Report Overview

UK Electric Vehicle Charging Highlights

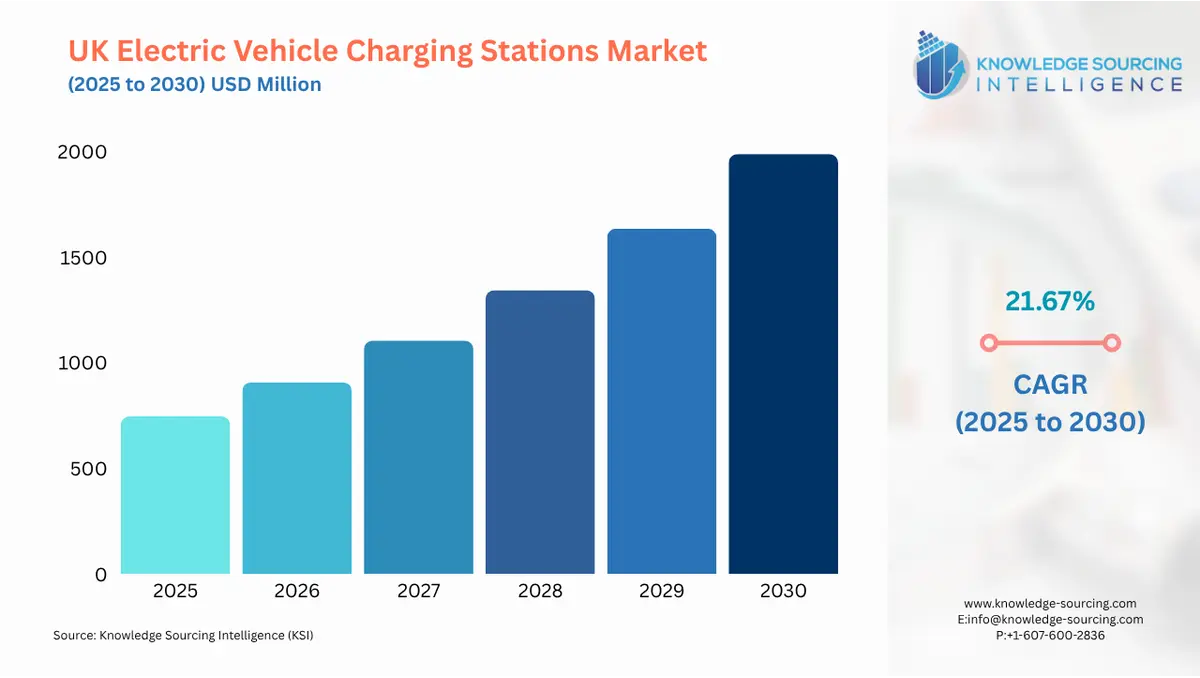

UK Electric Vehicle Charging Stations Market Size:

The United Kingdom electric vehicle charging stations market is projected to expand at a CAGR of 21.67% over the forecast period, increasing from US$745.871 million in 2025 to US$1,988.755 million by 2030.

The UK Electric Vehicle (EV) Charging Stations Market is experiencing a rapid maturation cycle, transitioning from a nascent infrastructure build-out to a service-driven, highly regulated utility. This pivot is necessitated by the substantial growth in the pure-electric vehicle parc, which reached over 1.36 million units by the end of 2024, an approximately 39% increase from the previous year. The market’s current phase is characterized by a dual focus: expanding high-speed en-route charging to support long-distance travel and densifying lower-power destination and on-street charging to serve the over 50% of EV drivers who rely on the public network monthly.

UK Electric Vehicle Charging Stations Market Analysis

- Growth Drivers

The implementation of the Zero Emission Vehicle (ZEV) Mandate creates a direct, non-cyclical demand floor for charging infrastructure. By establishing a legally binding trajectory for manufacturers to sell a rising percentage of zero-emission vehicles, the mandate guarantees a sustained surge in the number of vehicles requiring public and private charging access. This directly propels the need for new charging stations to maintain a viable vehicle-to-charger ratio and ensures consistent CapEx spending from Charge Point Operators (CPOs) to avert future infrastructure bottlenecks.

