Report Overview

Specialty Adhesive Tape Market Highlights

Specialty Adhesive Tape Market Size:

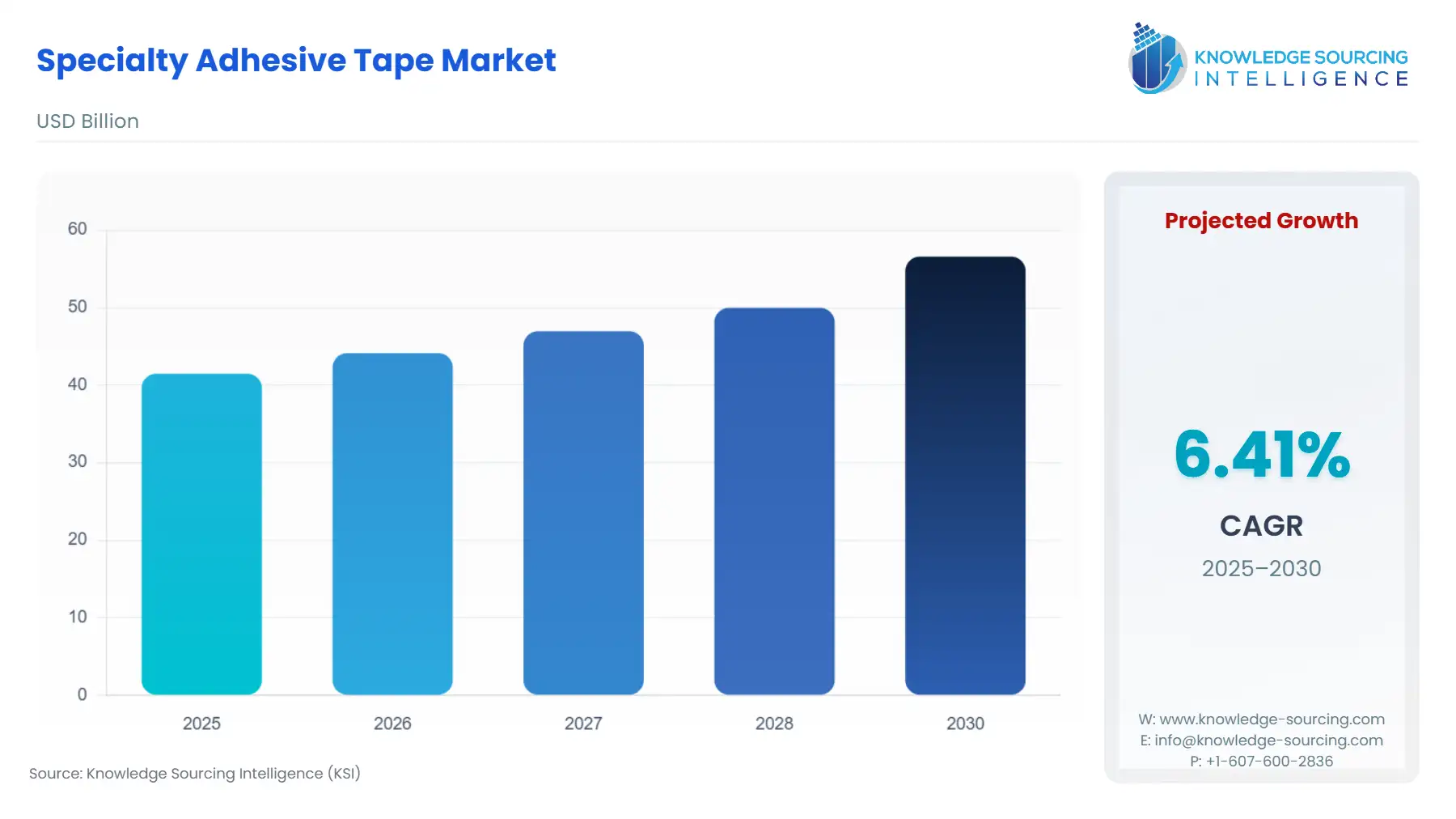

The Specialty Adhesive Tape Market will reach US$56.588 billion in 2030 from US$41.474 billion in 2025 at a CAGR of 6.41% during the forecast period.

Specialty adhesive tapes are designed for specific purposes such as construction, electrical, automotive, and more. Increasing research and development in the adhesive tape market is budding the applicability and features that these tapes offer, resulting in increasing their demand across industry verticals. Furthermore, global expansion in the electrical, construction and healthcare industries will result in a further boost in the demand for these tapes. The tapes are used for applications in electronics and electrical purposes, the materials may be either electrically conductive, thermally conductive, or non-conductive as well. Examples include EMI copper foil shielding tape, circuit plating tape, aluminium foil tape, and high-performance adhesive transfer tape, among others.

The North American region, followed by Europe, is expected to hold a substantial market share owing to the early technology adoption and continuous innovation of new products by major players in the region is continuing to propel the market growth during the forecast period. In addition, according to the IPC-Association Connecting Electronics Industries, the sales of semiconductors, electronics manufacturing services, and printed circuit boards (PCBs) continued to perform better, which led to strong growth in the sales of electronics products, further providing strong prospects for market growth during the forecast period and in the upcoming years, due to the application of adhesive tape in electrical and electronic products.

Specialty Adhesive Tape Market Geographical Outlook:

- The market in North America and Europe is expected to expand rapidly due to significant investments in the automotive, healthcare, and construction industries.

The successful market growth in the North American region is attributed to the strict regulations by US Federal Agencies for use of electrical and electronic equipment, in addition to successful business models. Also, the presence of a high-tech-savvy population adopting smart electrical and electronic devices for carrying out their daily activities is further contributing to stable market growth in the United States by the end of the forecast period. The Asia Pacific is expected to show high market growth owing to the growing electronics industry, especially in emerging economies like China, and India. Consumer electronics, electronic components, industrial electronics, computer hardware, communication, broadcast equipment, and strategic electronics. In addition, the adoption of electric household appliances in the Asia-Pacific region is further propelling the market growth in this region owing to the rising disposable income. The manufacturers of these appliances are working on offering smart and automatic devices to their customers through the integration of electronics with intelligent sensors and machine programming, thus reducing the amount of human work and providing superior home care.

Furthermore, the budding electronics, healthcare, and construction industries in these emerging economies of the world are bolstering market growth in the forecast period.

In Israel, as in the Middle East and Africa region, high-tech sectors have experienced the fastest growth rates. These sectors are skilled and capital-intensive and require sophisticated production techniques, in addition, they require a considerable investment in research and development. The demand for specialty adhesive tapes is growing due to their potential applications in the country’s growing hi-tech industry. Additionally, the companies in Israel are among the world’s leaders in the designing and manufacturing of building metal structures, prefabricated parts, and components that are marketed at the international level. These include the use of the building and construction adhesive tapes required in various building applications, which include duct tape for a quick repair, joining and sealing ducting, protection and masking of delicate surfaces, electrical insulation, and many more.

These investments significantly extended their manufacturing capabilities, which in turn, led Turkey to become an important part of the global value chain of international OEMs (source: Investment Agency and Promotion Agency of Turkey, ISPAT). Thus, the specialty adhesive tape technology finds immense utilization in automotive assembly and manufacturing applications, providing solutions for automotive masking and protection, electronics, and external internal bonding and mounting applications promoting market growth in Turkey. In addition, the fastest-growing defence and aerospace sectors, and growing infrastructure due to rapid urbanization are further contributing to achieving sustainable market growth in this region.

With the increasing number of new construction activities globally, the market is projected to surge during the forecast period.

The rising construction activity, especially in the developing economies of the world, is driving market growth in the forecast period. The growing construction activities are attributed to rapid urbanization along with technological advancements and growing innovations in the field of construction materials. This further results in faster production of products in addition to a reduction in time-to-market, contributing to market growth as well. With growing urbanization, there is a constant shift of people from rural areas to urban areas. Hence, this is creating a need for new developments to take place, which includes novel construction to be carried out in different sectors, residential, commercial, and industrial. Furthermore, for the facilitation of the movement of the newly shifted urban population, the construction of new roads and highways is highly demanded. Additionally, the provision of an improved healthcare facility is further propelling the construction of new and better healthcare infrastructure, burgeoning the market demand for specialty adhesive tapes in the forecast period. The increasing infrastructure spending on new construction projects, improvement, and repair of existing buildings is further anticipated to drive the market growth in the forecast period.

