Report Overview

Thin Film Encapsulation Market Highlights

Thin Film Encapsulation Market Size:

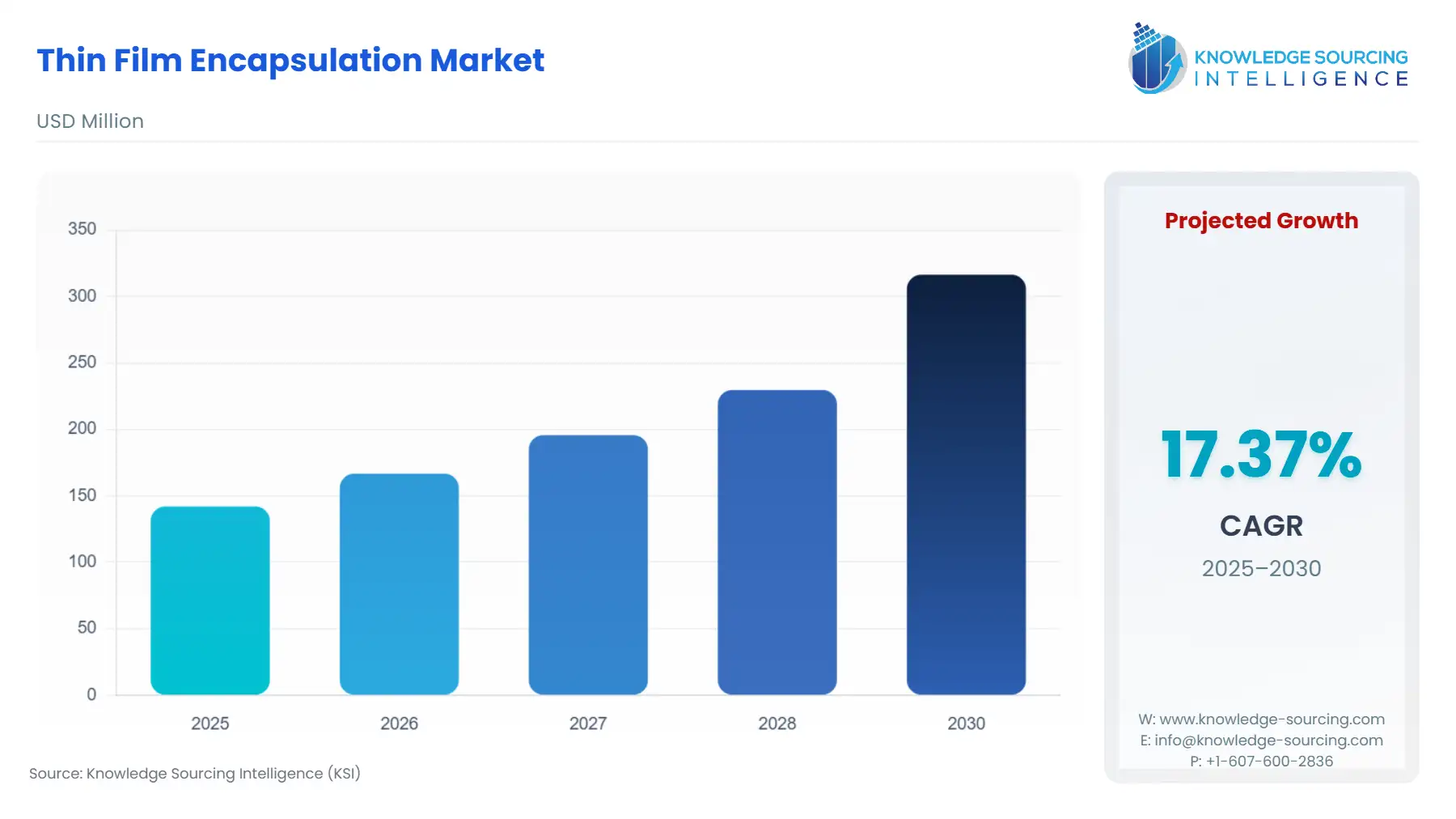

Thin Film Encapsulation Market is expected to grow at a 17.37% CAGR, achieving USD 316.504 million by 2030 from USD 142.082 million in 2025.

