Report Overview

Steam Turbine Market - Highlights

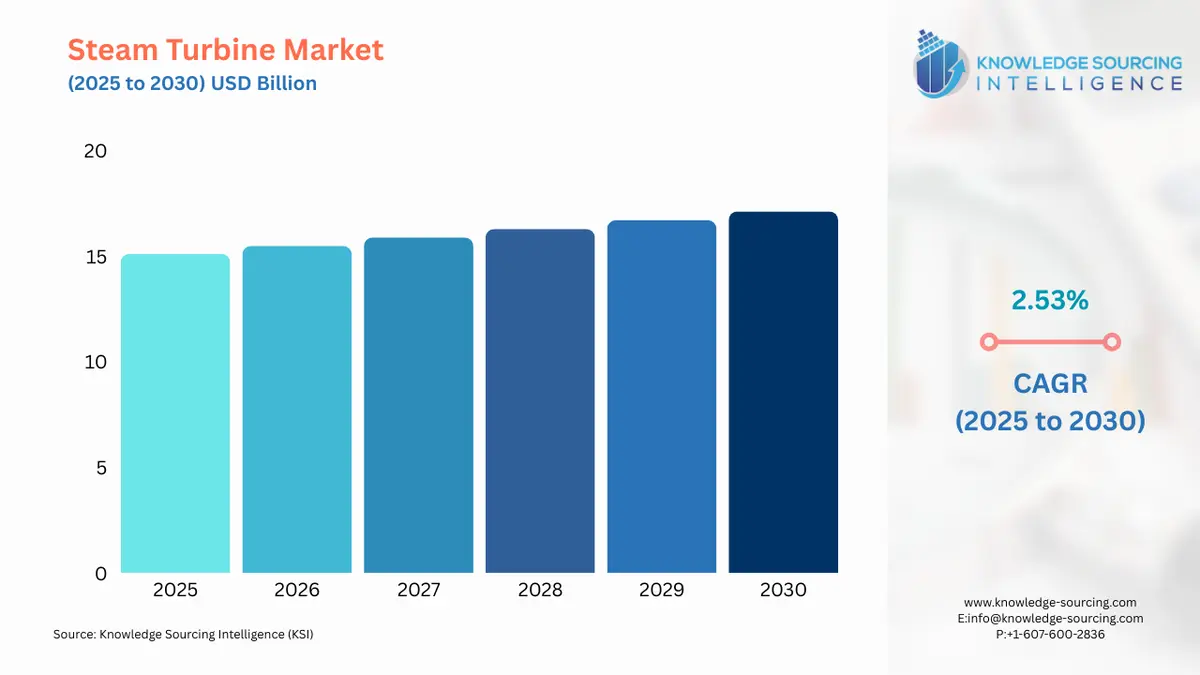

Steam Turbine Market Size:

Steam Turbine Market, with a 2.45% CAGR, is projected to increase from USD 15.111 billion in 2025 to USD 17.477 billion in 2031.

A steam turbine is a turbine that converts the thermal energy that is released by pressurized steam into rotational mechanical energy. It is a particular kind of turbine that uses the high-pressure and high-temperature steam produced by a steam generator or boiler and functions on the impulse and reaction principle. Steam turbines are used in large-scale power generation facilities such as fossil fuel power plants, nuclear power plants, concentrated solar power plants, and other industrial applications. Because of their great effectiveness, dependability, and capacity to operate in a variety of steam conditions, steam turbines are a common option for generating electricity.

Steam Turbine Market Growth Drivers:

Increasing demand for district heating systems

The focus on energy-efficient heating systems to reduce energy consumption and lower greenhouse gas emissions is rising. District heating systems or heat networks are centralized heating systems that supply heat to multiple buildings or an entire neighbourhood from a central energy plant. Steam turbines are used in district heating systems, which provide centralized heat distribution to residential and commercial buildings. Overall, the use of waste heat in industrial operations and district heating systems drives the development of the steam turbine market.

The surge in renewable energy growth

Systems for producing renewable energy, such as concentrated solar power (CSP) facilities use steam turbines. According to Renewables 2022 by IEA, the capacity of renewable energy worldwide is predicted to increase by 2,400 GW between 2022 and 2027. Further, by early 2025, renewable energy is expected to surpass coal as the primary source of electricity, accounting for almost 90% of the growth in global electricity over the following five years. Steam turbines are used to incorporate renewable energy into the power grid. Hence, the increasing capacity of renewable energy is expected to propel the demand for the steam turbine market.

