Report Overview

Solenoid Valve Market Report, Highlights

Solenoid Valve Market Size:

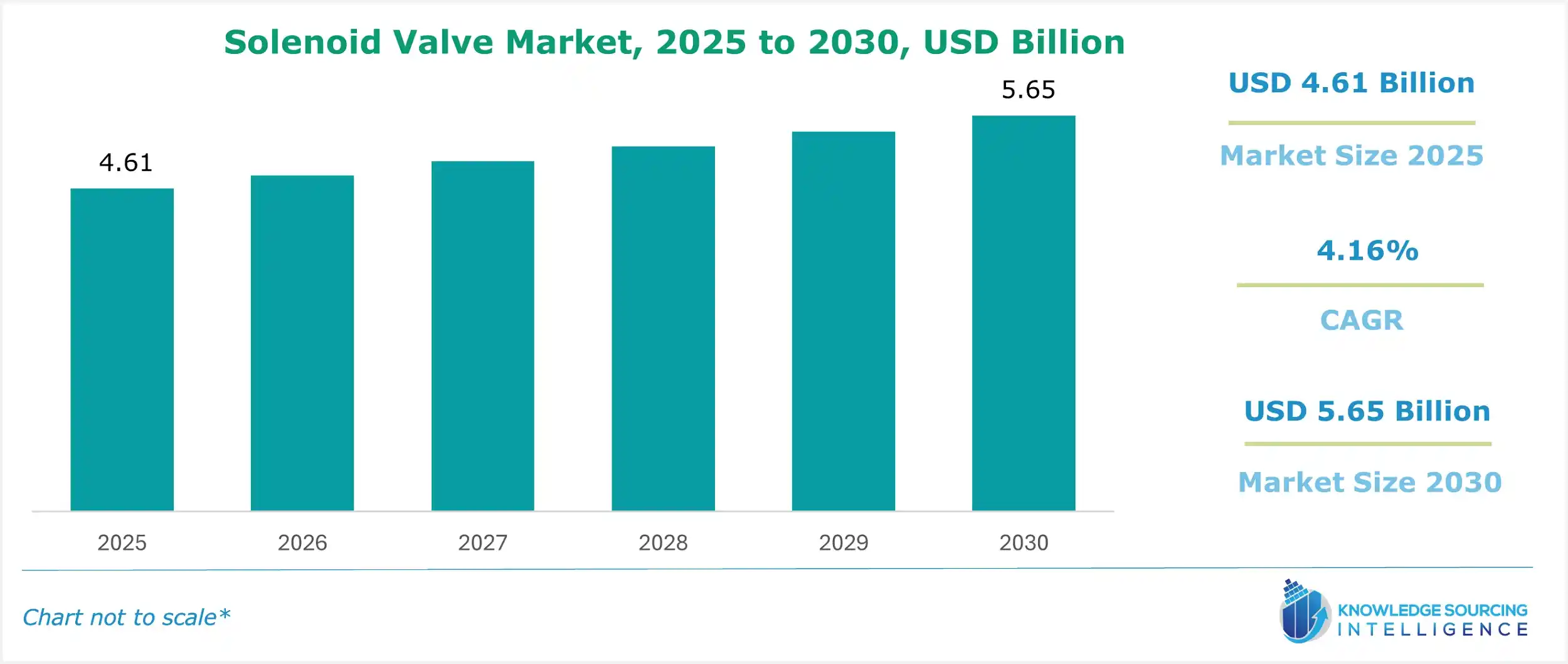

Solenoid Valve Market is projected to grow at a CAGR of 4.16% from US$4.61 billion in 2025 to US$5.65 billion in 2030.

Solenoid Valve Market Introduction:

A solenoid valve is essential for an electromechanical-operated valve. The valve consists of a solenoid, which is an electric coil and has a movable ferromagnetic core located in its center. When electric current passes through the coil, a magnetic field is created, which in turn creates upward pressure on the ferromagnetic core. It is typically used to control the flow of air or liquid in fluid power systems.

The evolution of miniature solenoid valves is expected to boost market growth. They are effectively used to control the flow. Pressure and direction of both gases and fluids. The miniature solenoid valves have greater life and better automated functions, and hence, they are used in the entire medical device industry. This, in turn, has driven the growth of the market for gas and liquid valves.

The solenoid valve market is a cornerstone of industrial automation, delivering precise fluid control through energy-efficient solenoids and low-power solenoids for optimized power consumption. Real-Time Monitoring Valves and Predictive Maintenance Valves leverage AI-driven valve control and Wireless Solenoid Valves to enhance operational reliability and reduce downtime. Industry 4.0 Valves with digital integration enable seamless IoT connectivity, while Additive Manufacturing Solenoid and Advanced Materials Solenoid improve durability and design flexibility for harsh environments. These advancements support applications in oil and gas, automotive, and healthcare sectors. The market drives innovation, sustainability, and automation across industries.

The demand for solenoid valves has increased in the food and beverage and agriculture industries. Corrosive and anti-bacterial fluids are extensively used to minimize the risk of food contamination by cleaning the food production lines. Moreover, the solenoid valves are used to automatically irrigate flowers, bushes, and plants. The growth in the food and agriculture industry is also expected to bolster the growth of the solenoid valve market.

Technological innovation enhances solenoid valve efficiency, reducing energy consumption and fluid resistance. In 2024, Emerson launched a low-power solenoid valve series for industrial automation, cutting energy use by up to 15%.

Solenoid valves are widely used in Hybrid Electric Vehicles (HEVs) and Electric Vehicles (EVs). Global EV sales surged to 14 million units in 2023 (IEA, 2024), with projections reaching 17 million in 2024, driving demand for solenoid valves in fluid management systems and contributing significantly to market growth.

Furthermore, Water treatment needs are escalating, with the UN’s 2024 World Water Development Report estimating that 2–3 billion people face water shortages annually. Manufacturing and industrial activities have witnessed a steep increase across the world. A variety of solenoid valves are used in the water treatment industry, including plastic, brass, and stainless steel valves.

The global solenoid valve market report delivers a comprehensive analysis of the industry landscape, providing strategic and executive-level insights backed by data-driven forecasts and analysis. This regularly updated report empowers decision-makers with actionable intelligence on current market trends, emerging opportunities, and competitive dynamics. It evaluates demand across various solenoid valve types and technologies, such as direct-acting, pilot-operated, and two-way or three-way valves, while exploring applications and end-user segments.

Solenoid Valve Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

:

The solenoid valves market is expanding significantly globally due to the rapid uptake of automation technologies in a number of industrial sectors, including power & energy, food and beverage, chemical processing, oil and gas, water and wastewater management, and pharmaceuticals. Since solenoid valves are dependable, responsive, and energy-efficient, they are quickly becoming essential parts of automated systems. They work electromechanically to regulate the flow of liquids or gases.

One of the primary drivers fueling the market growth is the increasing requirement for precise fluid control in complex machinery and processes, where solenoid valves offer automated on-off functionality, remote control, and safety shut-off mechanisms. In the oil and gas business, these valves are crucial in managing the flow of fuel, steam, and other chemicals under high-pressure and high-temperature conditions. Similarly, in the water treatment industry, solenoid valves are frequently utilized in irrigation systems, desalination plants, and wastewater recycling units to manage water flow efficiently.

Governments worldwide are investing in developing stringent laws addressing emissions, safety, and water conservation, which is encouraging industries to replace antiquated valve systems with new solenoid-based valves. Additionally, the emergence of the Industrial Internet of Things (IIoT) and Industry 4.0 is paving the way for smart solenoid valves that can be connected to digital monitoring and control systems, providing real-time data collection, predictive maintenance, and increased process optimization. 2-Way Solenoid Valves and 3-Way Solenoid Valves by Parker Hannifin Corporation have a maximum pressure rating of 4500 psi and 1100 psi, respectively.

Despite concerns such as high initial prices for sophisticated valves and potential issues linked to compatibility and maintenance in severe environments, the general prognosis for the solenoid valve market remains relatively hopeful. As innovation continues to influence the future of fluid control technology, the solenoid valve market is likely to observe continuous expansion, presenting attractive prospects for manufacturers, suppliers, and technology providers worldwide.

The competitive landscape of the solenoid valve market shows a gradual evolution from a moderately consolidated structure toward a more consolidated trend. Currently, the market is dominated by 5 to 6 top global players, such as Emerson Electric Co., Parker-Hannifin Corporation, Danfoss A/S, Burkert Fluid Control Systems, SMC Corporation, and Festo SE & Co. KG, who collectively cover approximately 60% to 70% of the market share. With the dynamic growth of regional markets, a large portion of demand is being met by regional and local players who cater to specific industries or geographic niches, such as CKD Corporation and Takasago Electric.

Solenoid Valve Market Trends:

The solenoid valve market is evolving with the miniaturization trend, enabling compact designs for space-constrained applications like medical devices and automotive systems. Electrification impact on solenoids drives demand for energy-efficient, high-performance valves in electric vehicles and renewable energy systems. Digitalization in fluid control integrates IoT and AI for real-time monitoring and optimization. Sustainable manufacturing valves prioritize eco-friendly materials and processes, aligning with environmental regulations. Customization of solenoid valves and modular solenoid systems offers tailored, scalable solutions for diverse industrial needs. These trends reflect the market’s shift toward compact, intelligent, and sustainable fluid control solutions, enhancing efficiency across dynamic industry landscapes.

Solenoid Valve Market Drivers:

- Expansion of the oil & gas and energy sectors

Solenoid valves are essential for managing the flow of oil, gas, steam, and other chemicals in oil and gas operations, from upstream exploration and drilling to midstream transportation and downstream refining. Since the oil & gas industry mostly depends on sophisticated fluid control systems to ensure operational efficiency, safety, and dependability, the bolstering growth in such sectors is a major factor driving the global solenoid valve market growth.

Given the particularly harsh temperature and pressure conditions frequently present in hydrocarbon processing settings, these valves are essential for operations like fuel injection, pressure control, chemical dosing, and emergency shut-off systems. Oil and gas companies are investing in digital automation, safety systems, and infrastructure upgrades due to the world's increasing energy demand, which is being driven by urbanization, population growth, and industrial expansion. These investments all require the integration of durable and responsive flow control devices, such as solenoid valves. The International Energy Agency (IEA) projects a 720 kb/d rise in global oil demand by 2025. It is anticipated that refinery throughputs will increase by approximately 460 kb/d in 2025 and 2026, averaging 83.3 mb/d and 83.7 mb/d, respectively.

Furthermore, to meet strict regulatory requirements, minimize leaks, and guarantee ecologically safe operations, energy companies are implementing increasingly sophisticated and accurate valve systems in response to the global push for environmental sustainability and emission reduction. Simultaneously, the emergence of renewable energy sources such as geothermal installations, solar thermal plants, and hydrogen fuel systems has opened up new markets for solenoid valve applications, which control the flow of gases, heat transfer fluids, and other media in clean energy systems.

Overall, the vital role solenoid valves play in streamlining the operations of the energy sector, in conjunction with continuous technical advancements and developing energy projects, highlights their increasing significance and demand in this vital and dynamic area.

Solenoid Valve Market Geographical Outlook:

- The US is expected to hold a large market share

The solenoid valve market is experiencing robust growth, with the United States expected to hold a significant share due to its widespread adoption across industries like oil and gas, wastewater treatment, power and energy, automotive, and manufacturing. Solenoid valves, valued for their compact size and easy integration, optimize fluid control, enhancing energy efficiency and process automation in industrial applications.

In the U.S., substantial investments in industrial productivity and smart manufacturing drive demand for solenoid valves. The adoption of Industry 4.0 principles, including IoT-based solenoid valves, supports real-time monitoring and predictive maintenance, improving operational efficiency. For instance, smart solenoid valves integrate with automation systems to provide data-driven insights, aligning with digital transformation goals. The Environmental Protection Agency (EPA) announced $110 million in funding in February 2025 under the Water Infrastructure Finance and Innovation Act (WIFIA) to expand drinking water access in Utah, supporting two water treatment plants (EPA, 2025). Such infrastructure investments in wastewater treatment and oil exploration boost demand for solenoid valves for precise fluid management.

The automotive sector is a key growth driver, with the U.S. witnessing a surge in electric vehicle (EV) production and demand for fuel-efficient vehicles. Solenoid valves play a critical role in fuel transmission and emission control, supporting low-carbon emissions and environmental sustainability. According to the International Organization of Motor Vehicle Manufacturers (OICA), U.S. automotive production grew by 5% in 2024 compared to 2022, driven by rapid urbanization and improved living standards (OICA, 2024). Regulatory standards emphasizing environmental impact reduction further propel the adoption of solenoid valves in automotive applications.

Globally, the Asia-Pacific region, led by China and India, is a fast-growing market due to industrialization and infrastructure development. Europe, particularly Germany and the UK, supports solenoid valve demand through the automotive and energy sectors. The Middle East and Africa, and South America are emerging markets, driven by oil and gas exploration. Challenges like high initial costs persist, but technological advancements and cost-effective solutions mitigate these issues. The solenoid valve market thrives on smart manufacturing, sustainability, automation, and regional investments, with the U.S. leading due to its industrial innovation and regulatory support.

Solenoid Valve Market Key Developments:

- In July 2025, Sanhua Europe launched the CDF-U solenoid valve, enhancing CO2 refrigeration efficiency with smart monitoring.

- In February 2024, Bürkert introduced a new range of solenoid valves designed for tool-free maintenance, targeting OEMs in commercial coffee machines and medical equipment for efficient fluid control.

- In November 2023, Emerson launched the ASCO Series 327C solenoid valve, featuring a direct-acting, high-flow design with a balanced poppet structure, optimized for low-power, high-flow applications in refineries, power plants, and chemical processing.

Solenoid Valve Companies:

- Parker-Hannifin Corporation

- IMI plc

- Burkert Fluid Control Systems

- Danfoss A/S

- SMC Corporation

Solenoid Valve Market Scope:

| Report Metric | Details |

| Solenoid Valve Market Size in 2025 | US$4.61 billion |

| Solenoid Valve Market Size in 2030 | US$5.65 billion |

| Growth Rate | CAGR of 4.16% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Solenoid Valve Market |

|

| Customization Scope | Free report customization with purchase |

Solenoid Valve Market Segmentation:

- By Type

- Direct-Acting Solenoid Valves

- Pilot-Operated Solenoid Valves

- Others

- By Material

- Aluminum

- Stainless Steel

- Brass

- Plastic

- By End-User

- Oil and Gas

- Water and Wastewater Treatment

- Automotive

- Chemical and Petrochemical

- Food and Beverage

- Pharmaceuticals

- Power & Utility

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- UK

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Others

- North America