The global specialty adhesive tape market report provides an in-depth analysis of the industry landscape, delivering strategic and executive-level insights backed by data-driven forecasts and analysis. This regularly updated report equips decision-makers with actionable intelligence on current market trends, emerging opportunities, and competitive dynamics. It examines demand across various type, specialty adhesive tape systems, such as double-sided and acrylic tapes, while exploring applications. The report also investigates technological advancements, key government policies, regulations, and macroeconomic factors, offering a comprehensive view of the market.

Specialty Adhesive Tape Market Segmentations:

Specialty Adhesive Tape Market Segmentation by type

The market is analyzed by type into the following:

- Double Sided

- Non-Woven

- Acrylics Tapes

- Transfer Adhesive Tapes

- Others

Specialty Adhesive Tape Market Segmentation by material

The report analyzes the market by material as below:

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Paper

- PET

- Foam

- Glass Cloth

- Woven/Non-Woven

- Others

Specialty Adhesive Tape Market Segmentation by application

The report analyzes the market by application as below:

Specialty Adhesive Tape Market Segmentation by regions:

The study also analysed the Specialty Adhesive Tape Market into the following regions, with country level forecasts and analysis as below:

- North America (US, Canada, and Mexico)

- South America (Brazil, Argentina, and Others)

- Europe (Germany, UK, France, Spain, and Others

- Middle East and Africa (Saudi Arabia, UAE, and Others)

- Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)

Specialty Adhesive Tape Market Competitive Landscape:

The Specialty Adhesive Tape Market features key players such as 3M, Tesa SE, Shurtape Technologies, LLC, LINTEC Corporation, PPM Industries S.p.A., Gergonne, Nitto Denko Corporation, MBK Tape Solutions, and ECHOtape, among others.

Specialty Adhesive Tape Market Report Coverage:

This report provides extensive coverage as explained in the points below:

- Market size, forecasts, and trends by different types, with historical revenue data and analysis focusing on key factors driving adoption, current challenges faced by key players, and major growth areas.

- Market size, forecasts, and trends by material, with historical revenue data and analysis.

- Market size, forecasts, and trends by application, with historical revenue data and analysis across various segments.

- Specialty Adhesive Tape Market is also analysed across different regions, with historical data, regional share, attractiveness, and opportunity of these solutions in different countries. The growth prospects and key players operating in these markets. The section also dwells on the macro factors, economic scenario and other complementing factors aiding in market growth.

- Market dynamics: The section details the market growth factors, restraints, and opportunities in the market. The segment also presents complete market scenario with the help of Porter’s five forces model.

- Competitive Intelligence: A thorough investigation on the competitive structure of the market presented through proprietary vendor matrix model, market share analysis of key players, insights on strategies of key players and recent major developments undertaken by the companies to gain competitive edge.

- Research methodology: The assumptions and sources which were considered to arrive at the final market estimates. Additionally, how our model is refined to ensure most significant factors are taken into consideration with the proper hypothesis and bottom-up and top-down approaches enhance the reliability of forecasts further strengthening the trustworthiness of the numbers being presented.

How this report is helpful to you and reasons for purchase?

- The report provides a strategic outlook of the specialty adhesive tape market to the decision-makers, analysts and other stakeholders in the easy-to-read format for taking informed decisions.

- The charts, tables and figures make it easy for the executives to gain valuable insights while skimming the report.

- Analyst support through calls and email for timely clarification and incorporating additional requests.

- Option of presentation or doc format with the estimates file to take care of diverse requirements.

- 15% FREE customization with all our reports help cater additional requirements with significant cost-savings.

- Option of purchasing specific segments of the study, including opting for summary reports or just the estimates file.

Specialty Adhesive Tape Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Specialty Adhesive Tape Market Size in 2025 | US$41.474 billion |

| Specialty Adhesive Tape Market Size in 2030 | US$56.588 billion |

| Growth Rate | CAGR of 6.41% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Specialty Adhesive Tape Market |

|

| Customization Scope | Free report customization with purchase |