Report Overview

Spray Adhesive Market Size:

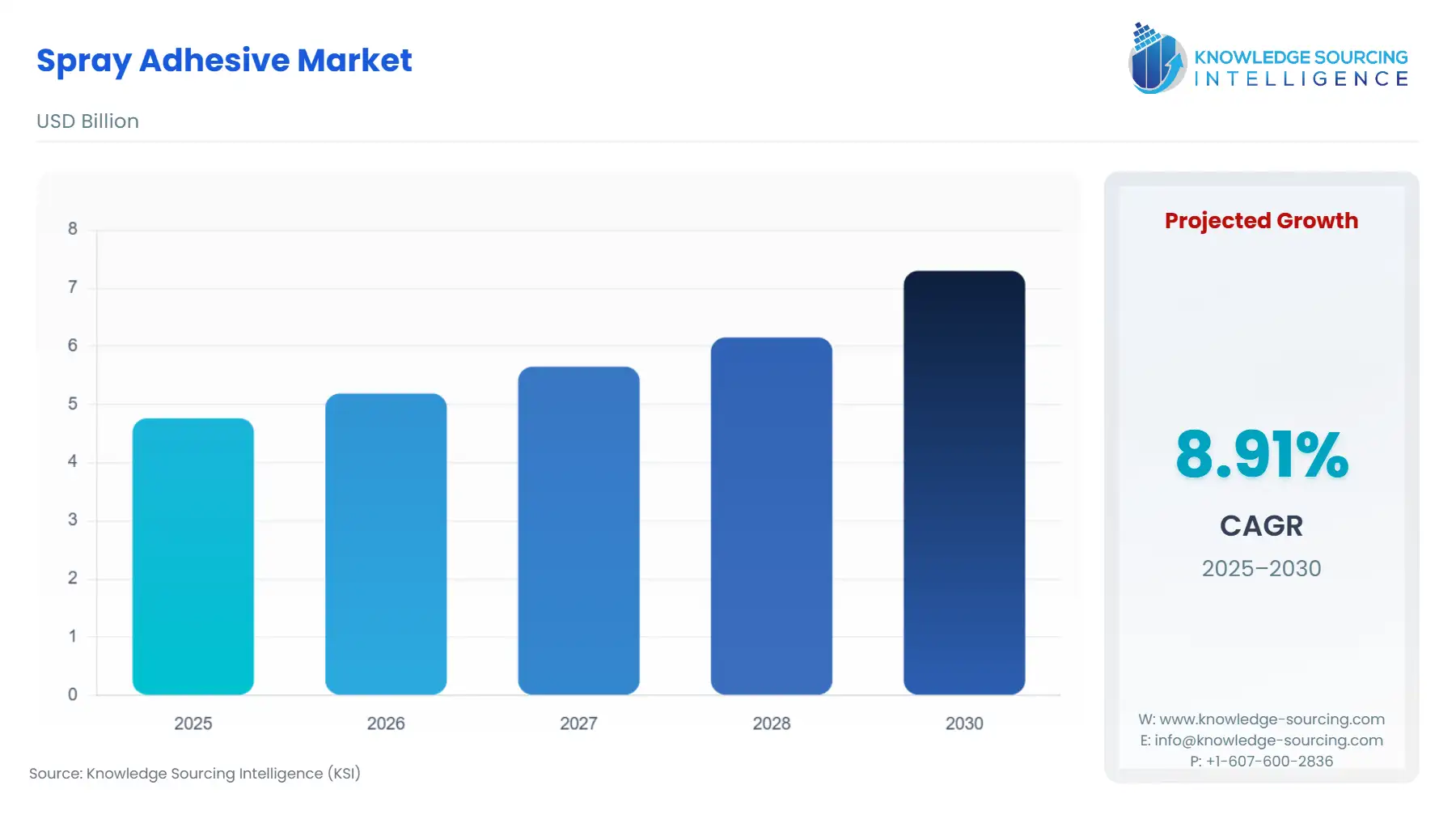

The spray adhesive market will grow from US$4.765 billion in 2025 to US$7.301 billion in 2030 at a CAGR of 8.91%.

Spray Adhesive Market Trends:

The growing demand from the various end-user industry verticals where the spray adhesives are used will likely expand the market. Different types of spray adhesives are available according to their strengths and uses. Among the end-user industries, the major demand comes from packaging, construction, and automotive & transportation, among others.

In addition, the increasing participation by market players in the form of partnerships and product launches to further expand the adoption of the spray adhesive to increase their market share is further boosting the market growth opportunities during the forecast period.

The main factors driving the spray adhesive market are rising demand from the building construction sector, increased application in nonresidential buildings, and growing application of technologies in construction work and repairs.

- During the financial year of March 2023, 210,320 dwellings were completed in the UK. In England, the number of dwellings completed was 174,600, 5,790 in Wales, 23,510 in Scotland, and 6,420 in Northern Ireland.

