Report Overview

Solar PV Backsheet Market Highlights

Solar PV Backsheet Market Size:

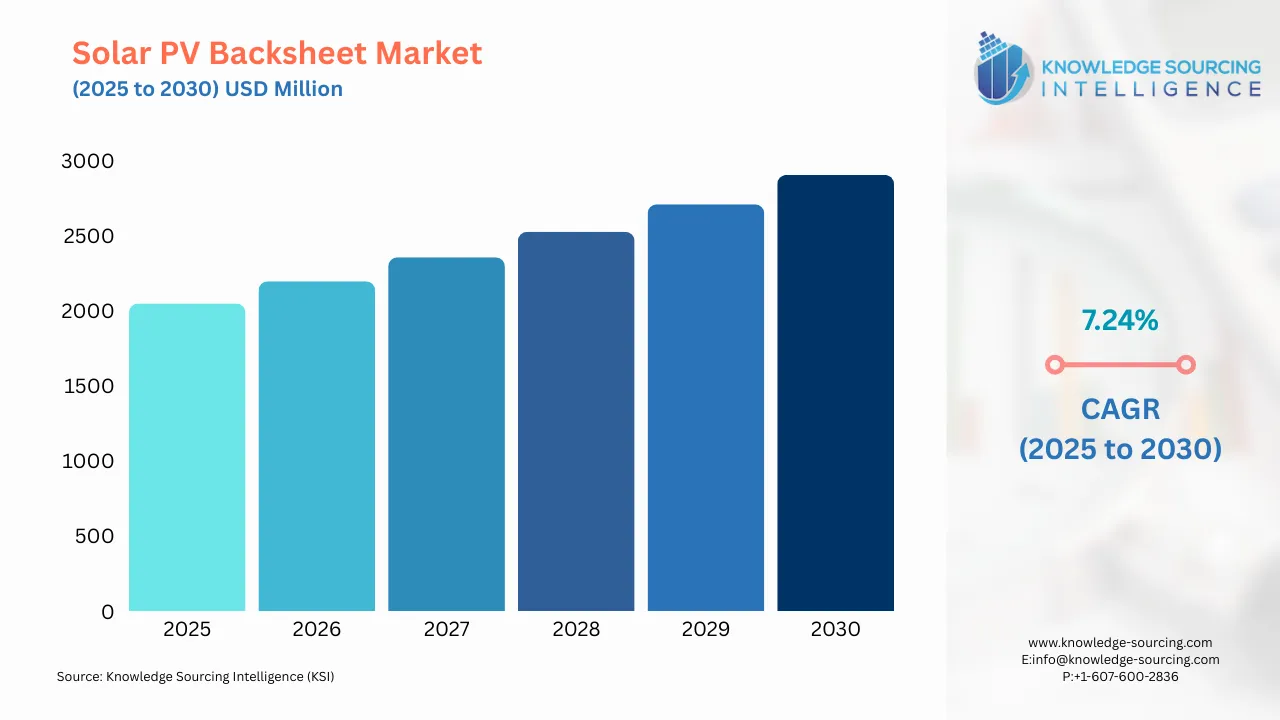

The Solar PV Backsheet Market will reach US$2,904.854 million in 2030 from US$2,048.345 million in 2025 at a CAGR of 7.24% during the forecast period.

Rising solar PV installation is the major driver of the solar PV back sheet market. Growing focus on the renewable energy sector due to rising electricity prices and environmental sustainability concerns is driving the installation of solar panels which, in turn, is propelling the growth of the solar PV back sheet market. Furthermore, the declining cost of solar panels is further augmenting the use of solar energy, thus positively impacting the growth of the solar PV back sheet market. While favorable government initiatives and policies to encourage the use of solar energy will continue to support the growth of the solar PV back sheet market in the coming years.

The Solar PV Backsheet Market Report offers an in-depth analysis of the global solar PV backsheet industry, providing strategic insights and data-driven forecasts to empower decision-makers with actionable intelligence. This regularly updated report examines current market trends, growth opportunities, and competitive dynamics, focusing on product types such as single-layer, double-layer, and triple-layer backsheets. It covers material types like fluoropolymer and polyester, installation methods including rooftop, ground-mounted, and floating solar PV systems, and applications across residential, commercial, and industrial sectors. The report incorporates technological advancements, regulatory frameworks, and macroeconomic factors to deliver a comprehensive overview of the solar PV backsheet market.

