Report Overview

Wearable Breast Pump Market Highlights

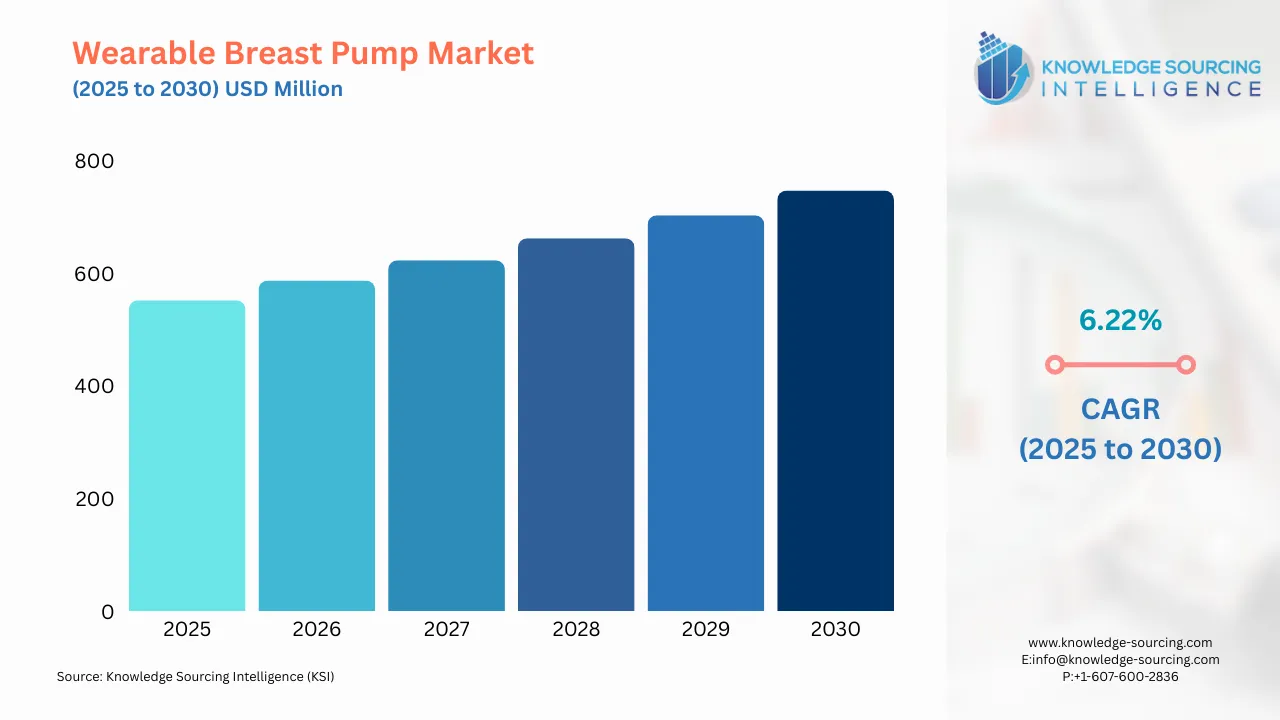

Wearable Breast Pump Market Size:

The wearable breast pump market is estimated at US$552.445 million in 2025 and is anticipated to grow at a CAGR of 6.22% during the forecast period and reach US$747.021 million in 2030.

Growth in consumer awareness about the convenience, comfort, and discreet use of wearable breast pumps is expected to drive market sales during the forecast period. The demand for wearable breast pumps can be further fueled by more aggressive awareness campaigns and education initiatives promoting the benefits of breastfeeding and the convenience of the wearable pump.

Notable recent changes in healthcare infrastructure in emerging economies and development create an enabling environment for their use. Governments and the private sector invest in healthcare, meaning increased access to health-related equipment, from breast pumps, which could be worn by the individual, to their availability and reach. Changes in disposable income with growth in urbanization enable an increase in consumers over this target demographic.

Moreover, technological advancements such as silent operation, tracking applications, and enhanced battery life are making the user experience more enjoyable and increasing consumer preference.

The increased involvement of women in workforces and their demand for efficient solutions to balance work and parenting are expected to propel the wearable breast pump market substantially in the forecast period.

Wearable Breast Pump Market Growth Drivers:

- The increasing number of women in the labor force is expected to fuel the demand for wearable breast pumps in the coming years

Increasing women's participation in the workforce will greatly influence the demand for wearable breast pumps in the coming years. The number of women in both professional responsibilities and motherhood is increasing. For instance, according to the U.S. Bureau of Labor Statistics, the percentage of women in the labor force in the United States increased to 83.0% in 2022 and slightly further to 83.6% in 2023. This steady increase reveals the increasing participation of women in the workforce, consistent with the trends of greater gender parity and economic participation. More working mothers are increasingly demanding products such as wearable breast pumps, as these help women maintain a work-life balance.

