Cellular and Broadband Packages and Prices

Introduction

A network operator refers to a firm, company, or institution which provides wired as well as wireless communication services to consumers. These network operators control the necessary infrastructure that enables proper connection and communication. Communication is done using voice calls, messaging, and internet connectivity. 5G has been emerging as a fast and speedier version of communication that has captured the eyes of consumers. The network is faster and clearer than its decedents. Hence the network operators have been developing and adopting 5G networking to strengthen communication and, at the same time, expand their footing in IT and communication technology. These operators are offering voice calls and message services to their customers. Furthermore, 5G internet connectivity across various devices ensures connectivity. Mobile internet, broadband services, and sim plans are the connectivity packages and plans which are offered by these operators. The white paper explores numerous 5G packages and plans which are offered by network operators around the world.

Market Driver

Growing Internet Connectivity Will Surge the Demand for 5G Cellular Telephone Service and Broadband Service.

One of the prime reasons which are expected to surge the demand for 5G cellular and telephone services is the surge in internet penetration globally. Internet connectivity has become an integral and important part of life as it opens a new world for consumers. Access to the internet has become crucial since it enables connection and communication uninterruptedly. Moreover, the internet empowers users with information and data from around the world. 5G internet connectivity is a faster and more effective source of communication, resulting in a surge in demand.

It is expected that increasing internet demand and penetration will create demand for 5G internet connectivity, be it cellular telephone or broadband services. Data from the World Bank Organization shows that the proportion of the global population accessing the internet increased from 28.876% in 2010 to 60% in 2021. It is further estimated that by 2030, 88.24% of the population will have access to the internet.

Figure: Proportion of People Using Internet, Global, in Percentage, 2010 to 2021.

Source: World Bank

A surge in consumer disposable income coupled with the necessity of internet connectivity in everyday lifestyle is projected to be the prime reason to create demand for 5G networking. Moreover, the rise in mobile and broadband subscriptions is expected to play a vital role in the increase in connectivity. A report published by Ericsson estimates that mobile subscriptions globally will increase from 8.139 billion, calculated in 2021, to 8.937 billion by 2027. This smartphone subscription is expected to increase to 7.692 billion by 2027, from 6.258 billion in 2021. The rise in smartphone penetration will likely increase the demand for 5G cellular telephone services globally.

