Automotive and Construction Industries to Boost the Structural Adhesives Market

The Structural Adhesives Market was valued at US$8.689 billion for the year 2020 and is expected to grow at a CAGR of 4.47%, reaching a market size of US$11.798 billion by the year 2027.

Structural adhesives are strong adhesives that harden or cure into materials strong enough to hold two or more substrates together while carrying the forces between the substrates. In an end-use product, these junctions between substrates are crucial because if they break, the structure and functionality of the product could be severely compromised. High-performance structural adhesives are in greater demand because they can enable final end-use goods or components to withstand shock, chemicals, vibration, temperature changes, and other sorts of agents.

Structural adhesives are now being used in the automotive and aerospace sectors to ensure impact resistance and light weight. The automobile industry's growing use of structural adhesives will likely contribute significantly to the market's predicted significant growth. The demand for daylight reduction and energy-efficient "smart" buildings from the building and construction sectors is anticipated to increase. The structural adhesive market is experiencing increased demand as a result of the economic expansion in developing nations. However, rising public health concerns and stringent government regulations on VOC emissions are anticipated to have a detrimental effect on market growth.

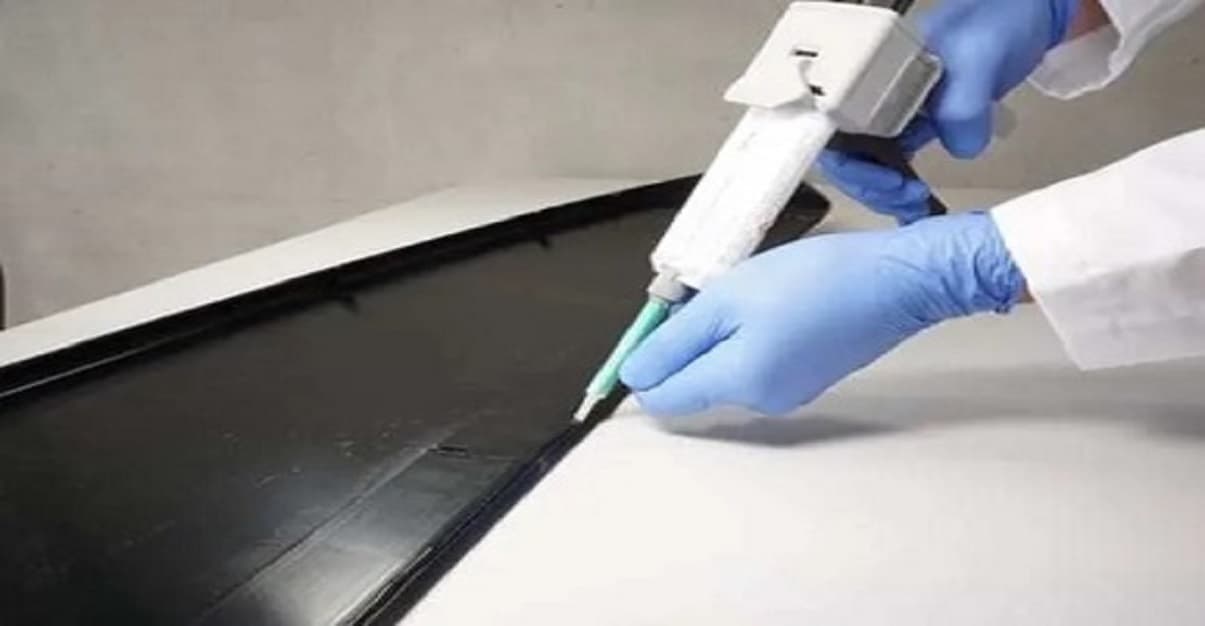

Lucrative opportunities in the Automotive Sector are driving the Structural Adhesives Market's Growth.Fasteners, riveting, welding, and other procedures have been used by stakeholders in the automotive sector to perform commercial activities for many years. In order to create reliable multi-substrate end products, structural adhesives are emerging as a possible replacement for these traditional methods. Structural adhesives are not only more powerful than previous methods, but they also have a number of advantages over them. For example, they are more cost-effective, accelerate the production of autos, and require less technical expertise to operate. For instance, BETAMATE by Dupont is a range of structural adhesives that provide adhesion to automotive substrates like steel, aluminium, magnesium, and composites. It takes the role of welds and mechanical fasteners, which lowers fatigue and failure that are frequently seen with conventional procedures and significantly boosts manufacturing efficiencies.

In order to make cars lighter, structural adhesives were launched as a low-volume substitute in the automotive sector. However, after realising its potential, the auto industry began utilising it for mass production. A growing reliance on high and ultrahigh strength aluminium and steels for body structures, particularly unitized bodies-in-white (BIW), to save weight without compromising crash-mitigating strength or handling-degrading stiffness is driving the growth in the use of structural adhesives. The use of structural adhesives in the automotive industry has also increased in Japan.

