Report Overview

Vibration Measurement Accelerometer Market Highlights

Vibration Measurement Accelerometer Market Size:

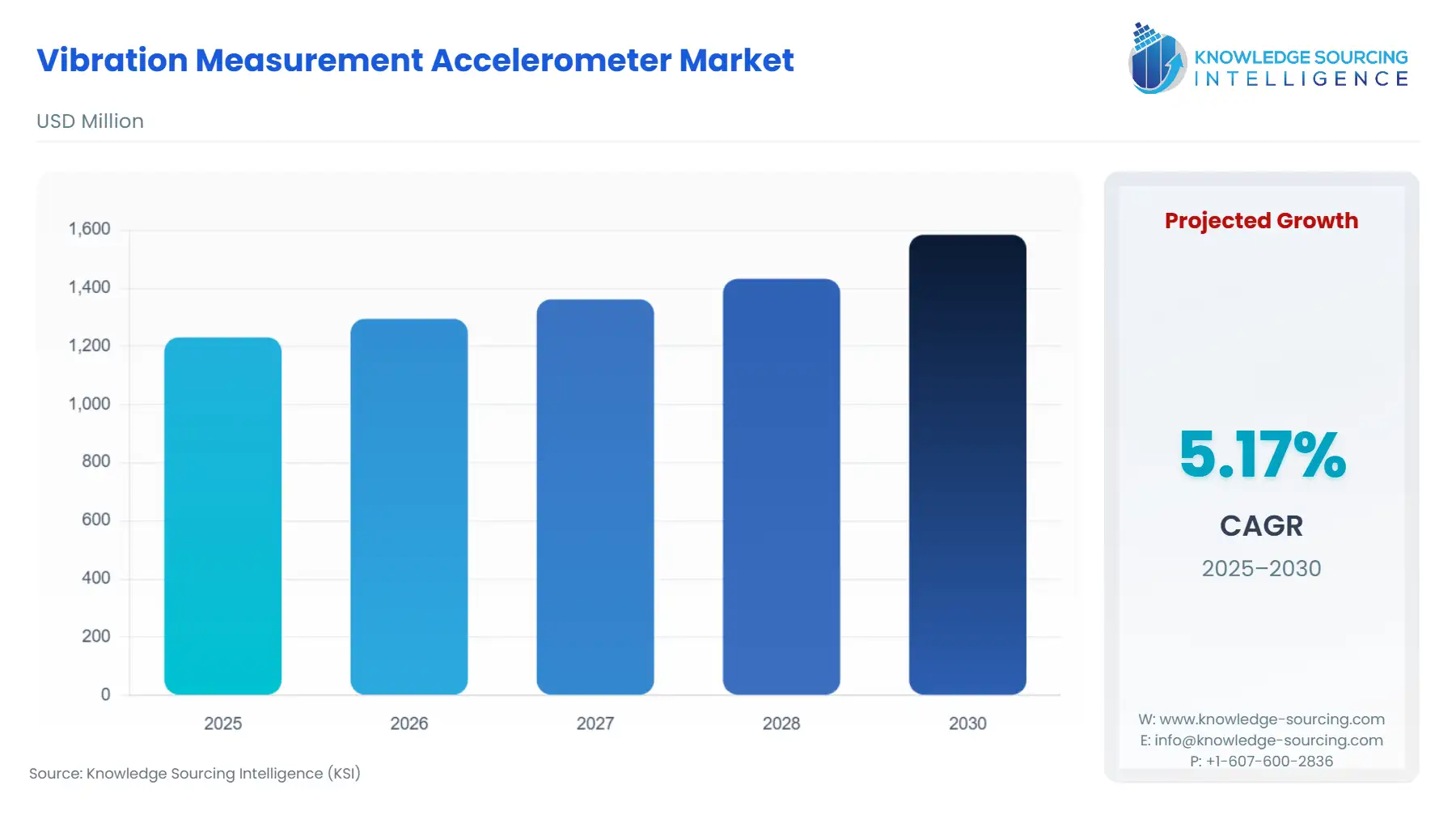

The vibration measurement accelerometer market is valued at USD 1231.3 million in 2025 and is expected to increase at a CAGR of 5.2% during the forecasted period and reach USD 1584.3 million in 2030.