Figure: Mobile Subscription, Global, in Millions, Estimates, 2021 to 2027

Source: Ericsson

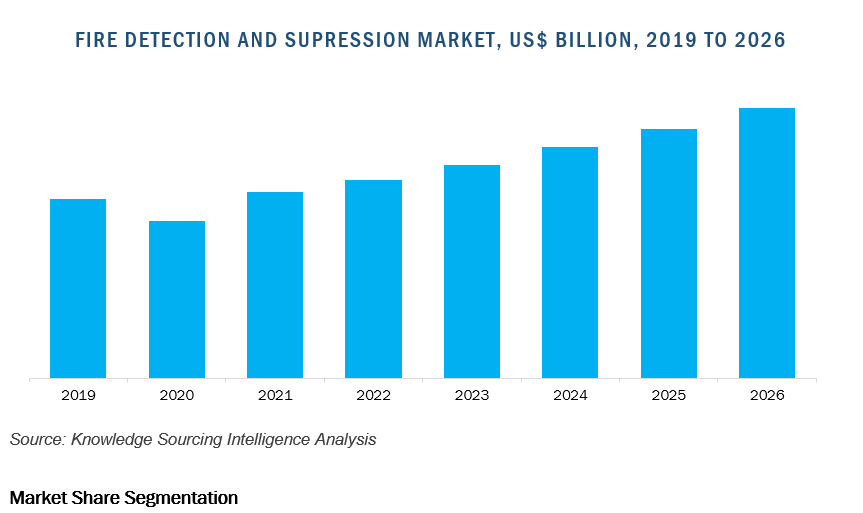

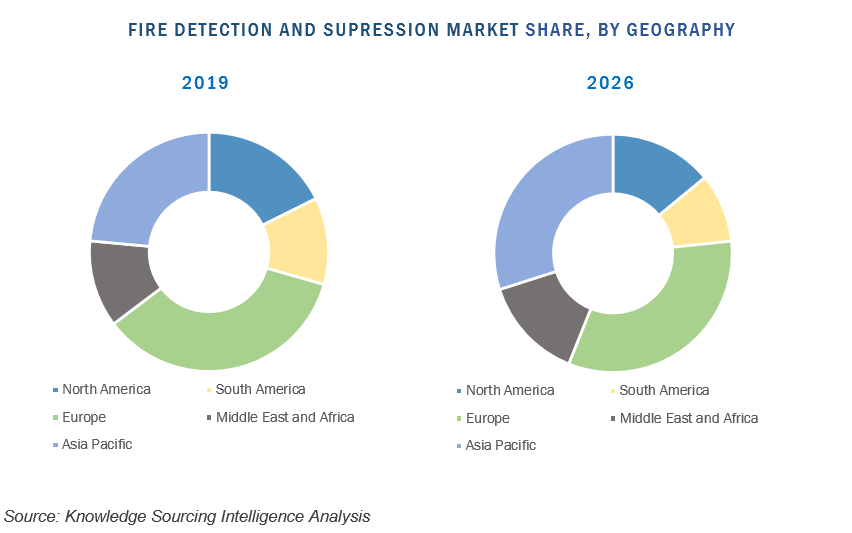

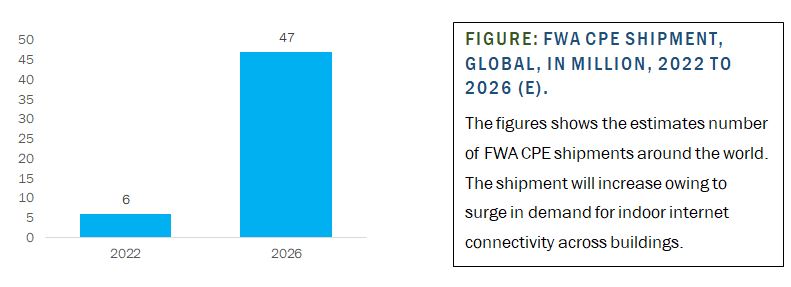

5G Broadband services are projected to increase at offices, industries, and residences. Internet connectivity is becoming crucial for carrying out business operations, creating demand for broadband for connecting the workplace using the same network. Furthermore, the rising adoption of a hybrid work culture coupled with the rising construction of smart homes is expected to nudge growth in residential regions for broadband services. Data from OpenSystem Media estimates that FWA CPE shipment for 5G broadband services will increase to 47 million units by 2026, from the predicted 6 million units in 2022. It is expected that dominating 5G broadband services will be availed in developed regions such as North America and Europe. However, developing nations are expected to catch up with technological advancement over time.

Source: Qualcomm

Market Restraints

Unequal Global Penetration of 5G

A prime restrain that the 5G network operators are the unequal global presence of 5G networking which restrains connectivity and communication between countries with and without 5G networking, constraining their market and limiting demand for their services. 5G networking has been slowly penetrating a global level. While in certain regions such as North America and Europe, 5G acceptance and implementation were fast, other regions still find it challenging to inculcate networking. Also, certain countries even lack 4G connectivity. At Present, in addition to North America and European countries, Brazil, Argentina, China, Japan, and South Korea have commercially rolled out 5G plans; however, they are restricted to cellphone communication. While numerous other countries are developing infrastructure around networking, it will take a while before its fully integrated. The difference in connectivity is likely to cause communication issues and barriers and hence restrain the market demand for 5G networking.

Global Outlook for 5G Network Operators

Europe

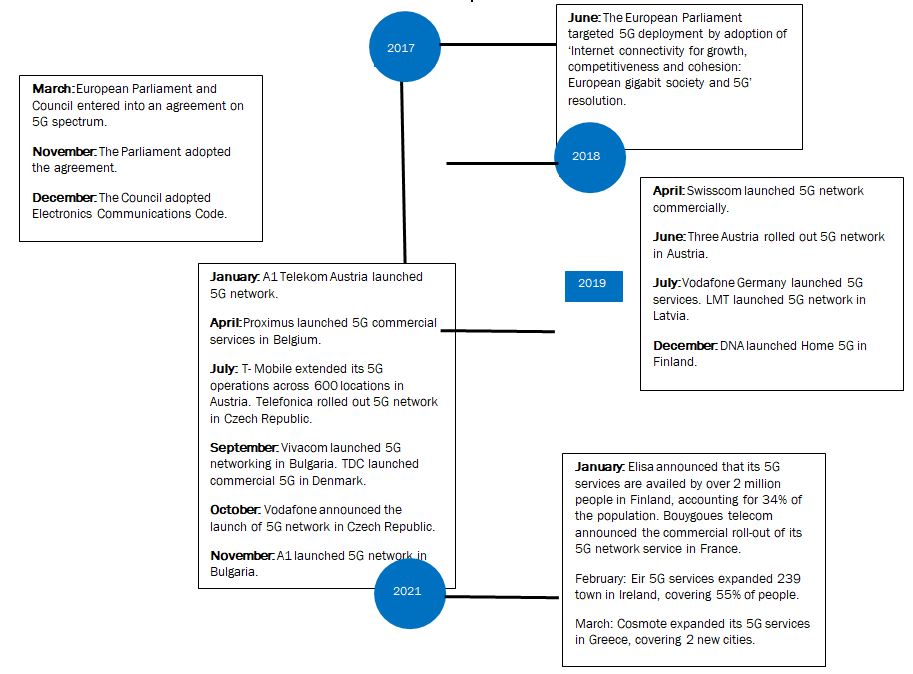

Europe was one of the initial regions where 5G networking witnessed installation. Empowered by funds and technical support provided by the European Commission, the 5G networking blueprint was laid out in early 2017. In June 2017, the European Parliament targeted the deployment of 5G networking across the region under its “Internet connectivity for growth, competitiveness, and cohesion: European gigabit society and 5G” resolution. Under this, the Parliament laid out its action plans, objective, and expectation linked with 5G networking. The initial stage of the action plan was executed in March 2018, when the Parliament agreed with the European Council, negotiating the terms of deploying the 5G spectrum. By November 2018, the Parliament adopted the agreement, while the Council sanctioned the proposed Electronic Communications Code in early December 2018.

