Report Overview

Swarm Intelligence Market - Highlights

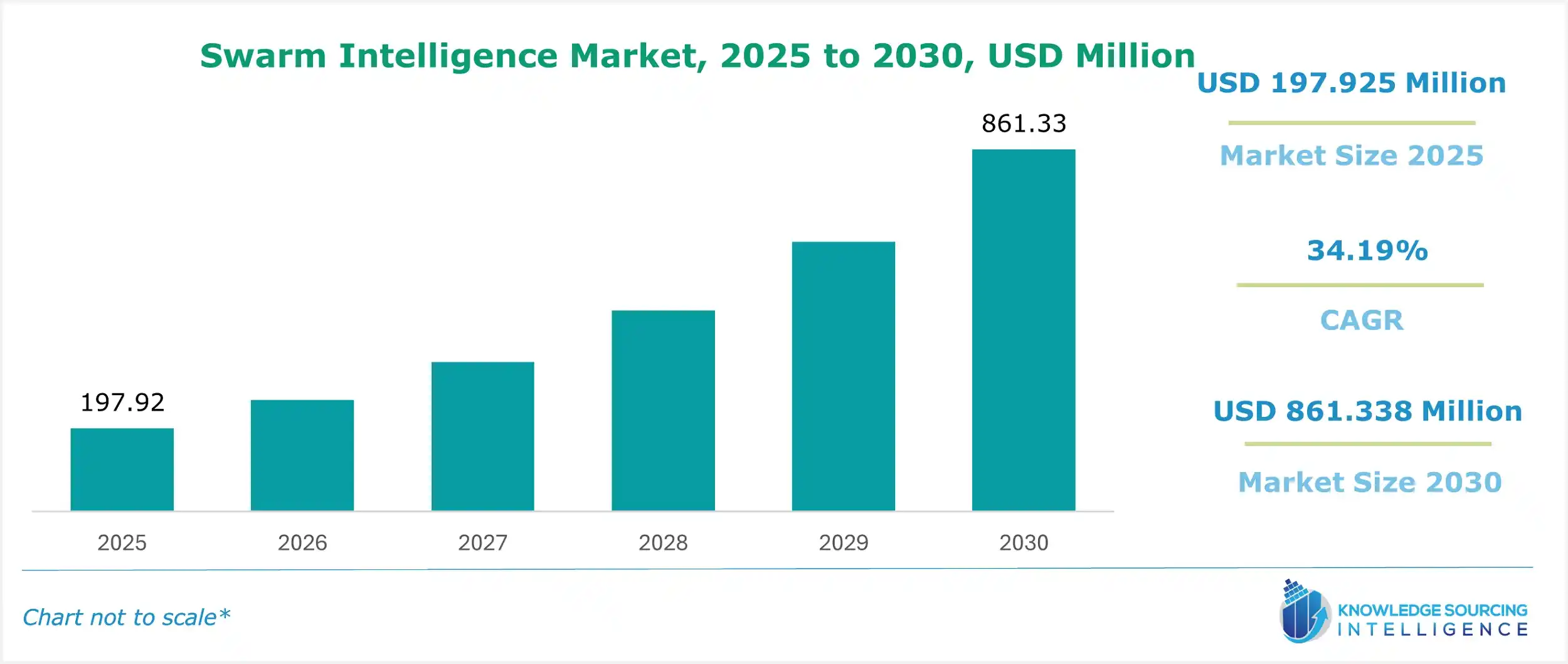

Swarm Intelligence Market Size:

The swarm intelligence market is expected to grow at a compound annual growth rate of 34.19% over the forecast period to reach a market size of US$861.338 million in 2030, from US$197.925 million in 2025.

Swarm intelligence is an artificial intelligence (AI) inspired by the behavioral models of insects like bees, ants, wasps, etc. The technology consists of many individuals collaborating on a platform to achieve a common goal that, on a large scale, improves human group decisions and helps in forecasting events. Swarm intelligence is being widely used to solve big data problems, and drone technology is used in defense and the military. Besides that, swarm intelligence is also being widely used in robotics, which usually consists of agents like radar, sonar, and cameras that help in collecting data and information. Its application in transportation and logistics has also increased over the years, which is expected to drive its growth further.

The swarm intelligence market is experiencing rapid growth due to the rising demand for innovative solutions and advancements in artificial intelligence (AI), robotics, and computing power. This technology is increasingly being adopted across various industries, including military and defense, agriculture, logistics, healthcare, and finance.

Applications of swarm intelligence include swarm-based drones, autonomous systems, precision farming, efficient route planning, personalized medicine, portfolio optimization, and risk management, among others.

Swarm Intelligence Market Growth Drivers:

- Increasing demand for unmanned aerial vehicles is expected to fuel the swarm intelligence market.