A second critical driver is the exponential growth of the ultra-rapid segment. With 84% growth in 150kW+ installations in 2024, the market is responding to consumer demand for minimal downtime. This technological shift directly increases the need for high-power DC charging stations at strategic 'en-route' and 'destination' locations, such as motorway service areas and retail parks, fundamentally changing the charging mix and raising the power rating requirements for new deployments.

- Challenges and Opportunities

A significant challenge remains the pronounced regional disparity in charging provision. As of July 2024, London's public device density stood at 233.6 per 100,000 population, vastly exceeding that of Northern Ireland at 32 per 100,000. This geographical imbalance constrains EV uptake outside of highly provisioned areas, thereby dampening expansion for new infrastructure in underserved regions until government or private investment de-risks deployment.

The prime opportunity lies in the residential and workplace segments, particularly for those without off-street parking. While 80% of UK EV drivers charge at home, the growing number of urban residents relying on on-street charging (which accounts for 37% of all devices) and the demand for workplace charging present a substantial growth avenue for AC charging solutions. The development of seamless, low-power charging solutions for residential streets directly increases EV accessibility, converting potential buyers into active users and thus expanding the total addressable market for charging services.

- Raw Material and Pricing Analysis

The EV charging station market constitutes a physical product, primarily comprising power electronics, wiring harnesses, and structural enclosures. The pricing dynamics are heavily influenced by the raw material costs for essential components. Copper remains a crucial commodity for high-voltage cables and connectors due to its conductivity, making its volatile price a direct factor in the Bill of Materials (BoM) for both AC and high-power DC units. Similarly, the structural components rely on steel and aluminum for robustness, with price fluctuations in these base metals impacting the final hardware cost. The increasing power ratings of DC chargers necessitate more sophisticated cooling systems, typically relying on aluminum heat sinks, further linking material prices to end-product cost.

- Supply Chain Analysis

The global supply chain for UK EV charging hardware is critically dependent on East Asian manufacturing hubs for power electronics and semiconductor components, which form the core of the charging station's intelligence and power conversion capabilities. Logistical complexities stem from the specialized nature of high-power components, which are subject to stringent safety and quality standards (e.g., CE marking). A key dependency exists on the stable supply of specialized copper alloys and high-performance polymers for weatherproof enclosures and internal circuitry, leading to a degree of reliance on a limited number of high-capacity global suppliers. The logistical challenge involves transporting these bulky and sensitive electronic systems to UK deployment sites, a process that requires specialized handling and installation expertise.

UK Electric Vehicle Charging Stations Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United Kingdom |

The Public Charge Point Regulations 2023 |

Mandates 99% average annual reliability for all rapid chargers (50kW+), requires contactless payment on all new public chargers 8kW+ and existing 50kW+ chargers from November 2024. This immediately elevates CapEx for CPOs by enforcing investment in remote monitoring, proactive maintenance, and payment hardware upgrades, directly increasing demand for advanced network management software and robust, reliable charging hardware. |

|

United Kingdom |

Zero Emission Vehicle (ZEV) Mandate |

Sets minimum ZEV sales targets for manufacturers, starting at 22% in 2024 and rising to 28% in 2025. This creates an enforced supply of EVs into the market, ensuring a perpetual increase in the national EV parc and establishing a mandatory, high-growth environment for charging service demand. |

|

United Kingdom |

PAS 1899:2022 (Accessible chargepoint standard) |

Provides guidance on accessibility and inclusivity for public charging infrastructure, focusing on ground surface, height, and space requirements. While voluntary, it drives demand for specifically designed hardware and site layouts that accommodate diverse user needs, influencing tender specifications for public contracts and promoting best practice in civil engineering. |

UK Electric Vehicle Charging Stations Market Segment Analysis:

- By Propulsion Type: DC Charging Station

The imperative to minimize charging time for high-mileage users, commercial fleets, and drivers on long journeys drives the necessity for DC charging stations. The structural growth of the pure-electric Commercial Vehicle segment, requiring high daily energy throughput and rapid turnarounds, significantly drives demand for DC ultra-rapid hubs (150kW+ and above). This necessity is intrinsically linked to two factors: the increasing battery capacity of modern EVs, which necessitates higher power delivery to remain efficient, and the premium placed on driver convenience and asset utilization. The commercial imperative of fleet operators, who calculate the cost of downtime, makes DC charging an unavoidable requirement for the economic viability of electric logistics and taxi services, translating directly into procurement of high-power hardware and subsequent network rollout. Furthermore, the concentration of these devices at en-route and strategic destination locations (e.g., retail parks, logistics depots) reinforces their role in monetizing driver dwell time, ensuring CPOs prioritize DC expansion over lower-power AC alternatives in commercially attractive areas.

