Report Overview

Ultra-Fast EV Batteries Market Highlights

Ultra-Fast EV Batteries Market Size:

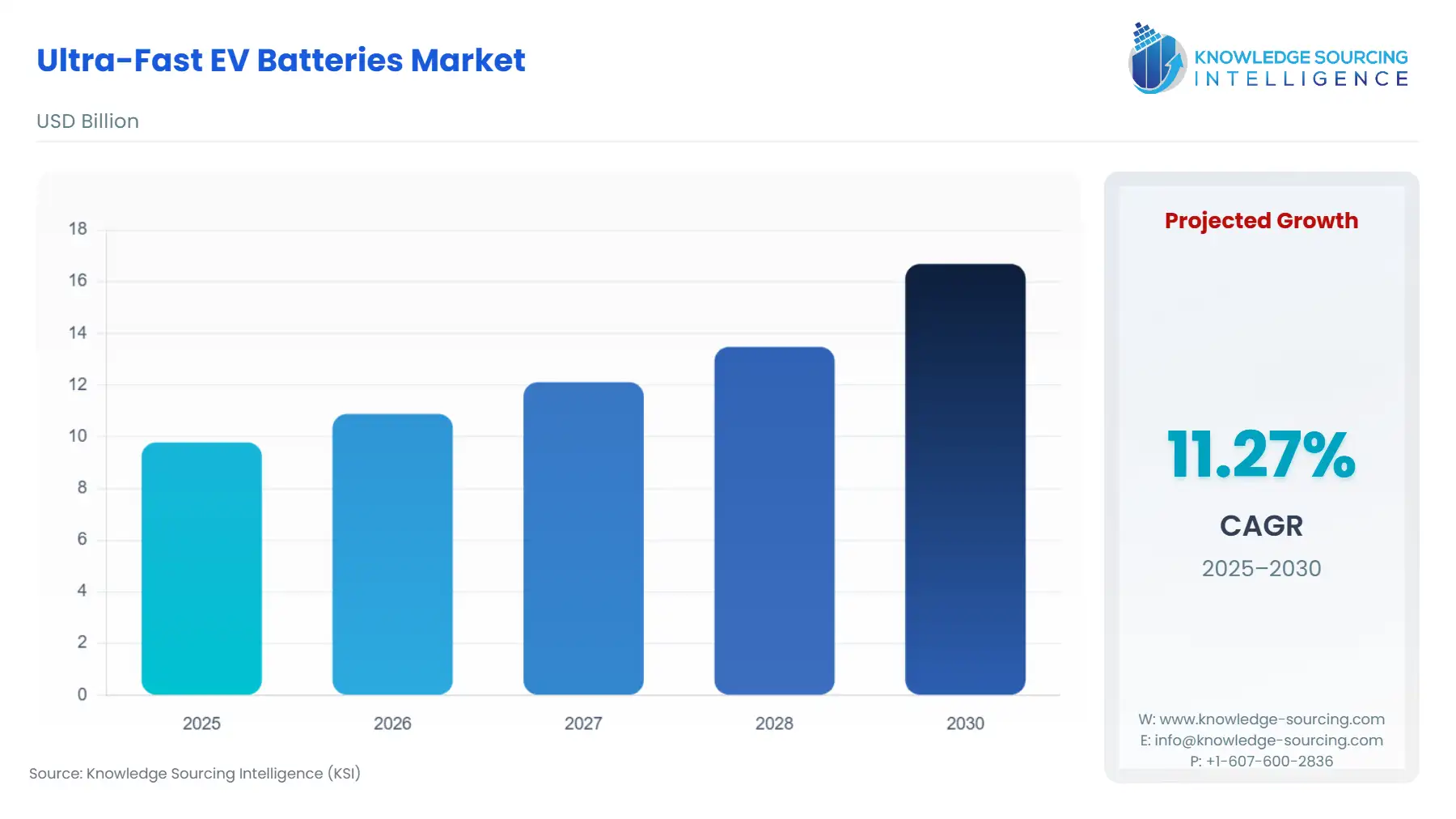

The Ultra-Fast EV batteries market is set to witness robust growth at a CAGR of 11.27% during the forecast period, reaching US$16.692 billion in 2030 from US$9.785 billion in 2025.

