Report Overview

Soup Market Size, Share, Highlights

Soup Market Size:

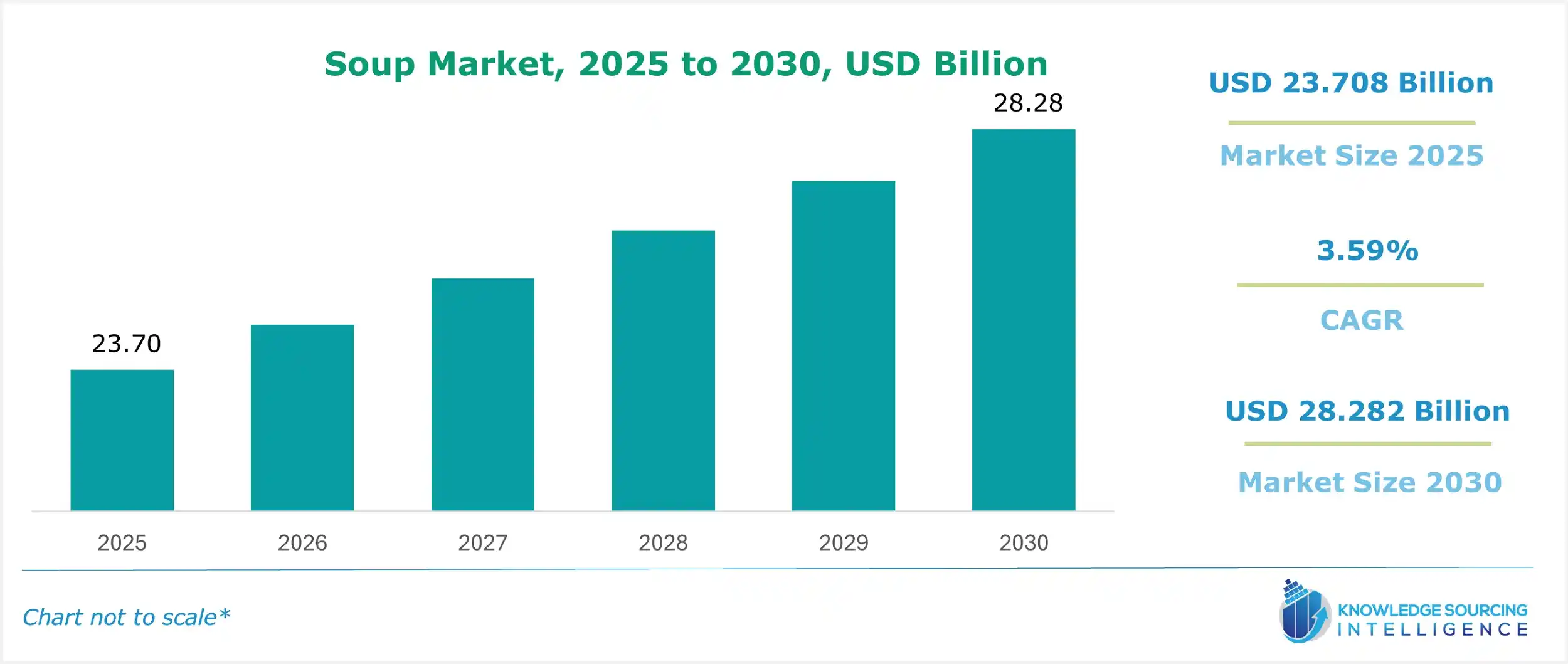

The Soup market, valued at US$28.282 billion in 2030 from US$23.708 billion in 2025, is projected to grow at a CAGR of 3.59% during the forecast period.

The market is driven by growing demand for convenience food due to changing lifestyles. The growing production and consumption of soup are attributed to improvements in technology, collection methods, and increased taps to support consumers' interest in the intake of soup globally. The rising demand for food and beverage products made from natural ingredients is further driving the demand for natural-based soups in many countries.

Furthermore, the growing trend of organized retail is augmenting the sales of soups with the construction of hypermarkets, supermarkets, convenience stores, and shopping malls, contributing to market growth over the forecast years.

Soup Market Overview & Scope:

The Soup market is segmented by:

- Type: The soup market by type is segmented into clear soups and thick soups. The demand for quick and healthy food options drives the global soup market, including the clear soup market’s growth. Clear soups, which are frequently consumed on liquid diets, are prepared by simmering meat and/or vegetables in liquid until the flavours are released.

- Product: The product is segmented into canned, dried, UTH, and others. Canned or preserved soups are commercially processed, high-temperature cooked, and sealed in cans or jars to extend their shelf life without refrigeration. Because of their accessibility, convenience, and variety, these soups significantly contribute to the market's growth. Canned and preserved soups provide convenience and an easy, fast meal option with little cooking and preparation time.