Observing rising China’s technological presence and potential security threat in the EU, the Parliament emphasized its action plans to inculcate 5G networking; hence, in April 2019, 1st commercial 5G plans were rolled out by Swisscom became the 1st enterprise that rolled out 5G networking commercially. Since then, numerous companies have hit the 5G milestone, and many have rolled out 5G networking commercially. By the end of 2021, 24 countries out of EU-27 had access to 5G networking available commercially.

5G Network Prices and Packages in Europe

Numerous domestic and international players are offering 5G cellular as well as telephone services in the European region. 5G networking is being offered as 3 packages in the European region- sim-only plans, mobile subscription, internet plans, and broadband plans.

- 5G Sim Only Plans

5G Sim-only plans are offered by mobile cellular operators on the purchase of the operator’s sim by the customer. These plans’ validity ranges from a month, 12 months, or 24 months, most of which the customer can choose from mobile subscription plans. These types of plans are dominantly found in the United Kingdom. Vodafone, Three, and EE are prime mobile operators who offer these plans. In addition to these plans, the company offers extra benefits to attract customers.

|

Company |

Plan |

Duration |

Minutes and Texts |

Data |

Range (per Month) |

||

|

Min. |

Max. |

Min. |

Max. |

||||

|

Vodafone |

Red Plan |

1 Month/ 12 months/ 24 Months |

Unlimited |

1GB |

Unlimited |

£11 |

£47 |

|

Three |

Sim Plan |

1 Month/ 12 months/ 24 Months |

Unlimited |

4GB |

Unlimited |

£6 |

£28 |

|

EE |

Sim Plan |

24 Months |

Unlimited |

1GB |

200GB |

£ 14 |

£28 |

- Mobile Plans

Mobile subscription plans are the cellular recharge plans the consumer demands post-completion of their sim plans to ensure connectivity. The plans in the European market are either individual-based or enterprise-based. Individual plans are packages offered by network operators to individual customers for connectivity to their smartphones. Enterprise Plans, on the other hand, are organization plans where numerous individuals of an organization share the same package. Proximus is a leading player offering enterprise plans in the European region. Mobile subscription plans are offered by numerous international market players, including Vivacom, Cytamobile, Orange, Telenor Denmark, Bouygues Telecom, SFR, Wind Hellas, Iliad Italia, Windtr, Tele 2, Tango, and Sunrise.

|

Company |

Plan |

Minutes and Texts |

Data |

Range (per Month) |

|||

|

Min |

Max |

Min. |

Max. |

Min. |

Max. |

||

|

Proximus |

Enterprise Plan |

Unlimited |

12 GB |

50GB |

€24 |

€49 |

|

|

Vivacom |

Mobile Plan |

Unlimited |

6,000 MB |

Unlimited |

BGN 8 |

BGN 4.99 |

|

|

Cytamobile |

Mobile Plan |

150 min/sms |

Unlimited |

500 MB |

Unlimited |

€11 |

€ 165 |

|

Orange |

Mobile Plan |

Unlimited |

20 GB |

Unlimited |

€ 29.99 |

€79.99 |

|

|

Bouygues Telecom |

Mobile Plan |

Unlimited |

70 GB |

200 GB |

€16.99 |

€ 49.99 |

|

|

Wind Hellas |

Mobile Plan |

1,000 min/sms |

Unlimited |

3GB |

Unlimited |

€ 26.99 |

€ 39 |

|

Windtre |

Mobile Plan |

Unlimited Minutes & 200SMS |

50 GB |

Unlimited |

€11.99 |

€29.99 |

|

|

Telecom Italia |

Mobile Plan |

Unlimited |

50 GB |

100 GB |

€ 11.99 |

€ 19.99 |

|

|

Tango |

Mobile Plan |

Unlimited |

Unlimited |

€ 50 |

€ 80 |

||

|

Sunrise |

Mobile Plan |

Unlimited |

Unlimited |

CHF 4 |

CHF 20 |

||

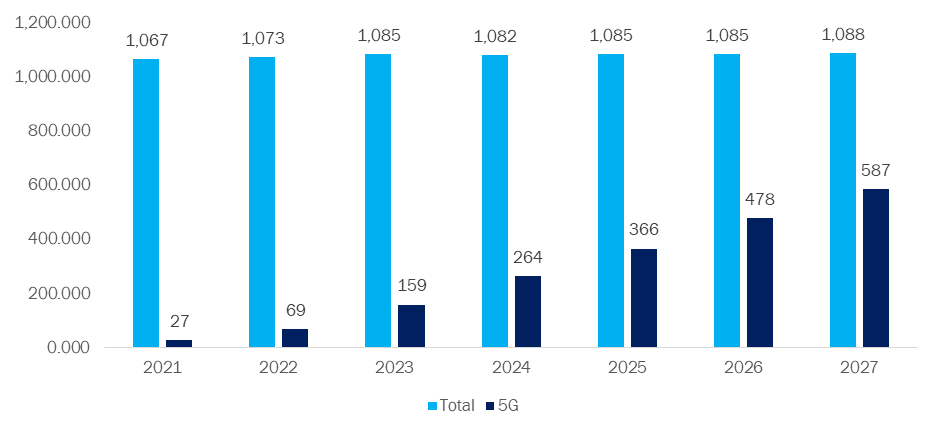

Growing mobile phone demand coupled with a surge in sales is projected to increase demand for sims creating the market demand for sim-only plans. A report published by Ericsson predicts that the number of mobile phone subscriptions in the European region will surge from 1,067 million in 2021 to 1,088 million in 2027. 5G mobile phone subscription is projected to increase from 27 million in 2021 to 587 million in 2027.

