Report Overview

Vector Control Market Size, Highlights

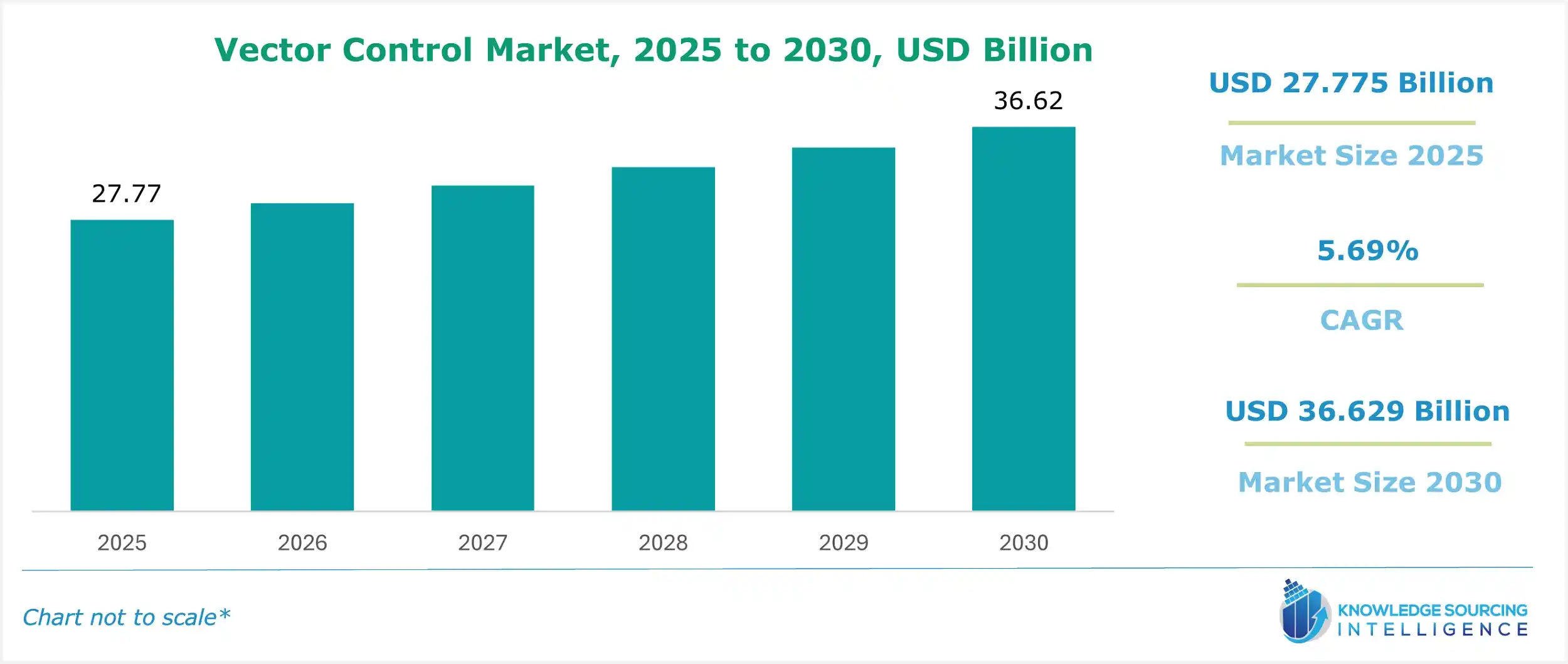

Vector Control Market Size:

The Vector Control Market, valued at US$36.629 billion in 2030 from US$27.775 billion in 2025, is projected to grow at a CAGR of 5.69% through 2030.

Vector-borne diseases pose a significant global health challenge. These diseases not only cause physical suffering, including debilitation and disfigurement but also disrupt lives economically. The impact is most severe in low-income countries, where poor housing, inadequate sanitation, and limited access to healthcare exacerbate the risks. Vector control market has experienced significant growth in recent years, driven by a combination of rising public health concerns, technological advancements, and increasing demand for effective pest management solutions. The growing industrialization and need for cleanliness are also driving the growth in the industrial sector. There is a growing demand for sustainable vector control due to growing health concerns and growing sustainability use.

