Report Overview

Smart Grid Software Market Highlights

Smart Grid Software Market Size:

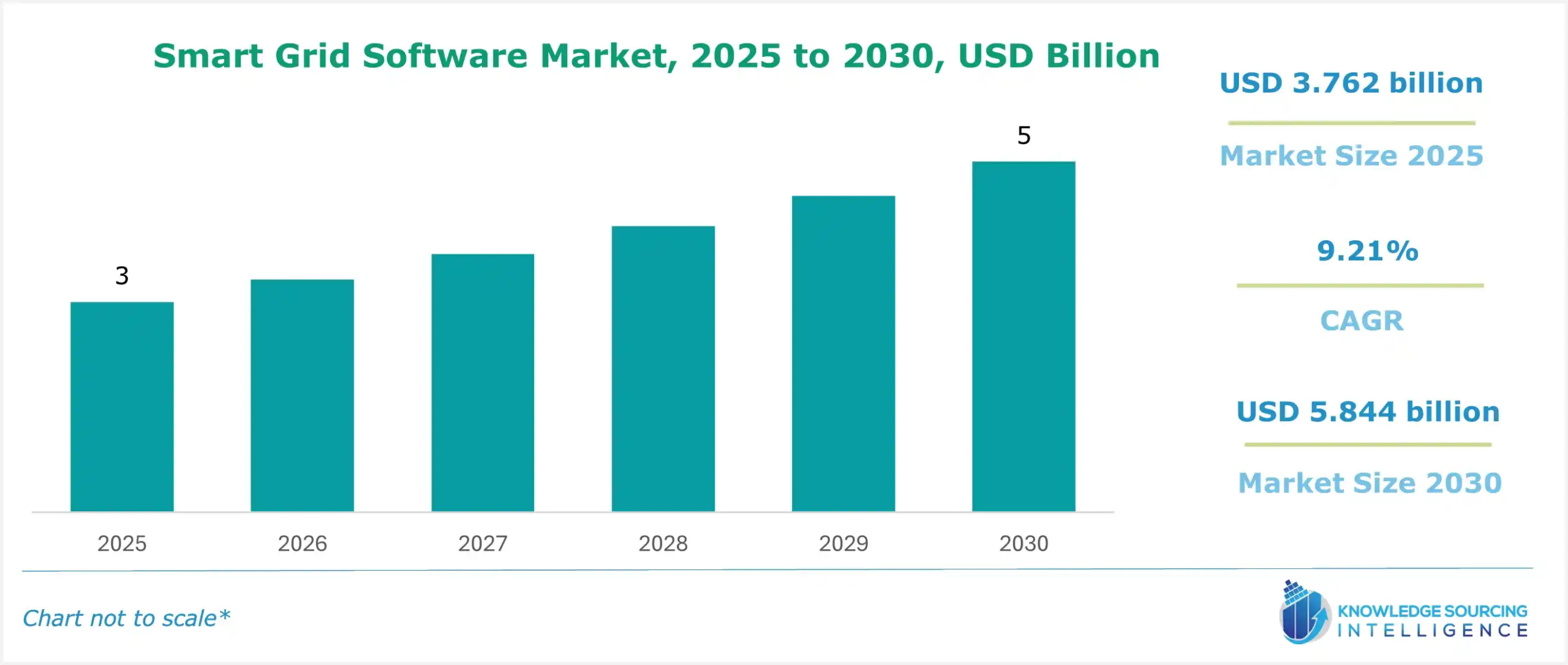

The smart grid software market is projected to grow from USD 3.762 billion in 2025 to USD 5.844 billion in 2030 at a CAGR of 9.21%.

Smart Grid Software Market Highlights:

- Optimizing energy distribution: Software is enhancing grid efficiency with real-time monitoring.

- Integrating renewable energy: Platforms are enabling seamless solar and wind incorporation.

- Driving AI adoption: Analytics are improving fault detection and grid resilience.

- Boosting North American growth: Investments are fueling smart grid software deployment.

- Enhancing demand response: Systems are balancing loads for energy savings.

- Supporting EV integration: V2G solutions are managing electric vehicle grid interactions.

- Promoting grid automation: Advanced software is reducing outages and operational costs.

Smart Grid Software Market Trends:

The smart grid software market is gaining momentum as utilities modernize their infrastructure to meet the demands of a more sustainable, efficient, and resilient energy system. Smart grid software enables real-time monitoring, intelligent decision-making, and seamless integration of renewable energy sources, helping utilities manage complex grids with greater accuracy and flexibility.

At the core, smart grid software simplifies operations by automating energy distribution, enhancing grid reliability, and improving energy efficiency. It leverages information and communication technology (ICT) to optimize grid performance, reduce operational costs, and support decarbonization goals. These software platforms support functions such as advanced metering infrastructure (AMI), outage management systems (OMS), distribution management systems (DMS), and demand response (DR).

The global rise in electricity consumption, driven by urbanization and digitalization, is a key driver of market growth. In particular, the adoption of electric vehicles (EVs) is expanding rapidly, placing new demands on the grid. Smart grid software plays a crucial role in vehicle-to-grid (V2G) integration, allowing EVs to interact with the grid to balance supply and demand.

By incorporating artificial intelligence (AI) and machine learning (ML), smart grid platforms can detect anomalies, predict faults, and manage energy flows efficiently. These intelligent systems help utilities respond quickly to outages, optimize energy usage, and enhance customer service.