- Italy made the infrastructure plans for the upcoming years, such as Italy's National Recovery and Resilience Plan for 2021 to 2026, consisting of 132 investments and 58 reforms. This resulted in a total outlay of investment of EUR 15.3 billion.

Spray Adhesive Market Growth Drivers:

- The construction industry is expected to grow significantly during the forecast period.

The construction sector is growing globally due to rising disposable income coupled with increasing government initiatives to boost residential construction and infrastructural development. The major contributing factors are the increasing affordable housing solutions, premium housing in growing economies, and increased migration and urbanization. The improving economic conditions in many parts of the world are expected to be one of the key drivers to amplify the demand for spray adhesives for the construction industry and add to the market's growth during the coming years.

Construction is a major contributor to the U.S. economy. There were about 919,000 construction establishments in the U.S. in 2023. The industry creates nearly $2.1 trillion worth of structures each year. Construction is one of the largest customers for various products and services, including spray adhesive. Adhesives are utilized for indoor/outdoor bonding of heavier materials or bonds exposed to high temperatures.

- Growing adoption in the packaging industry is expected to augment the market growth.

The packaging industry is developing rapidly due to the growing demand for various consumer products, such as food and beverages, electronics, sanitary products, and personal care products.

In addition, the increasing sale of products through eCommerce channels and the growth of e-retail stores add to this increased demand. According to the International Trade Administration, global B2C e-commerce revenue is expected to grow to USD$5.5 trillion by 2027 at a steady 14.4% compound annual growth rate.

The increased leading segments for B2C e-commerce included consumer electronics, fashion, furniture, toys/hobby, health pharmaceuticals, media & entertainment, beverages, and food. The e-commerce business needs specialized packaging for the products. This is important to ensure the quality and the finish of the end product depend on it. Thus, adhesives ensure the effectiveness of different applications in the packaging industry.

- Rising demand from the transportation sector

Spray adhesives are required for a variety of applications in the transportation sector. With the increased use of commercial airplanes as a mode of transportation, demand for aircraft has increased globally. The adhesives are primarily used in automobile and aircraft interior trim applications. While the active global commercial fleet stood at 28,674 aircraft in 2022, according to ch-aviation, these figures are expected to grow in the forecast period owing to the rising air travel demands in Asia and Africa. Further, according to the International Organization of Motor Vehicle Manufacturers (OICA), the number of commercial vehicles sold in 2022 was 24,226,493 and rose to 27,452,301 in 2023.

The demand for the automotive industry has been significant due to the world's growing economies. The demand for electric vehicles is rising mostly from the developed markets of Europe, America, and China. The spray adhesive gives bonding in the laminates, fabrics, foam, felt, carpets, carpet tiles, cardboard, rubber, polythene, plastics, wood, metal, etc., materials used in the automotive industry, thus surging its demand.

Spray Adhesives Market Geographical Outlook:

- The Asia Pacific region will dominate the spray adhesive market during the forecast period.

By geography, the global spray adhesive market has been segmented as follows: North America, South America, Europe, the Middle East, Africa, and Asia Pacific (APAC) regions. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries.

The Indian passenger car market is expected to reach a value of US$54.84 billion by 2027, and the electric vehicle (EV) market is estimated to reach US$7.09 billion by 2025. In FY23, total automobile exports from India stood at 47,61,487, and two-wheeler exports stood at 36,52,122. Further, India contributed around 1.12% to global furniture exports, which are at US$3.5 billion in 2022.

According to the China Association of Automobile Manufacturers, in 2023, automobile production and sales will reach 30.161 million and 30.094 million, respectively. It is an 11.6% and 12% increase year-on-year in annual production and sales volumes, respectively. These regional developments indicate the high dependence on raw materials in the manufacturing industry, including spray adhesive.

Spray Adhesive Market Restraints:

- The spray adhesive market would experience restraints due to the volatility of raw material prices across various countries, geopolitical tensions, and supply chain disruption. Moreover, the stringent government rules relating to spray adhesive use might hamper the market growth.

Spray Adhesive Market Key Developments:

- In September 2023, H.B. Fuller Compan, the pureplay adhesives company in the world, acquired the business of UK-based Sanglier Limited, one of Europe’s largest independently owned manufacturers and fillers of sprayable industrial adhesives. This acquisition expanded H.B. Fuller’s innovation capabilities and product portfolio across the UK and Europe. The construction Adhesives and Engineering Adhesives businesses particularly benefited from this acquisition.

- In November 2023, Saint-Gobain entered a definitive agreement to acquire FOSROC. FOSROC is a global construction chemicals player with a strong geographic footprint in India, the Middle East, and Asia-Pacific.

Spray Adhesive Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Spray Adhesive Market Size in 2025 | US$4.765 billion |

| Spray Adhesive Market Size in 2030 | US$7.301 billion |

| Growth Rate | CAGR of 8.91% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Spray Adhesive Market |

|

| Customization Scope | Free report customization with purchase |

The spray adhesive market is segmented and analyzed as follows:

- By Type

- Water-based

- Solvent-based

- Hot melt

- Others

- By End User

- Construction

- Packaging

- Furniture

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America