The vibration measurement accelerometer market is a pivotal segment within the broader vibration sensor market, driven by the increasing adoption of industrial automation, predictive maintenance, and condition monitoring across industries such as manufacturing, aerospace, automotive, and energy. Accelerometers, which measure acceleration forces to detect vibrations, are critical for monitoring machinery health, ensuring operational efficiency, and preventing costly downtime. Technologies like MEMS accelerometers and piezoelectric accelerometers dominate due to their precision, compact size, and adaptability to diverse applications, including IoT sensors and high-temperature accelerometers for harsh environments. The market is propelled by technological advancements and the integration of sensor fusion for enhanced data accuracy, aligning with Industry 4.0 trends.

The vibration measurement accelerometer market focuses on sensors that detect vibrational forces to monitor equipment health, structural integrity, and dynamic motion. These devices are integral to condition monitoring, enabling early detection of issues like bearing faults or misalignment in rotating machinery. The rise of industrial automation has amplified demand for accelerometers in smart factories, where real-time data supports predictive maintenance strategies. MEMS accelerometers, with their compact size and low power consumption, are widely used in consumer electronics and automotive applications, while piezoelectric accelerometers excel in high-frequency, high-temperature environments like aerospace and energy. The integration of IoT sensors and sensor fusion—combining accelerometer data with gyroscopes or other sensors—enhances precision for applications like robotics and structural health monitoring. Recent developments underscore the market’s growth trajectory. In April 2024, IMI Sensors launched the Model 674A91, a piezoelectric accelerometer with IO-Link compatibility, enhancing condition monitoring in industrial automation by enabling faster data transmission. Similarly, in November 2024, Analog Devices introduced the ADIS1657x IMU family, featuring MEMS accelerometers with improved vibration rejection for aerospace and industrial applications. These innovations reflect the market’s focus on precision, connectivity, and adaptability to challenging environments. Several factors propel the market’s growth:

Rise of Industrial Automation: The adoption of industrial automation in manufacturing and energy sectors drives demand for vibration sensors to ensure machinery reliability.

Growth in Predictive Maintenance: Predictive maintenance strategies rely on condition monitoring with accelerometers to reduce downtime and maintenance costs.

Advancements in IoT and Sensor Fusion: Integration of IoT sensors and sensor fusion enhances data accuracy for robotics, automotive, and structural monitoring.

Demand for High-Temperature Accelerometers: High-temperature accelerometers are critical for aerospace and energy applications in extreme environments.

Despite growth, the market faces challenges:

High Initial Costs: Advanced MEMS accelerometers and piezoelectric accelerometers require significant investment, limiting adoption in cost-sensitive markets.

Complex Integration Challenges: Incorporating IoT sensors and sensor fusion into existing systems demands technical expertise and compatibility solutions.

How Do Accelerometers Measure Vibration, and What Are the Different Types?

Accelerometers measure vibration by detecting acceleration forces caused by motion or mechanical oscillations. A typical accelerometer consists of a proof mass suspended within a housing. When subjected to vibration, the mass moves relative to the housing, generating an electrical signal proportional to the acceleration. This signal, often measured in g (gravitational units), is processed to analyze vibration amplitude and frequency, critical for condition monitoring and predictive maintenance. The measurement process varies by accelerometer type, each suited to specific applications. The main types of accelerometers include:

Piezoelectric Accelerometers: These use piezoelectric materials (e.g., quartz or ceramic) that generate an electrical charge under mechanical stress. Ideal for high-frequency vibrations (0.5 Hz to 14 kHz), they are widely used in industrial automation and condition monitoring for machinery like pumps and turbines. Their high dynamic range and high-temperature tolerance (up to 500°C with specialized cables) make them suitable for harsh environments.

MEMS Accelerometers: Based on capacitive or piezoresistive technology, MEMS accelerometers are compact, low-power, and cost-effective, measuring both static (DC) and dynamic (AC) acceleration. They are prevalent in consumer electronics, automotive safety, and IoT sensors, with frequency ranges up to 6 kHz. Their small size (e.g., 2.5 x 3 mm) suits sensor fusion applications.