Vector Control Market Overview & Scope:

The Vector Control Market is segmented by:

- Vector Type: By vector type, the vector control market is divided into insects and rodents. These are the carriers of diseases, as the mosquitoes are the leading cause of many diseases across the world.

- End-User: By end user, the vector control market is divided into commercial & industrial and residential. The market serves commercial and industrial sectors, such as agriculture, hospitality, and healthcare, as well as residential users seeking protection from pests in their homes.

- Method of Control: By method of control, the vector control market is divided into chemical, physical & mechanical, and biological. The chemical methods included insecticides and rodenticides, and physical and mechanical approaches included traps, nets, etc.

- Region: By geography, the vector control market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific.

Top Trends Shaping the Vector Control Market:

1. Rising demand from the emerging economies

- Growing demand for vector control products and services in emerging economies due to rising awareness and healthcare development.

2. Demand for the innovative products

- Rising resistance of vectors to chemical insecticides is driving innovation in alternative control methods.

Vector Control Market: Growth Drivers vs. Challenges:

Drivers:

- Rising incidence of vector-borne diseases: The rising incidence of vector-borne diseases is a significant global health challenge, driving the demand for effective vector control solutions. Vector-borne diseases are illnesses caused by pathogens transmitted to humans and animals through the bites of infected vectors like mosquitoes, ticks, fleas, and sandflies.

Additionally, in 2021, there were an estimated 249,000 global malaria cases, reflecting the persistent burden of the disease worldwide. By 2022, this number increased to 252,000 cases, indicating a slight rise in infections. In 2023, the estimated global malaria cases further climbed to 263,000, highlighting the ongoing challenge of controlling and eliminating this vector-borne disease.

- Population growth and urbanization: This market is expected to grow due to the growing demand for hygiene and disease prevention in commercial and industrial sectors such as hotels, hospitals, food processing and warehouses, manufacturing facilities, offices, markets, and commercial buildings. The growing government regulations requiring commercial and industrial sectors to maintain hygiene and implement measures to take preventive measures for disease prevention are also propelling the market growth.

Challenges:

- Price volatility: The price volatility due to the supply-chain constraint is the serious challenge in the industry.

Vector Control Market Regional Analysis:

- Asia-Pacific: The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region such as ASEAN countries. Asia Pacific is poised to hold a prominent position in the Vector Control Market, particularly due to its the high population density and tropical climate.

- North America: North American market will show constant growth and will account for a considerable share. The vector control market is expected to have a high growth rate driven by factors such as the rising prevalence of vector-borne diseases worldwide, and the high efficiency of chemical-based vector control products.

Vector Control Market: Competitive Landscape:

The market is fragmented, with many notable players including Bayer, Syngenta, Bell Laboratories, Inc., Rentokil Initial plc, FMC Corporation, Ecolab, Terminix International Company, Rollins, Inc, Arrow Exterminators, Inc., and Mitsui Chemicals, among others:

Few strategic developments related to the market:

- Expansion: In July 2024, Co-Diagnostics, Inc., a molecular diagnostics company with a unique, patented platform for the development of molecular diagnostic tests, announced that the use of the company's vector control technology would expand to the 15th U.S. state following an installation in Nevada.

- New Product: In March 2023, VECTRON T500, a new vector control product from Mitsui Chemicals, was prequalified by The World Health Organization (WHO). Mitsui Chemicals Agro, Inc. launched VECTRON T500, a new IRS product containing TENEBENAL. It is the world’s first meta-diamide active ingredient (IRAC Group 30) which has a different mode of action from existing vector control products.

Vector Control Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Vector Control Market Size in 2025 | US$27.775 billion |

| Vector Control Market Size in 2030 | US$36.629 billion |

| Growth Rate | CAGR of 5.69% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Vector Control Market | |

| Customization Scope | Free report customization with purchase |

The Vector Control Market is analyzed into the following segments:

By Vector Type

- Insects

- Rodents

By End User

- Commercial and Industrial

- Residential

By Method of Control

- Chemical

- Physical & Mechanical

- Biological

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Others