Figure: Mobile Subscription, Total and 5G Smartphones, Europe, in Millions, Estimates, 2021 to 2027

Source: Ericsson

- Broadband Plans

Broadband plans are routers plans that an individual of an enterprise can avail to connect devices with a certain area, limited to home or building. With the surge in the construction of smart buildings and IoT devices at offices and in-home, an increase in the installation of routers is expected, which will increase the demand for broadband plans. Furthermore, companies offer to combine broadband and cellular recharge plans, which gives an advantage to the customers.

|

Company |

Plan |

Data |

Range (per Month) |

||

|

Min. |

Max. |

Min. |

Max. |

||

|

Elisa |

Broadband Plan |

Unlimited |

€31.90 |

€49.90 |

|

|

Vivacom |

Broadband Plan |

20GB |

150GB |

—- |

—- |

|

SFR |

Internet Plan + Box |

Unlimited |

€35 |

€ 65 |

|

|

LMT |

Internet with 5G router |

Unlimited |

€ 23.99 |

||

- Internet Plans

In addition to the above 3, numerous network operators also offer internet plans for broadband and cellular recharge. These plans only provide it increase existing internet availability to the users. The prime purpose of such plans is to extend the internet limit. These plans can be availed by both individuals and enterprises.

|

Company |

Plan |

Data |

Range (per Month) |

||

|

Min. |

Max. |

Min. |

Max. |

||

|

Proximus |

Extra Data Volume |

500 MB |

2.5 GB |

€3 |

€12 |

|

Orange |

Internet Speed Edition |

20GB |

150GB |

—- |

—- |

|

SFR |

Internet Plan |

80 GB |

Unlimited |

€ 25 |

€ 80 |

However, one major constraint facing the 5G networking in the European region is uneven pricing across the countries. Owing to the difference in taxes levied by the governments, similar plans in the two countries cost differently. Data from Eurostat shows that telecom prices are highest in Belgium, Greece, Ireland, and Luxemburg, while lowest in Switzerland, Norway, Iceland, and United Kingdom. Uneven pricing is projected to hamper 5G penetration in the region.

North America

United States of America

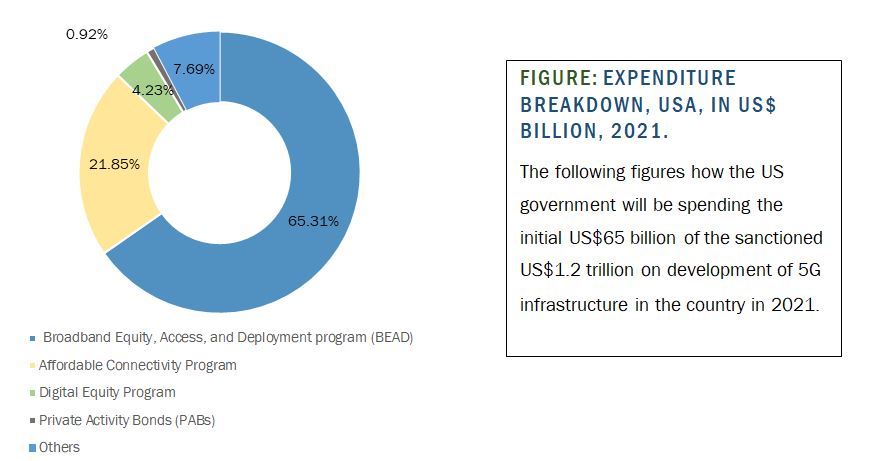

In the North American region, the United States was the 1st country to introduce and launch 5G networking. The government passed the 5G infrastructure bill to support and develop 5G infrastructure in November 2021. Under the bill, US$1.2 trillion has been sanctioned to be invested in infrastructure development. Of the initial US$65 billion, US$42.45 billion is allocated for Broadband Equity, Access, and Deployment program (BEAD), and US$14.2 billion to create the Affordable Connectivity Program. US$2.75 billion has been sanctioned for Digital Equity Program. Promising investment is undertaken by private players as well, which is expected to diversify networking.