Ultra-Fast EV Batteries Market Trends:

The fast-charging electric vehicle (EV) battery industry is evolving due to trends like recent technology breakthroughs, supportive government policies, and rising customer expectations. Solid-state batteries are emerging as the ideal choice because they store more energy than lithium-ion batteries and charge faster while providing better safety protection. Higher-voltage power systems allow for faster charging while protecting battery function. Ultra-fast charging stations are now used as charging network providers, leading to rapid charging. New production methods help reduce battery costs due to modern materials development in ultra-fast charging batteries.

Ultra-Fast EV Batteries Market Growth Drivers:

- Increasing EV sales: The increasing sales of EVs are driving up the demand for ultra-fast EV batteries. As more people purchase these vehicles, they are overcoming range anxiety, leading to a rise in the construction of faster charging systems. By charging EVs quickly, people can manage anxiety better while using these vehicles during daily commutes or long trips. Rapid growth in EV production requires batteries that support quick charging rates. Battery production rose by 40% from 2022 to 750 GWh in 2023 because EV sales grew promptly, as stated by IEA data. In 2023, countries like the US and Europe experienced a strong increase in EV market sales, reaching 40% above their 2022 levels. This growth was followed by China, which achieved 35% growth during the same period.

- Government Policies and Initiatives: More EV buyers are choosing batteries designed for fast charging due to government policies that support electric vehicle use. Governments fund the installation of fast-charging stations to optimize usage of these stations. The increased availability of financial incentives for EV purchases makes them more affordable while also promoting research into quicker battery charging solutions. For instance, UK drivers must switch from gas and diesel to electric cars by 2023, while EU member states plan total conversion by 2035, and President Biden expects 50% of U.S. vehicles to use electric power by 2030.