Piezoresistive Accelerometers: These use strain gauges to measure acceleration, offering robustness for high-shock environments like crash testing. They are less common in vibration sensor market applications due to lower sensitivity compared to piezoelectric models.

Capacitive Accelerometers: Often integrated into MEMS accelerometers, these measure changes in capacitance caused by proof mass movement, suitable for low-frequency vibrations and tilt sensing in industrial automation.

How Do I Choose the Right Accelerometer for My Application?

Selecting the right accelerometer requires evaluating application-specific parameters:

Frequency Range: Ensure the accelerometer’s frequency range matches the vibration characteristics of your equipment. For example, piezoelectric accelerometers are ideal for high-frequency machinery like turbines, while MEMS accelerometers suit low-frequency applications like structural monitoring.

Environmental Conditions: High-temperature accelerometers are essential for environments exceeding 130°C, such as aerospace engines, while MEMS accelerometers are better for standard conditions (-40°C to +105°C).

Power and Size Constraints: MEMS accelerometers offer low power consumption (e.g., 1.1 mA) and compact size for IoT sensors, while piezoelectric accelerometers may require more power and space.

Application Requirements: For predictive maintenance in industrial automation, choose piezoelectric accelerometers for high accuracy in machinery monitoring. For sensor fusion in robotics or drones, select MEMS accelerometers with integrated digital interfaces.

Integration Needs: Consider compatibility with IoT sensors and data systems. The IO-Link-enabled piezoelectric accelerometer from IMI Sensors simplifies integration in smart factories.

Consulting manufacturer datasheets and testing sensors in real-world conditions ensures optimal performance.

Vibration Measurement Accelerometer Market Overview:

The vibration measurement accelerator market is witnessing growth due to its rising technological advancements and the increasing requirement for real-time monitoring systems across diverse industries. These devices work in diverse components, which are critical factors for industries, including structural health monitoring, fault detection, operational safety, and predictive maintenance. Further, rising automation is also leading to its growing adoption in diverse industries, contributing to its growth during the forecast period. Vibration measurement accelerators are increasingly vital in the automotive and aerospace sectors. In automotive applications, they are used for crash testing, ADAS systems, and vehicle stability control, while in aerospace, they support navigation, rotor track balancing, and structural health monitoring. The rising production of electric vehicles and unmanned aerial vehicles is expected to further drive demand. Companies are actively innovating, such as TDK Corporation's September 2024 launch of a high-performance digital MEMS accelerator for industrial applications, featuring a +-14 g input range and 20 ?g/g2 vibration rejection with closed-loop integration. The incorporation of IoT and AI into vibration measurement accelerators is enhancing their efficiency and versatility. IoT-enabled accelerators facilitate remote monitoring and real-time data collection, while AI integration enables predictive maintenance by analyzing vibration data to anticipate equipment failures. These smart accelerators reduce downtime in industries like manufacturing, automotive, and oil and gas, where predictive monitoring is essential. North America is expected to command a significant market share, driven by growing industrial demand for energy-efficient, compatible sensors and the presence of leading market players advancing technology. For example, in April 2024, IMI Sensors introduced the Model 674A91, a fully programmable accelerometer with IO-Link universal protocol, designed for vibration monitoring in industrial applications. Some of the major players covered in this report include Amphenol Corporation, StrainSense Ltd., STMicroelectronics N.V., DJB Instruments UK Ltd., Parker Hannifin Corporation (Aerospace Group), and Thales Group, among others.

Vibration Measurement Accelerometer Market Trends:

The vibration measurement accelerometer market is advancing rapidly, driven by innovations in industrial automation and predictive maintenance. Tri-axial accelerometers are gaining prominence for their ability to measure vibration in three orthogonal directions, enhancing accuracy in condition monitoring. In April 2024, IMI Sensors launched the Model 674A91, a tri-axial accelerometer with IO-Link for seamless integration in smart factories. Low-noise accelerometers improve precision in applications like aerospace, with Analog Devices’ ADIS1657x IMU family offering superior vibration rejection in November 2024. High-g shock sensors are critical for automotive crash testing and defense, providing robust performance under extreme conditions. Analog vs digital accelerometers reflect a shift toward digital models for easier integration with IoT sensors, while wireless vibration sensors, like Motionics’ VibeSense, enable cable-free data collection via Bluetooth. Edge AI sensors enhance real-time data processing, with STMicroelectronics’ AI-enabled MEMS accelerometer for predictive maintenance. These trends highlight a focus on connectivity, precision, and smart analytics.

