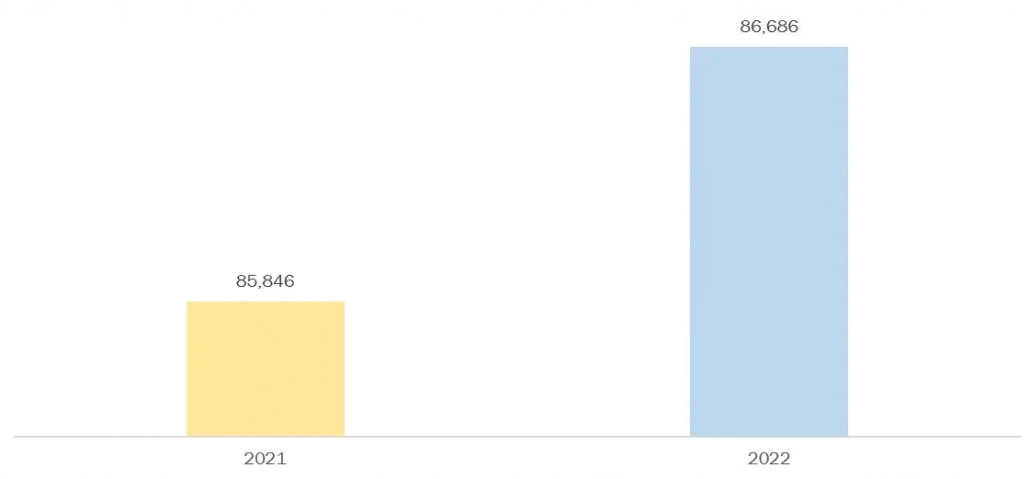

Moreover, rising economies like China, India, and Japan are experiencing a surge in demand for waterproofing chemicals due to the expansion of construction and infrastructure activities leading to increased investment. For instance, as per the World Bank, infrastructure investment increased to US$86,686 million in 2022.

Figure 1: Private Investment by Infrastructure, in Millions, Global, 2021 to 2022

Source: World Bank

Moreover, new membrane materials with superior performance have been developed as a consequence of the waterproofing industry's ongoing research and development. They enable market expansion by improving flexibility, durability, and ease of installation. It is becoming increasingly important to waterproof considering the negative effects of water seepage, such as long-term harm to property developers or owners, contractors, and homeowners. This awareness helps the market for membranes that provide waterproofing.

Key Developments

Source: World Bank

Moreover, new membrane materials with superior performance have been developed as a consequence of the waterproofing industry's ongoing research and development. They enable market expansion by improving flexibility, durability, and ease of installation. It is becoming increasingly important to waterproof considering the negative effects of water seepage, such as long-term harm to property developers or owners, contractors, and homeowners. This awareness helps the market for membranes that provide waterproofing.

Key Developments

Explore the Waterproofing Systems Market

This article provides an overview. Dive into our comprehensive report for detailed insights, market forecasts, and competitive analysis of the global waterproofing systems industry.- ? Market Size & Growth Projections

- ? Key Player Strategies & Market Share

- ? Emerging Technologies & Applications

Discover the Waterproofing Chemicals Market

Waterproofing chemicals are critical for sustainable infrastructure. Get our in-depth report to explore market trends, regulatory impacts, and growth opportunities. Source: World Bank

Moreover, new membrane materials with superior performance have been developed as a consequence of the waterproofing industry's ongoing research and development. They enable market expansion by improving flexibility, durability, and ease of installation. It is becoming increasingly important to waterproof considering the negative effects of water seepage, such as long-term harm to property developers or owners, contractors, and homeowners. This awareness helps the market for membranes that provide waterproofing.

Source: World Bank

Moreover, new membrane materials with superior performance have been developed as a consequence of the waterproofing industry's ongoing research and development. They enable market expansion by improving flexibility, durability, and ease of installation. It is becoming increasingly important to waterproof considering the negative effects of water seepage, such as long-term harm to property developers or owners, contractors, and homeowners. This awareness helps the market for membranes that provide waterproofing.

Understand the Geomembrane Market

Geomembranes are revolutionizing waterproofing applications. Access our detailed report to uncover market dynamics, material innovations, and growth forecasts.- In June 2023, Fosroc launched Polyurea WH 100, a product that offers numerous advantages to various applications for waterproofing roofs. Its hand-applied application makes installation very simple, which is especially helpful in situations involving flat roofs where spray equipment may not be available and detailing can be challenging. Its smooth finish and the full range of polyurea technology performance ensure long-lasting waterproofing. Reduced construction times are possible because of the speedy return to service times, which enable subsequent trades to proceed with minimal delay. With this new grade, Fosroc's Polyurea portfolio is further strengthened to meet the waterproofing needs of all market sectors.

- In February 2023, Bostik India proudly launched SEAL & BLOCK, the brand's waterproofing solutions for basements to roofs. APAC Business Director for Wall and Floor Renam Timbó and Bostik Asia Pacific Head of Construction and Consumer, Arnold De Silva, joined Bostik India Managing Director Vikas Kulkarni in extending a warm welcome to all. With the SEAL & BLOCK line, the launch proudly demonstrated the importance of cutting-edge waterproofing technology in creating more sustainable infrastructures, which is essential for economic growth.

Go from Insight to Action with Our Market Research

You've seen the overview. Now, get the detailed data and strategic analysis you need to stay ahead in the waterproofing market. Explore our related, in-depth reports. Each report includes comprehensive data, forecasts, and competitive analysis to empower your business decisions.Get in Touch

Interested in this topic? Contact our analysts for more details.

Latest Thought Articles

Top OSAT Companies Driving Semiconductor Assembly and Test Services Worldwide

Recently

EV Charging Stations Market Outlook: Smart Charging, Fast Charging, and Regional Expansion

Recently

Future of Corporate Wellness: Global Trends and Regional Outlook

Recently

Regional Breakdown of the Mechanical Keyboard Market: Who Leads and Why?

Recently