Report Overview

Solar-Powered Pumps Market - Highlights

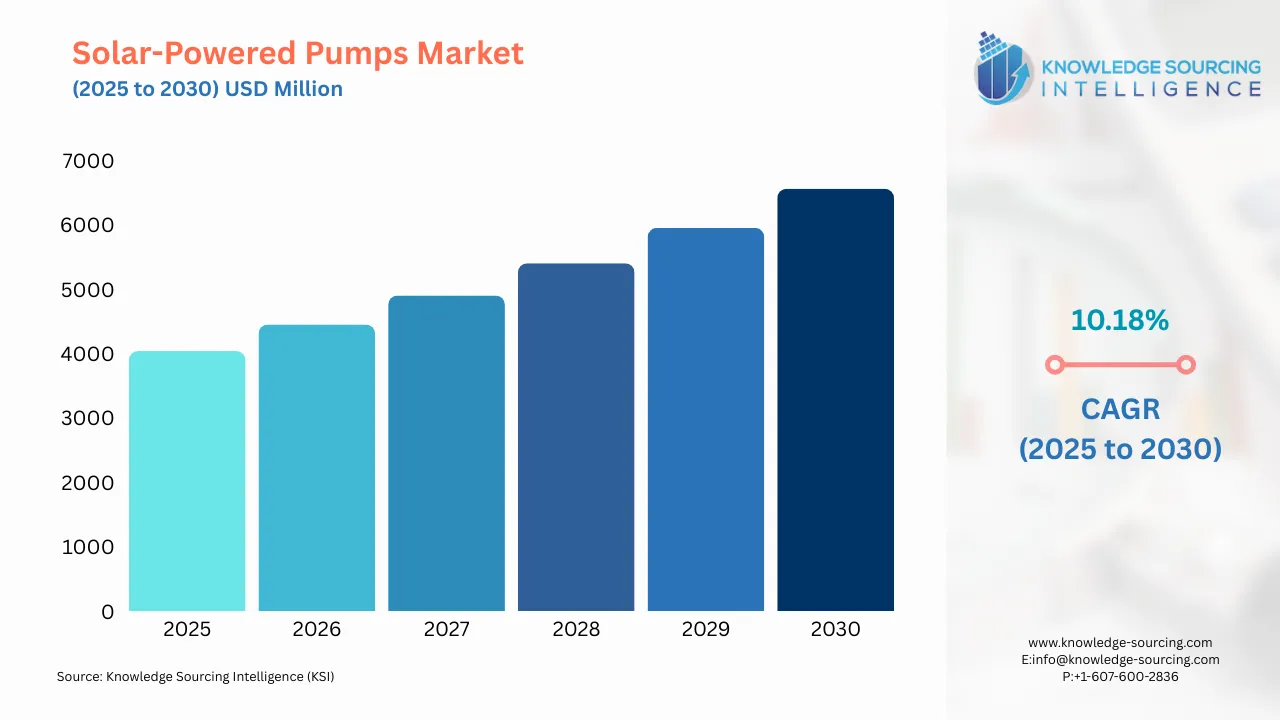

Solar-Powered Pumps Market Size:

The Solar Powered Pumps Market is expected to grow at a CAGR of 10.18%, reaching a market size of US$6,560.99 million in 2030 from US$4,040.25 million in 2025.

Solar-powered pumps are a better alternative to traditional electric and fuel-powered pump sets as they are cost-effective, easy-to-use, and energy-efficient. These pumps are extensively being used in residential and commercial settings as well as in agriculture. They use solar energy, eliminating the need for fuel, and are thus a more feasible and environment-friendly option for pumping water. At the same time, it is beneficial for countries where farmers have low incomes and limited access to traditional fuels for pumping water. The market is also accelerated by increasing government investment in affordable, reliable, and environmentally sustainable energy infrastructure, particularly for the agricultural sector. Further, the rising technological advancement in solar technology is propelling the market growth of solar-powered pumps.

As solar-powered water pumps use photovoltaic technology that converts solar energy into electricity, they are increasingly being demanded by the agricultural sector in place of pollution-causing diesel-powered pumps. The cost-effectiveness of solar-powered pumps also drives its demand in this sector. It is especially beneficial for countries with low-income farmers and limited access to traditional fuels.

A solar pumping system has three main components: an electric motor, a photovoltaic (PV) array, and a pump. These pumps are categorized as direct current (DC) or alternating current (AC) based on their motor type. They are widely used across various sectors, with key applications in agriculture, waste management, and industries.

