Report Overview

Surgical Blades Market - Highlights

Surgical Blades Market Size:

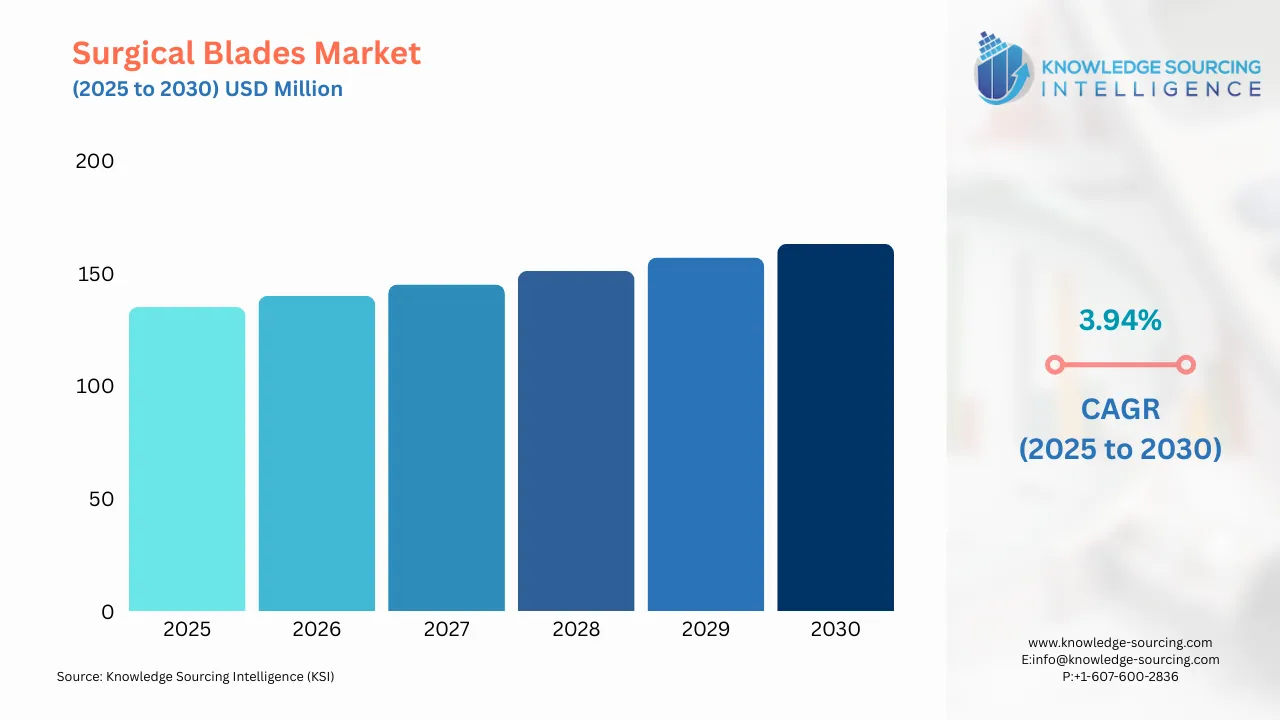

The global surgical blade market is projected to grow at a CAGR of 3.94%, from US$134.654 million in 2025 to US$163.353 million in 2030.

The surgical blade market is projected to grow in the forecast period with the growing number of surgical procedures globally, escalating cosmetic surgeries, and rising health expenditures. The increasing number of Centers of Excellence (CoE) worldwide for disease management is fueling market growth in the forecast period.

The global aging population requires improved and focused healthcare activities to treat their chronic diseases due to their old age. This will further boost the market growth in the forecast period for specific treatment surgeries. Furthermore, cardiovascular diseases worldwide will positively impact the market's growth.

The prevalence of organ donation and transplantation activities worldwide further strengthens the growth prospects of global surgical blades in the forecast period, bolstering the market growth over the next five years. Additionally, the growing adoption of minimally invasive surgeries worldwide allows the market to flourish in the forecast period. However, stringent government regulations will moderately hamper market expansion in the forecast period.

Geographically. North America and Europe are projected to hold a significant market share, followed by the Asia Pacific region's growth at a high CAGR during the forecast period.

Surgical Blades Market Growth Drivers:

- The increasing number of surgical procedures worldwide

The growing number of surgeries worldwide propels the market growth in the forecast period. For example, in the United Kingdom, the market is poised to grow in the forecast period as surgeries here are considered to be the most critical treatment offered by the National Health Service in secondary care within the country. This is further supported by the growing number of surgeons, especially women surgeons, contributing to market growth in the forecast period.

Additionally, with the growing number of people aged 65 years and above in the United Kingdom, the number of age-associated diseases, such as cardiovascular diseases, will increase. Hence, the market for surgical blades will continue to soar over the next five years. As per the Population Reference Bureau, the number of Americans above 65 is projected to grow significantly from 58 billion in 2022 to 82.5 billion by 2050, indicating a 47% increase. Additionally, the proportion of the population of people aged 65 or older will grow from 17% to 23% in the future.