Figure: Expenditure Breakdown, USA, US$65 Billion, 2021

Source: NCIT

5G networking in the US was 1st introduced in April 2019 by Verizon in Chicago and Minneapolis as a cellular service plan. Other players to join the 5G race in the US are AT&T and T0mobile. Other carriers in the country include UScellular and DISH Network. These players have rolled out notable plans in the state to share a significant chunk of the market. In January 2021, 75% of the population living in the US had access to 5G. Furthermore, by February 2022, all states will have 5G access. Early adoption, coupled with a rise in infrastructure, has resulted in the successful penetration of 5G networking. Moreover, affordable business, as well as personal network packages, create promising opportunities. The company offers numerous benefits in addition to nationwide coverage, which catches consumer attention.

|

Company |

Plan |

Duration |

Minutes and Texts |

Data |

Range (per Line) |

||

|

Min. |

Max. |

Min. |

Max. |

||||

|

AT&T |

Elite Plan |

1 Month |

Unlimited |

Unlimited |

$35 |

$50 |

|

|

T-Mobile |

Business Unlimited |

1 Month |

Unlimited |

50 GB |

Unlimited |

$25 |

$40 |

|

Verizon |

5G More |

1 Month |

Unlimited |

Unlimited |

$35 |

$55 |

|

In Canada, Sprint, Rogers Wireless, Bell Mobility, Telus Mobility, and Sasktel are the leading 5G network operators who have commercially rolled out 5G network services in the country. These companies have offered numerous plans to inculcate 5G networking while increasing their market foothold. Data from Ericsson shows that by November 2021, there were around half a million 5G users in the country.

|

Company |

Plan |

Duration |

Minutes and Texts |

Data |

Range (per Line) |

|||

|

Min. |

Max. |

Min. |

Max. |

|||||

|

Sprint |

Sprint |

1 Month |

Unlimited |

Unlimited |

$60 |

$85 |

||

|

Rogers Wireless |

Rogers Infinite |

1 Month |

Unlimited |

Unlimited |

$85 |

$110 |

||

|

Bell Mobility |

Unlimited Share Plans |

1 Month |

Unlimited |

5 GB |

50 GB |

$55 |

$92 |

|

|

Telus Mobility |

Unlimited |

1 Month |

Unlimited |

25 GB |

50 GB |

$70 |

$85 |

|

|

Sasktel |

Total/ VIP |

1 Month |

Unlimited |

5 GB |

30 GB |

$80 |

$115 |

|

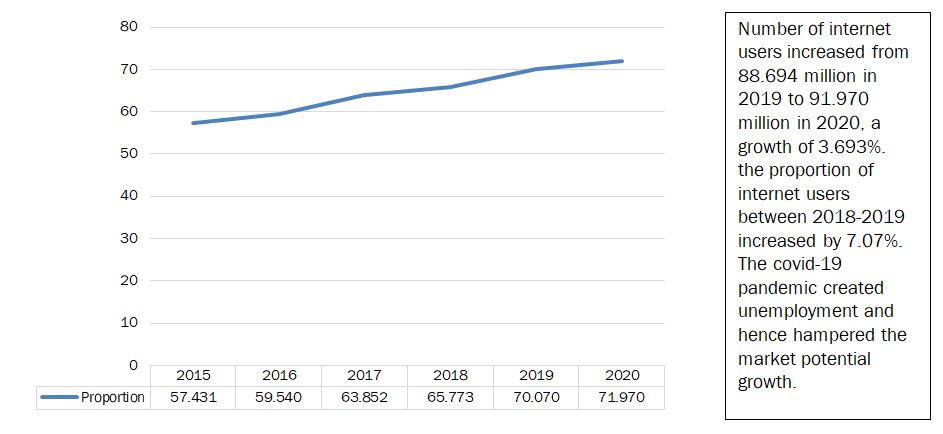

Mexico’s trembling economy and slow infrastructure development, coupled with low internet and network penetration, constrains the market of 5G. Wilson Center states that 5G, commercially available in Mexico, will be rolled by 2025 at a slower pace. Infrastructure constraints coupled with the severe impact of the COVID-19 pandemic have harshly impacted the country, pulling it backward. Low network and internet penetration is another reason which delays 5G network operation. Data from World Bank shows that number of individuals having access to the internet in Mexico was 71.97%, up from 57.431% in 2015.

Figure: Proportion of Population Having Access to Internet, Mexico, in Percentage, 2015 to 2020

Source: World Bank Database

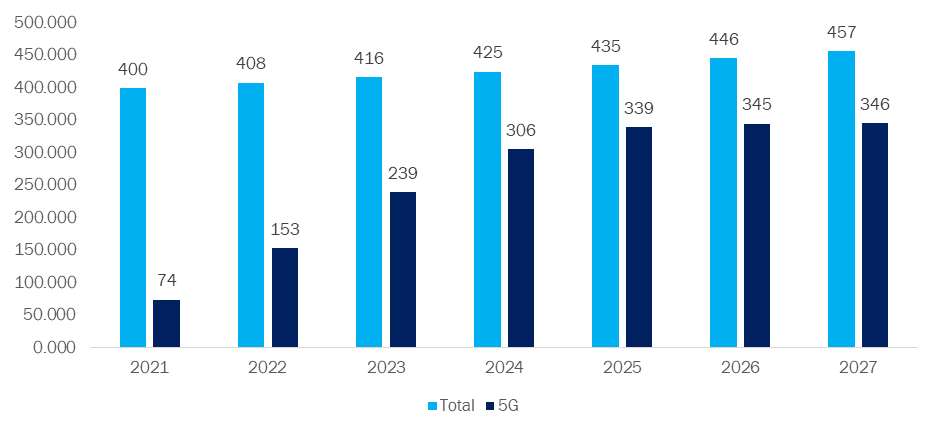

Nevertheless, the rising standard of living will surge the adoption of smart devices backed by IoT to facilitate a comfortable life and hence is projected to surge demand for networking services, especially in the US and Canada. Moreover, a surge in mobile subscriptions is forecasted by Ericsson with an increase in 5G smartphones, creating robust potential for the market.