Further, the growth of steam turbine technology is still being fueled by ongoing improvements like increased efficiency, superior materials, and sophisticated control systems. Higher power output, enhanced performance, and greater plant efficiency are the results of these developments.

Steam Turbine Market Challenges:

Capital Intensive Industry

Construction of steam turbine power plants or industrial facilities requires a sizable initial expenditure. Steam turbines have expensive capital expenditures because they require intricate engineering and specialized components. Thus, implementing steam turbine technology may be monetarily difficult, especially for smaller-scale applications. Furthermore, steam turbines, especially the big ones used in power plants, requires a lot of space and infrastructure to sustain them. It can be difficult to build steam turbine facilities when considering factors like land availability, cooling water sources, and transmission infrastructure, especially in heavily populated areas.

Precise pressure and temperature requirements

Steam turbines are made to function best at a particular pressure and temperature for the steam. Variations in steam conditions, such as shifts in pressure or temperature, can have an impact on the turbine's functionality and effectiveness. For optimal power generation, stable steam conditions must be maintained which might limit the market growth.

Steam Turbine Market Segment Analysis:

The power and energy segment is expected to account for a major market share.

Steam turbines are widely utilized in thermal power plants, including those that are fuelled by coal, gas, and oil. The turbines are propelled by the steam produced during the burning of fossil fuels or nuclear reactions, which rotates generators to create power. IEA expected a 4.5% increase in global electricity demand in 2021. The need for power production technologies like steam turbines is fuelled by the rising demand for electricity on a global scale, which is being driven by population increase, industrialization, and urbanization. The need for efficient and reliable power generation is expected to drive the steam turbine market growth.

Steam Turbine Market Geographical Outlook:

Asia Pacific is one of the significant steam turbines market

The steam turbine market has been expanding significantly in the Asia-Pacific region, particularly in China and India. The energy demand has been driven by rapid industrialization and population growth, which has led to the development of new power plants and an increase in the number of steam turbine installations.

Leading producers of steam turbines in China include firms like Shanghai Electric Group, Harbin Electric Corporation, and Dongfang Electric Corporation, which serve both domestic and foreign markets. Additionally, nations with substantial manufacturing bases in the steam turbine sector include Japan and South Korea, both of which have cutting-edge technology.

Rest of the World:

A mature steam turbine market exists in both North America and Europe, with an emphasis on integrating renewable energy sources and energy efficiency. There is a sizable installed base of steam turbines, particularly in nations like Germany, the UK, and Russia. European businesses are actively engaged in the development of cutting-edge steam turbine solutions and have a wealth of knowledge in high-efficiency steam turbine technology. On the other hand, the United States and Canada have placed a greater emphasis on renewable energy sources has also been seen in the area, which has led to the integration of steam turbines with renewable power facilities.

Steam Turbine Market Product Offerings:

General Electric (GE) offers a range of steam turbines for a variety of applications, including power generation and industrial processes. Their product portfolio includes both condensing and non-condensing steam turbines with different power output capacities and steam conditions. GE is known for its advanced technology and high-efficiency steam turbines.

Siemens Energy is a significant competitor in the market. They offer a variety of steam turbines ideal for mechanical drives, industrial applications, and power generation. To meet varying demands for power output, Siemens offers steam turbines in a variety of configurations, including single-casing, double-casing, and multi-casing designs.

The steam turbine power generation solutions provided by Mitsubishi Power include a wide range of steam turbines, including models with great dependability and efficiency. The steam turbines made by Mitsubishi Power can be customized to meet the needs of each customer and can operate in a variety of steam conditions.

Doosan Škoda Power is another leading manufacturer of steam turbines. They provide a range of steam turbines, including impulse and reaction turbines, with a focus on operational flexibility and high efficiency.

List of Top Steam Turbine Companies:

Boston Scientific Corporation

MAN Energy Solutions

Siemens AG

MITSUBISHI HEAVY INDUSTRIES, LTD.

General Electric

Steam Turbine Market Segmentation:

By Type

Impulse Turbine

Reaction Steam Turbine

Back Pressure Steam Turbine

Others

By Pressure

Low

Medium

High

By Source

Fossil Fuel

Nuclear

Geothermal

Others

By Stage

Single Stage

Multi Stage

By End-User

Chemical & Petrochemical

Oil & Gas

Paper & Pulp

Power & Energy

Manufacturing

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Taiwan

Others