Some of the major players covered in this report include DuPont de Nemours, Inc., Coveme S.p.A., Krempel GmbH, Toyo Aluminium K.K., Toray Industries, Inc., Hangzhou First Applied Material Co., Ltd., Dunmore Corporation, Cybrid Technologies Inc., Jolywood (Suzhou) Sunwatt Co., Ltd., Isovoltaic AG, Taragray Technology International Inc., BioSolar Inc., 3M Company and Koninklijke DSM N.V.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive Intelligence

Report Coverage:

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

Solar PV Backsheet Market Segmentations:

Solar PV Backsheet Market Segmentation by Product Type

The market is analyzed by product type into the following:

- Single-layer Backsheets

- Double-layer Backsheets

- Triple-layer Backsheets

Solar PV Backsheet Market Segmentation by Material:

The report analyzes the market by material type as below:

- Fluoropolymer-Based Backsheets

- Polyvinyl Fluoride (PVF) Backsheets

- Polyvinylidene Fluoride (PVDF) Backsheets

- Ethylene Tetrafluoroethylene (ETFE) & Other Fluoropolymers

- Non-Fluoropolymer-Based Backsheets

- Polyester (PET) Backsheets

- Co-extruded Backsheets / Polyamide (PA) / PP-based

Solar PV Backsheet Market Segmentation by Installation Type:

The report analyzes the market by installation type as below:

- Rooftop Solar PV Systems

- Ground-Mounted Solar PV Systems

- Floating Solar PV Systems

Solar PV Backsheet Market Segmentation by Application:

The report analyzes the market by application as below:

- Residential

- Commercial

- Industrial

Solar PV Backsheet Market Segmentation by Regions:

The study also analysed the Solar PV Backsheet Market into the following regions, with country-level forecasts and analysis as below:

- North America (US, Canada, and Mexico)

- South America (Brazil, Argentina, and Others)

- Europe (Germany, UK, France, Spain, and Others

- Middle East and Africa (Saudi Arabia, UAE, and Others)

- Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)

Solar PV Backsheet Market Report Coverage:

This report provides extensive coverage as explained in the points below:

- Market size, forecasts, and trends by different types, with historical revenue data and analysis focusing on key factors driving adoption, current challenges faced by key players, and major growth areas.

- Market size, forecasts, and trends by components, with historical revenue data and analysis.

- Market size, forecasts, and trends by application, with historical revenue data and analysis of sales based on applications.

- Market size, forecasts, and trends by end-user segment, with historical revenue data and analysis across various segments.

- The Solar PV Backsheet Market is also analyzed across different regions, with historical data, regional share, attractiveness and opportunity of these solutions in different countries. The growth prospects and key players operating in these markets. The section also dwells on the macro factors, economic scenario and other complementing factors aiding in market growth.

- Market dynamics: The section details the market growth factors, restraints, and opportunities in the market. The segment also presents a complete market scenario with the help of Porter's five forces model.

- Competitive Intelligence: A thorough investigation of the competitive structure of the market presented through a proprietary vendor matrix model, market share analysis of key players, insights on strategies of key players and recent major developments undertaken by the companies to gain a competitive edge.

- Research methodology: The assumptions and sources that were considered to arrive at the final market estimates. Additionally, how our model is refined to ensure the most significant factors are taken into consideration with the proper hypothesis and bottom-up and top-down approaches enhance the reliability of forecasts further strengthening the trustworthiness of the numbers being presented.

How this report is helpful to you and reasons for purchase?

- This report provides a strategic outlook of the Solar PV Backsheet Market to the decision-makers, analysts and other stakeholders in an easy-to-read format for making informed decisions.

- The charts, tables and figures make it easy for the executives to gain valuable insights while skimming the report.

- Analyst support through calls and emails for timely clarification and incorporating additional requests.

- Option of presentation or doc format with the estimates file to take care of diverse requirements.

- 15% FREE customization with all our reports helps cater to additional requirements with significant cost savings.

- Option of purchasing specific segments of the study, including opting for summary reports or just the estimates file.

List of Top Solar PV Backsheet Companies:

- DuPont de Nemours, Inc.

- Coveme S.p.A.

- Krempel GmbH

- Toyo Aluminium K.K.

- Toray Industries, Inc.

Solar PV Backsheet Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Solar PV Backsheet Market Size in 2025 | US$2,048.345 million |

| Solar PV Backsheet Market Size in 2030 | US$2,904.854 million |

| Growth Rate | CAGR of 7.24% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Solar PV Backsheet Market |

|

| Customization Scope | Free report customization with purchase |