Figure: Mobile Subscription, Total and 5G Smartphones, North America, in Millions, Estimates, 2021 to 2027

Source: Ericsson

South America

5G network has been commercially rolled out in Brazil in the 4th quarter of 2021. AT&T and Carlo are the operators who offer 5G mobile plans in the country. These companies offer cheaper plans which attract customers to switch towards 5G.

|

Company |

Plan |

Duration |

Data |

Range (per Month) |

||

|

Min. |

Max. |

Min. |

Max. |

|||

|

AT&T |

Internet Plans |

1 Month |

Unlimited |

$35 |

$50 |

|

|

Rogers Wireless |

Smart Play |

1 Month |

100 Minutes and SMS |

RD$1,554 |

RD$3,244 |

|

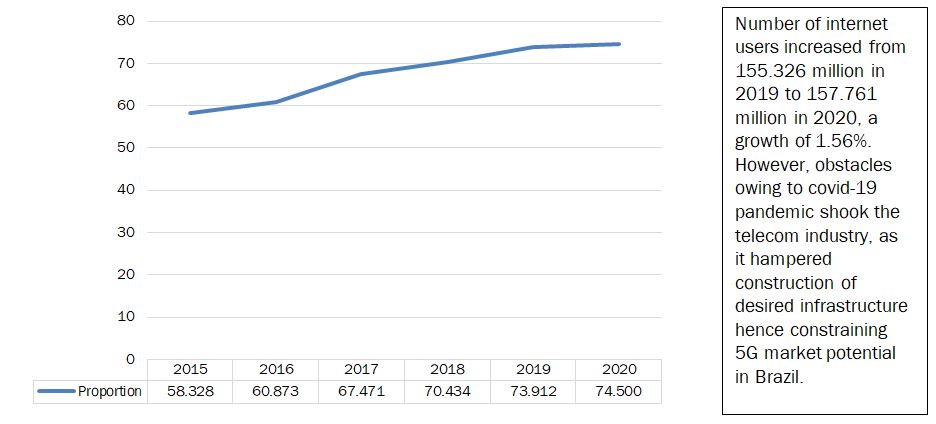

Promising internet penetration in the country, coupled with a rise in disposable income and economic development, is projected to create a robust potential for the market during the forecasted period. Data from World Bank Database shows that the proportion of the population accessing the internet increased from 58.328% in 2015 to over 74% in 2020.

Figure: Proportion of Population Having Access to Internet, Brazil, in Percentage, 2015 to 2020

Source: World Bank Database

The government of Argentina has also auctioned its 5G spectrum in late 2021. Telecom Argentina is the initial operator that has received the contract to roll out 5G infrastructure and commercial plans in the country. It is forecasted that the country will witness commercial 5G plans in the near future.

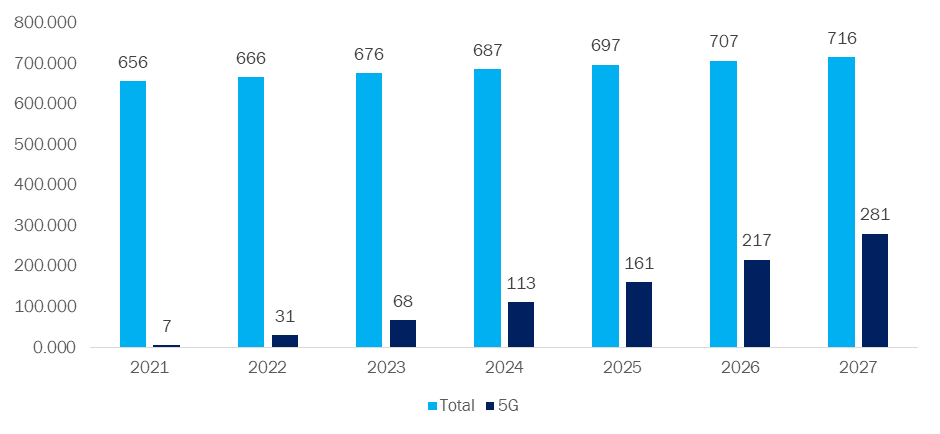

Rising mobile phone adoption and usage in the region will further expand the market dynamics. A report by Ericsson predicts that total mobile subscriptions will increase to 716 million in 2027, up from 656 million in 2021. Furthermore, the report extends that the subscriptions of 5G smartphones will reach 281 million by the period, from 7 million in 2021.