The term "thin-film encapsulation" refers to a method that guarantees the defence of flexible electronics against water, moisture, and other polluted elements. Usually, it is deposited through both an organic and an inorganic layer. Costs are decreased as a consequence, while flexibility and capacity are increased. TFE can swap out the front glass layer for an OLED device's thin-film barrier. When exposed to different external elements like water and air, OLED material is particularly prone to deterioration. The barrier layer for this technology must have minimal water and oxygen permeability, be deposited at a low temperature, and endure for the whole shelf life of the OLED device. The Thin-Film Encapsulation (TFE) Market has benefited from rising investments and technical advancements.

One of the key reasons propelling the growth of the thin-film encapsulation market is the rising need for thin-film barriers in flexible and organic devices throughout the world. Due to massive investments made in the roll-to-roll production of OLED lighting and the construction of OLED business facilities, the market is growing at an accelerated rate.

Moreover, the market for thin-film encapsulation is favourably impacted by the existence of strict passenger safety laws, the trend towards digitalized production, rising urbanisation, and technological advancements. Additionally, throughout the projection period, market participants will have lucrative prospects due to the growing demand for thin, high-efficiency solar cells and the significant investments made in OLED production plants and technologies.

Thin Film Encapsulation Market Growth Drivers:

- Sector for Flexible OLED Displays to Control Most Market Share

Shortly, the most cutting-edge display technology for consumers and industry will be the flexible organic light-emitting diode (OLED). AMOLED (active-matrix organic light-emitting diode) is evolving into OLED TV (television), mobile devices, and smartwatches are poised to enter consumer markets shortly due to their excellent display quality, which includes perfect video capability, vivid full colour, and thin form factor. The durability and adaptability of AMOLED on flexible substrates make it the ideal display. Realizing flexible AMOLED is difficult, especially on plastic substrates. TFE is the most challenging assignment among these challenges since OLED requires the highest level of protection against moisture and oxygen penetration in electrical devices.

- Organic layer deposition will retain a bigger market share for thin-film encapsulation (TFE).

As organic layer deposition is essential in protecting OLED panels from humidity and oxygen content, the TFE market for organic layer deposition is anticipated to have the largest share over the projected period. Planarizing the top layer, also makes the structure more flexible, which raises the calibre of the second inorganic layer. Equipment for TFE inkjet printing is produced by Kateeva. The business has developed several novel inkjet printing products. For instance, it introduced YIELDjet FLEX, which uses its ink-jet technology to make flexible OLED thin films.

Thin Film Encapsulation Market Geographical Outlook:

- Asia Pacific is projected to be the prominent market shareholder in the global thin film encapsulation market and is anticipated to continue throughout the forecast period.

The thin-film encapsulation market is predicted to be dominated by Asia-Pacific. The expansion of the regional market is correlated with the development of the electronics and semiconductor sectors, particularly in China. Demand for thin film encapsulation technologies increased as a result of the established electronics manufacturing hubs in South Korea, China, and Taiwan.

Also, compared to national averages for all the combined sectors, the electronics manufacturing area is more receptive to FDI in a region with tight regulatory rules on FDI across industries. A favourable market environment is anticipated to be created for the thin film encapsulation sector as a result of government policies, particularly those that have been implemented recently to assist the establishment of the region's dynamic electronics industry. For instance, the Indian government introduced a PLI programme of INR 76,000 crore in 2021 to support the nation's semiconductor and display manufacturing sector.

Thin Film Encapsulation Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 142.082 million |

| Total Market Size in 2031 | USD 316.504 million |

| Growth Rate | 17.37% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Technology, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Thin Film Encapsulation Market Segmentation:

- THIN FILM ENCAPSULATION MARKET BY TECHNOLOGY

- Atomic Layer Deposition

- Plasma-enhanced Chemical Vapor Deposition

- Vacuum Thermal Evaporation

- Inkjet Process

- Others

- THIN FILM ENCAPSULATION MARKET BY APPLICATION

- Flexible OLED

- Thin-film Photovoltaics

- Others

- THIN FILM ENCAPSULATION MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America