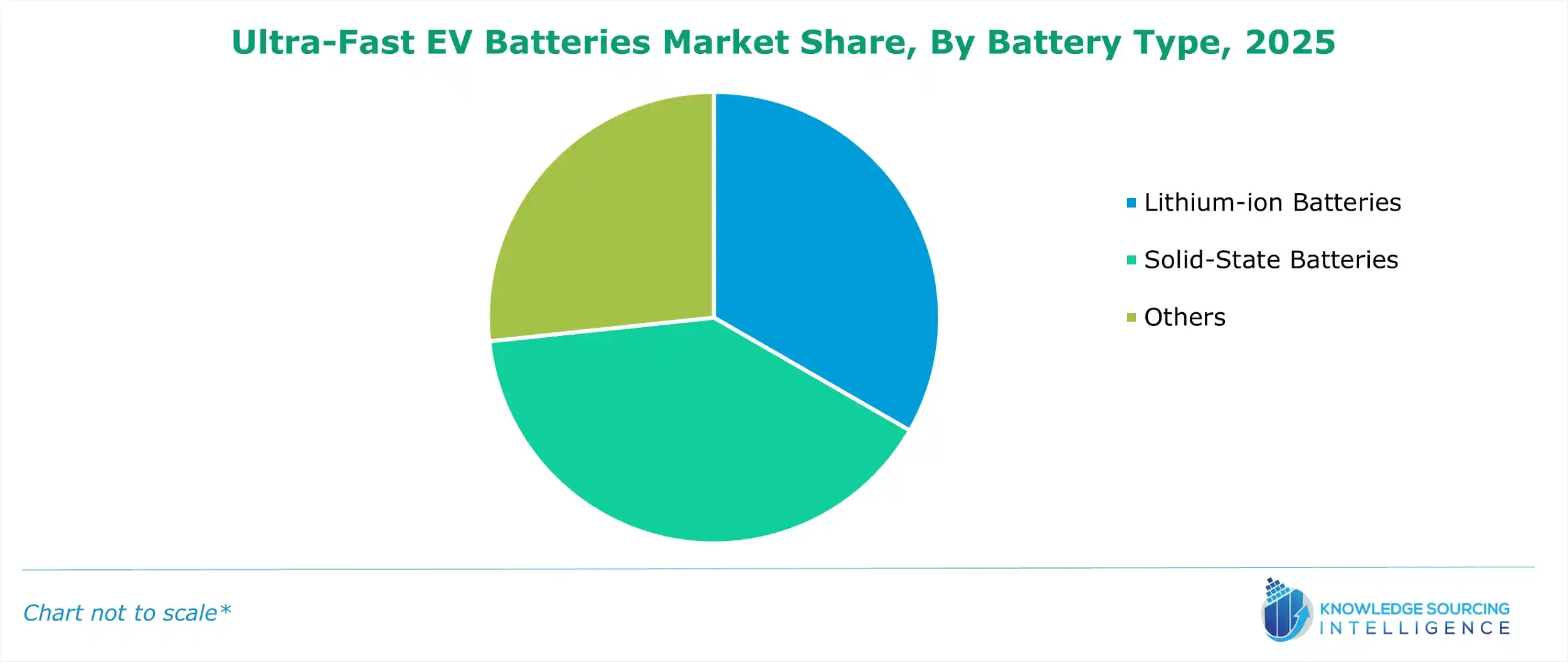

Ultra-Fast EV Batteries Market Segmentation Analysis by Battery Type

- Lithium-ion Batteries: Research and development of lithium-ion batteries with higher energy storage are rising. These batteries speed up charging times and boost vehicle range while working to make batteries stronger and safer for mass electric vehicle adoption.

- Solid-State Batteries: Solid-state batteries produce more energy and power up faster than lithium-ion batteries because their materials are solid. The new battery technology delivers greater security because its solid electrolytes prevent the battery from catching fire. Their operational lifespan is longer than other batteries, allowing owners to save money by replacing them less frequently.

Ultra-Fast EV Batteries Market Segmentation Analysis by Vehicle Type

- Passenger Vehicles: The developing EV market focuses on reducing charging wait times and enhancing charging access so passenger vehicle user adoption matches traditional gasoline vehicle use patterns.

- Commercial Vehicles: Commercial trucks and buses require quick charging to operate their frequent routes while staying operational. This rise in demand also increases the efficiency of commercial vehicles and reduces delays.