Figure: Mobile Subscription, Total and 5G Smartphones, Latin America, in Millions, Estimates, 2021 to 2027

Source: Ericsson

Asia Pacific

In the Asia Pacific region, China, Japan, Australia, and South Korea have successfully rolled out commercial plans for 5G networking. Advanced technology coupled with supporting infrastructure and high penetration is the prime reasons which have led to the successful penetration of 5G networking in these countries. Furthermore, countries like India, Nepal, and Bhutan have been working to inculcate and develop 5G in the economy, creating scope for potential operators to expand in the market. It is expected that by 2025, the 5G network will be accessible in more countries owing to promising infrastructure development by the respective governments.

The region has been emerging as a manufacturing hub for the semiconductor industry, creating notable potential. Increasing disposable income and higher living standards have led to a rise in the adoption of smart devices. Furthermore, an increase in investment is projected to tap into new opportunities, creating opportunities for international and domestic operators to enter/ operate in the region.

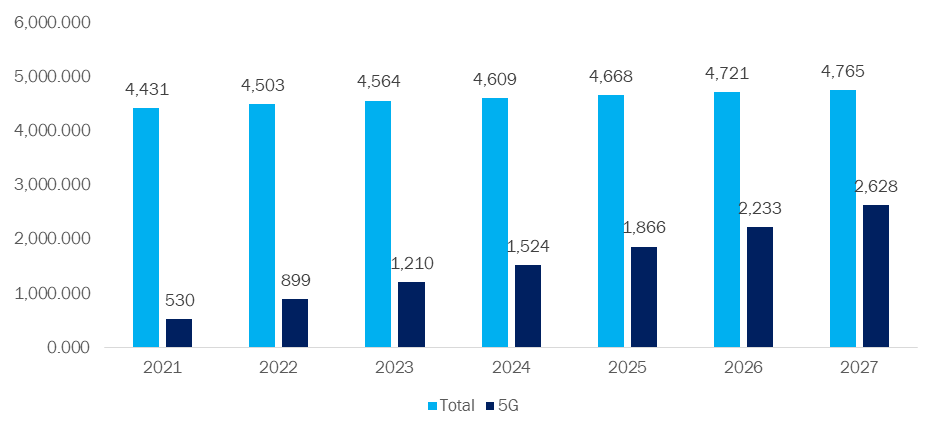

The rise in mobile phones and routers for superior connectivity at the enterprise as well as individual levels expands the market dynamics in the regions. A report by Ericsson predicts that the number of 5G smartphone users in the region will reach 2,628 million by 2027, from 530 million in 2021.

Figure: Mobile Subscription, Total and 5G Smartphones, Asia Pacific, in Millions, Estimates, 2021 to 2027

Source: Ericsson

China

China was the first country in the Asia Pacific region to introduce a 5G network. In November 2019, Chinese carriers officially announced the launch of 5G networking services in the country. Since then, numerous domestic players have significantly expanded their 5G networking services in the country and the international market, especially in the European region, where it faces government regulations and tough competition.

China Mobile and China Unicom are leading players who have commercially rolled out their 5G plans in the country. These companies offer cellular as well as broadband internet plans to their customers. It is expected that the ability of these network operators to capture international and domestic markets has toughened their footing in the industry. Furthermore, the surge in the construction of 5G smart buildings and smart devices offers notable expansion opportunities. These companies tie up with automotive and consumer electronics market leaders to increase their market share. China Mobile, for instance, partnered with Huawei to facilitate the construction of the latter’s smart factory.

|

Company |

Plan |

Duration |

Data |

Range (per Month) |

||

|

Min. |

Max. |

Min. |

Max. |

|||

|

China Mobile |

Voice call + Internet |

1 Month |

10 GB |

50 GB |

HK$168 |

HK$248 |

|

China Unicom |

Sim Plan |

1 Month |

1 GB |

6GB |

$25 |

$80 |

Japan

5G was launched in Japan in March 2020 by Softbank, a leading network operator. The company plans to invest US$1.9 billion over 5 years to increase its coverage throughout the country. Economic and infrastructure superiority coupled with wider acceptance and surge in automation across numerous industry verticals owing to the labor shortage is projected to increase demand for the faster network in the country, creating robust growth opportunities for 5G networking. The rise in geriatric population and support for robots over immigration paths ways for IoT enabled devices hence supporting the market. In addition to Softbank, NTT Docomo, Rakuten Mobile, and KDDI au have also commercially introduced 5g plans in the country.

