Report Overview

Specialty Silica Market Size, Highlights

Specialty silica market size

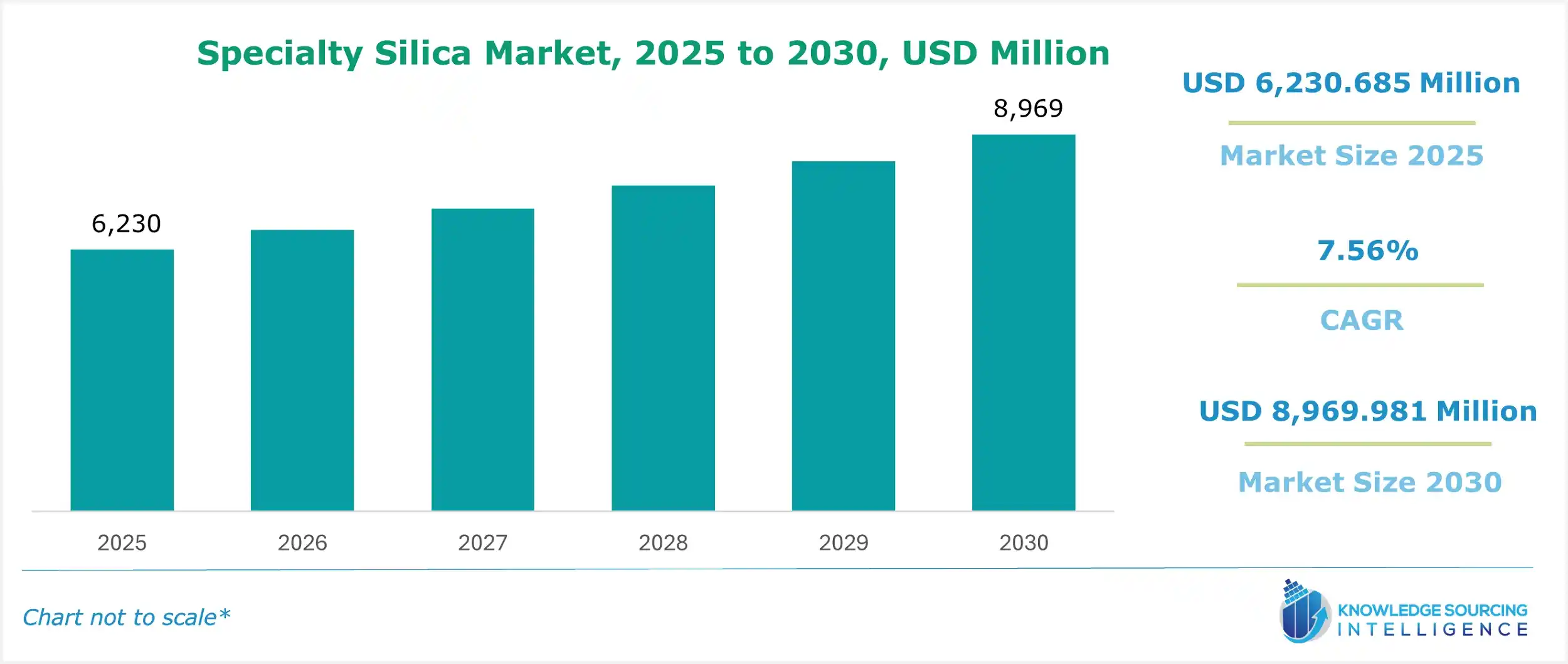

The speciality silica market is projected to grow at a CAGR of 7.56 % over the forecast period, increasing from US$6,230.685 million in 2025 to US$8,969.981 million by 2030.