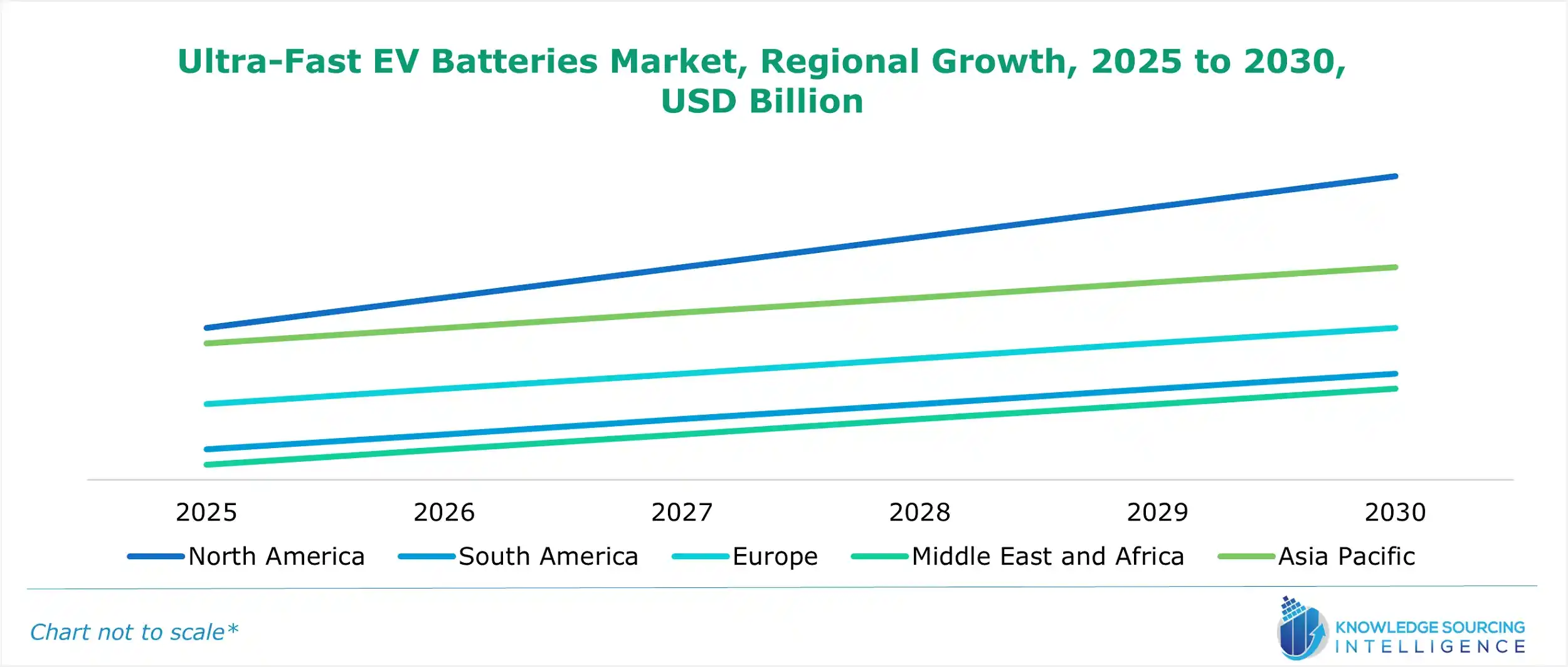

Ultra-Fast EV Batteries Market Geographical Outlook:

The Ultra-Fast EV Batteries Market report analyzes growth factors across the following five regions:

- North America: North America's growth is driven by strong electric mobility, government support, and big battery plant investments. EV battery sales in the United States grew more than 40% over 2023 compared to the previous year.

- South America: South America, especially Brazil, is witnessing a growing preference for EVs as citizens and government authorities work together to make transportation more sustainable.

- Europe: Several European nations are accelerating their electric mobility transition through factory expansions and EV purchase assistance programs. Europe is quickly becoming the main market for EV batteries, consuming 185 GWh of batteries in 2023.

- Middle East and Africa: Despite having fewer EV infrastructure points compared to other regions, the Middle East and Africa show potential growth because of urban expansion and electric energy investments, with an increasing number of EVs in South Africa.

- Asia-Pacific: Asia Pacific countries expand EV batteries through qualified manufacturing and government backing, with China leading production and India investing in domestic production development.

Ultra-Fast EV Batteries Market Competitive Landscape

- Contemporary Amperex Technology Co., Ltd. (CATL)

- Tesla

- Samsung SDI

- BYD Co., Ltd.

- Hitachi Industrial Products, Ltd.

These market players stay dominant with growing R&D work to build better batteries to satisfy growing customer needs. Organizations invest time and resources into developing devices that recharge faster, need less power, and stand up better to daily wear and tear.

Ultra-Fast EV Batteries Market Latest Developments:

- In October 2024, CATL launched the first hybrid vehicle battery, the Freevoy Super Hybrid Battery. This combines industry-leading attributes such as a 400km pure electric range and 4C superfast charging technology. This breakthrough marks a new era for vehicles with high-power ranged EREV and PHEV solutions.

- In October 2024, Samsung SDI presented its entire battery collection, spanning solid-state and cylindrical 46-phi models and LFP+ products. The LFP+ battery with updated cells supports wider commercial vehicle use by boosting energy density by more than 10% and delivering 5,000 charge cycles plus fast charging functions.

Ultra-Fast EV Batteries Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Ultra-Fast EV Batteries Market Size in 2025 | US$9.785 billion |

| Ultra-Fast EV Batteries Market Size in 2030 | US$16.692 billion |

| Growth Rate | CAGR of 11.27% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Ultra-Fast EV Batteries Market |

|

| Customization Scope | Free report customization with purchase |

Ultra-Fast EV Batteries Market Segmentation:

- By Battery Type

- Lithium-ion Batteries

- Solid-State Batteries

- Others

- By Vehicle Type

- By Propulsion Type

- Battery Electric Vehicles (BEV)

- Hybrid Electric Vehicles (HEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Australia

- Others

- North America