Report Overview

Surgical Mask Market - Highlights

Surgical Mask Market Size:

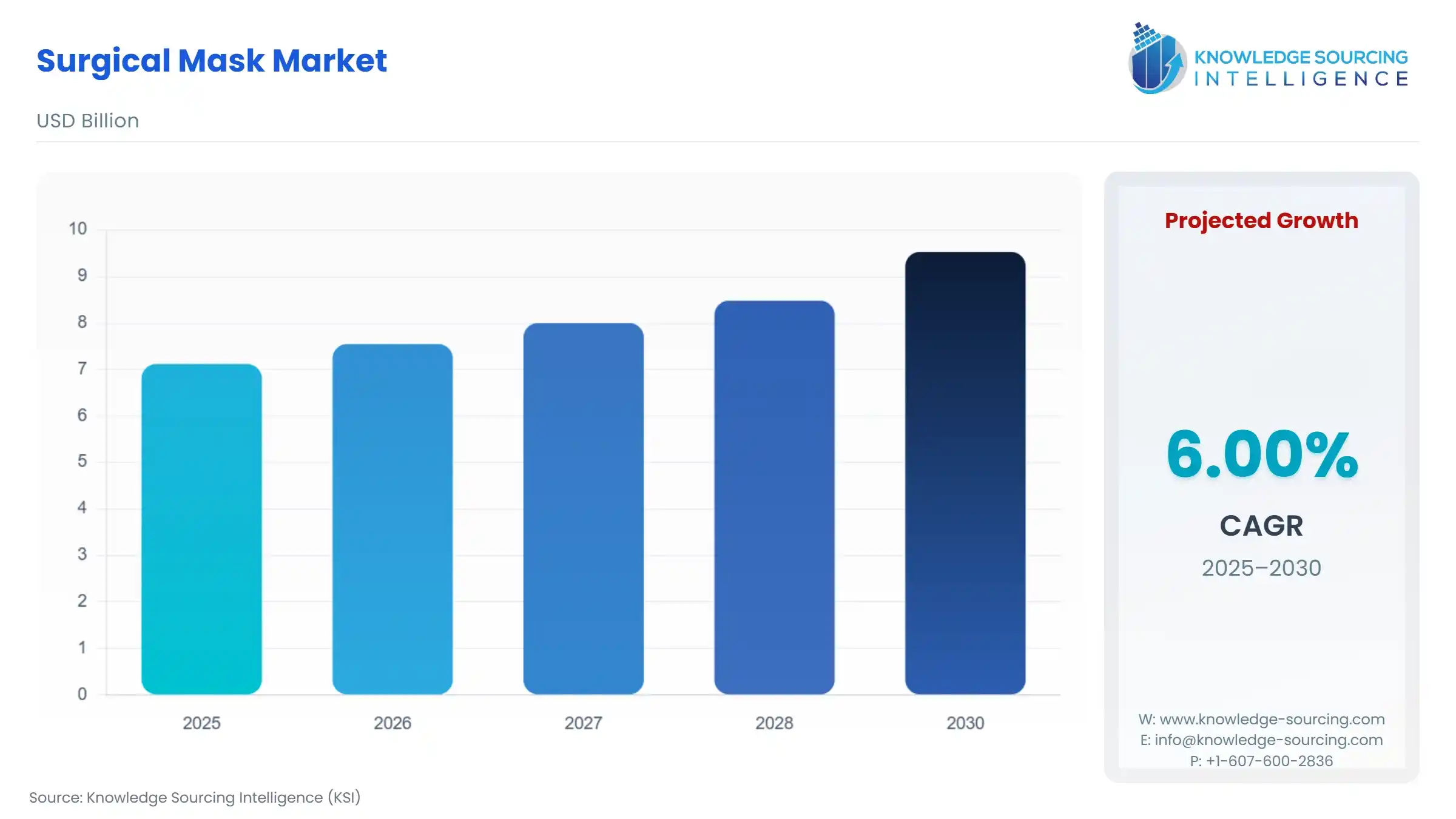

The Surgical Mask Market is expected to grow from USD 7.120 billion in 2025 to USD 9.530 billion in 2030, at a CAGR of 6.00%.