The specialty silica market is growing as the manufacturers are focusing on environmentally friendly production methods. There is a notable trend towards bio-based silica derived from renewable sources that is also widely used. In January 2023 Solvay invested in a major investment in its Livorno facility in Italy to launch highly dispersible silica (HDS) made with bio-based sodium silicate from rice husk ash. Speciality silica has extensive application as a reinforcement additive in rubber production, particularly in tyre manufacturing. It increases fuel efficiency and reduces rolling resistance leading to increased adoption of electric vehicles and resulting in increased production. This increased production and demand require specialized tyres that improve range and performance, thus boosting the demand for the speciality silica.

What are the speciality silica market growth drivers?

Specialty silica is a reinforcement agent of rubber that plays an important role in tire manufacturing with benefits like fuel efficiency improvement and rolling resistance minimisation. Further, the global demand for sustainable products and developments in the automotive industry are acting as major growth factors in the specialty silica market for rubber goods. The special reinforcing properties of this material are very essential for the manufacture of high-performance rubber products, ensuring high growth rate during the forecast period. For instance, highly Dispersible Grade Silica (HDS) is supplied by Tata Chemicals for use in tire rubber applications. Traditional silica grades exhibit poor dispersion in the rubber matrix of tires due to a high silica-silica particle interaction and a low silica-rubber particle interaction

What are the key segments increasing the specialty silica market?

- By product type, precipitated silica is expected to witness significant growth in the specialty silica market.

Precipitated silica is a high demand liquid mineral in high demand where it is readily available for improving product performance and manufacturing processes in several industries. Its versatility and rising improvements have allowed it to enter new markets and applications, illustrating its relevance in contemporary consumer products and industrial goods. Precipitated silica is an important ingredient in automotive paints and coatings as it increases the weathering gloss, scratch resistance and ultimately the strength of the vehicles. Furthermore, tire manufacturers are forced to use silica in order meet performance and sustainability standards which have led primarily to high production of rubber.

- By application, rubber goods are expected to witness significant growth in the speciality silica market.

Speciality silica is majoring used in high-temperature-vulcanized and liquid silicone rubbers. In addition to ensuring good electrical insulation properties and high mechanical strength. The great use of tires with low rolling resistance is expected to further fuel the growth of the segment in the coming years.

Further, the global demand for sustainable products and developments in the automotive industry are acting as major growth factors in the specialty silica market for rubber goods. The special reinforcing properties of this material are very essential for the manufacture of high-performance rubber products, ensuring a high growth rate during the forecast period.

What are the key geographical trends shaping the specialty silica market?

- The North American region is expected to witness significant growth in the specialty silica market.

The North American market for specialty silica is anticipated to grow considerably over the coming years owing to the growing demand from a range of industries. One of the major factors leading to high demand is the growing manufacturing of electric vehicles, which require high-performance tires that usually contain specific silica as a reinforcing filler. Furthermore, specialty silica will attract the construction and automotive sectors in the region, as there would be increasing infrastructural developments in the North American region with high demands for lightweight materials.

Key developments in the speciality silica market:

- In January 2025, Solvay and Hankook announced a memorandum of understanding to collaborate on the development of circular silica from bio-sourced and waste-sourcing for tyre production.

- In June 2024, a new facility for the manufacturing of AEROSIL Easy-to-Disperse (E2D) silicas was put into operation at Evonik's Rheinfelden location. By improving dispersion technology, this cutting-edge facility makes it easier to incorporate silica into paint and coating compositions. By drastically cutting down on processing time and energy usage, the new approach encourages production efficiency and sustainability.

Specialty silica market scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Specialty Silica Market Size in 2025 | US$6,230.685 million |

| Specialty Silica Market Size in 2030 | US$8,969.981 million |

| Growth Rate | CAGR of 7.56% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Specialty Silica Market |

|

| Customization Scope | Free report customization with purchase |

The speciality silica market is analyzed into the following segments:

- By Product Type

- Precipitated Silica

- Fumed Silica

- Silica Gel

- Others

- By Application

- By End-User

- Manufacturing

- Chemicals

- Personal Care & Cosmetics

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific Region

- Japan

- India

- South Korea

- Indonesia

- Taiwan

- Thailand

- Others

- North America