Electric vehicles (EVs) have started using structural adhesives as a lightweight substitute for traditional binding materials since they are becoming mindful of the many advantages they offer. The International Energy Agency predicts that sales of electric vehicles will increase from 3 million vehicles in 2017 to 23 million in 2030. The shift toward electric vehicles is likely to increase demand for structural adhesives.

Demand for structural adhesives is rising in the construction industry.The demand for smart and innovative construction solutions that increase construction's efficiency and durability is rising due to the significant surge in infrastructure development around the world. Building materials like structural insulated panels offer advantages like simple installation and great construction quality. The need for structural insulated panels in commercial buildings is increased by features including their light weight, superior insulation, and cost effectiveness. Costs associated with mechanically fastened joints can be avoided with the aid of structural adhesives. They thus lower the cost of materials, the quantity of parts, labour costs, and processing time. Additionally, they are simple to administer because they come in a range of packaging and dispensing choices. As the global population has grown exponentially, there has been a significant increase in energy demand. This has led to an increase in the demand for energy generation infrastructure that makes use of structural adhesives to maintain structures that are lightweight, effective, and efficient without sacrificing structural integrity.

The booming construction industry, which uses new materials that require strong adhesion, as well as the use of the product in numerous applications like carpet flooring, drywall lamination, ceramic tile fixing, and so on, due to their affordability and aesthetic appeal, can be attributed to the industry's growth. For instance, H.B. Fuller Company purchased the construction adhesives supplier, Fourny NV, situated in Belgium, on July 20, 2022. Fourny's status as a pioneer in the commercial roofing sector, which enables the localization of goods imported from the U.S., is thought to have accelerated H.B. Fuller's expansion throughout Europe. Construction expenditures are predicted to rise as a result of economic development and population growth. It is anticipated that this will increase the demand for structural adhesives in the construction industry.

Asia-Pacific is expected to hold a major share due to the rapid adoption of adhesives in industrial and automotive manufacturing.Given the rapid adoption of adhesives in industrial and automotive manufacturing, it has been reported that the Asia-Pacific area holds a considerable market share. Due to the rising sales of consumer electronics, where structural adhesives are used for electronic assemblies, conductive films, and other applications, the Asia-Pacific region is expected to become a lucrative growth market for stakeholders in the upcoming years. A further driving force is the rising need for adhesives in nations like Thailand, India, and China. Other important elements are ease of access, subsidies, and tax incentives from the government.

Furthermore, the National Development and Reform Commission reports that the Chinese government has given the go-ahead for 26 infrastructure projects with a total estimated investment of about USD 42 billion. The expected completion date for these ongoing projects is 2023. The Indian government has put in place a number of initiatives, like the Smart Cities project and Housing for all by 2022, which are anticipated to provide the sluggish construction sector a boost. Over the course of the projection period, the aforementioned elements are anticipated to have an impact on structural adhesive demand in the Asia-Pacific region.

Government restrictions on VOC emissions are anticipated to have a negative effect on market growth.There are many benefits associated with structural adhesives. However, the majority of structural adhesives are harmful to both the environment and human health. Phthalates and formaldehyde have been shown to be the two most frequently occurring substances in structural adhesives. These two substances are both prone to off-gassing, which means that as they dry, they emit gases. With adverse consequences ranging from skin irritability to liver and kidney damage, these emissions have the potential to have a significant impact on air quality and human health. Although phthalates and formaldehyde are the substances in adhesives that are most frequently cited, there are many other ones as well.

As the demand for eco-friendly or green products in various applications grows, so does the need for green adhesives or those with low VOC. Environmentally friendly adhesives with low VOC levels have been required by REACH (Registration, Evaluation, Authorization, and Restrictions of Chemicals) in Europe, USEPA (United States Environmental Protection Agency), LEED (Leadership in Energy and Environmental Design) in the US, and other regulatory bodies across various regions.

Structural Adhesives Market Scope:

| Report Metric | Details |

| Market size value in 2020 | US$8.689 billion |

| Market size value in 2027 | US$11.798 billion |

| Growth Rate | CAGR of 4.47% from 2020 to 2027 |

| Base year | 2020 |

| Forecast period | 2022–2027 |

| Forecast Unit (Value) | USD Billion |

| Segments Covered | Type, Industry Verticals, And Geography |

| Regions covered | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies covered | 3M, DuPont de Nemours, Inc., SIKA AG, Scott Bader Company Ltd., ITW Performance Polymers, Arkema, Lord Corporation, Henkel AG, Shanghai Huitian New Material Co., Ltd. |

| Customization scope | Free report customization with purchase |

Get in Touch

Interested in this topic? Contact our analysts for more details.

Latest Thought Articles

Top OSAT Companies Driving Semiconductor Assembly and Test Services Worldwide

Recently

EV Charging Stations Market Outlook: Smart Charging, Fast Charging, and Regional Expansion

Recently

Future of Corporate Wellness: Global Trends and Regional Outlook

Recently

Regional Breakdown of the Mechanical Keyboard Market: Who Leads and Why?

Recently