Healthcare workers who perform surgery or provide nursing care must wear surgical masks to avoid the spread of pathogens or viruses. The need for surgical masks will be further increased by the rising number of surgeries brought on by the rising number of injury cases and the ageing population.

Surgical Mask Market Growth Drivers:

- Favourable government initiatives

Growing government initiatives in support of the healthcare sector around the world are propelling the market's expansion over the projection period. In countries like Saudi Arabia and the UAE, where medical tourism is growing exponentially, with the increasing investment by both public and private players coupled with favourable government policies, It is projected that the demand for surgical masks would expand significantly. The country’s Vision 2030 programme also focuses on healthcare, under which the government is diverting its funds towards the development of new hospitals and robust healthcare infrastructure. Furthermore, the UAE’s cutting-edge healthcare infrastructure and the ease of obtaining a visa for medical treatment in Dubai are attracting people from all over the world who want high-quality healthcare at a lower cost.

- The rising popularity of cosmetic surgeries

The market’s growth is also being contributed to by the rising popularity of cosmetic surgeries in many parts of the world. For instance, according to data from the International Society of Plastic Surgery (ISAPS), the total number of face and head aesthetic procedures stood at 311,571 in 2015. In the same year, the total number of breast procedures for aesthetics reached 74,876 and the number of other cosmetic surgical procedures also witnessed healthy growth. Increasing Healthcare Expenditures per person in emerging nations Data from the Organization for Economic Co-operation and Development show that by the end of 2018, Mexico's per capita healthcare spending had climbed from 907 USD in 2009 to about 1338 USD. Both public and private players are investing heavily in developing countries to cater to the growing demand for surgical masks on account of growing surgical processes and increasing health awareness.

- A growing ageing population

One of the main factors driving the market's growth over the forecast period is anticipated to be the rising elderly population in several regions of the world. For instance, ageing is one of the causes contributing to China's rising surgery rate is the country's booming population. Based only on China's rising senior population, the WHO forecasts a 50% increase in yearly cardiovascular disease occurrences between 2010 and 2030. Rising disposable income is encouraging people to demand better quality healthcare solutions for which they are willing to pay high premiums. The amount of surgical operations in this country is likewise rising along with the need for private health insurance. However, the majority of Japanese people continue to live healthy lifestyles, which limits the occurrence of complex diseases among them.

Surgical Mask Market Geographical Outlook:

- A sizeable portion of the market is controlled by North America.

The surgical mask market in North America, South America, Europe, the Middle East, Africa, and Asia-Pacific. Due to growing health consciousness and strong healthcare standards in nations like the United States and Canada in the area, the North American surgical mask market is predicted to hold a sizable position in 2019 and grow quickly. The largest pharmaceutical businesses in the world are also based in this region, and because of the high expectations of healthcare workers in North America and Europe for their personal hygiene, market growth in these regions is expected to be significant. The Asia-Pacific region is also expected to provide good growth opportunities due to Japan’s growing geriatric population and China’s increasing prevalence of severe conditions such as cancer and strokes among others.

Surgical Mask Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 7.120 billion |

| Total Market Size in 2030 | USD 9.530 billion |

| Forecast Unit | USD Billion |

| Growth Rate | 6.00% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Product, Material or Layer Composition, Distribution Channel, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Surgical Mask Market Segmentation:

- By Product

- Level 1 Surgical Mask

- Level 2 surgical Mask

- Level 3 Surgical Mask

- Surgical N95 Respirator

- Antimicrobial/Antiviral Surgical Mask

- Specialty Masks

- By Material or Layer Composition

- 2-ply

- 3-ply

- 4-ply and above

- By Distribution Channel

- Online Retail

- Offline

- Hospital and Healthcare Facility Procurement

- Pharmacy Chains

- Medical Supply Distributors

- By End-User

- Hospitals & Surgical Centers

- Dental Clinics

- Consumers

- Industries

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Spain

- Italy

- Others

- Middle East and Africa

- UAE

- Saudi Arabia

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Thailand

- Indonesia

- Taiwan

- Others

- North America