Vibration Measurement Accelerometer Market Drivers vs. Challenges:

Drivers:

Growth in Industrial Automation and Smart Factories: The vibration measurement accelerometer market is propelled by the rapid adoption of industrial automation and smart factory initiatives, where condition monitoring ensures machinery reliability. Tri-axial accelerometers and wireless vibration sensors enable real-time data collection for predictive maintenance in smart factories, reducing downtime and costs. For example, IMI Sensors launched the Model 674A91, a tri-axial accelerometer with IO-Link compatibility, enhancing integration in smart factory environments for HVAC monitoring and manufacturing equipment. The rise of Industry 4.0 drives demand for MEMS accelerometers in automated systems, supporting applications like oil and gas equipment monitoring, where sensors detect vibrations in pumps and compressors. This trend, particularly strong in North America and Europe, fuels market growth as manufacturers prioritize efficiency and data-driven maintenance strategies.

Expansion in Aerospace and Defense Applications: The aerospace & defense sector significantly drives the vibration measurement accelerometer market, requiring precise condition monitoring for aircraft, drones, and military equipment. Low-noise accelerometers and high-g shock sensors are critical for monitoring vibrations in engines and structural components, ensuring safety and performance. For instance, Analog Devices introduced the ADIS1657x IMU family, featuring MEMS accelerometers with enhanced vibration rejection for aerospace & defense applications, including navigation and structural health monitoring. These sensors support structural health monitoring in aircraft, detecting fatigue in critical components. The growing investment in defense modernization and space exploration, particularly in North America, amplifies demand for piezoelectric accelerometers and edge AI sensors, driving market expansion as reliability and precision remain paramount.

Advancements in IoT and Wearable Technologies: The integration of IoT sensors and wearable device sensors is a key driver, with MEMS accelerometers enabling motion detection and vibration monitoring in consumer electronics and industrial IoT. Edge AI sensors enhance real-time analytics for wearable device sensors in fitness trackers and smartwatches, while wireless vibration sensors support autonomous sensor networks in oil and gas equipment monitoring. The rise of sensor fusion, combining accelerometers with gyroscopes, enhances accuracy in automotive safety systems like airbag deployment and stability control. This trend drives market growth by expanding accelerometer applications in smart, connected devices across industries.

Restraints:

High Costs of Advanced Accelerometer Technologies: The vibration measurement accelerometer market faces challenges due to the high costs of advanced technologies like low-noise accelerometers and high-g shock sensors, which require sophisticated materials and manufacturing processes. Piezoelectric accelerometers, critical for aerospace & defense and oil and gas equipment monitoring, are expensive due to their high precision and high-temperature capabilities. For instance, IMI Sensors’ Model 674A91 offers advanced features but at a premium cost, limiting adoption in cost-sensitive sectors like small-scale manufacturing. This restraint hinders market penetration in emerging economies, where budget constraints favor cheaper, less precise alternatives, slowing the growth of vibration sensors in widespread industrial applications.

Integration Complexities with IoT Systems: The integration of wireless vibration sensors and edge AI sensors into existing smart factory and IoT systems poses significant challenges, restraining market growth. Compatibility issues, data processing requirements, and the need for specialized software to handle sensor fusion data complicate deployment, particularly in legacy systems. For example, while Analog Devices’ ADIS1657x IMU family enhances condition monitoring, its integration into older industrial setups requires significant technical expertise. This restraint affects applications like HVAC monitoring and structural health monitoring, where retrofitting sensors into existing infrastructure is costly and time-consuming, limiting adoption among smaller enterprises and slowing market expansion in the vibration sensor market.