The popularity and demand for unmanned aerial vehicles (UAVs) have witnessed significant growth over the years, which is considered a major driver for swarm intelligence adoption in the coming years. An unmanned aerial vehicle or drone is an aircraft-shaped device without any human or crew that uses swarm algorithms to perform in a more advanced fashion to search for an affixed target or resource. Swarm intelligence applied with UAVs performs better than simple scanning algorithms. For instance, the HL-150 drone powered by swarm intelligence will be available in India in about two years and will be able to transport around 150 kilograms of cargo to a distance of 150 km. This is expected to be India’s first ‘heavy lift’ drone that can transform and redefine e-commerce delivery.

Swarm Intelligence drones are highly used in the defense and military sector, and their high efficiency and accuracy are expected to drive the market growth further in the coming years. For instance, many governments made swarm intelligence project announcements, including Spanish RAPAZ, the French Icarus project, the U.K. Blue Bear Swarm, and Russian Lighting, which are expected to play a key role in the defense and security of the nations. Unlike natural swarms, drone swarms can perform different tasks together, including specialized tasks like attackers, communicators, sensors, and decoys.

In addition to this, in February 2024, Aertec, a Spanish aerospace and defense technologic firm, developed three TARSIS RPAS systems for the Ministry of Defense of Spain. The TARISIS-ISTAR is a high-end, tactical, compact class I UAS, which allows multiple combinations and is designed for demanding operational environments. The systems integrated new functionalities and payloads developed by the General Directorate of Armament and Material.

Besides that, the increasing use of swarm intelligence in robotics is also considered a major driving factor for the market. For instance, Russia’s new project, “Marker,” is an unmanned ground vehicle armed with machine guns and anti-tank missiles that can be used for military purposes but is also expected to participate in scientific research projects on the moon and other planets.

Swarm Intelligence Market Restraints:

- Data privacy and lack of technical expertise are major concerns that could hinder the swarm intelligence market growth.

The swarm intelligence market faces several challenges, such as different countries of the world, and the area lacking technical expertise could restrict their growth in those regions. In addition, data privacy concerns related to technology are also major barriers to its development owing to its high vulnerability to cyber-attacks in the coming years. According to IBM's report, the worldwide average cost of a data breach would be USD 4.88 million in 2024. High initial investments in intelligence and extremely expensive research can hinder this market’s growth.

Swarm Intelligence Market Geographical Outlook:

- North America is expected to dominate the swarm intelligence market.

North America is expected to dominate the swarm intelligence market due to its major technology companies focusing on research and development of AI and robotics. North America is a key hub for advances in swarm intelligence, driven by substantial investments in AI, robotics, and related fields that enhance the development of swarm intelligence technologies.

Moreover, the growing investments in the US military will contribute to increasing the demand in areas of swarm intelligence primarily directed toward developing drone swarms and autonomous systems. For instance, as per the Stockholm International Peace Research Institute (SIPRI), the U.S. defense spending in 2023 accounted for about 40 percent of global military spending with a $55 billion increase from 2022 to 2023, surpassing the defense spending of the top nine countries combined.

Further, leading American technology firms like Google, Amazon, and Microsoft are delving into swarm intelligence research and development. Despite this, the big-time investors in swarm intelligence, especially in drone swarms and autonomous systems, remain in the US military. However, it is also seen in agriculture, logistics, and health settings, proving that the North American swarm intelligence market is a potential region for continued expansion.

Swarm Intelligence Market Key Developments:

- October 2024- The ANTS 2024 conference took place in Konstanz, Germany, from 9-11 October 2024, on swarm intelligence with showcased algorithms and methods used to solve complex problems across many domains. The event allowed researchers to present their latest research and discuss advancements in swarm intelligence with their applications.

- January 2024- German research institutions utilized the "Swarming AI" application in analyzing place-distributed data of COVID-19 patients. It is a three-year initiative in partnership with DZNE and financed by the Volkswagen Foundation. The 'Swarm Learning technology analyzes distributed data compliant with the current data protection regulations. This initiative would establish an international research network and infrastructure to improve the response to the pandemic development with researchers in scientific ethics. The outcome of this project would be a better understanding of COVID-19.

Swarm Intelligence Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Swarm Intelligence Market Size in 2025 | US$197.925 million |

| Swarm Intelligence Market Size in 2030 | US$861.338 million |

| Growth Rate | CAGR of 34.19% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Swarm Intelligence Market |

|

| Customization Scope | Free report customization with purchase |

Swarm Intelligence Market Segmentation:

- By End Users

- Transportation

- Telecommunication

- Robotics

- Construction Management

- Military

- Others

- By Capability

- Optimization

- Routing

- Staff Scheduling

- Clustering

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Australia

- Others

- North America

Our Best-Performing Industry Reports:

- Artificial Intelligence Engineering Market

- Artificial Intelligence (AI) In Social Media Market

- Adaptive AI Market