The rising health expenditure of Saudi Arabia is further providing an opportunity for the market to grow in the forecast period. The Saudi Arabian government intends to invest more than $65 billion under Vision 2030 to build the nation's healthcare infrastructure, restructure and privatize insurance and health services, establish 21 "health clusters" nationwide, and increase the availability of e-health services. Similarly, private sector participation is aimed to be increased from 40 % to 65 % by 2030.

According to the European Union Statistics, the selected high-growth surgical procedures in Spain include cochlear implantation, laparoscopic colectomy, laparoscopic appendectomy, laparoscopic repair of inguinal hernia, and laparoscopic hysterectomy.

This has increased the number of transplantations, further fueling the market growth in the forecast period. For instance, as per the 2022 articles published by the National Institute of Diabetes and Digestive and Kidney Disease, nearly 8,08,000 people in the United States are suffering from End-Stage Kidney Disease (ESKD), out of which 69% are on dialysis, and 31% of the people need a kidney transplant.

Cardiovascular Diseases (CVDs) are the leading global cause of death. The prevalence of high blood pressure, obesity, and diabetes in a population contributes to CVDs. The increasing prevalence worldwide is due to excessive tobacco use, unhealthy diet, physical inactivity, and excessive use of alcohol, giving rise to harmful conditions like high blood pressure, obesity, and high blood glucose levels.

The United States is the global leader in the number of cardiovascular diseases. Worldwide, there are more than a billion adults who are overweight, and around 300 million people are under the category of being clinically obese. These are highly prevalent in countries like North America and Western Europe. They die from obesity-related disorders every year, including cardiovascular diseases.

Low and middle-income countries also face the problem of chronic diseases, including cardiovascular diseases, due to their lack of awareness of disease management and maintaining proper dietary consumption to prevent the occurrence of these diseases. In developing countries like India, owing to the changing lifestyle and behavioral patterns, the risk of cardiovascular diseases has started occurring in people who are below 65 years of age. In response, certain government initiatives are detecting and treating cardiovascular diseases affecting a larger population base. Hence, high cardiovascular disease prevalence has a high impact on the global surgical blade market growth.

Surgical Blades Market Geographical Outlook:

Geography-wise, the global surgical blade market is divided into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific. The surgical blade market in North America and Asia-Pacific is influenced by several key factors specific to each region, reflecting advancements in healthcare, technological developments, and changing medical demands.

The established healthcare infrastructure in North America, coupled with a high prevalence of chronic diseases and a rising number of surgical procedures, especially in orthopedics, cardiovascular, and cosmetic surgery, supports market growth. The demand for high-quality surgical blades is also driven by the growing geriatric population, advancements in minimally invasive surgery techniques, and strict regulatory standards. Other factors are innovation in blade materials with stainless steel and carbon steel, and the presence of key manufacturers of medical devices, which support market expansion.

In the Asia-Pacific region, the growth factor is rapid urbanization, increased investment in healthcare infrastructure, and demand for advanced medical devices because of the rising prevalence of chronic diseases. The regional population is growing rapidly as access to healthcare services expands, especially in developing nations like India and China, thus adding to market expansion. Increased medical equipment, especially for surgical procedures, with the implementation of disposable surgical instruments in various medical institutions to limit possible infection, is also boosting growth. For instance, India reported 37,416 cases of prostate cancer in 2016, and by 2020, that number had risen to 41,532 cases. By 2025, the incidence of prostate cancer is predicted to rise to over 47,000 cases. This figure represents approximately 3% of all cancer cases in the nation. Additionally, in India, the average age at which prostate cancer occurs is 69.7 years.

Comprehensively, both regions have benefited from technological advances, infection control, and increased attention to precision in surgery.

Surgical Blades Market Recent Developments:

- July 2025: Innovia Medical acquired two companies, expanding its portfolio with ENT and ophthalmic surgical products, solidifying its focus as a single-use surgical instrument manufacturer.

- June 2024: HumanOptics exhibited a completely new image and launched the new EXTRA IN VISION campaign and new disposable surgical knives for ophthalmic procedures.

- March 2024: privately held medical device company C2Dx announced that it received 510(k) clearance from the FDA for the next-generation controller for its leading-edge surgical technology, The Shaw Scalpel System. Designed to provide a better user experience for everyone in the room, the Shaw Scalpel System allows for precise anatomical dissection and immediate hemostasis through its surgically sharp scalpel blade.

List of Top Surgical Blades Companies:

- GPC Medical Ltd

- B. Braun Melsungen AG

- Stryker

- Smith-Nephew

- CONMED

Surgical Blades Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 134.654 million |

| Total Market Size in 2031 | USD 163.353 million |

| Growth Rate | 3.94% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Material Type, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Surgical Blades Market Segmentation:

- By Type

- Sterile

- Non-Sterile

- By Material Type

- Hardened & Tempered Steel

- Stainless Steel

- Carbon Steel

- By End-User

- Hospitals

- Clinics

- Ambulatory Surgery Centers

- Life Sciences & Biomedical Research Organization

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America