|

Company |

Plan |

Duration |

Data |

Range (per Month) |

||

|

Min. |

Max. |

Min. |

Max. |

|||

|

NTT Docomo |

Gigaho Premier |

1 Month |

Unlimited |

Yen 7,315 |

||

|

KDDI au |

Unlimited |

1 Month |

1 GB |

80 GB |

Yen 1,650 |

|

|

Rakuten Mobile |

|

1 Month |

1 GB |

Unlimited |

Yen 980 |

Yen 2,980 |

|

Softbank |

Merihari Unlimited |

1 Month |

3GB |

Unlimited |

Yen 3,278 |

Yen 4,9948 |

South Korea

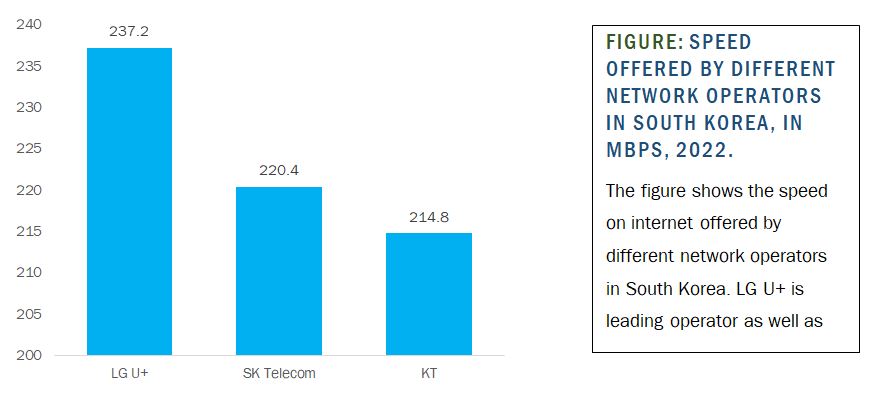

South Korea was the 2nd country to launch a 5G network commercially. In June 2020, the country witnessed the rollout of 5G in a few regions. The Initial 5G network was launched for smartphone users. LG U+, SK Telecom, and KT were the companies operating in the market, with the former leading the market. SK Telecom is placed in 2nd position in speed, offering 220.4 Mbps. KT offers a speed of 214.8 Mbps.

SK Telecom offers the cheapest data plan in the country. Owing to its remarkable speed and low rate, the company’s plans are popular. However, LG U+ has a noteworthy share, being one of the prime companies to roll out a 5G network in the country.

|

Company |

Plan |

Duration |

Minutes and Texts |

Data |

Range (per Line) |

|

LG U+ |

5G Signature |

1 Month |

Unlimited |

Unlimited |

130,000 won |

|

SK Telecom |

5GX Platinum |

1 Month |

Unlimited |

Unlimited |

125,000 won |

|

KT |

Unlimited Share Plans |

1 Month |

Unlimited |

Unlimited |

130,000 won |

Australia

Vodafone Australia was one of the prime companies that introduced 5G networking in 2020. The company covers Sydney, Brisbane, Peth, Canberra, Melbourne, and Adelaide. By 2021, the company will have 1,000 subscribers and over 100,000 customers. Other players in Australia’s 5G network services include Telstra and Optus. 5G network has been roll-out only in limited cities of the country. However, by 2025, it is expected that the 5G network will have 100% coverage across the country.

India, Nepal, and Bhutan

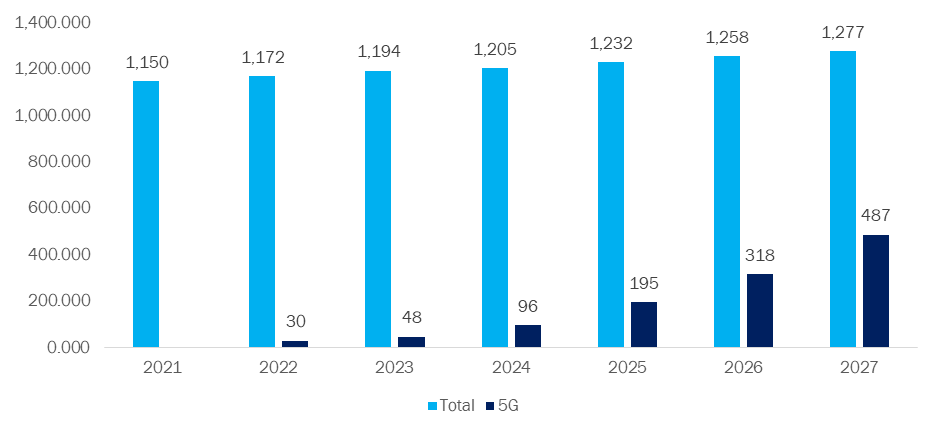

India, Nepal, and Bhutan have also made significant growth in the 5G network industry. the countries have been updating their infrastructure to accommodate the same. Development of towers, routers, modules, and other necessary infrastructure is projected to support the launch of the 5G network. 5G Cellular services will be initially started in the countries, owing to many mobile phone users. A report by Ericsson projected that number of mobile subscribers will surge to 1,277 million by 2027, from 1,150 million in 2021. Furthermore, 5G smartphone subscribers will reach 487 million by 2027.

Figure: Mobile Subscription, Total and 5G Smartphones, India, Nepal, and Bhutan, in Millions, Estimates, 2021 to 2027

Source: Ericsson

Expectations

It has been observed that the price of 5G network services differs depending on the country. The tax and charges levied by the respective governments are the prime reason behind the price difference. Nevertheless, numerous network operators are competing in the market to increase their market foothold. Advertisement and speed are the prime promotional strategy adopted by these companies to gain a competitive edge. It is expected that with rising 5G penetration and an increase in 5G development along with the globe, existing 5G market network layers will have the potential to diversify. In contrast, new players will have the opportunity to enter the market.

About the author

Sakshi Bohra is a Market Research Analyst at Knowledge Sourcing Intelligence LLP. Sakshi has a strong background in qualitative research. Her strong suit is gathering and analyzing key market data to assist businesses in gaining or maintaining a competitive advantage. Visit www.knowledge-sourcing.com to read more of her articles and learn more about various global markets.