Shortly, the growing demand for convenient, efficient, and discreet breastfeeding solutions is bound to rise. Wearable breast pumps are ideal for working mothers since they can operate hands-free and are well integrated into daily routines. These gadgets allow women to stick to their breastfeeding plans without dropping a beat in pursuing careers and childbearing duties. The trend is also augmented by corporate policies for improving the health of mothers at work and raising awareness of the benefits of breastfeeding nutrition. In general, the various elements will create a strong demand for wearable breast pumps in the future.

- Increasing penetration of the e-commerce sector is expected to fuel the market in the projected period

One significant driver of product sales is the expanding presence of e-commerce portals for wearable breast pumps because those websites are convenient and easy to use. E-commerce sites allow consumers to check options, compare features and price points, and determine appropriate products from the comfort of a customer's home.

This high availability has increased penetration rates by tech-savvy customers and time-constrained clients. For instance, the Census Bureau of the Department of Commerce said today that U.S. retail e-commerce sales for the third quarter of 2024, adjusted for seasonal variation but not for price changes, was US$300.1 billion, an increase of 2.6 percent (±0.4) from the second quarter of 2024. Total retail sales for the third quarter of 2024 were estimated at US$1,849.9 billion, an increase of 1.3 percent (±0.2) from the second quarter of 2024.

Wearable Breast Pumps Market Segment Analysis:

- The smart wearable segment is expected to hold a dominant market share in the projected period

Advanced technology used with smart wearable breast pumps will maintain major market shares by focusing more on the demands of convenient efficiency that modern mothers want and need. Many of these pumps use app integration for tracking how much milk was expressed, their use, and pump setup configurations that range from settings to the strength of the suction pump. The hands-free and discreet nature of smart pumps, their silent operation, and their portability make it an extremely attractive product for working mothers and people with very active lifestyles. Moreover, increasing demand for technologically advanced and user-friendly healthcare devices strengthens the market's preference for smart wearable breast pumps.

Wearable Breast Pump Market Geographical Outlook:

- The North American region is expected to hold a major market share in the coming years

North America is expected to lead the wearable breast pump market, growing at a moderate CAGR during the forecast period. The reasons for this growth are the rapid innovation of wearable breast pumps, the increasing adoption of electric pumps, a well-developed healthcare infrastructure, and the constant launch of innovative products by leading market players. All these factors have combined to ensure a high consumer base and steady development of the market.

Europe is expected to grow at a significant CAGR during the same period, primarily fueled by a growing population of working women and a mounting demand for technologically advanced breast pumps. Moreover, awareness campaigns by companies promoting the benefits of wearable breast pumps are significantly helping boost market penetration. These, along with favorable regulations and consumers' preference toward innovative healthcare devices, are also likely to propel market growth in the European region.

Wearable Breast Pump Market Key Developments:

- In September 2024, Ameda Inc. announced that its Ameda Pearl hospital-grade breast pump has been named the winner of the prestigious Breast Pump Product of the Year award at the 2024 Baby Innovation Awards.

- Launched in October 2022, Ameda Pearl has wowed the market with its innovative design and superior performance. It has quickly become a favorite among pumping mothers across the United States, delivering exceptional user satisfaction and results from hospital to home.

List of Top Wearable Breast Pump Companies:

- Ameda

- Chiaro Technology Limited

- Koninklijke Philips N.V.

- Evenflo Feeding, Inc.

- Canpol Sp. z.o.o.

Wearable Breast Pump Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Wearable Breast Pump Market Size in 2025 | US$552.445 million |

| Wearable Breast Pump Market Size in 2030 | US$747.021 million |

| Growth Rate | CAGR of 6.22% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Wearable Breast Pump Market |

|

| Customization Scope | Free report customization with purchase |

The Wearable Breast Pump Market is analyzed into the following segments:

- By Technology:

- Battery-Operated

- Manual

- Smart Wearable

- By Component:

- Accessories

- Wearable Pumps

- By Geography:

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America

Our Best-Performing Industry Reports:

- Blood Pressure Monitoring Devices Market

- Smart Medical Device Market

- Refurbished Medical Equipment Market

- Cosmetic Chemicals Market

- AI Image Generator Market

- Ice Cream Market

Navigation

- Wearable Breast Pump Market Size:

- Wearable Breast Pump Market Key Highlights:

- Wearable Breast Pump Market Growth Drivers:

- Wearable Breast Pumps Market Segment Analysis:

- Wearable Breast Pump Market Geographical Outlook:

- Wearable Breast Pump Market Key Developments:

- List of Top Wearable Breast Pump Companies:

- Wearable Breast Pump Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 11, 2025