Vibration Measurement Accelerometer Market Segmentation Analysis

Piezoelectric Accelerometers are expected to grow significantly

Piezoelectric accelerometers dominate the vibration measurement accelerometer market due to their high sensitivity, wide frequency range (0.5 Hz to 14 kHz), and robustness in condition monitoring for industrial and aerospace applications. These sensors use piezoelectric materials like quartz or ceramic to generate an electrical charge proportional to mechanical stress, making them ideal for predictive maintenance in machinery such as turbines and pumps. Their ability to withstand high-temperature environments (up to 500°C with specialized cables) enhances their use in aerospace & defense and oil and gas equipment monitoring. For instance, IMI Sensors launched the Model 674A91, a piezoelectric accelerometer with IO-Link compatibility, optimizing smart factory integration for real-time vibration data. Their versatility and precision drive their dominance in the vibration sensor market, particularly for industrial automation and structural health monitoring.

The Industrial sector is gaining a large market share

The industrial sector is the leading end-user industry in the vibration measurement accelerometer market, driven by the critical role of condition monitoring and predictive maintenance in optimizing equipment performance. Piezoelectric accelerometers and variable-capacitance MEMS are widely used to monitor vibrations in rotating machinery like motors, compressors, and pumps, preventing costly downtime. In April 2024, IMI Sensors’ IO-Link-enabled piezoelectric accelerometer enhanced data integration in smart factories, supporting industrial automation. The segment benefits from the rise of Industry 4.0, with wireless vibration sensors and edge AI sensors enabling real-time analytics for HVAC monitoring and manufacturing processes. The industrial sector’s focus on efficiency and reliability solidifies its position as the largest market segment.

Asia Pacific is predicted to hold a significant market share

Asia Pacific leads the vibration measurement accelerometer market, fueled by rapid industrialization, automotive production, and infrastructure development in countries like China, India, and Japan. The region’s manufacturing sector drives demand for piezoelectric accelerometers and MEMS accelerometers in smart factories and automotive safety systems. In 2024, TDK Corporation introduced a high-performance MEMS accelerometer for industrial applications, designed for condition monitoring with high vibration rejection. The region’s focus on structural health monitoring for bridges and buildings, combined with growing EV production, boosts demand for vibration sensors. Supportive policies and investments in industrial automation further position the Asia Pacific as the dominant region, with China and Japan leading in technological adoption and manufacturing scale.

Vibration Measurement Accelerometer Market Key Developments

In February 2025, Trinseo collaborated with Lapo srl to develop lenses using ALTUGLAS™ R-LIFE V046 CR88, a recycled PMMA bead resin with high recycled content. This innovation supports the specialty chemicals market by offering sustainable solid acrylics for optical applications, aligning with circular economy trends and reducing environmental impact.

In April 2024, IMI Sensors, a division of PCB Piezotronics, launched the Model 674A91 IO-Link piezoelectric accelerometer. This product is designed for industrial vibration monitoring, offering a frequency range up to 10 kHz for enhanced fault detection compared to many MEMS-based devices. It's fully programmable and provides multiple data outputs, including true peak acceleration, RMS acceleration, RMS velocity, crest factor, and temperature. This is a significant development in smart sensors for predictive maintenance.

In April 2024, Kistler introduced its new 8740A and 8788A accelerometer series aimed at aerospace and aviation vibration testing. These piezoelectric sensors are designed to provide highly accurate and reliable data in harsh environments, a crucial requirement for aircraft and space applications. The launch highlights a continued focus on high-precision instrumentation for demanding sectors.

In April 2024, Gladiator Technologies launched the GA50, a high-performance single-axis MEMS accelerometer. This product is tailored for precision and reliability in unmanned systems and autonomous applications. It's a key entry into the navigation-grade sensor market, where accuracy and stability under dynamic conditions are paramount for the operation of drones and other autonomous vehicles.

Vibration Measurement Accelerometer Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 1231.3 million |

| Total Market Size in 2030 | USD 1584.3 million |

| Forecast Unit | Million |

| Growth Rate | 5.2% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, Axis, End-user Industry, Region |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Vibration Measurement Accelerometer Market Segmentation:

By Type

Piezoelectric Accelerometers

Variable-capacitance MEMS

Piezoresistive Accelerometers

By Axis

3-Axis

2-Axis

1-Axis

By End-user Industry

Automotive

Consumer Electronics

Aerospace & Defense

Industrial

Others

By Region

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Italy

Spain

Others

Middle East & Africa

Saudi Arabia

United Arab Emirates

Others

Asia Pacific

China

India

Japan

South Korea

Taiwan

Thailand

Others