- Distribution Channel: The soup market is segmented by distribution channel into online and offline. The offline category is further segmented into supermarkets, convenience stores, and others. The online segment of the soup market is expected to witness the fastest growth over the forecast period due to expanding e-commerce businesses and increasing internet penetration in developing countries worldwide. New players are also introducing and developing services such as delivering hot-served soups. Besides, with the growing number of smartphone users, the time spent on the internet also increases. This is driving the growth of e-commerce platforms, which, in turn, boosts the online segment’s expansion.

- Region: North America is expected to emerge as the largest market due to the high visibility of major players and a rising number of product launches in the U.S. and Canada.

Top Trends Shaping the Soup Market:

1. Rising Convenience

- Canned soup and other convenience foods have gained increased popularity among consumers. This is because convenience foods, such as soup in a bottle, ease consumers' lives. Convenience foods like canned soup are appealing to people, especially working individuals, due to their busy schedules, inability to prepare meals, lack of time, fatigue, and other factors.

2. Increasing Vegan Population

- The demand for plant-based diets, especially boxed soups, has risen sharply in subsequent years. Generally, this is because consumers look to minimize animal-based products. A vegan diet excludes all products derived from animals, including meat, fish, dairy, and eggs. In contrast, many consumers pursue this path because of such emerging health fears regarding the consumption of animal products, as well as the moral and environmental issues associated with employing an animal agriculture system.

Soup Market Growth Drivers vs. Challenges:

Opportunities:

- Growing Health and Wellness Concerns: The soups market is greatly impacted by the increased emphasis on health and wellness. Customers are looking for food options that can give them nutrient density as they become more aware of their diets. A good proportion of consumers care about balancing diets, and an equally high amount care about making food and beverage decisions conducive to health as their priority in a wellness plan. Soups are favourite options among health-conscious and fitness-oriented people since they provide ways to incorporate lots of vegetables, lean proteins, legumes, and whole grains in a single bowl.

- Flavour Diversity: Another important factor propelling the soup market is the variety of flavors available. Customers are looking for a taste experience that goes beyond conventional soup options and are growing more receptive to trying out novel and distinctive flavours. Additionally, producers are launching soups in Thai, Mexican, Indian, Mediterranean, and other traditional culinary flavours in response to the growing demand for ethnic and exotic flavors. Offering a large range of soup flavours allows market participants to accommodate consumers' shifting tastes and preferences, promote culinary exploration and enjoyment, and improve the outlook of the soup market.

Challenges:

- Synthetic Flavours: A wide range of products, such as food, drinks, medications, and other items, are enhanced with artificial preservatives, chemicals, or other materials. These are added to packaged foods, especially soups, to stop undesirable chemical changes or breakage. The side effects of the preservatives added to soup for increasing the shelf life, consumers would prefer not to consume packaged soups.

Soup Market Regional Analysis:

- Asia Pacific: Due to changes in breakfast consumption patterns in a couple of years and rising Western influence in countries like China and India, the Asia Pacific market is expected to grow substantially over the forecast period. The rising number of modern grocery stores in India also contributes to the growth of the soup market by making it readily available to consumers.

Soup Market Competitive Landscape:

The market is fragmented, with many notable players, including Campbell Soup Company, Associated British Foods PLC, Westbrae Natural, Inc., and TSC Foods, among others:

Soup Market Key Developments:

- September 2025: The Kraft Heinz Company announced its plan to split into two independent companies by mid-2026, with the larger entity managing the global Heinz and Philadelphia brands.

- August 2025: The Campbell’s Company (Chunky) partnered with Pabst Blue Ribbon to launch two limited-edition beer-infused soups, “Beer Cheese with Potatoes & Chorizo” and “Beef, Bacon & Beer Chili with Beans,” exclusive at Walmart.

- August 2025: Progresso’s Pitmaster soups feature five bold, BBQ-inspired varieties with grilled meats, roasted vegetables, and 14 g+ protein, aiming to bridge summer seasonal tastes with classic soup comfort.

- August 2025: General Mills’ Progresso brand introduced the Pitmaster BBQ-inspired soup line, a high-protein range featuring bold barbecue flavours with 14–20 g protein per can, catering to convenience and nutrition trends.

Soup Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Soup Market Size in 2025 | US$23.708 billion |

| Soup Market Size in 2030 | US$28.282 billion |

| Growth Rate | CAGR of 3.59% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Soup Market |

|

| Customization Scope | Free report customization with purchase |

Soup Market Segmentation:

By Type

- Clear Soups

- Thick Soups

By Product

- Canned

- Dried

- UTH

- Others

By Distribution Channel

- Online

- Offline

- Supermarkets

- Convenience stores

- Others

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa