Report Overview

South Africa E-Hailing Market Highlights

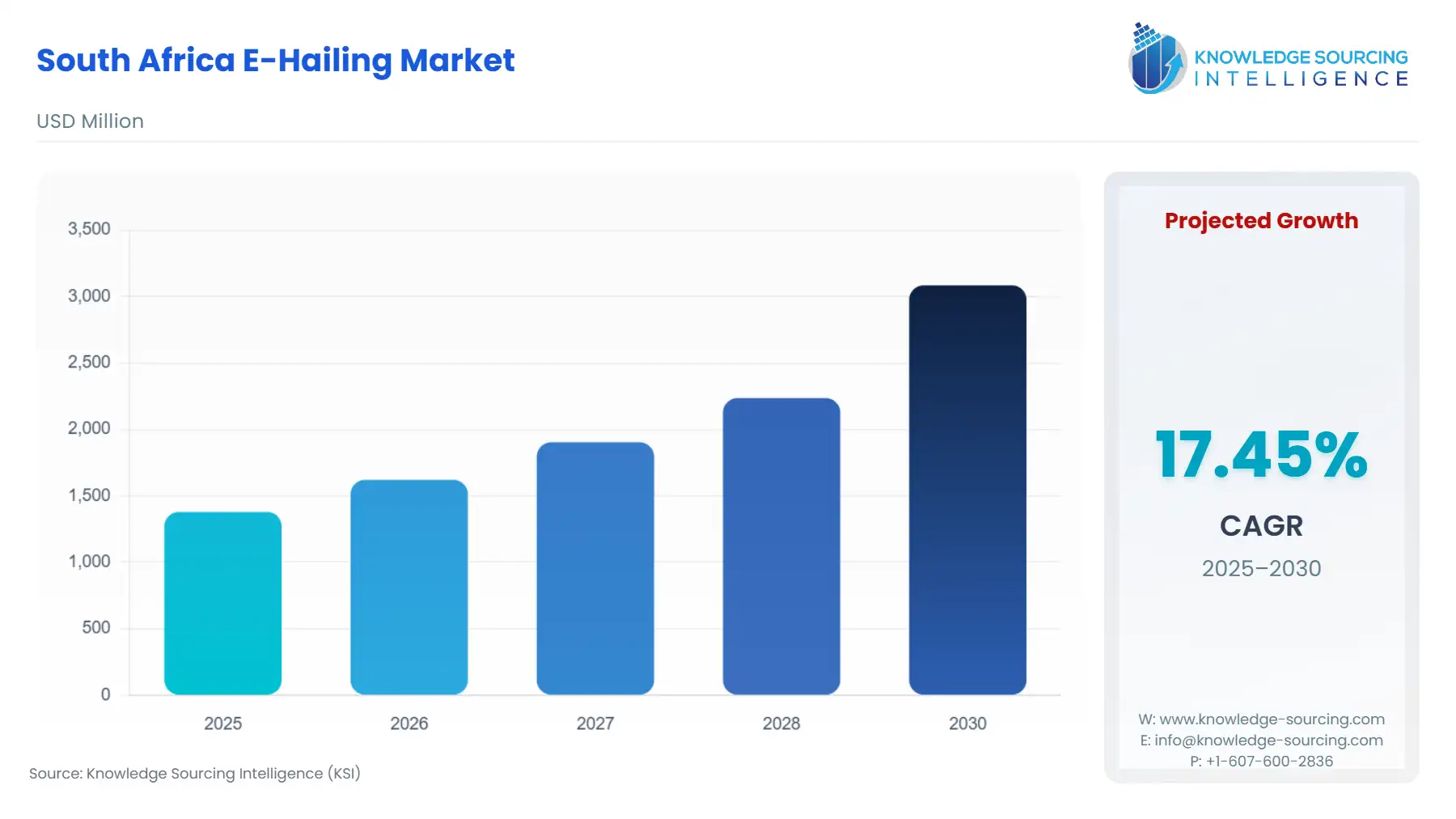

South Africa E-Hailing Market Size:

The South Africa e-hailing market is projected to grow at a CAGR of 17.45% over the forecast period, increasing from US$1,380.069 million in 2025 to US$3,084.741 million by 2030.

The e-hailing landscape in South Africa is on a solid upward trajectory. It is transforming urban mobility in cities like Johannesburg, Cape Town, and Durban, where the number of riders opting for app-based rideshare is steadily increasing against traditional taxis. On a sustainable front, platforms are working to ameliorate their carbon footprint, either by switching to electric vehicles, planting trees, or installing solar chargers. In policy, South Africa's National Land Transport Amendment Act of 2023 now formalises e-hailing into its definition of "electronic hailing services, which allows for more clarity on regulation and safety standards. Industry insiders note that e-hailing as a space has moved to be almost R7 billion, with significant economic implications from employing drivers, to dramatically changing consumer habits, and transforming logistics services.