With a growing focus on renewable energy integration, real-time data analytics, and grid automation, smart grid software is essential for transitioning toward a low-carbon, digitally enabled, and consumer-centric energy ecosystem.

Smart Grid Software Market Growth Drivers:

- Booming electricity consumption is expected to drive the demand globally.

A major factor propelling the smart grid software market growth worldwide is the rising global consumption of electricity. With this growing global consumption, the load on the existing grids will increase, raising the demand for smart grid management solutions.

The global consumption of electricity in 2023 witnessed a significant increase over the past years. Enerdata, in its report, stated that in 2023, the total global consumption of energy witnessed a growth of about 2.6%. The agency further stated that in 2022, the total electricity consumed in China and India was recorded at 7,852 TWh and 1,318 TWh, respectively. Similarly, about 983 TWh and 576 TWh were consumed in Russia and Brazil, respectively. In 2023, electricity consumption in China was recorded at 8,392 TWh, and 1,407 TWh in India. In Russia and Brazil, electricity consumption surged to 997 TWh and 594 TWh, respectively.

Smart Grid Software Market Restraints:

- Technical complexities can act as an obstacle to market growth

Software solution plays an important role in energy management since it signifies the level of consumption and energy requirements per consumer. Since the power distribution varies as per different geographies, the algorithm needs to be based keeping in mind such variations so that billing & maintenance, and grid asset management can be done properly. For achieving such functional software, a high level of technical expertise is required, followed by a high initial integration cost, which can pose a challenge for the overall market expansion, especially in the least developed and under economies.

Smart Grid Software Market Segment Analysis:

- Advanced metering infrastructure, based on software type, will account for a considerable market share.

By software type, the advanced metering infrastructure is expected to hold a considerable share of the market since AMI integrates an entire system consisting of smart meters, communication networks, control center hardware, and applications that enable almost real-time collection and transfer of energy usage data. AMI encompasses software for metering electricity, water, and gas consumption. These applications and their two-way communication with the utility provider allow the end user to make an informed decision.

This software is also advantageous in producing an accurate output measure that has helped companies operate more efficiently, since there is no need for on-site meter readings. The urbanization of several nations in pursuit of smart technologies and the technological boom are some of the few growth factors paving the way for the AMI solution. Municipal authorities of various countries have also turned to AMI software to reduce utility wastage.

Moreover, the adoption of the AMI software by the utilities is also attributed to the rise in energy use worldwide and the need to cut back on energy losses, thus requiring AMI to track the real-time energy use changes, which boosts the smart grid software market. OurWorldinData.org showed that the increase in per capita primary energy consumption distributed globally (in kilowatt-hours per person) went up from 21,154 kWh in 2022 to 21,394 kWh in 2023.

Smart Grid Software Market Geographical Outlook:

- North America will continue to hold a remarkable share of the market during the forecast period.

Geographically, the smart grid software market has been segmented into North America, South America, Europe, the Middle East, Africa, and the Asia Pacific.

During the forecast period, the North American region is estimated to show significant growth fueled by the ongoing investments in promoting smart grid automation, followed by strategic collaboration & government support in new smart grid projects in major regional economies, namely the United States

Likewise, the growing electricity consumption in such economies has stimulated the need for implementing grid software for optimizing power distribution. It renders enhanced effective management of the grid as well as curtailing the incidences of power outages to a minimum duration, especially during extreme weather conditions. As per EIA statistics in 2022, electricity consumption in the USA was at its all-time peak, estimated at 4.07 trillion kWh. Furthermore, there has been an increase in the uptake of smart grid software in the region due to the increasing investments in the smart grid.

Hence, financial and support provided by both federal & state governments, environmental agencies, and utility companies in the form of loans & grants to support research and development activities, commercialization, and deployment of advanced digital technologies is also driving the regional market expansion. For instance, in October 2024, the U.S. Department of Energy awarded grants worth $70 million each to Arizona Public Service Company (APS) for enhancing its smart grid, adding preventative measures against wildfires, and fulfilling increasing energy demand from customers. These grants were approved as part of the Department of Energy’s Grid Resilience and Innovation Partnerships (GRIP) program that seeks to enhance the electric systems in rural areas and tribal, as well as disadvantaged, communities across the country.

Smart Grid Software Market Key Developments:

- In October 2024: Aspen Technology Inc. launched its “Microgrid Management System™” to optimize the energy storage and distribution of sectors with heavy electric power requirements. The software solution assists in managing and orchestrating the on-site conventional & renewable power generation with the industrial operations.

- In February 2024: Siemens launched its modular software product “Gridscale X” which provides support to utilities in managing their energy transition by handling the complexity of DERs. The easy installation and deployment of the software further improve the grid flexibility and match the dynamic changes of energy distribution and power utilities.

List of Top Smart Grid Software Companies:

- Chetu

- Schneider Electric

- Smarter Grid Solutions

- Oracle

- IBM

Smart Grid Software Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Smart Grid Software Market Size in 2025 | USD 3.762 billion |

| Smart Grid Software Market Size in 2030 | USD 5.844 billion |

| Growth Rate | CAGR of 9.21% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Smart Grid Software Market |

|

| Customization Scope | Free report customization with purchase |

The smart grid software market is analyzed into the following segments:

- Consulting

- Deployment and Maintenance

- Support and Maintenance

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Indonesia

- Taiwan

- Others

Our Best-Performing Industry Reports:

Page last updated on: