Report Overview

Vanilla Bean Market - Highlights

Vanilla Bean Market Size:

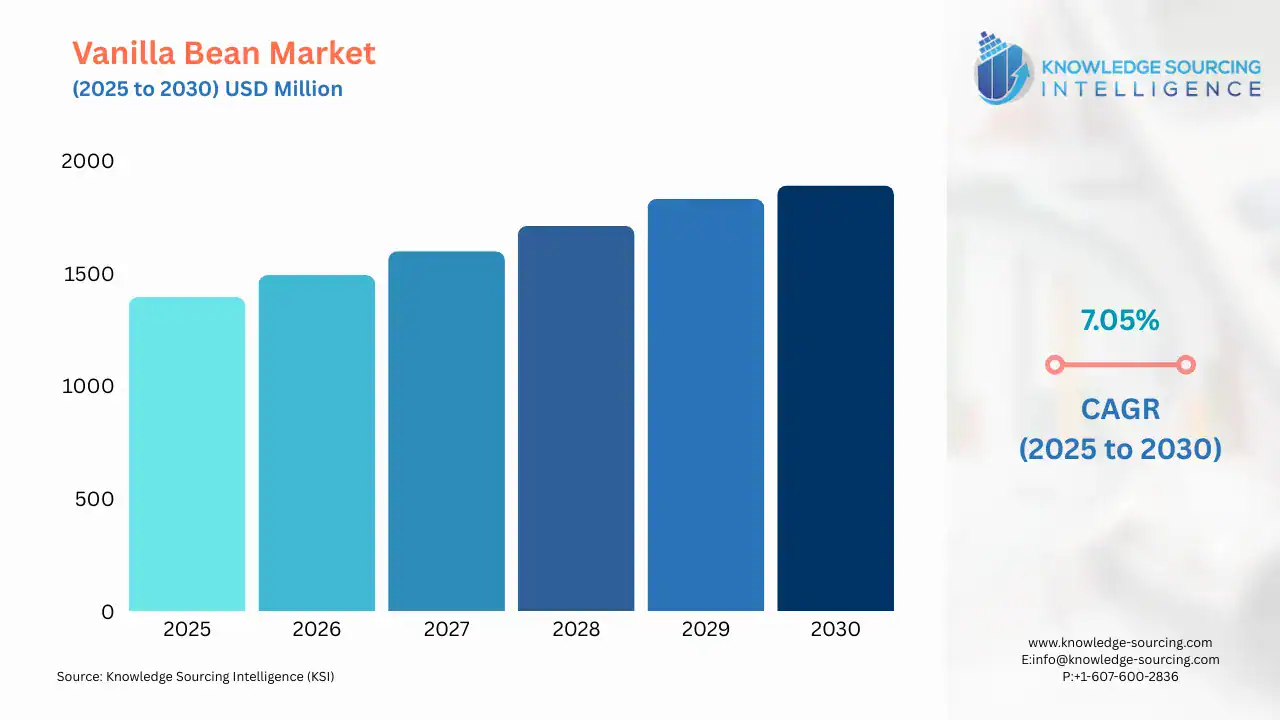

The Vanilla Bean market is projected to grow at a CAGR of 7.05% over the forecast period, increasing from USD 1,394 million in 2025 to USD 1,890.240 million by 2030.

Vanilla Beans are utilized extensively in the food and beverage, cosmetics, and pharmaceutical sectors due to their antioxidants and anti-carcinogenic properties. North America has experienced an increase in demand for vanilla-flavoured food, ice creams, cosmetics, and medications, driving the Vanilla Bean market. The demand for flavoured foods and beverages has been rising along with the population, which will ultimately fuel market expansion.

Further, in the food and beverage industry, vanilla is frequently used as a flavouring ingredient in syrups, jams, and jellies. Vanilla's antibacterial and antioxidant qualities make it a good choice for cleansing and treating skin-related issues.

Moreover, the growing demand for cosmetics and personal care products across the globe is among the major factors propelling the growth of the vanilla bean market. Additionally, the increasing global production and output of the food and beverage processing sector is also expected to boost the market during the forecasted timeline.

Vanilla Bean Market Growth Drivers:

- Increasing global demand for cosmetics and the personal care sector is accelerating the demand for vanilla extract in the global market

The major factor propelling the growth of the global Vanilla Bean market is the increasing application of vanilla in the cosmetics and personal care sector. In the cosmetics and personal care sector, vanilla offers aromatic and soothing properties to the products, enhancing the user experience.

The global cosmetics and personal care sector witnessed major growth, mainly in the North American and European regions. Moreover, the Cosmetic, Toiletry, and Perfumery Association in its report stated that in 2023, the cosmetics sector in Europe witnessed a growth of 9.1%, compared to 7.5% growth in 2022. The agency further stated that in the USA and Europe, the retail sales of the cosmetics industry were recorded at EUR 102 and EUR 96 billion, followed by EUR 59 billion of sales in China, and EUR 24 billion of sales in Brazil.

- The growing use to enhance food flavour is anticipated to increase the market demand

The vanilla bean market has flourished because of its increasing use in food items. For example, vanilla sweeteners are added to fine flavourings for ice cream, confections, bakery, beverages, and dairy goods. Instead, it is used as a flavour enhancer: hot and spicy foods become smoother and mellower in flavour with the addition of vanilla. Foods typically containing vanilla include sweet potato, yam, and butternut squash. It would serve many fruit-flavoured ice creams, baked products, and drinks. The growing trend for consumer awareness of natural and health benefits is pushing market growth.

- Rising consumer demand for clean-label products is also increasing the market demand

With the increasing inclination of consumers towards food that does not contain artificial or chemical ingredients, market expansion is impacting such markets, such as the Vanilla Bean Market. The major use of vanilla in the pharmaceutical industry is due to its antioxidant and anti-carcinogenic characteristics. It improves the overall aroma and texture of food, leading to an increased number of sales of vanilla-flavoured food products. Vomiting is relieved by vanilla, but natural vanillin is extremely costly, over 300 times greater than synthetic vanilla.

Vanilla Bean Market Key Segments:

- By product type, the processed segment is anticipated to grow during the forecast period

The global Vanilla Bean market for the processed segment has increased dramatically due to consumer preference for natural flavourings and clean labels. Known for their aroma as well as cooking uses, Vanilla Beans are largely used in food, beverage, cosmetics, and pharmaceutical end-users. The increasing demand for organic and sustainable foods drives this rise. As customers make an inward shift from artificial flavourings, the business of vanilla has been increasing largely within the premium and artisanal market.

Further, the requirement for processed Vanilla Beans is growing as people are now preferring to have products that are more natural and sustainable. With more innovation using smart alliances and government grants, the present issue the vanilla industry is facing could change into an opportunity in the future. It indicates how the processed Vanilla Bean would become important in a host of other industries and its role in satisfying different changing customer needs.

- By end-user, the food segment is anticipated to grow during the forecast period

The food industry's demand for Vanilla Beans has increased dramatically as a result of many important changes in consumer behaviour and product development. The growing interest in natural ingredients of superior quality has raised vanilla to the very top of a long line of flavouring contenders in all imaginable culinary categories. Vanilla Beans, recognized for their unique flavour profile and aromatic properties, are a crucial ingredient in a plethora of food products, confections and beverages, to baked goods and dairy products. While consumers are concerned about risks posed by synthetic additives, they are gravitating towards organic and clean-label products.

Vanilla happens to be marketed as a high-value natural flavour product, which fits quite well with these two aspects- authenticity and refinement. The increasing popularity of wellness and health has associated itself with vanilla, considering its antioxidant and anti-carcinogenic properties. Moreover, it also has applications in health-conscious formulations of food, pharmaceuticals, and cosmetics, which are very keen on functional benefits, as well as aroma.

Vanilla Bean Market Geographical Outlook:

- North America is witnessing exponential growth during the forecast period

The major factor propelling the growth of the Vanilla Beans market in the USA is the increasing number of processed food and beverage products in the nation.

In the food and beverage sector, Vanilla Beans offer aroma and flavour to the products, enhancing the consumer's experience. The US Department of Agriculture, in its report, stated that in the total GDP of the nation, the agriculture, food, and related sectors contribute about 5.5%, or about US$1.537 trillion annually.

Moreover, the rising consumption of cosmetics and personal care products in the nation is also expected to push the growth of the Vanilla Beans market during the forecasted timeline. In the cosmetics and personal care sector, Vanilla Beans are among the key ingredients across multiple types of products, which offer a soothing and aromatic experience to users.

Vanilla Bean Market Key Launches:

- In April 2024, Takasago announced the official launch of the Takasago International India Fragrance Centre (TIIFC) in Mumbai on April 3, 2024. This new plant establishes a new footprint in this major metropolis, reinforcing our commitment to the rapidly expanding Indian market.

List of Top Vanilla Bean Companies:

- Symrise AG

- Eurovanille

- Takasago International Corp.

- Cooks Vanilla

- Suminter India Organics

Vanilla Bean Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Vanilla Bean Market Size in 2025 | USD 1,394 million |

| Vanilla Bean Market Size in 2030 | USD 1,890.240 million |

| Growth Rate | CAGR of 7.05% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Vanilla Bean Market |

|

| Customization Scope | Free report customization with purchase |

Vanilla Bean Market Segmentation:

- By Product Type

- Raw

- Processed

- Spiced Vanilla Beans

- By Nature

- Organic

- Conventional

- By End-User

- Food

- Beverages

- Cosmetics & Personal Care

- Pharmaceutical

- Nutraceuticals

- Household/Retail

- By Geography