South Africa E-Hailing Market Overview & Scope:

The South Africa E-Hailing Market is segmented by:

By Service Type: The market is divided into segments by service type into ride sharing, ride hailing, and others. Ride sharing offers the possibility for multiple group passengers travelling in the same direction to share a single ride and fare. It is also less harmful to the environment as it could help to reduce emissions and alleviate traffic congestion. Ride-hailing, on the other hand, gives one passenger access to a driver through an app, which gives a sense of privacy and provides a slightly faster ride than group travel. Others include peer-to-peer rentals and niche/unique mobility models, which are not classified within either of these two categories.

By Device Type: The market is divided into segments by device type into smartphones, tablets, and others. Smartphones are the primary device in this segment, and it can be argued that nearly all users utilise mobile apps to book, track, and pay for rides. Smartphones are portable, and users generally have access to internet connectivity 24/7. Others include desktops or other types of in-car.

By Vehicle Type: The market is divided into segments by vehicle type: two-wheeled vehicle, three-wheeled vehicle, and four-wheeled vehicle. Four-wheeled vehicles are further divided into sedans, SUVs, and others. Two-wheeled vehicles such as scooters and motorcycles are quite popular modes of transportation in dense urban markets. They are affordable and can typically cut through traffic.

By End-User Industry: The market is segmented into personal (B2C) and corporate (B2B). Personal users account for the largest share, as millions of individuals book rides for commuting, shopping, and leisure daily.

By Region: Geographically, the market is expanding at varying rates depending on the location.

Top Trends Shaping the South Africa E-Hailing Market:

EV Push through Dealer Expansion:

BYD is expanding its electric vehicle presence in South Africa, close to doubling dealers by 2026. This ostensibly reflects a growing inquiry into new-energy vehicles. Meanwhile, with EVs increasingly available, e-hailing services are quite literally transitioning fleets to include hybrids and electrics.

Formal Regulation and Safety Governance:

The National Land Transport Amendment Act, enacted into South African law in 2024, e-hailing services are now defines and regulates separately from taxis. This regulation pushes the powers of the authorities concerning safety standards, licensing, and pricing. This provides clarity for the industry and improved safety for drivers and riders.

South Africa E-Hailing Market Growth Drivers vs. Challenges:

Drivers:

The growing tourism sector in the nation is anticipated to fuel the market expansion: The growing international tourism in South Africa is currently one of the chief contributing factors to the increasing progress of the e-hailing market. The expansion of the tourism market is crucial for the development of the e-hailing market in any country. The more e-hailing services are available in a country, the more international tourism will flourish, as they provide a very inexpensive way to move people around in the country.

The increasing demand for four-wheeler vehicles is anticipated to expand the South African e-hailing market. There is tremendous growth in the global tax segment of the IT and telecommunication sector, and competition from existing and new e-hailing operators entering this market has resulted in tremendous growth in revenue for the e-hailing market. There has been a growing number of smartphone users, which has changed the e-hailing market in a positive way for both user access to service and service utilization. The user-friendly applications and incorporation of GPS have facilitated optimal booking strategies.

Challenges:

Driver safety: Driver safety remains a significant problem facing South Africa’s e-hailing market. Unfortunately, violence continues to surface between metered taxi operators and e-hailing drivers, creating a climate of fear and instability. Unless regulations with security management are effectively enforced, both drivers and passengers are likely to remain subject to disturbances, physical harassment, and service interruptions.

South Africa E-Hailing Market Regional Analysis:

The rising proliferation of internet connectivity in Cape Town, followed by the increasing adoption of smartphone users, is driving the demand for e-hailing services. E-hailing services have been a successful form of flexible transport, extending the accessibility and mobility of private transportation. Due to motor vehicles only being utilised for a small portion of the day and with the rise of e-hailing and connected network technologies, commuters in Cape Town may change their travel habits and preferences.

South Africa E-Hailing Market Key Development:

Oct 2025: Bolt South Africa confirmed it filed its registration with the NPTR under the new law; Uber has yet to make a public compliance announcement.

Sept 2025: South Africa’s National Land Transport Amendment Act (NLTAA) was gazetted, officially regulating e-hailing services (such as Uber and Bolt) as a formal mode of public transport.

Sept 2025: The NLTAA requires all e-hailing vehicles to have visible branding and panic buttons installed, strengthening passenger safety and formalizing the sector.

Sept 2025: Under the new Act, e-hailing driver licences will specify geographic zones for pickups – drivers cannot accept a return fare outside their licensed area.

South Africa E-Hailing Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 1,380.069 million |

| Total Market Size in 2030 | USD 3,084.741 million |

| Forecast Unit | Million |

| Growth Rate | 17.45% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Service Type, Device Type, Vehicle Type, End-User Industry |

| Geographical Segmentation | Cape Town, Johannesburg, Gqeberha, East London, Durban, Others |

| Companies |

|

South Africa E-Hailing Market Segmentation:

By Service Type

Ride Sharing

Ride Hailing

Others

By Device Type

Smartphones

Tablets

Others

By Vehicle Type

Two-Wheeler

Three-Wheeler

Four-Wheeler

Sedans

SUVs

Others

By End-User Industry

Personal (B2C)

Corporations (B2B)

By City

Cape Town

Johannesburg

Gqeberha

East London

Durban

Others