- By Ownership Type: Private - Workplace

The necessity within the Private - Workplace segment is fundamentally driven by employer-led environmental, social, and governance (ESG) mandates and the commercial need to attract and retain talent in the new electric mobility ecosystem. Corporate fleet electrification, often mandated by internal sustainability targets, requires the installation of dedicated charging infrastructure for employee and company vehicles, creating a predictable, high-volume demand stream for both mid-speed AC and depot-based DC solutions. The primary driver is not the public utilization rate but the private operational requirement for guaranteed access and energy management. Smart charging solutions are in high demand within this segment, as they allow businesses to implement load balancing and time-of-use tariffs to optimize electricity consumption and mitigate the need for costly grid upgrades, directly connecting the demand for charging hardware with sophisticated back-office software and energy management services. The continuation of government grants and tax incentives for workplace charging further catalyzes this requirement, reducing the risk of the initial capital outlay for employers.

UK Electric Vehicle Charging Stations Market Competitive Analysis:

The UK market is fragmented, comprising energy majors, specialist CPOs, and Original Equipment Manufacturer (OEM) networks, creating an intensely competitive landscape defined by rapid infrastructure deployment and the drive for operational reliability. Competition has shifted from mere charger counts to network quality, focusing on uptime, payment simplicity, and power-delivery consistency.

- BP Pulse

BP Pulse maintains a significant market presence, underpinned by its strategic integration with BP's extensive retail fuel station network. The company’s strategic positioning leverages high-traffic, en-route locations, directly addressing the critical long-distance charging need. Their key product, the 150kW and 300kW ultra-fast chargers, is central to their strategy of establishing high-throughput charging hubs (Gigahubs), securing their position as a dominant player in the rapid charging segment and creating a reliable alternative to traditional fuel stops.

- Shell Recharge

Shell Recharge capitalizes on its global energy major parentage and a focus on integrating charging into existing retail and convenience operations. Their strategy involves both high-speed motorway hubs and destination charging, often in partnership with major retailers. The company is strategically focused on seamless digital integration and customer experience, which directly supports their brand premium by delivering a reliable and technologically advanced charging process for both long-haul and daily charging needs.

Recent Market Developments

- September 2025: BP Pulse and Moto Collaboration

BP Pulse announced a collaboration with motorway service area operator Moto to accelerate the transition for UK freight and logistics. The plan involves installing six pull-through bays equipped with Megawatt Charging System (MCS) chargers at each site, compatible with both CCS and MCS standards. This capacity addition directly targets the nascent, high-energy-demand heavy-goods vehicle (HGV) segment, creating new infrastructure supply that anticipates and supports the inevitable electrification of logistics fleets.

- July 2025: Tesla Q2 Global Supercharger Expansion

Tesla's Q2 2025 financial report confirmed the company had installed a net increase of 2,912 Supercharging connectors globally. This expansion, coupled with the ongoing opening of the Supercharger network to non-Tesla vehicles via the CCS standard, significantly increases the supply of high-quality, high-speed charging capacity available to the entire UK EV parc. This strategic move directly intensifies competition in the ultra-rapid segment, pressuring other CPOs on reliability and pricing.

UK Electric Vehicle Charging Stations Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 745.871 million |

| Total Market Size in 2031 | USD 1,988.755 million |

| Growth Rate | 21.67% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Vehicle Type, Propulsion Type, Ownership Type |

| Companies |

|

UK Electric Vehicle Charging Stations Market Segmentation:

BY VEHICLE TYPE

- Passenger Vehicle

- Commercial Vehicle

- Others

BY PROPULSION TYPE

- AC Charging Station

- DC Charging Station

BY OWNERSHIP TYPE

- Public

- Private

- Residential

- Workplace