Solar-Powered Pumps Market Growth Drivers:

- Solar-powered pump’s cost-effectiveness, accessibility, reliability, and sustainability are pushing its market growth

Solar-powered pumps are more cost-effective than the traditional fuel-powered pumps. At the same time, these pumps are environmentally sustainable as they eliminate the need for carbon dioxide-producing fuels. Thus, many countries worldwide have begun to use a clean, accessible, and renewable form of energy that is sustainable for irrigation. For instance, Egypt, with its high solar radiation of 2000 to 3200 kWh/m² and 9 to 11 hours of sunshine daily, is using it for domestic use, irrigation, livestock watering, and village water supply. Hence, the increasing demand for solar-powered pumps is driven by their cost-effectiveness, reliability, and sustainability, making them an attractive solution for various sectors.

- Government policies for clean energy and decentralization in irrigation are driving the market growth of solar-powered pumps

Government investment in cleaner energy is increasing rapidly in response to climate change concerns and the urgent need to address its impacts. At the same time, the government is taking steps to decentralize the irrigation system by encouraging the adoption of innovative technologies like solar-powered pumps. According to the International Energy Agency’s Government Energy Spending Tracker, governments have allocated USD 1.34 trillion to clean energy worldwide since 2020. Thus, governments worldwide are taking steps to push investment into clean energy, propelling the solar-powered pumps market.

Solar-Powered Pumps Market Restraints:

- Lack of infrastructural support for solar-powered pumps is acting as a restraint for its market

The lack of infrastructural support for solar-powered pumps is acting as a restraint for its market growth. Limited grid access in rural areas makes integrating solar-powered pumps difficult. Additionally, installation and maintenance require some knowledge, leading to difficulty in adopting solar-powered pumps. Further, an inadequate battery facility for energy storage leads to challenges during low sunlight or winter months. Thus, addressing these issues is critical for the market growth of solar-powered pumps.

Solar-Powered Pumps Market Segment Analysis:

- The agricultural sector will hold the largest market share of Solar-Powered Pumps

In the forecast period, the agricultural sector is anticipated to hold the largest share of the solar-powered pump market. In some countries, electricity is inaccessible to many farmers, so their dependency on rain for irrigation is high. Here, solar-powered pumps offer a reliable and more sustainable energy source that is cheaper than traditional pumps while being more environment-friendly. Hence, offering solar-powered pumps to the agricultural sector, such as non-dependency on power grid systems and non-dependency on fuel by generating electricity from easily available sunlight, is leading the agriculture sector in the solar-powered market. For instance, the government of India aims to install 17.50 lakh stand-alone solar agriculture pumps under the PM-KUSUM scheme of 2019. Thus, government investment in agriculture for solar-powered pumps is also increasing, contributing to the market growth of solar-powered pumps in this sector.

- Asia-Pacific will dominate the market share of Solar-Powered Pumps

The global solar-powered pumps market has been segmented into five major regional markets: North America, South America, Europe, the Middle East and Africa (MEA), and Asia Pacific (APAC). Asia Pacific accounts for a significant share of the global solar-powered pumps market. The market is poised to grow at a substantial rate during the forecast period as well. Countries like China and India with these countries are increasingly adopting solar-powered pumps for their irrigation as well as for wastewater management. Government initiatives like PM-KUSUSM in India are propelling the market growth of solar-powered pumps.

Solar-Powered Pumps Market Key Launches:

- In June 2024, Roto Pumps Ltd. started its new subsidiary, Roto Energy Systems Ltd. This new subsidiary will be operating in the solar submersible pumping solutions market. Roto Pumps Ltd. has its strategic expansion into solar pumping with this new subsidiary.

- In April 2024, ABB launched solar ACQ80 with built-in features of flow calculation, dry-run protection, and smart-operating modes for sustainable water pumping. It is based on Maximum Power Point Tracking (MPPT) logic with a wide input voltage range of 225 to 800 VDC.

- In September 2023, LORENTZ, a leading German solar water pump manufacturer, had a distribution agreement with Xylem Inc. – a leading global water technology company to expand the availability of solar-powered pumping systems globally.

List of Top Solar-Powered Pumps Companies:

- Vincent Solar Energy

- Tata Power Solar Systems

- LORENTZ

- SunEdison Infrastructure

- Lubi Industries LLP

Solar-Powered Pumps Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Solar-Powered Pumps Market Size in 2025 | US$4,040.25 million |

| Solar-Powered Pumps Market Size in 2030 | US$6,560.99 million |

| Growth Rate | CAGR of 10.18% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Solar-Powered Pumps Market |

|

| Customization Scope | Free report customization with purchase |

Solar-Powered Pumps Market Segmentation:

- By Motor Type

- AC Pump

- DC Pump

- By Application

- Agriculture

- Water Management

- Industrial

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America